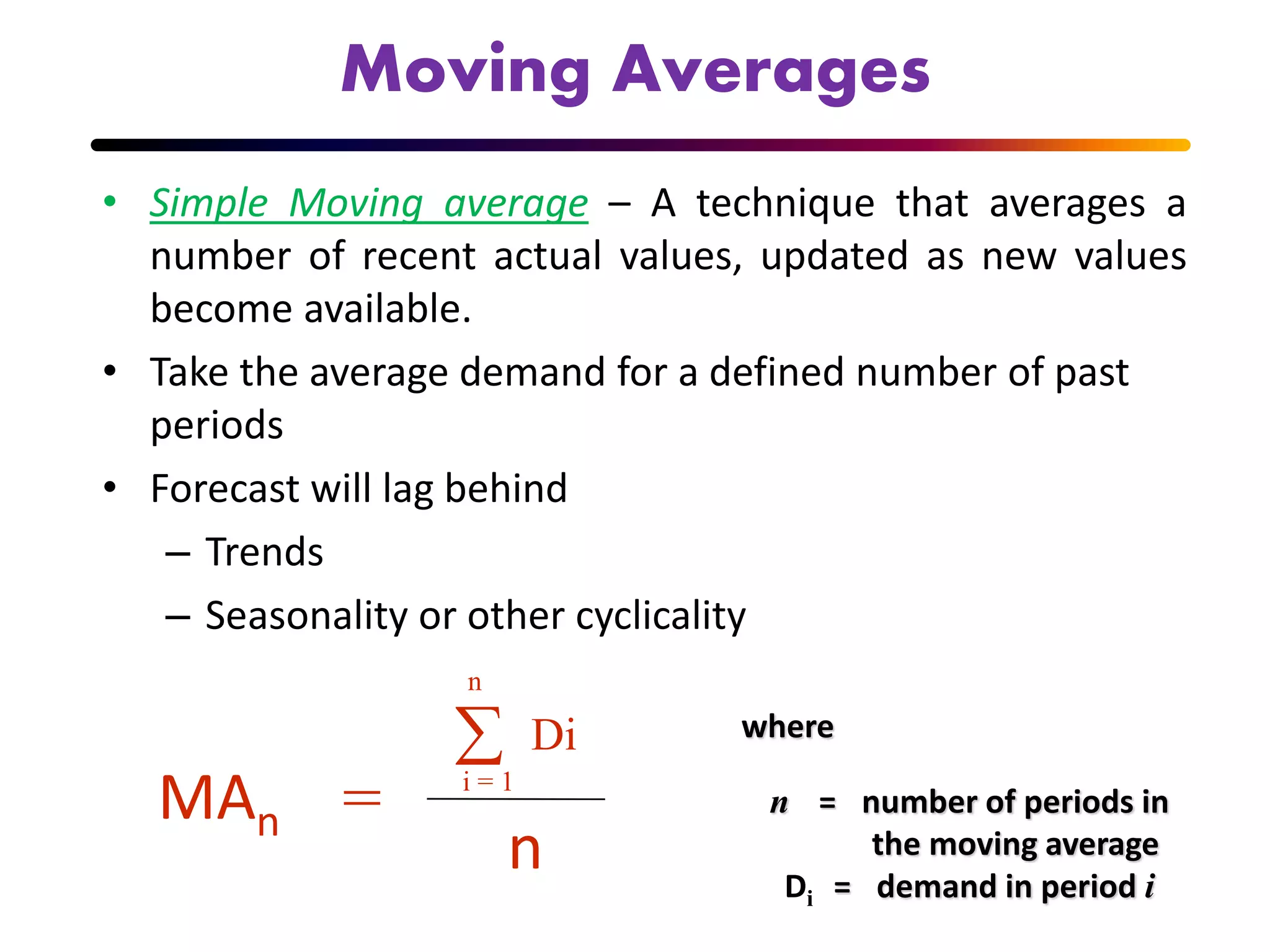

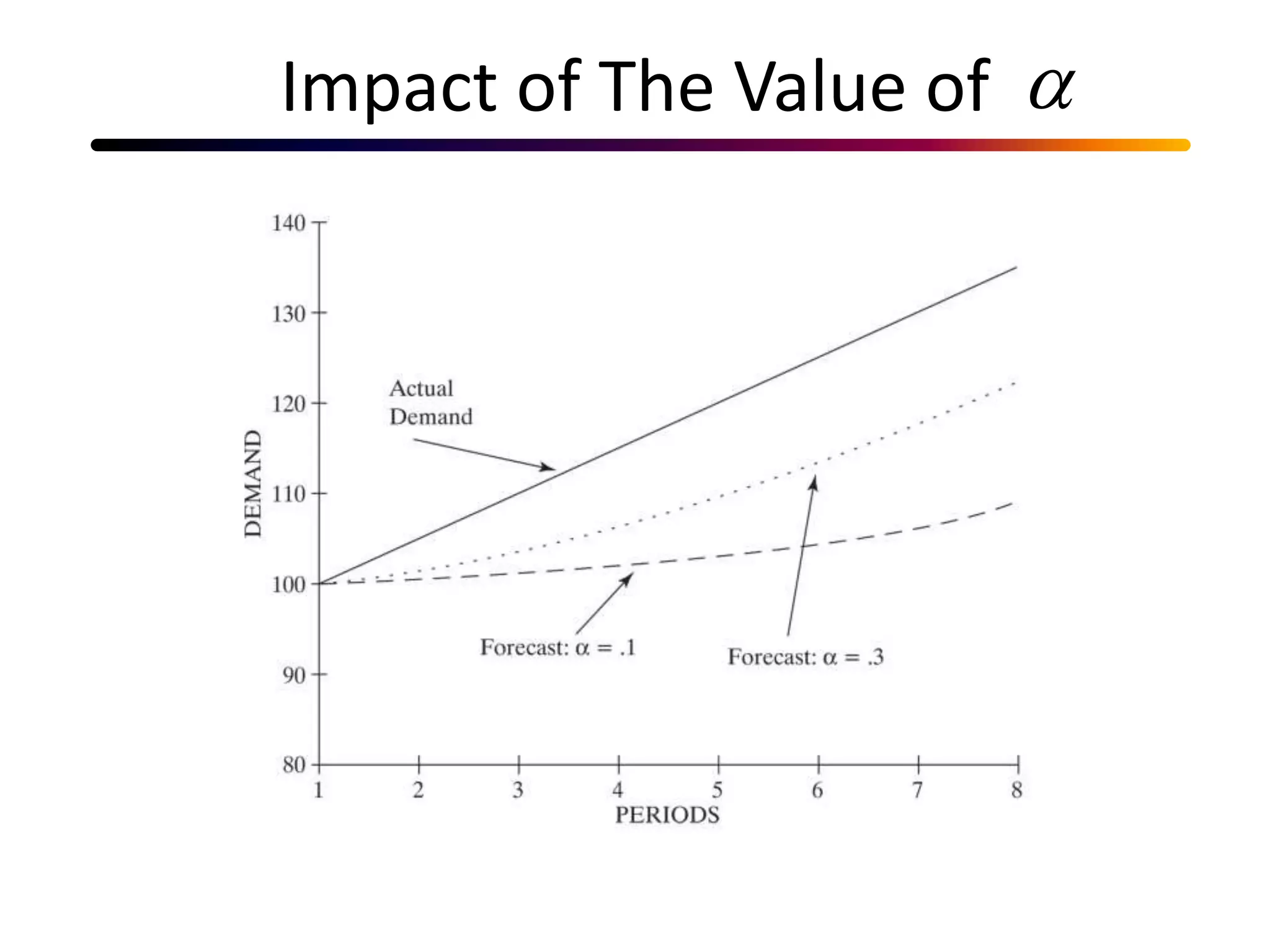

This document discusses various methods for forecasting demand and sales, including quantitative and qualitative techniques. It provides an overview of key forecasting concepts such as time series analysis, moving averages, exponential smoothing, regression analysis, and evaluating forecast accuracy. The document compares different forecasting methods and provides examples of calculating forecasts using techniques like simple and weighted moving averages, exponential smoothing, and linear regression analysis.

