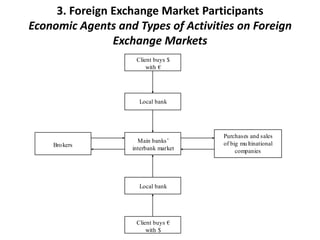

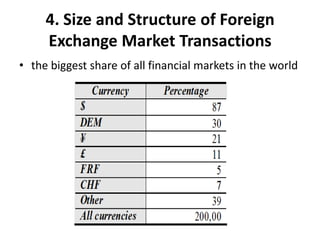

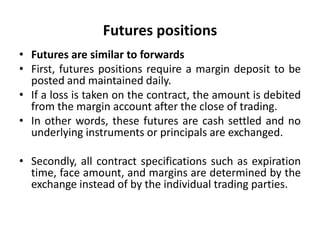

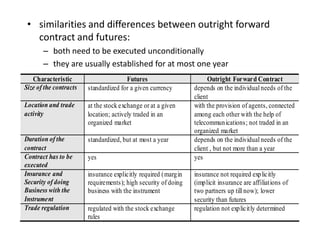

The foreign exchange market allows individuals, banks, and firms to buy and sell currencies. It operates globally through telecommunications and includes spot, forward, futures, swap, and options contracts. Major participants include commercial banks, central banks, brokers, importers/exporters, speculators, and hedgers. The market facilitates international trade and investment by enabling currency exchange.