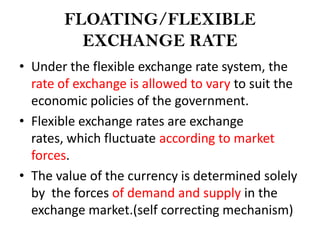

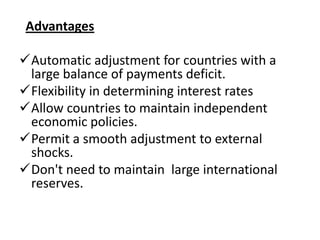

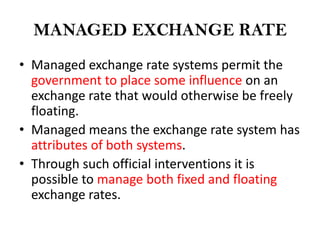

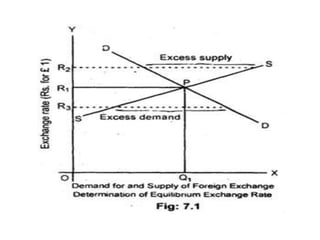

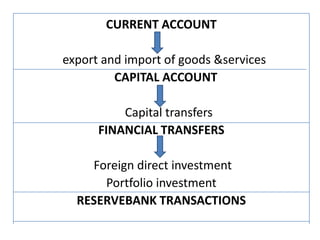

This document discusses foreign exchange rates and their determination. It explains that foreign exchange rates are the rates at which one country's currency can be converted into another's. These rates are determined by currency supply and demand in global foreign exchange markets. The key factors that influence supply and demand - and thus exchange rates - include interest rates, inflation rates, government budgets, and political stability. The document also outlines different exchange rate systems like fixed, floating, and managed rates.