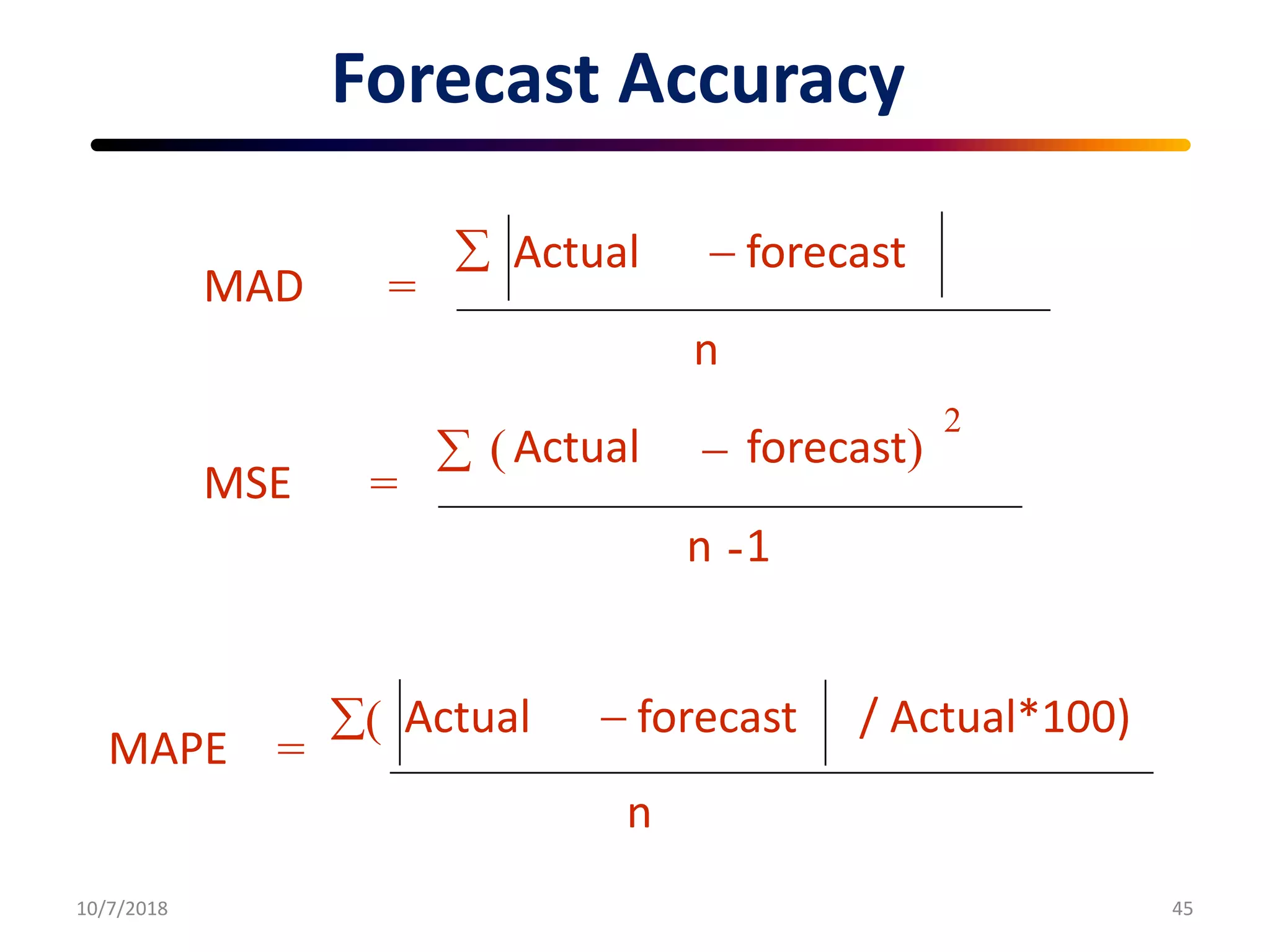

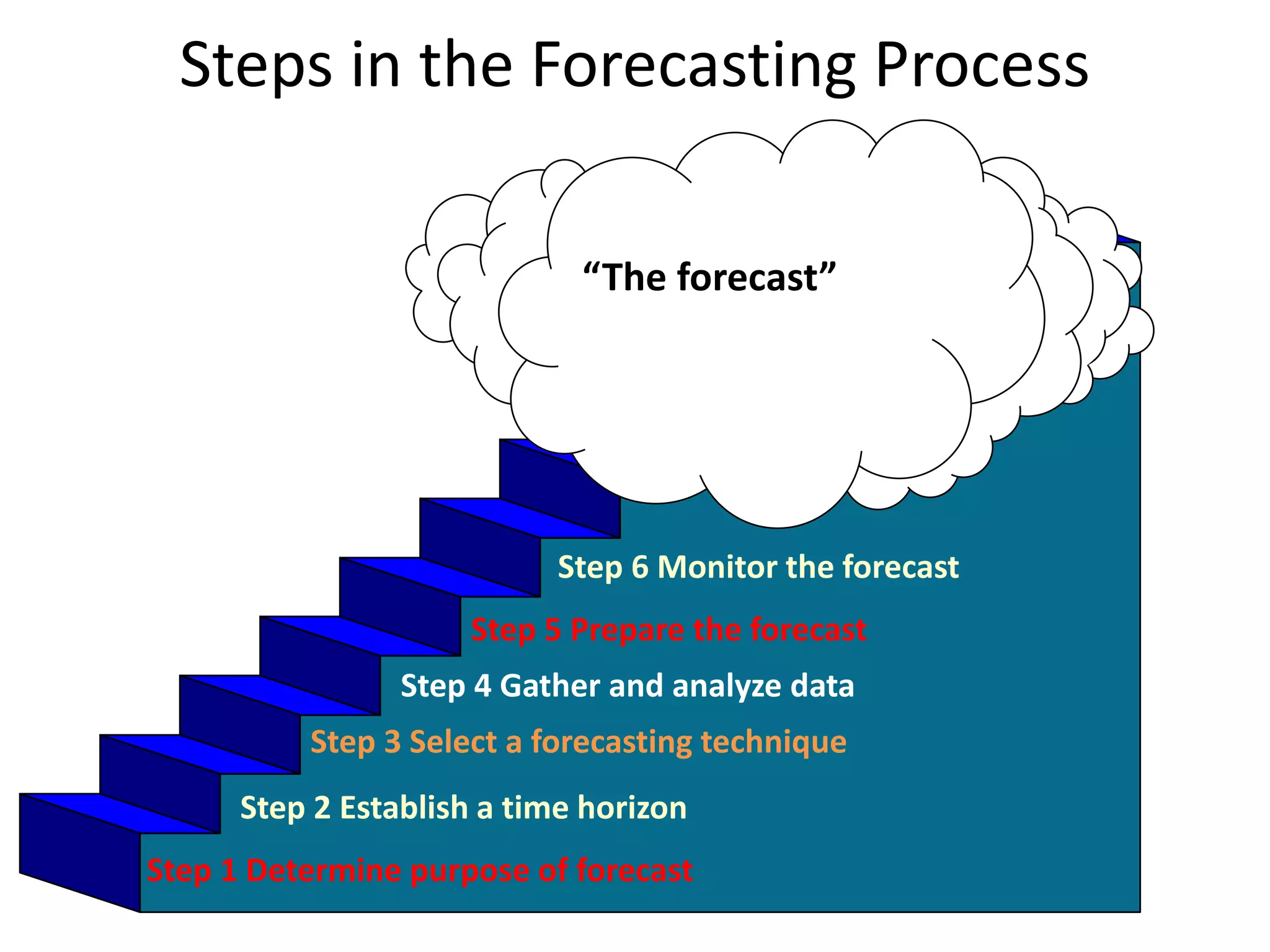

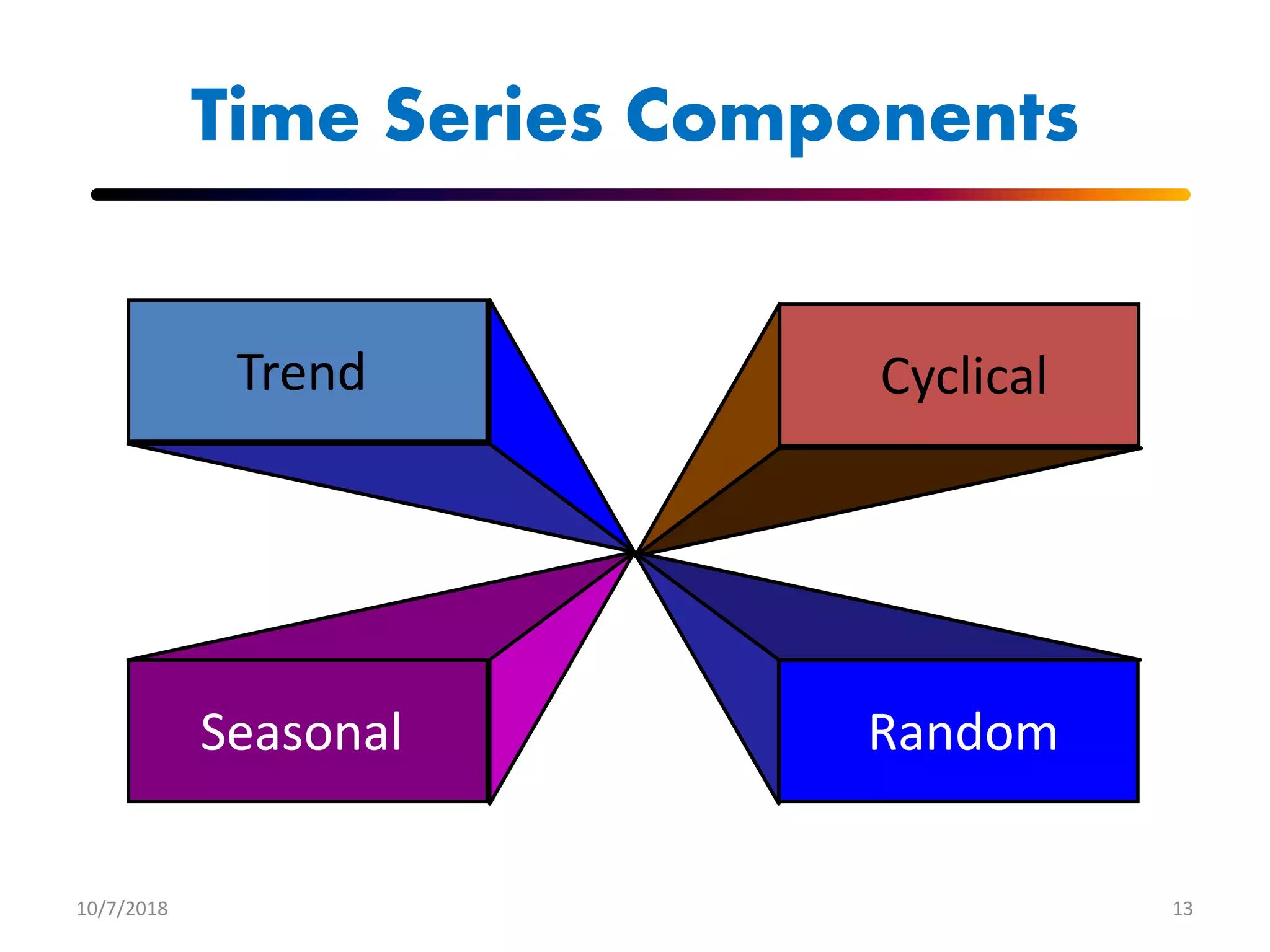

![Weighted moving average

2610/7/2018

January 10

February 12

March 13

April 16

May 19

June 23

July 26

Actual 3-Month Weighted

Month Shed Sales Moving Average

[(3 x 16) + (2 x 13) + (12)]/6 = 141/3

[(3 x 19) + (2 x 16) + (13)]/6 = 17

[(3 x 23) + (2 x 19) + (16)]/6 = 201/2

10

12

13

[(3 x 13) + (2 x 12) + (10)]/6 = 121/6](https://image.slidesharecdn.com/forcasting-181007052604/75/Forecasting-of-demand-management-26-2048.jpg)

