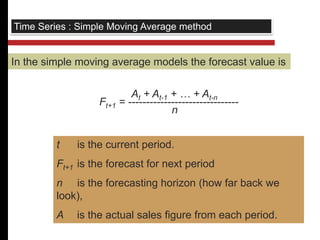

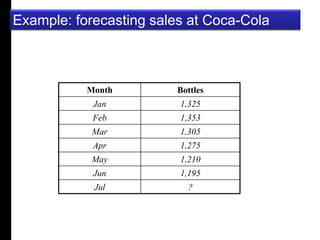

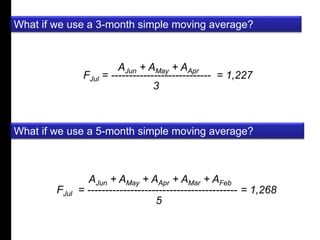

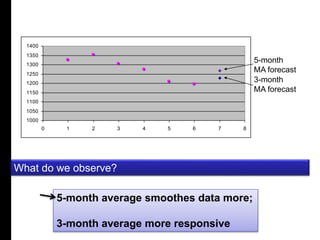

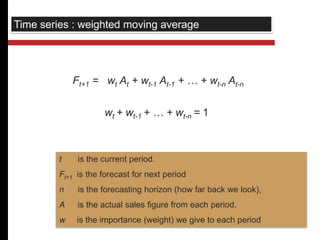

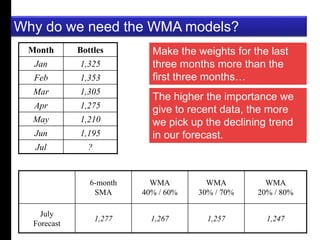

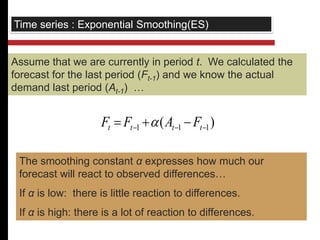

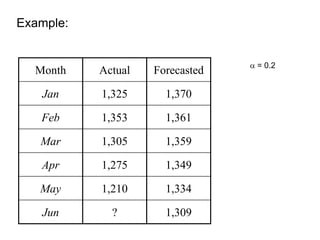

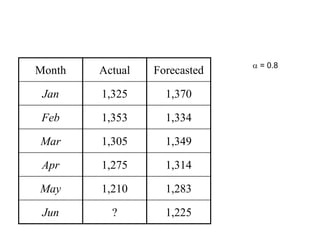

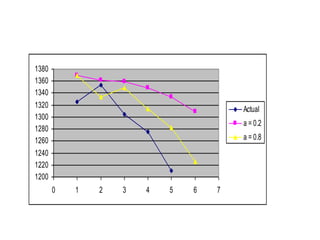

This document discusses quantitative forecasting methods. Quantitative forecasting depends on data and analytical techniques to predict future demand based on past demand information. Some common quantitative forecasting methods discussed include time series analysis, causal models, and simulation. Time series methods like simple moving averages, weighted moving averages, and exponential smoothing are explained as techniques to forecast future demand based on historical data trends. Linear regression models are also mentioned as a way to establish relationships between demand and other factors. Key factors that influence the selection of a forecasting method include data availability, required time horizon, accuracy needs, and available resources.