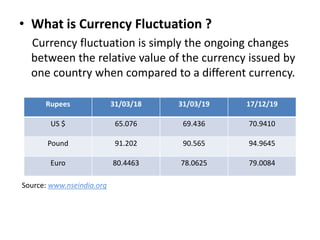

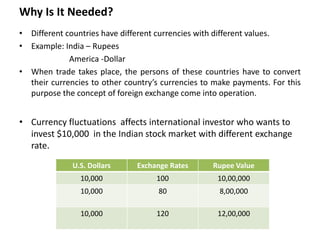

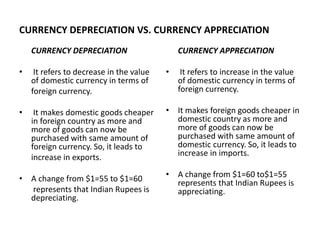

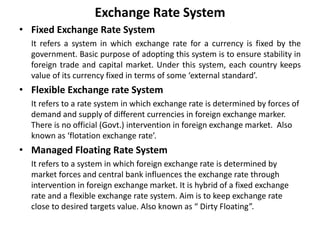

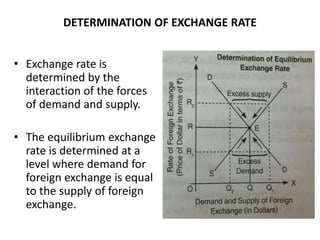

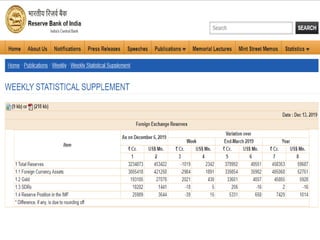

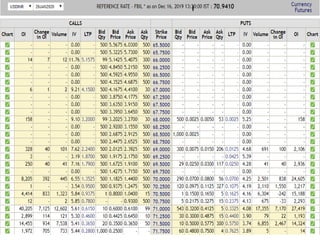

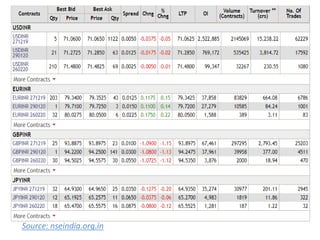

Currency fluctuation refers to the ongoing changes in the relative values of currencies between countries. The document provides examples of exchange rates between the Indian rupee, US dollar, and euro over time. It discusses causes of currency fluctuations like economic position, foreign debt, and interest rates. It also outlines the impacts of currency depreciation and appreciation on trade. The key exchange rate systems - fixed, flexible, and managed floating - are defined. Determination of exchange rates by the interaction of demand and supply in foreign exchange markets is explained.