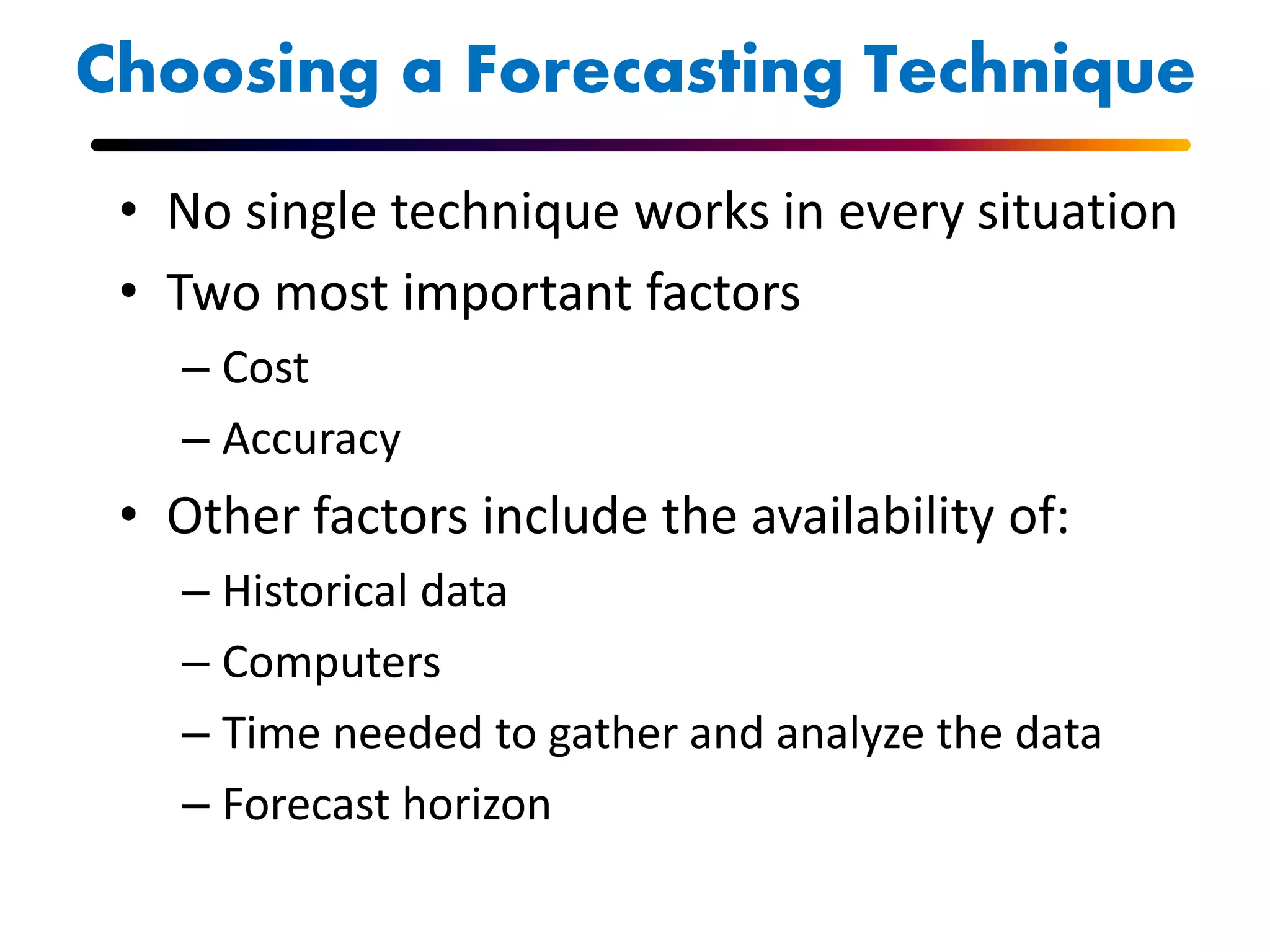

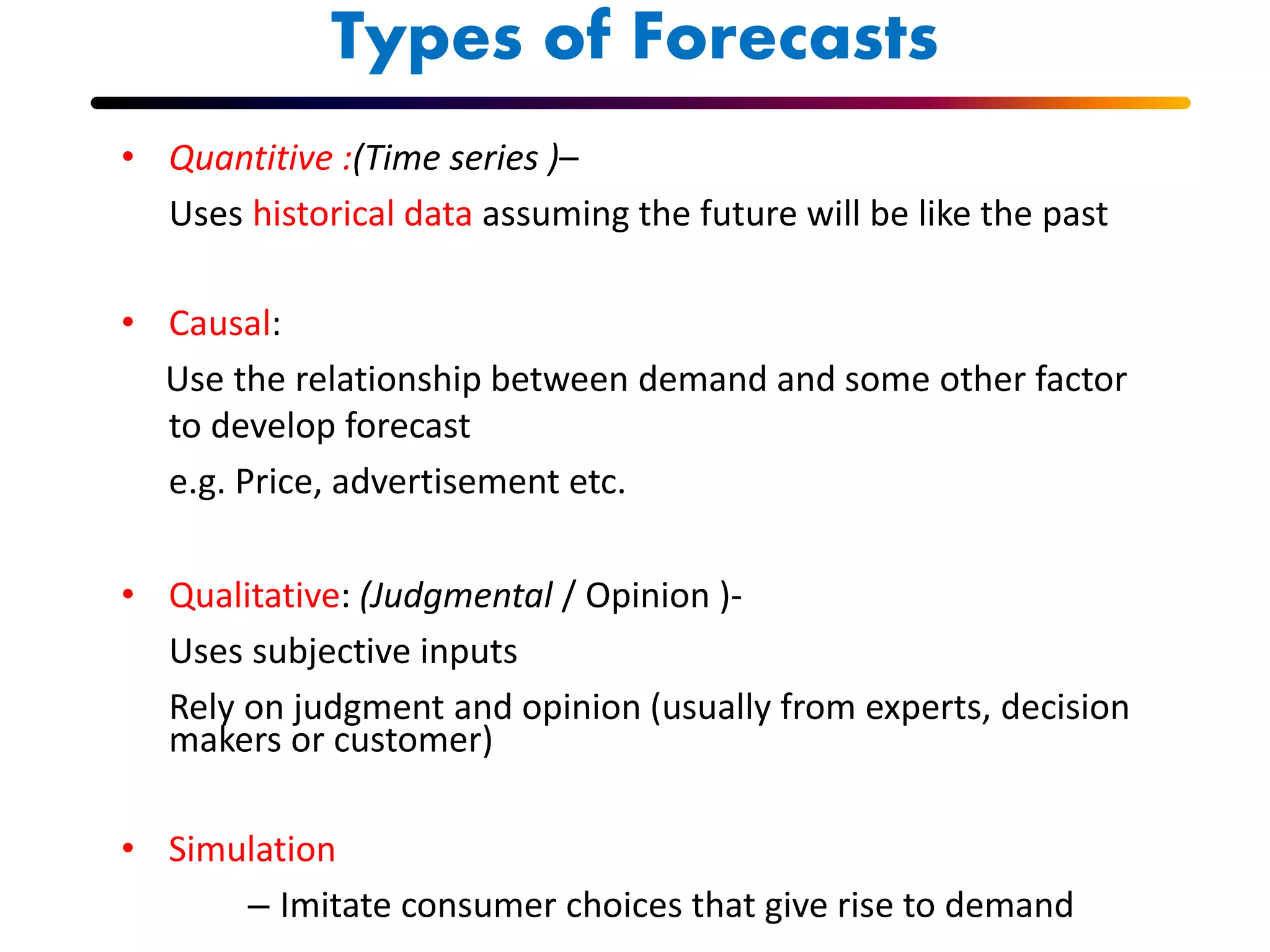

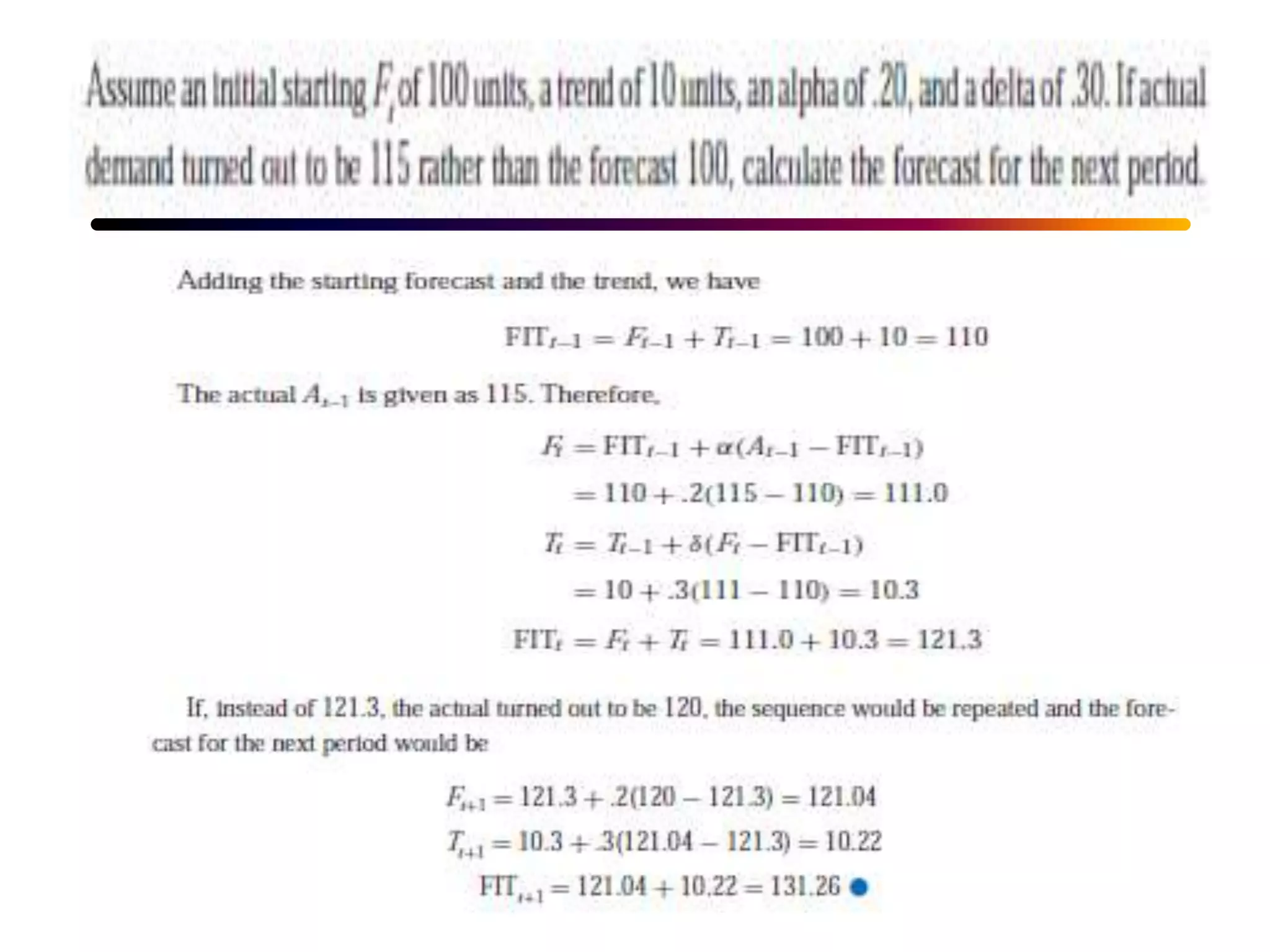

![Correlation Analysis

How strong is the linear relationship between the

variables?

- a measure of the strength of the relationship between

independent and dependent variables

Coefficient of correlation, r, measures degree of

association

Values range from -1 to +1

r =

nxy - xy

[nx2 - (x)2][ny2 - (y)2]](https://image.slidesharecdn.com/forcasting-181007052604/75/Forecasting-of-demand-management-40-2048.jpg)