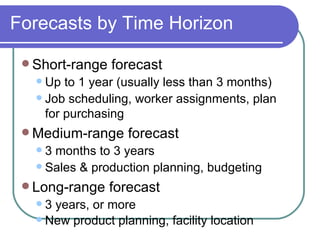

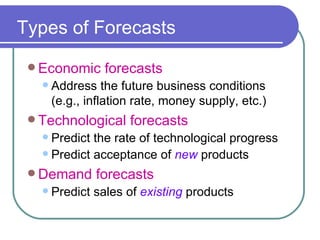

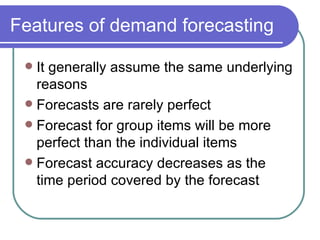

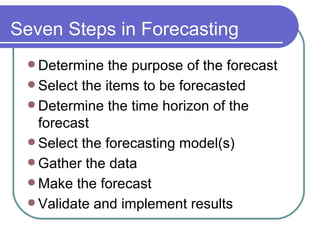

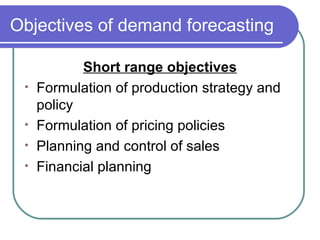

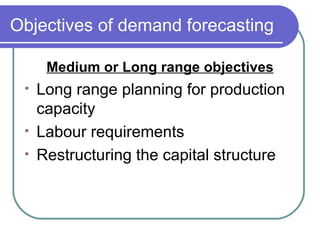

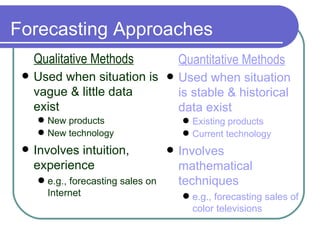

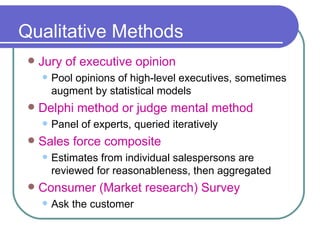

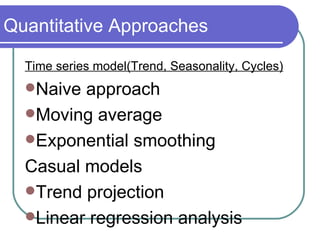

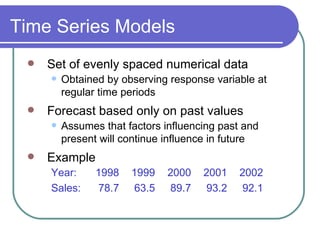

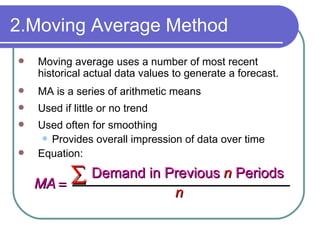

Forecasting involves predicting future events and is commonly used to estimate future demand for products and services. There are different time horizons for forecasts, including short-range (up to 1 year), medium-range (3 months to 3 years), and long-range (3 years or more). Forecasting methods can be quantitative, using mathematical techniques and historical data, or qualitative, using intuition and expert opinions. The objectives of demand forecasting include production planning, financial planning, and long-term strategic planning.