This document discusses different types of leverage:

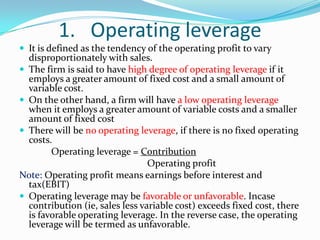

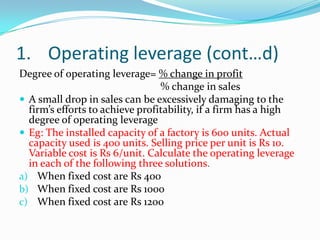

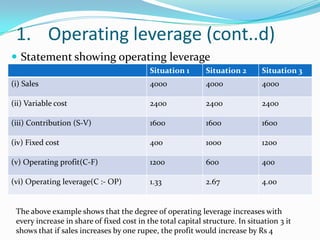

1. Operating leverage refers to how operating profits vary with sales. Higher fixed costs lead to higher operating leverage and risk.

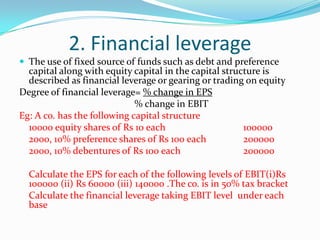

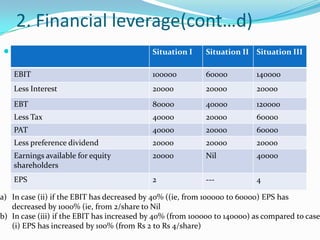

2. Financial leverage refers to using debt financing. Higher debt leads to higher financial leverage and risk but can also increase returns.

3. Composite leverage is the combined effect of operating and financial leverage on overall risk and returns. The document provides examples of calculating operating, financial, and composite leverage.