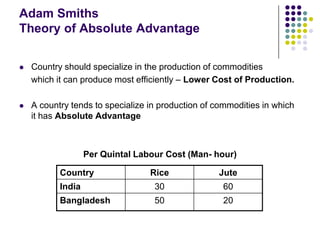

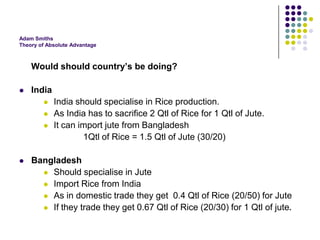

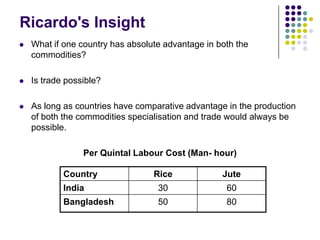

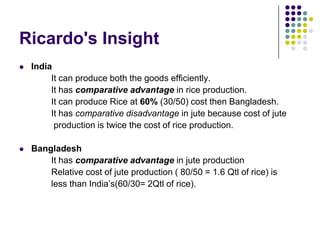

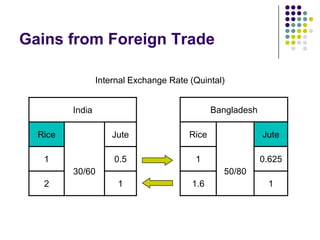

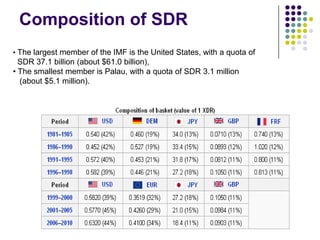

This document summarizes key concepts relating to international trade and monetary systems. It discusses Adam Smith's theory of absolute advantage, showing how countries can benefit from specializing in goods they have a cost advantage in producing. It then discusses Ricardo's theory of comparative advantage, noting trade can occur even if one country has an absolute advantage in all goods. The document also summarizes the gold standard system, its breakdown during WWI, and the establishment of the IMF to help restore order and facilitate international trade and payments. It describes how the IMF uses tools like SDRs and country quotas to achieve its goals.