The document discusses foreign exchange markets. It provides information on:

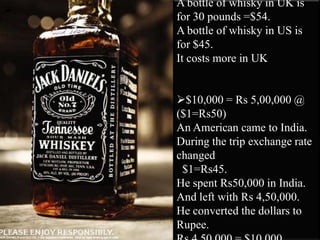

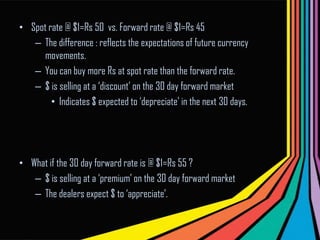

1) The foreign exchange market is a global network that allows currencies to be exchanged. Exchange rates are the prices of currencies relative to each other, such as $1 = Rs. 48.50.

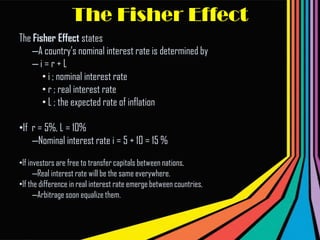

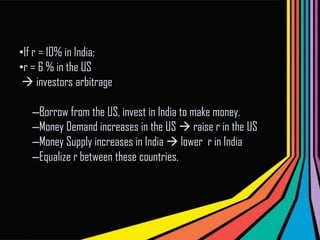

2) Arbitrage is the process of exploiting price differences between markets. If exchange rates differ, arbitragers can buy currency where it's cheaper and immediately sell it where it's more expensive.

3) Foreign exchange transactions involve converting one currency to another and carry exchange rate risk if rates change before settlement. Transactions are settled through payment systems like nostro/vostro accounts and SWIFT.