The document discusses factors that determine foreign exchange rates, including:

- Fundamental factors like the balance of payments, economic growth rates, fiscal and monetary policy, interest rates, and political stability.

- Technical factors like government control of exchange rates and capital flows between countries.

- Speculation, which can increase exchange rate volatility.

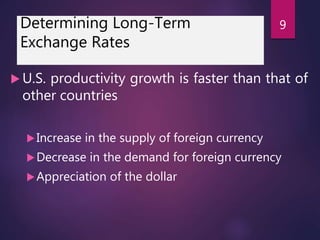

It also examines how market fundamentals, expectations, and capital asset transfers impact exchange rates in the short-term, while economic activity, inflation, investment, trade policy influence long-term exchange rates. Purchasing power parity is discussed as a better way to compare GDP between countries than market exchange rates.