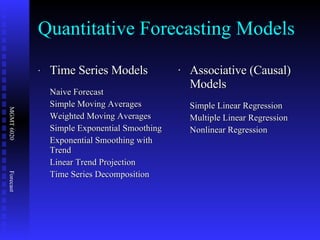

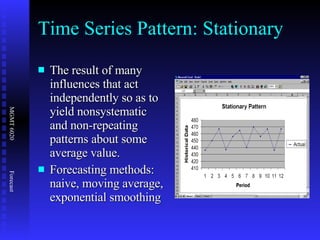

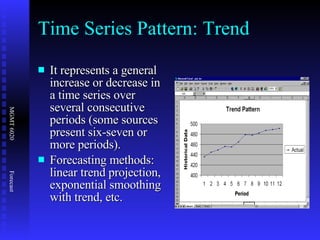

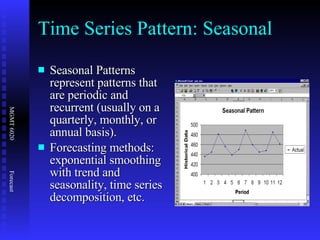

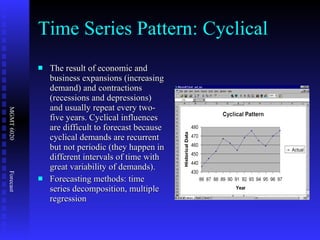

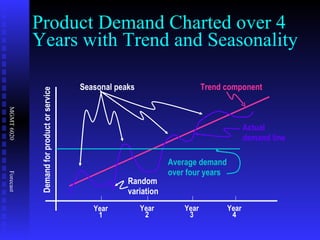

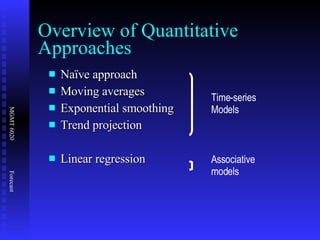

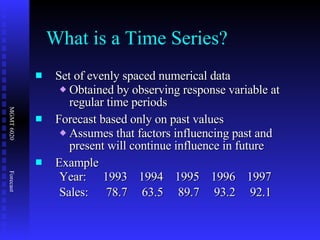

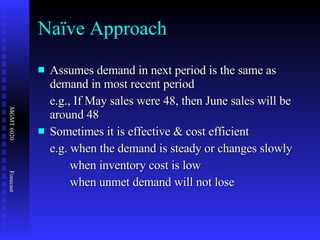

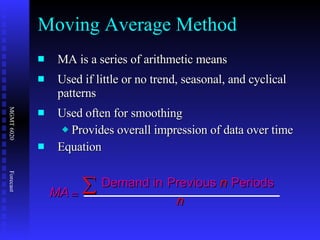

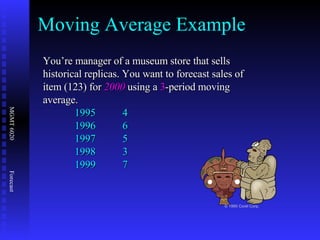

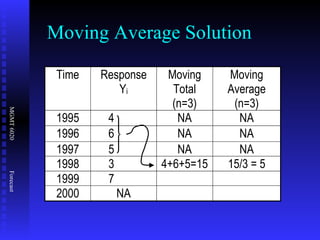

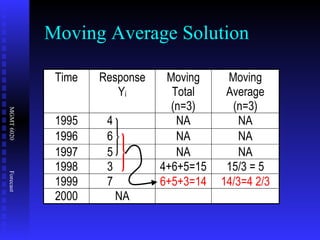

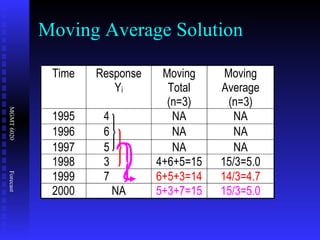

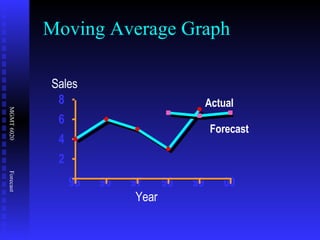

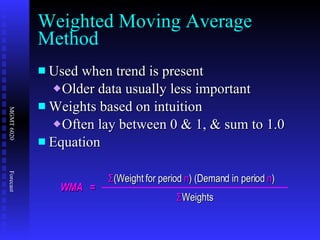

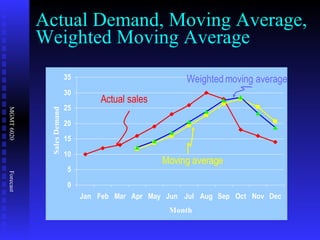

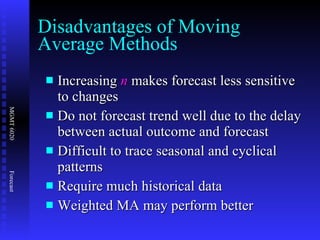

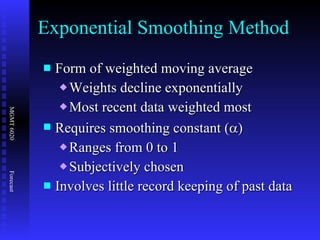

