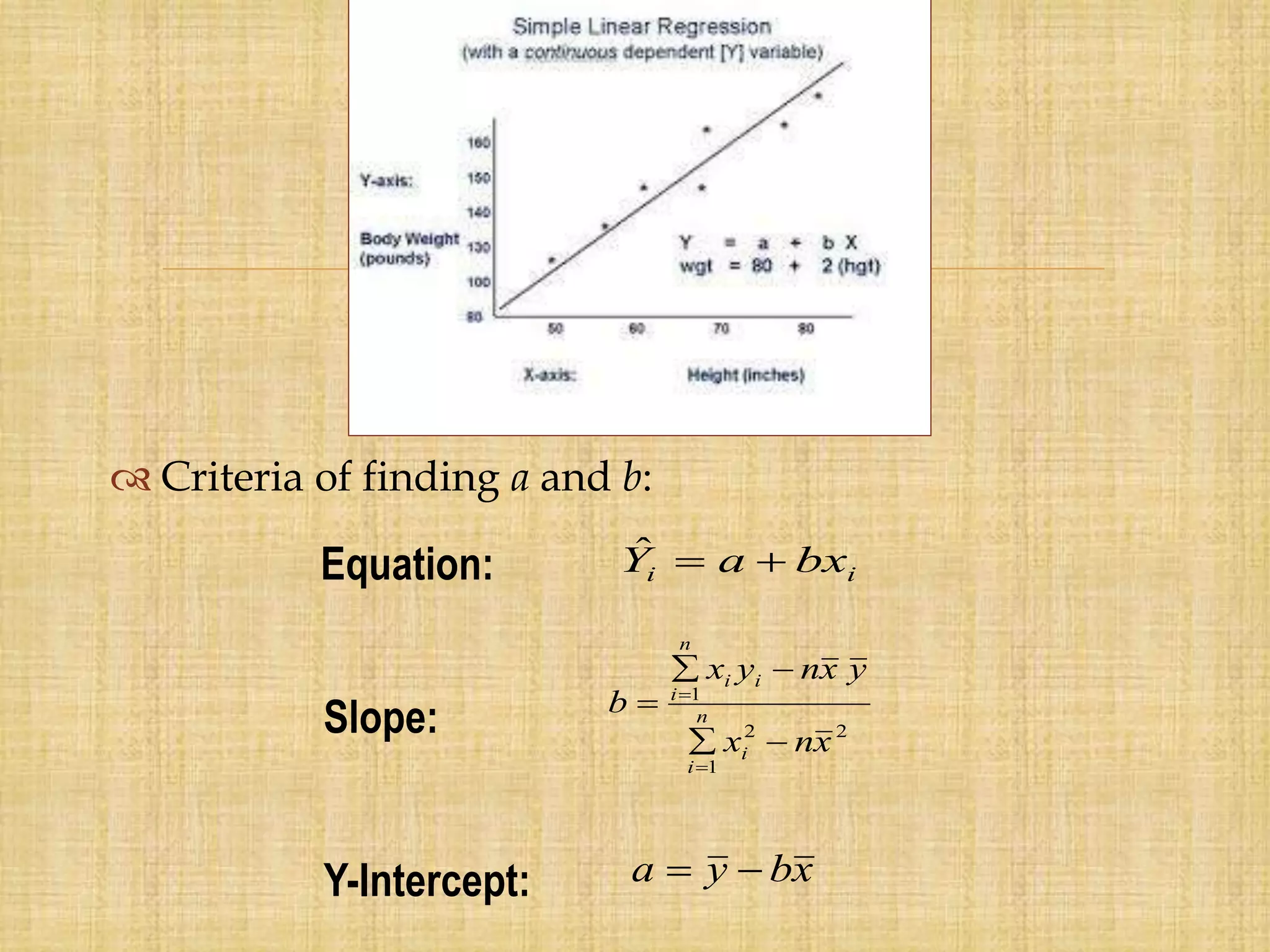

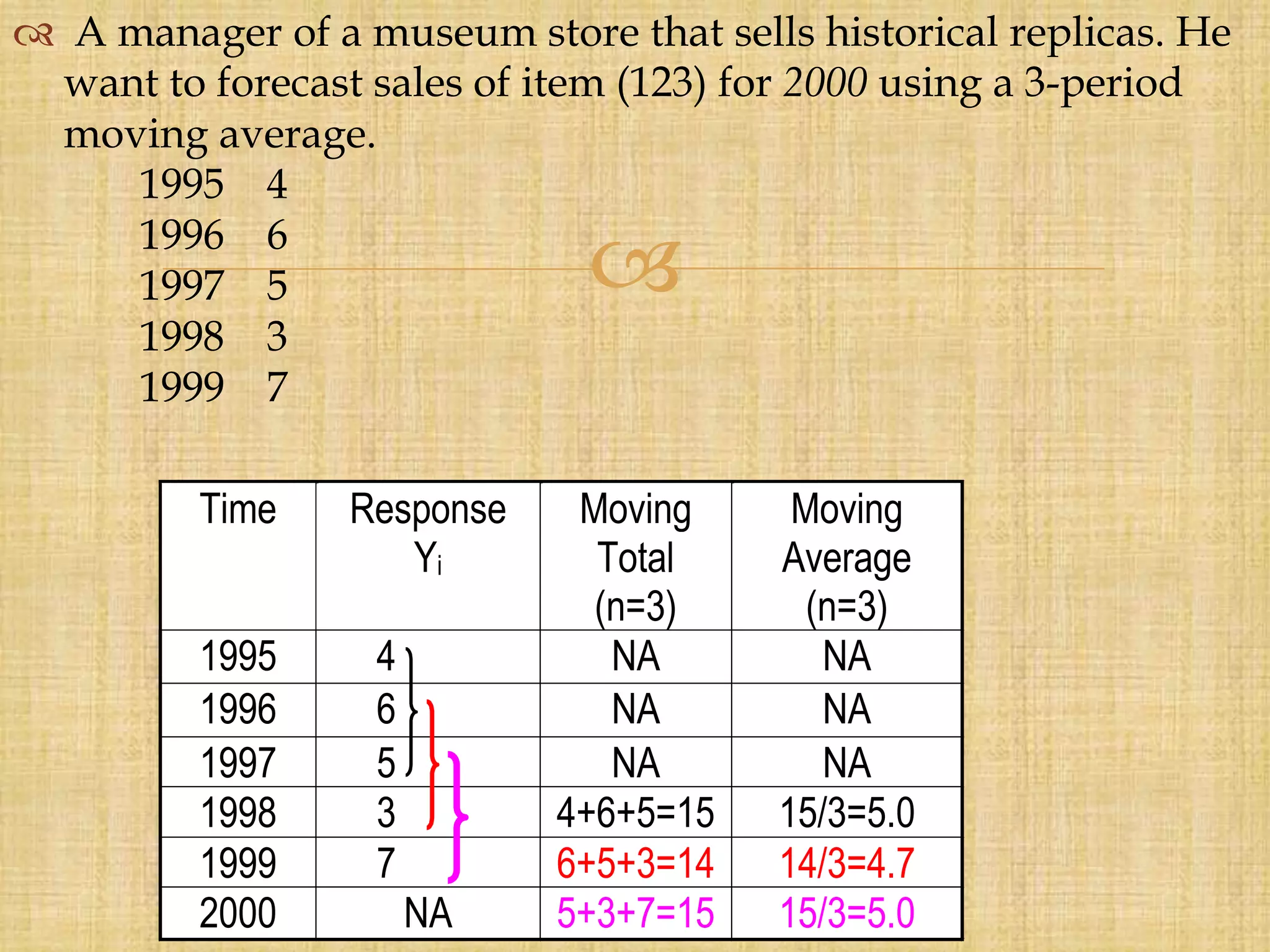

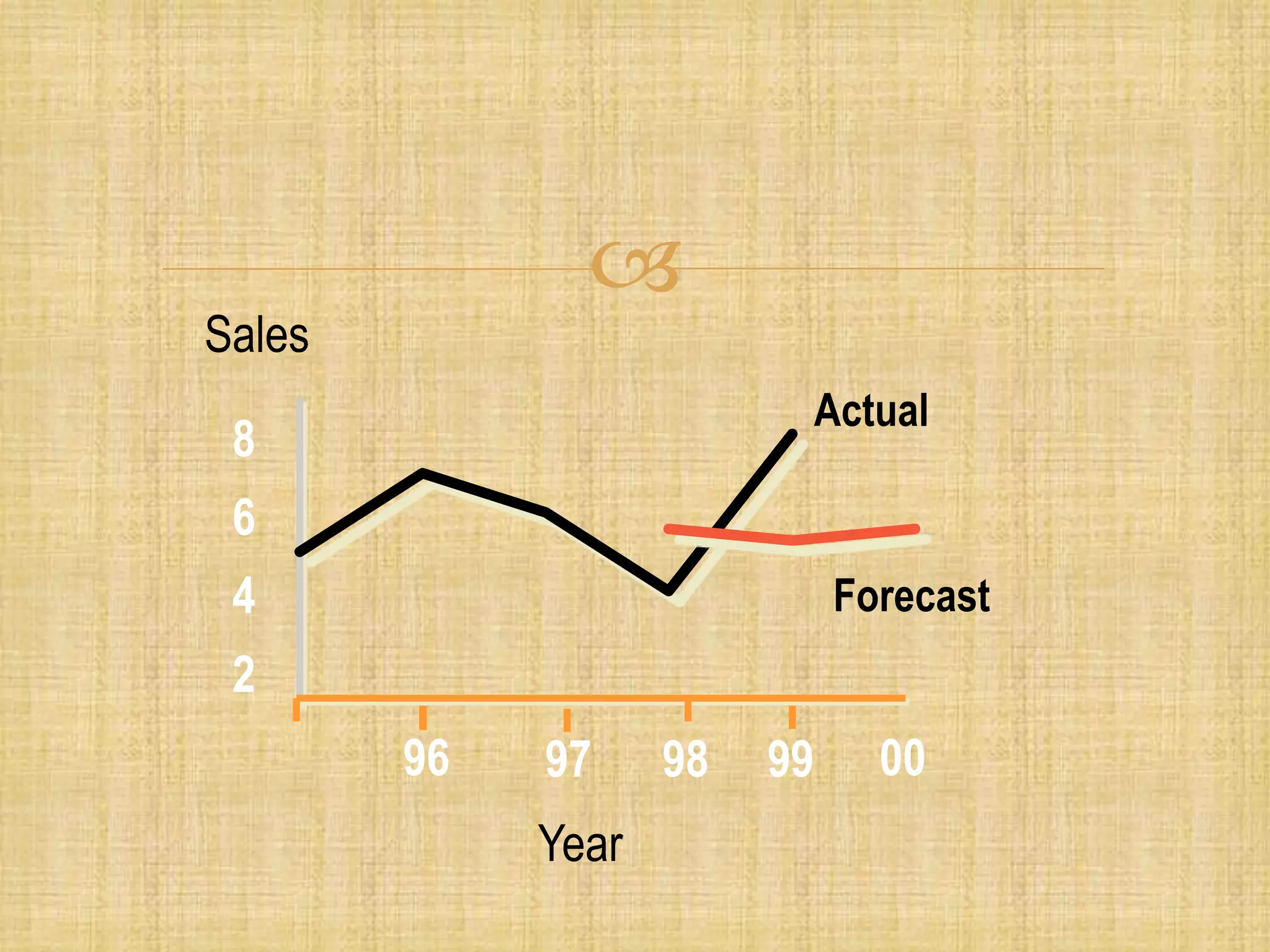

