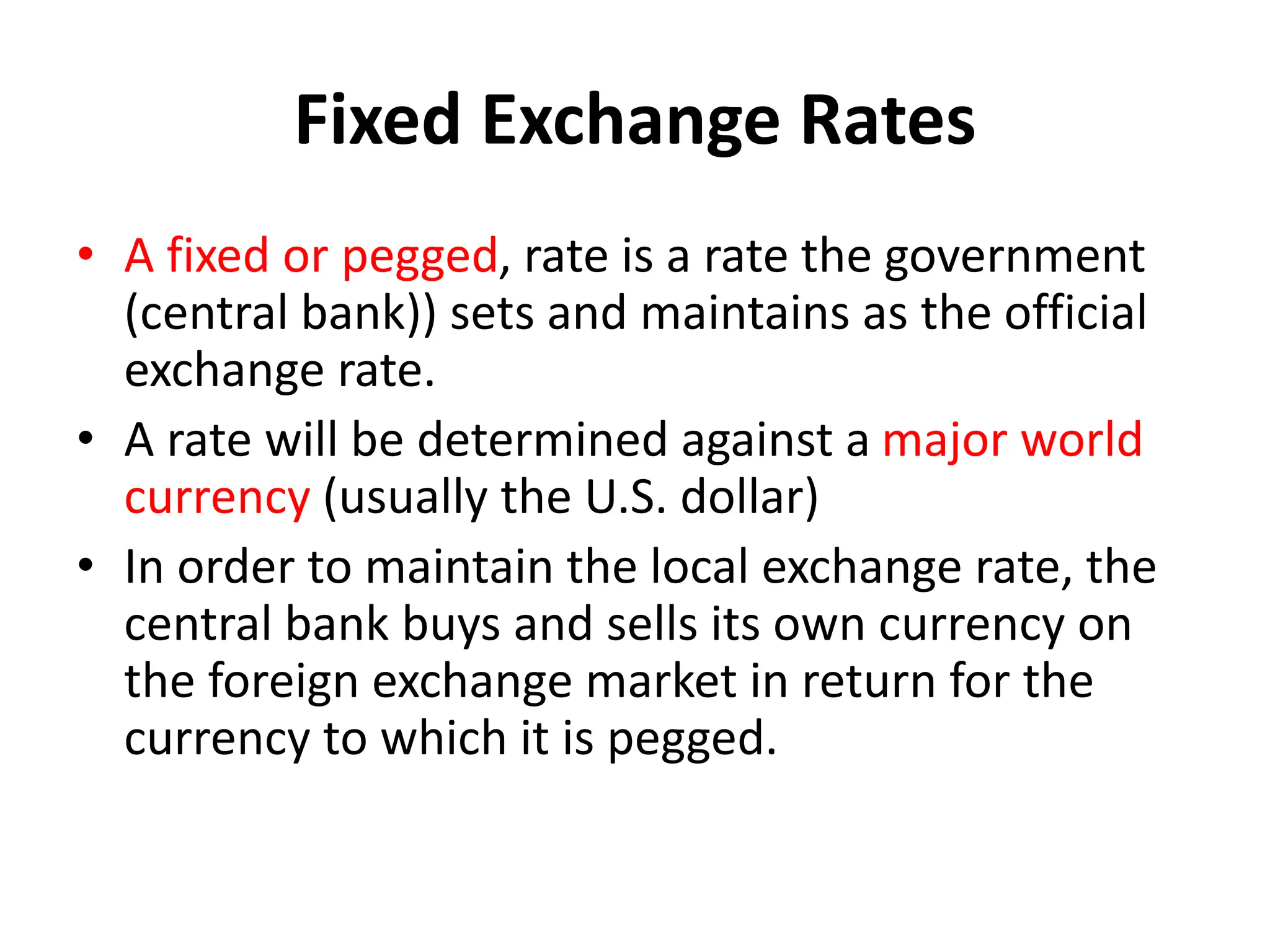

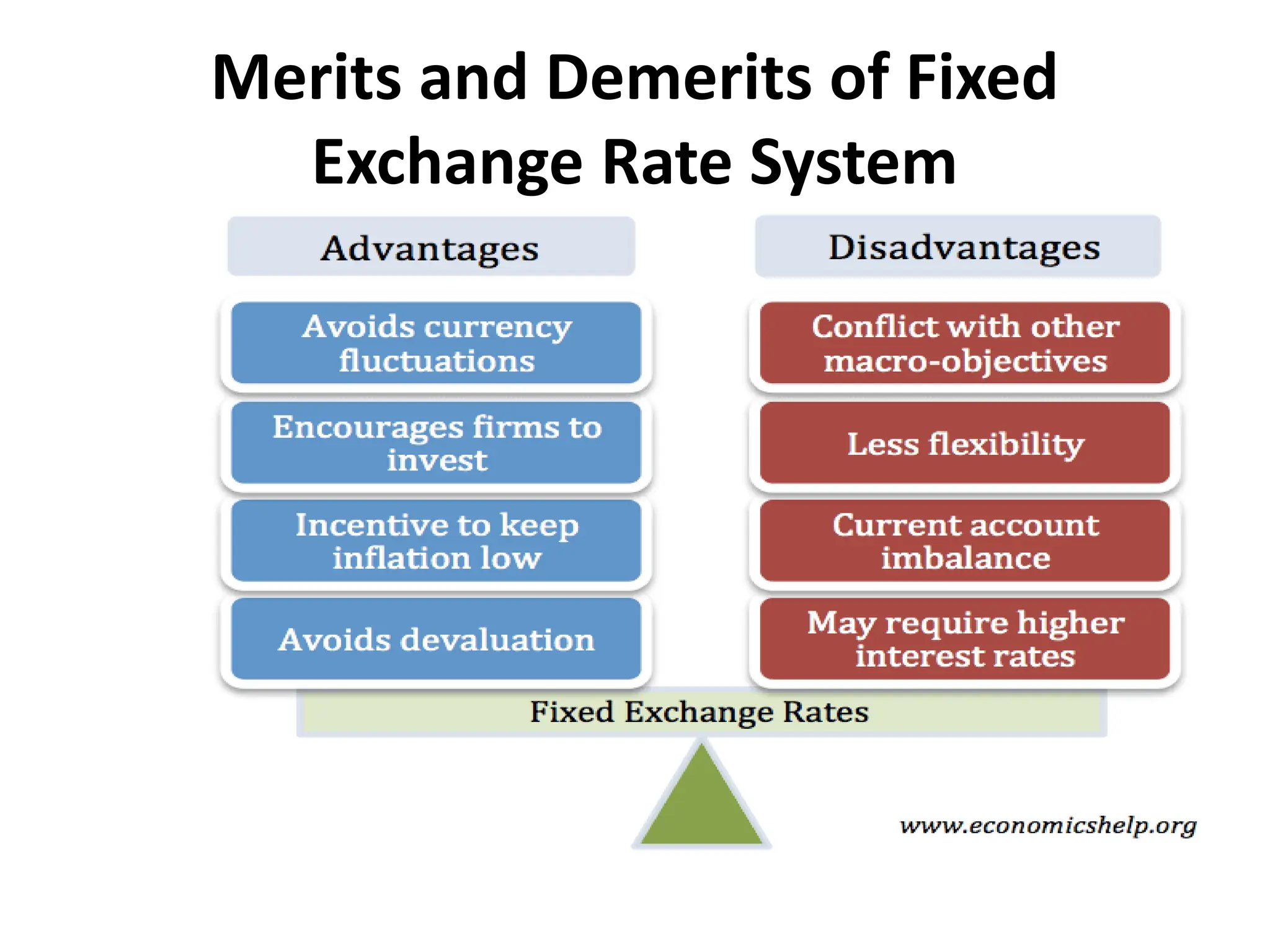

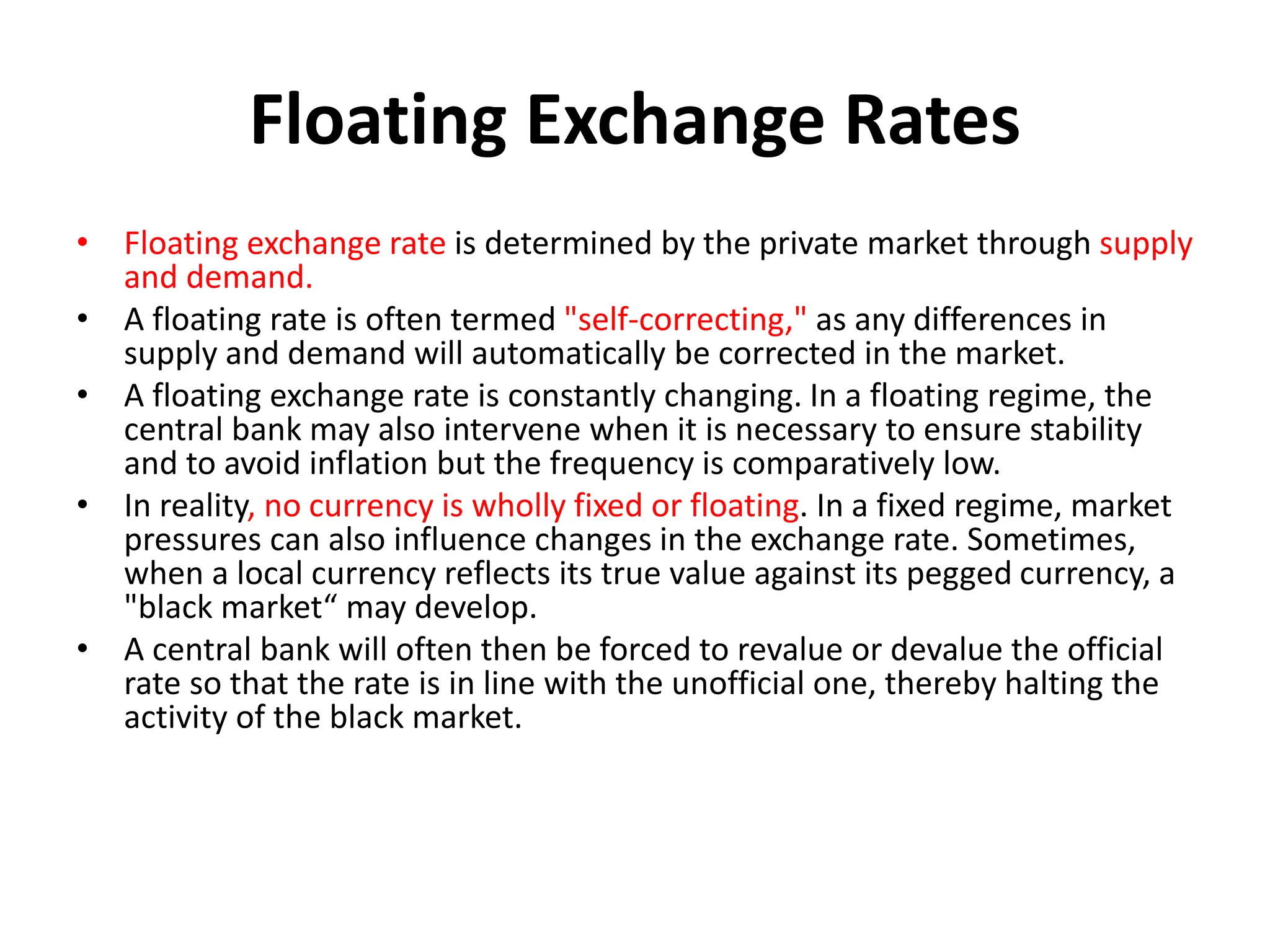