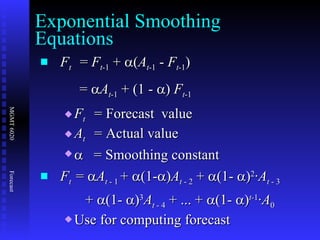

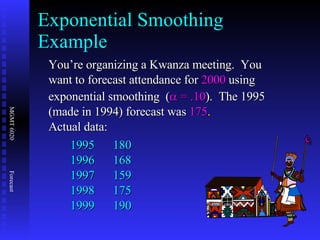

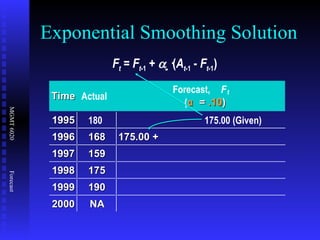

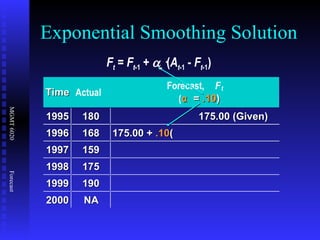

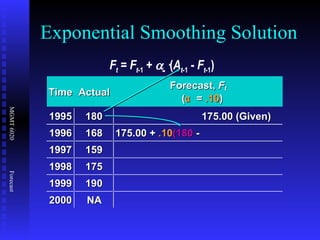

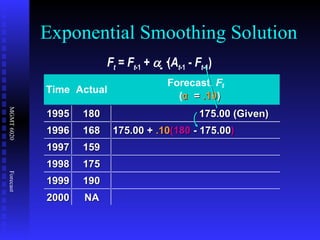

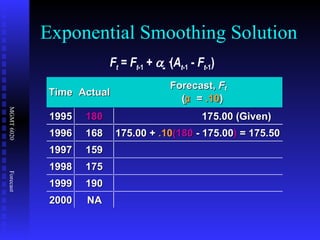

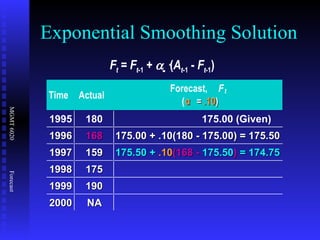

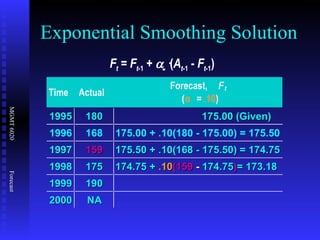

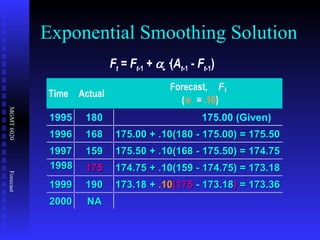

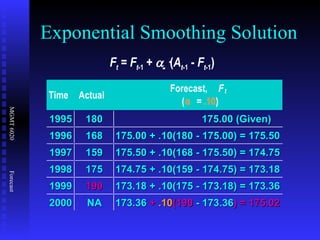

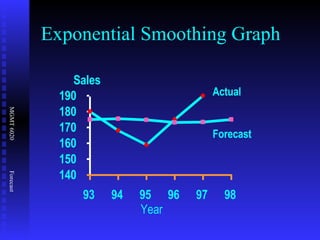

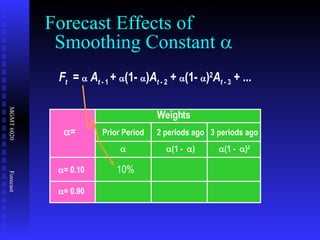

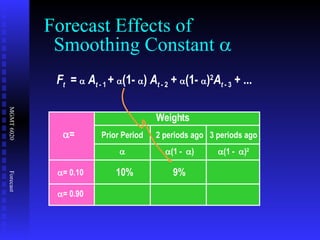

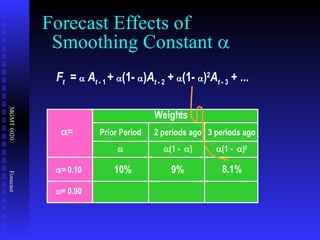

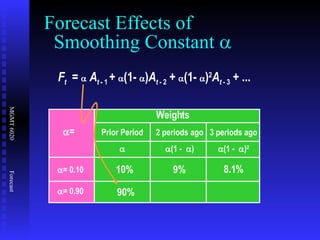

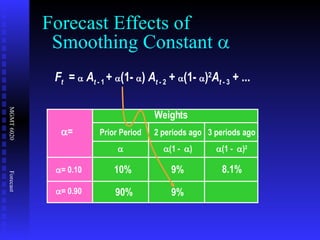

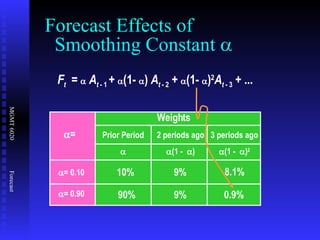

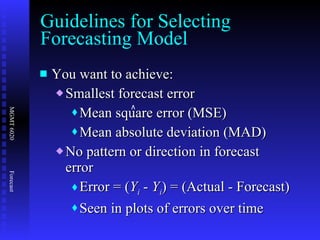

