This document provides an overview of foreign exchange, including:

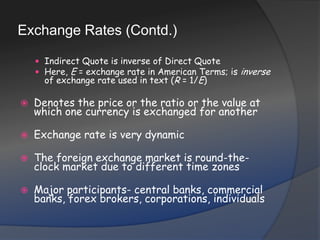

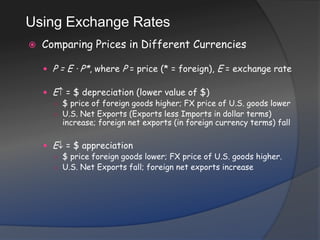

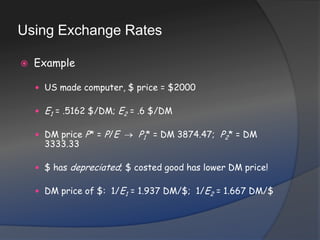

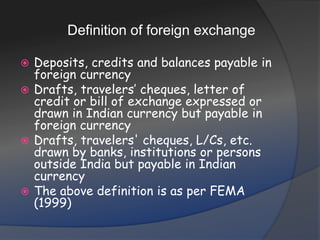

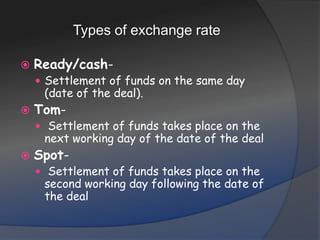

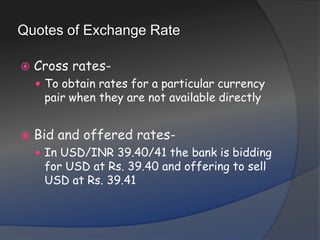

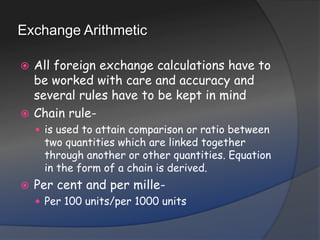

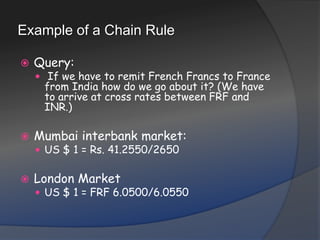

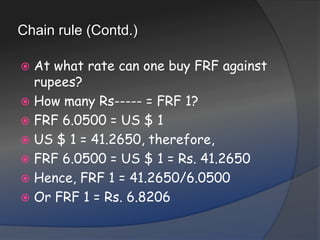

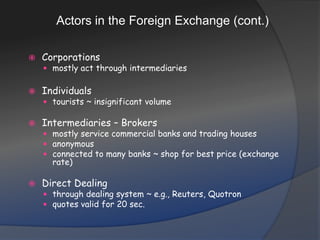

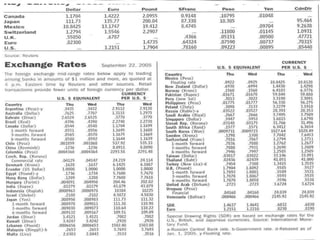

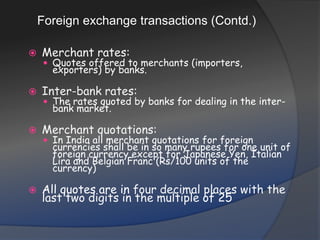

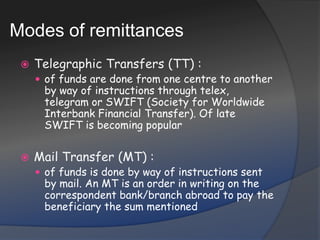

1) It defines exchange rates and describes the foreign exchange market and its major actors such as central banks and commercial banks.

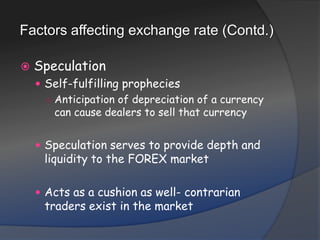

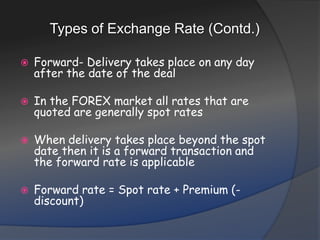

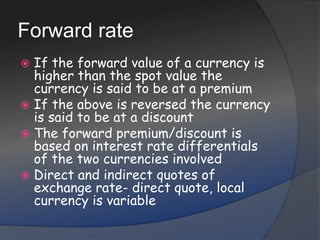

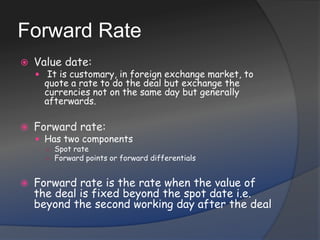

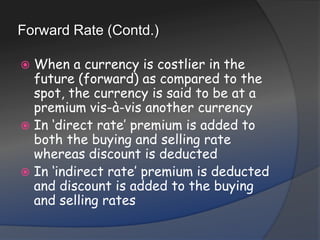

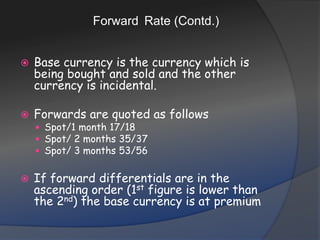

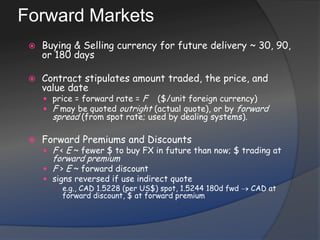

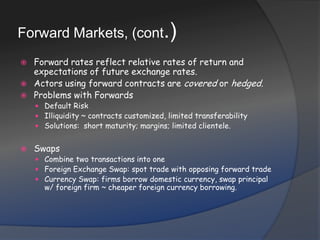

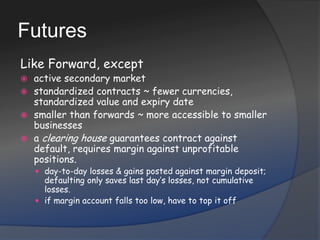

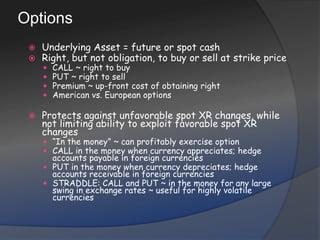

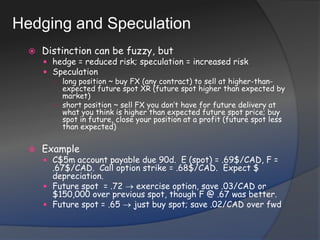

2) It considers different types of foreign exchange risk and instruments like forwards that can be used to manage this risk, as well as hedging and speculation strategies.

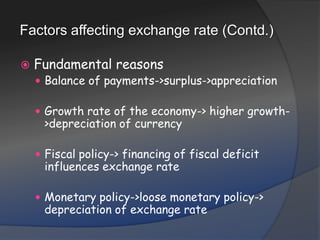

3) It discusses factors that influence exchange rates including fundamentals like balance of payments and technical factors like interest rate differentials.