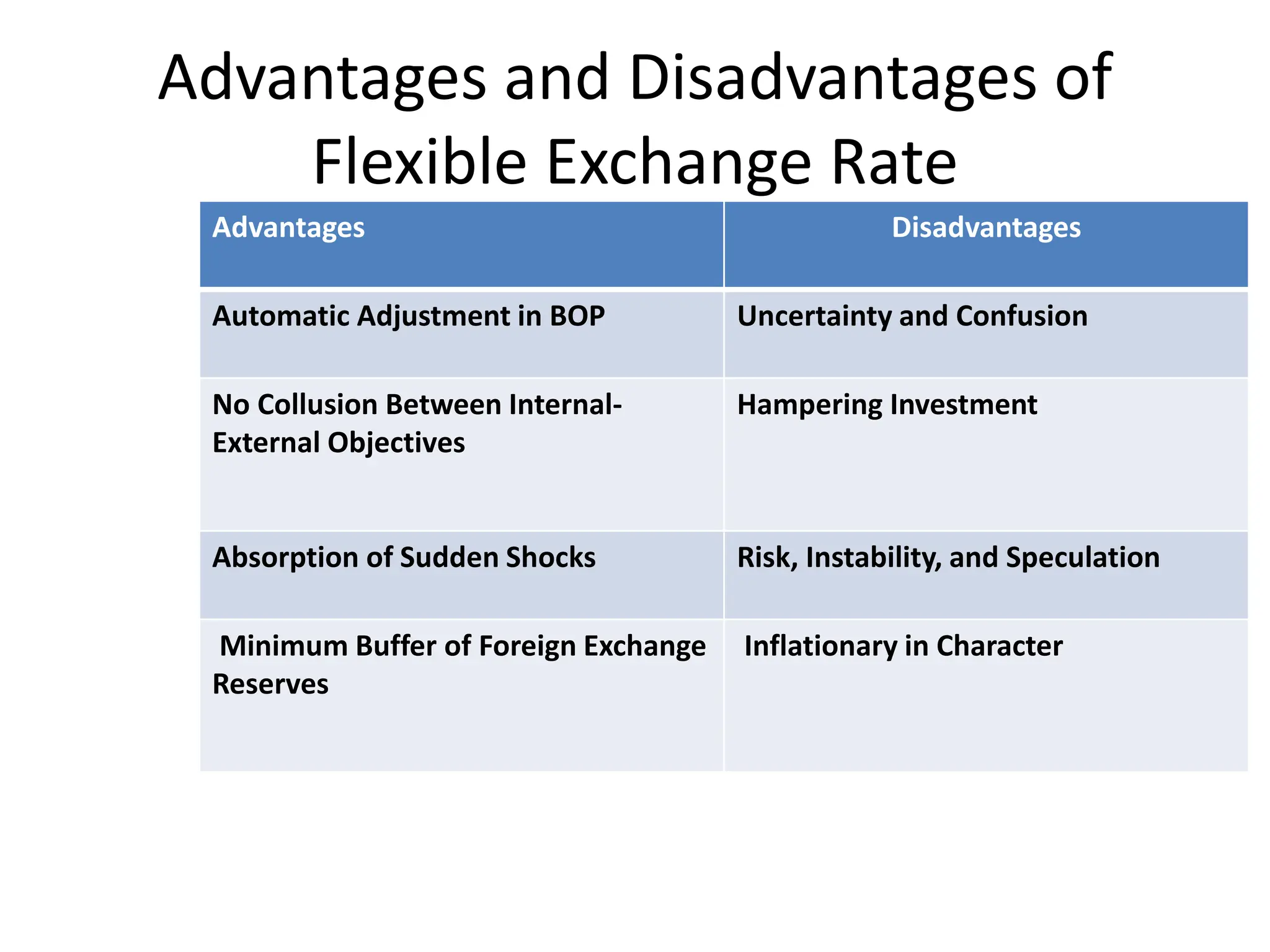

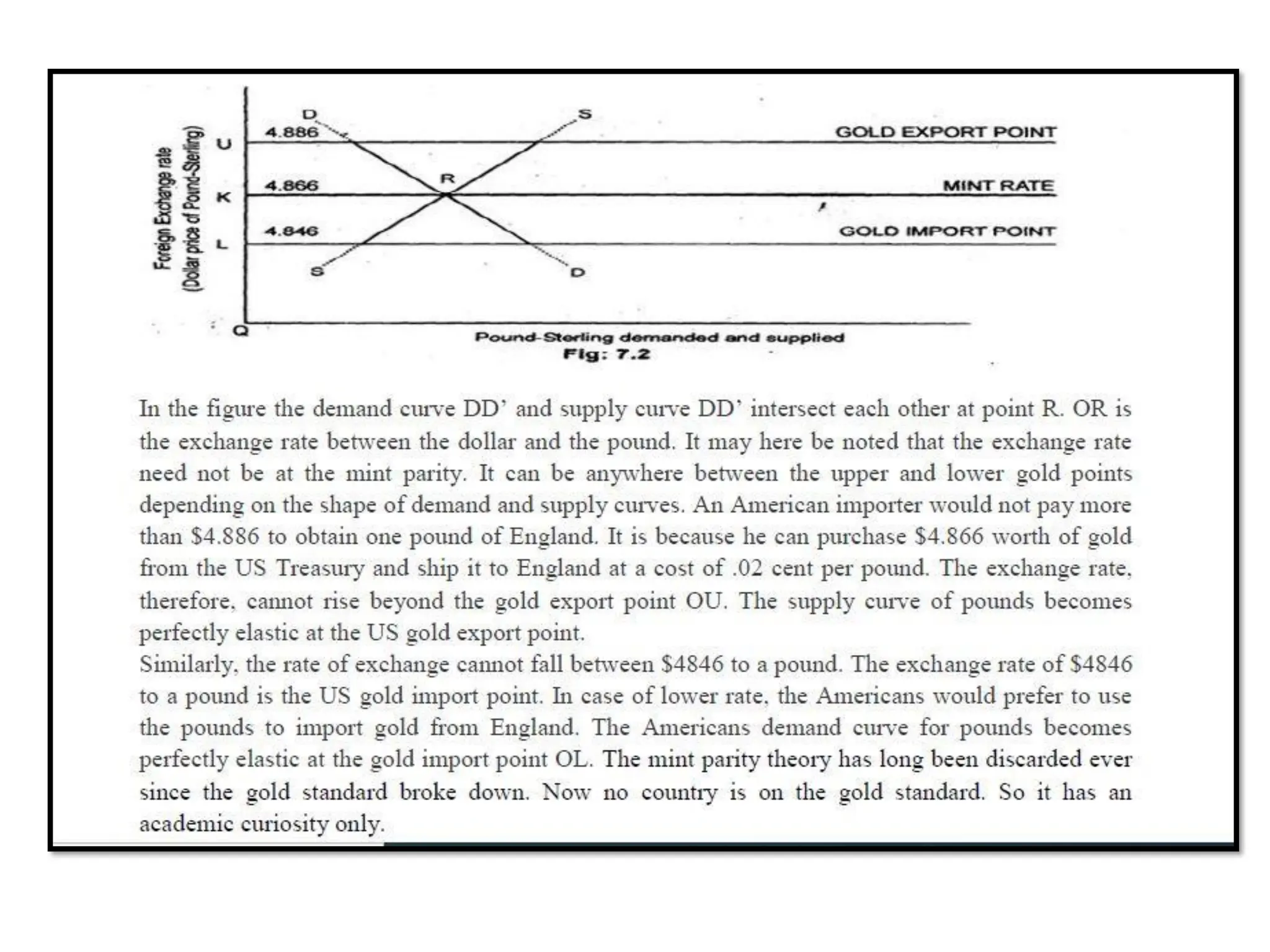

The document discusses the foreign exchange market, detailing its functions, types of transactions, and systems of exchange rate determination. Key concepts such as nominal and real exchange rates, as well as theories like purchasing power parity and mint parity, are explained. It also covers the implications of exchange rate changes, including devaluation, revaluation, appreciation, and depreciation.