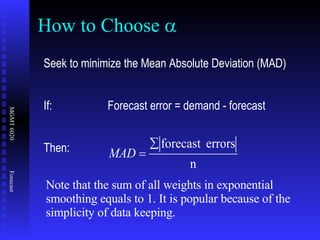

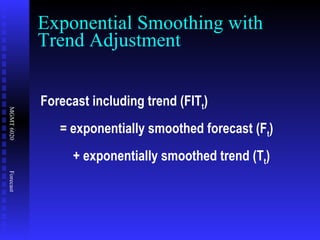

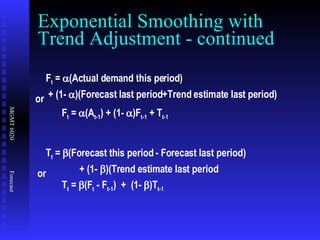

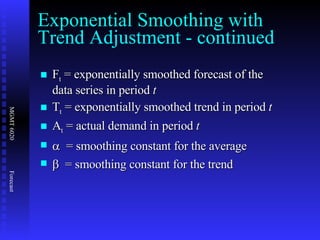

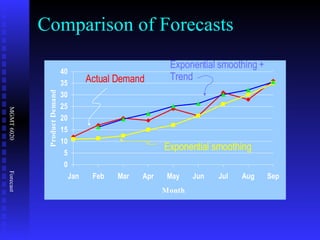

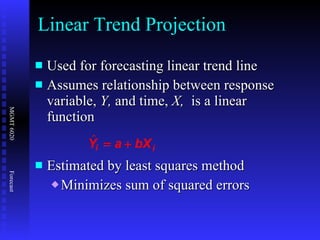

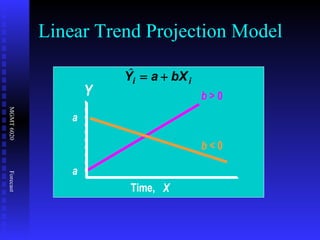

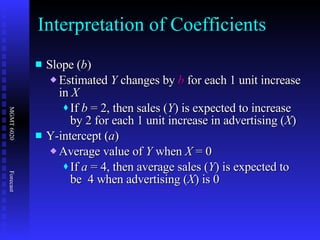

The document discusses various quantitative forecasting techniques including time series methods like moving averages and exponential smoothing. It provides examples of how to calculate 3-period moving averages and exponential smoothing forecasts using sample sales data. Exponential smoothing places more weight on recent observations compared to moving averages. The smoothing constant determines how quickly older data is discounted.