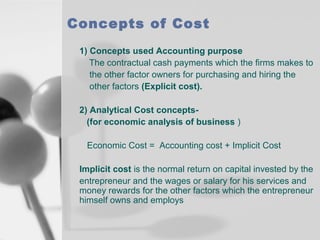

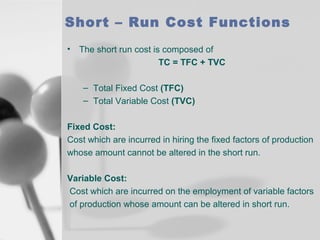

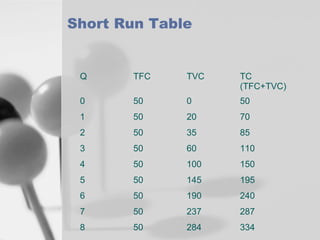

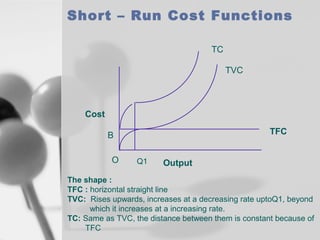

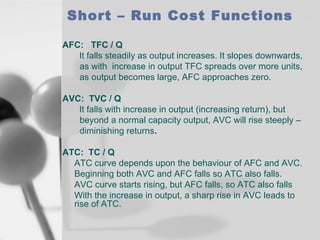

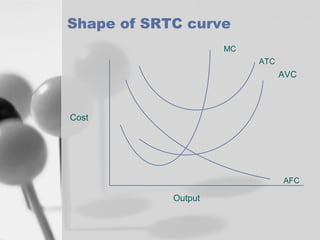

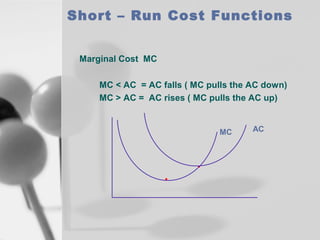

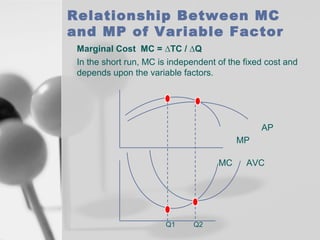

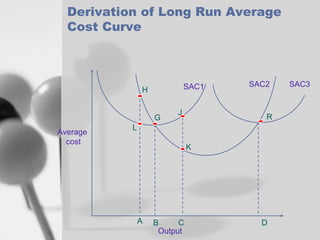

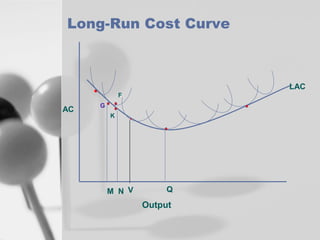

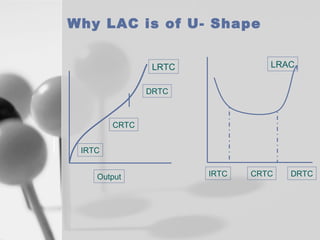

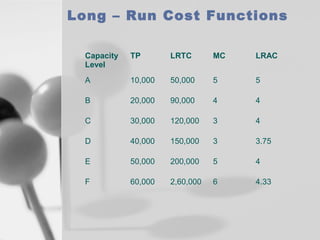

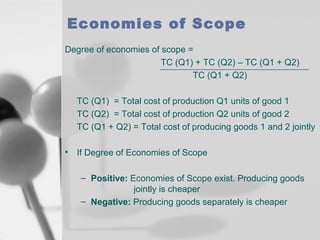

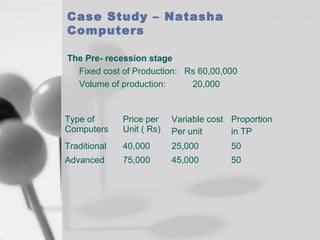

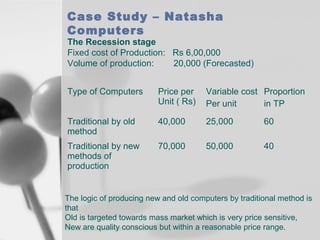

This document discusses cost concepts from an accounting and analytical perspective. It defines different types of costs such as fixed, variable, total, average, and marginal cost. It explains the relationship between these costs and how they change with varying levels of output in the short-run and long-run. The short-run cost curves are U-shaped while the long-run average cost curve is U-shaped, reflecting economies and diseconomies of scale. Other concepts covered include opportunity cost, sunk cost, learning curves, and economies of scope.