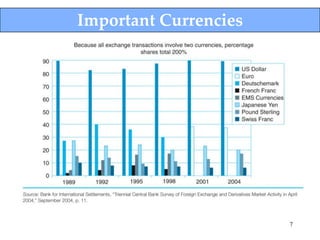

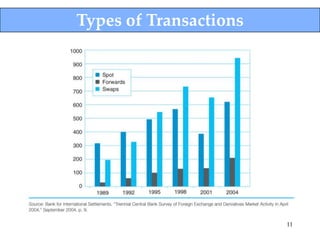

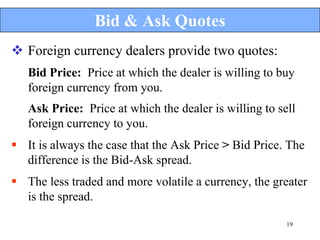

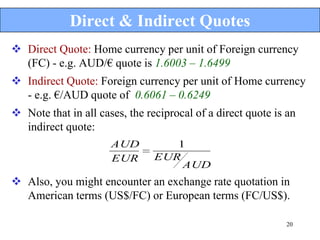

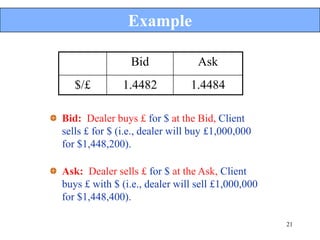

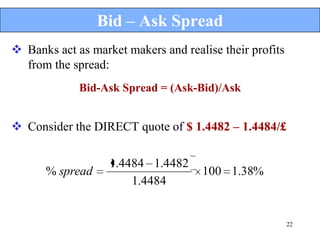

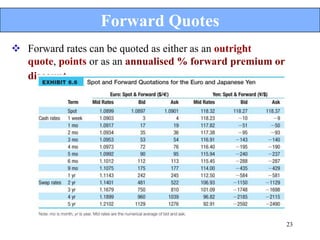

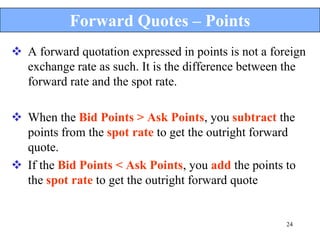

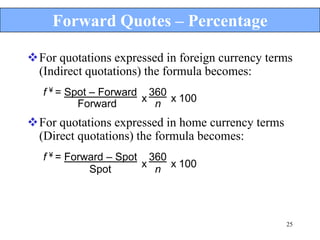

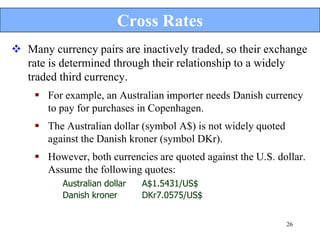

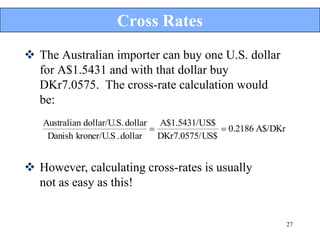

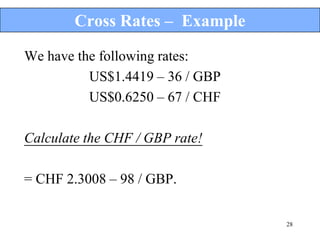

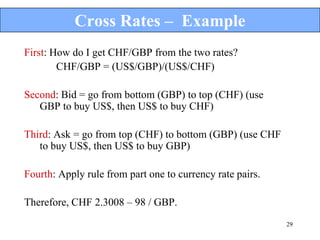

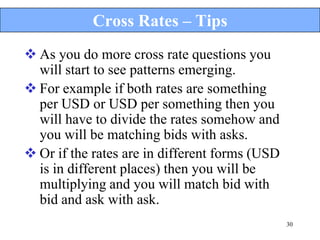

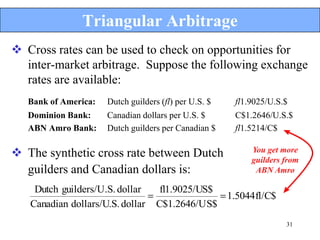

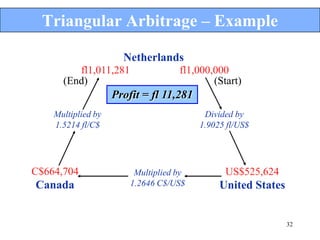

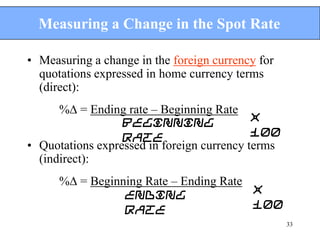

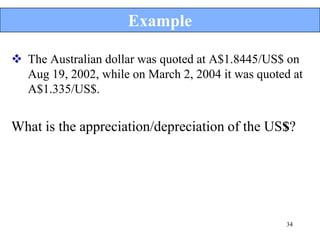

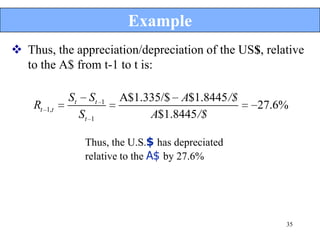

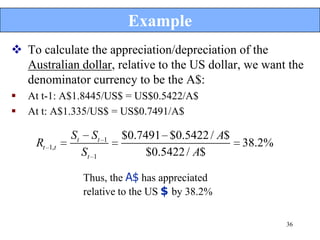

The document provides an overview of the foreign exchange market, including its key participants and characteristics. It describes the functions and size of the FX market, with an average daily turnover of over $2 trillion. The key participants are banks and dealers that act as market makers by buying and selling currencies. Spot transactions settle in 2 days while forwards lock in an exchange rate for future delivery. The document outlines different currency quotes and rates, including bid-ask spreads, direct vs indirect quotes, and how forward rates are expressed.