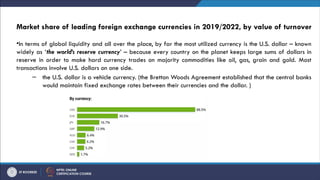

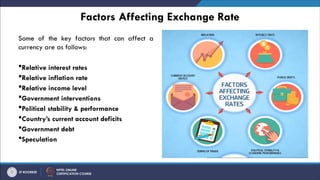

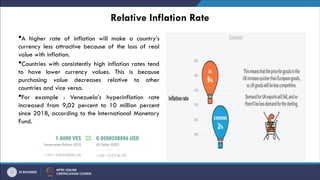

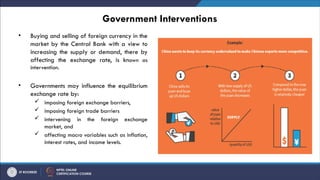

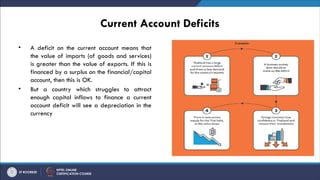

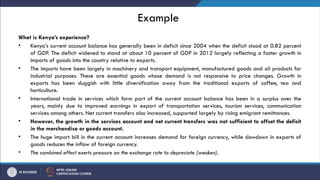

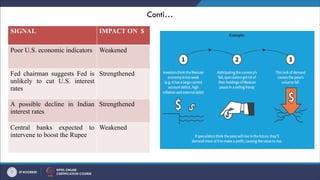

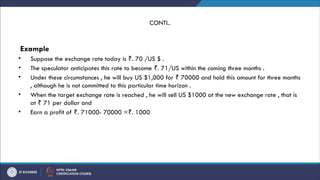

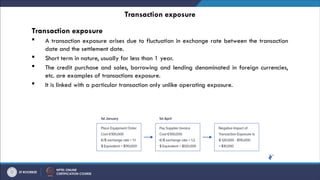

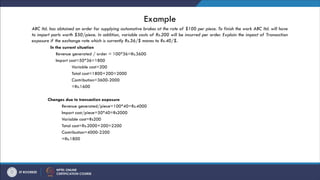

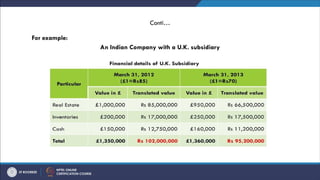

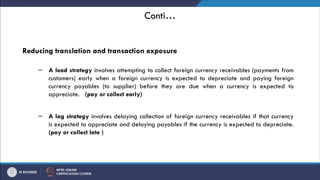

The document explains the concept of foreign exchange (forex), detailing its role in trading currencies, its significance for international trade, and the factors that influence exchange rates. It discusses the structure of the foreign exchange market, its major participants, and the functions it serves, including currency conversion and credit provision. Additionally, it covers the various types of foreign exchange exposure that firms face, such as transaction, operating, and translation exposure, along with the factors affecting exchange rates like interest rates, inflation, and government interventions.