- International payments can be settled through the conversion of one country's domestic currency into another's via the foreign exchange market. The three major forms of international money are gold, foreign reserve currencies, and SDRs (Special Drawing Rights).

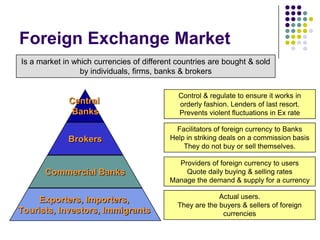

- Foreign exchange markets allow currencies to be bought and sold. They are regulated by central banks to prevent large fluctuations and ensure orderly functioning. Commercial banks, brokers, exporters/importers, and investors participate in these markets.

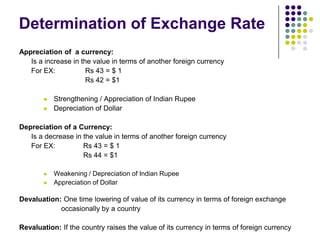

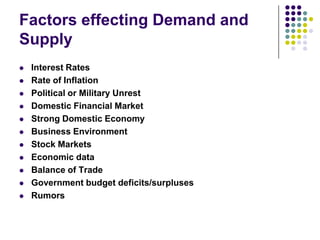

- Exchange rates are determined by the demand and supply of currencies in the foreign exchange market. A flexible exchange rate adjusts automatically based on market forces, while a fixed exchange rate is maintained by central bank intervention.