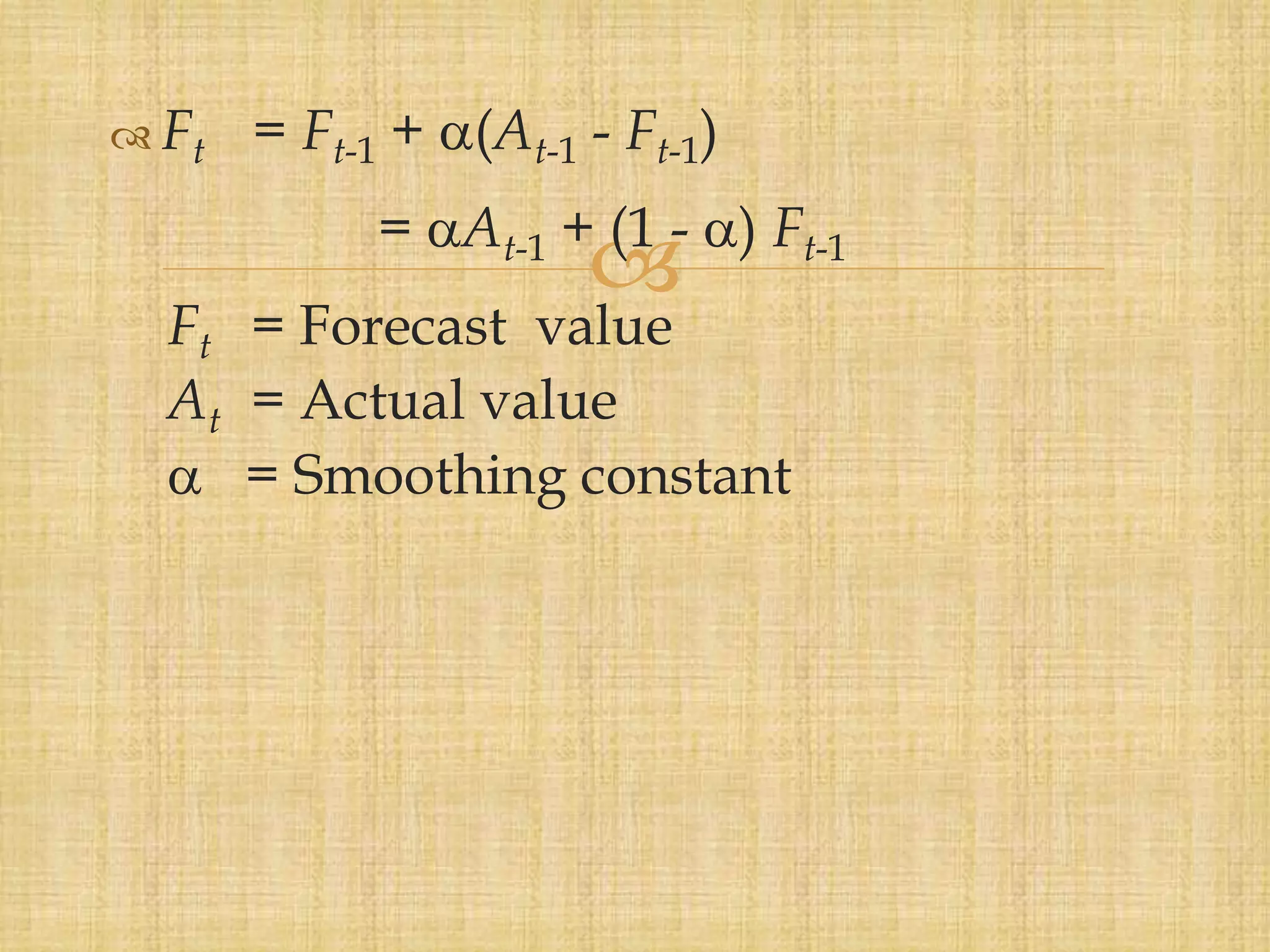

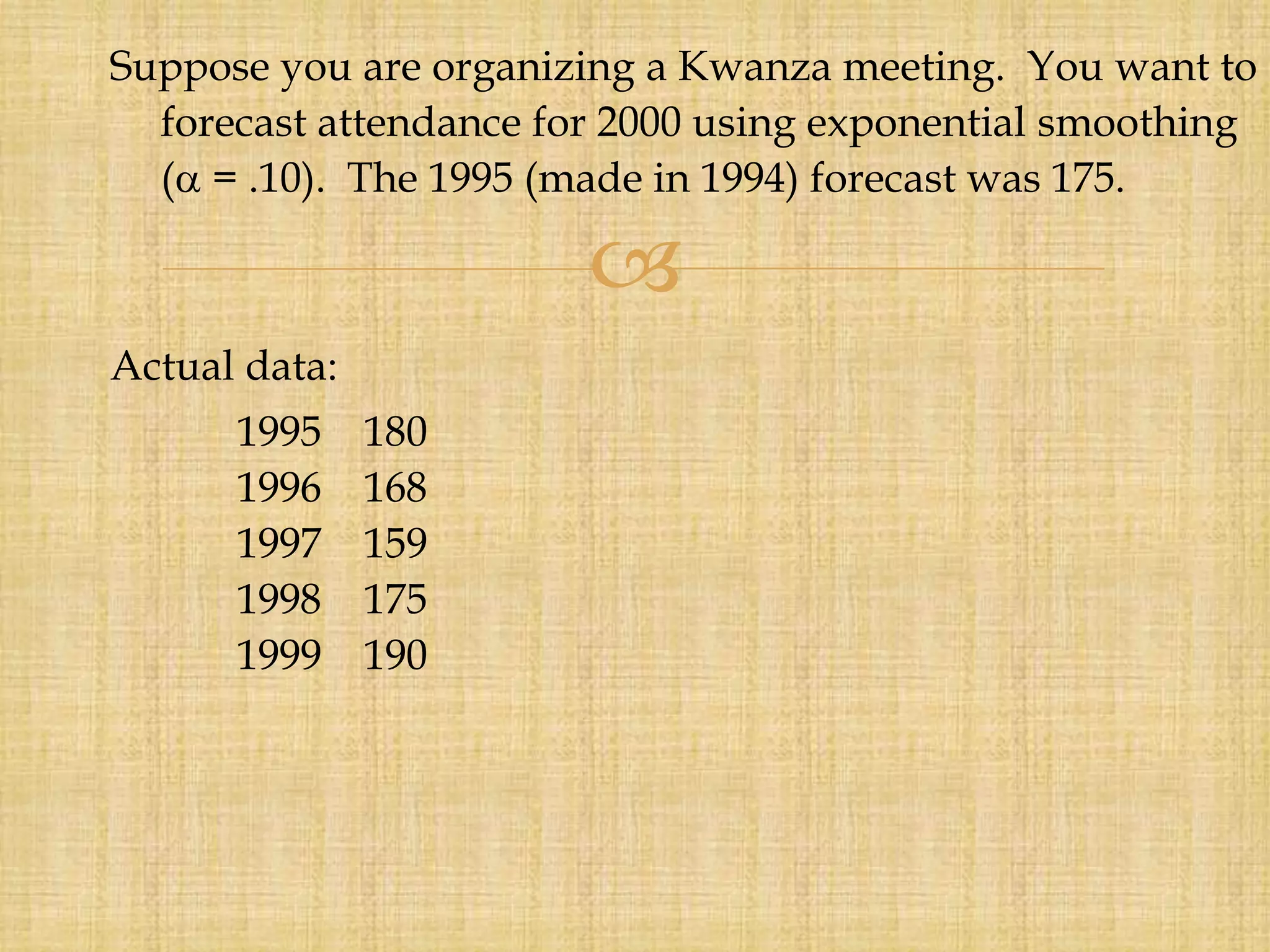

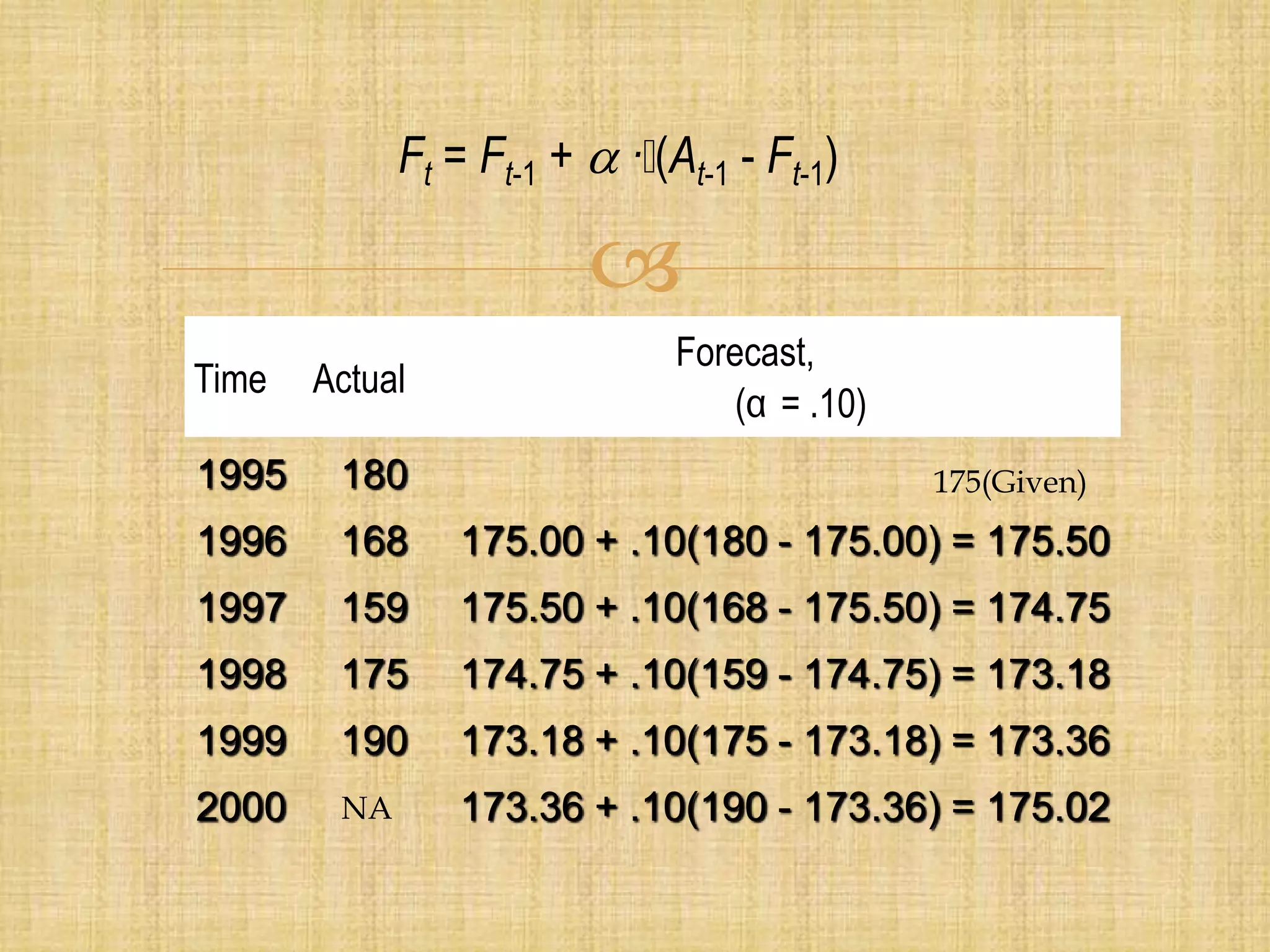

Forecasting is the process of estimating future events by analyzing past data, which is crucial for business decisions in areas like finance and marketing. There are both qualitative and quantitative forecasting methods, including time series and associative models, and various techniques like moving averages and exponential smoothing. Effective forecasting requires careful data analysis, understanding trends and seasonal variations, and ongoing monitoring for accuracy.