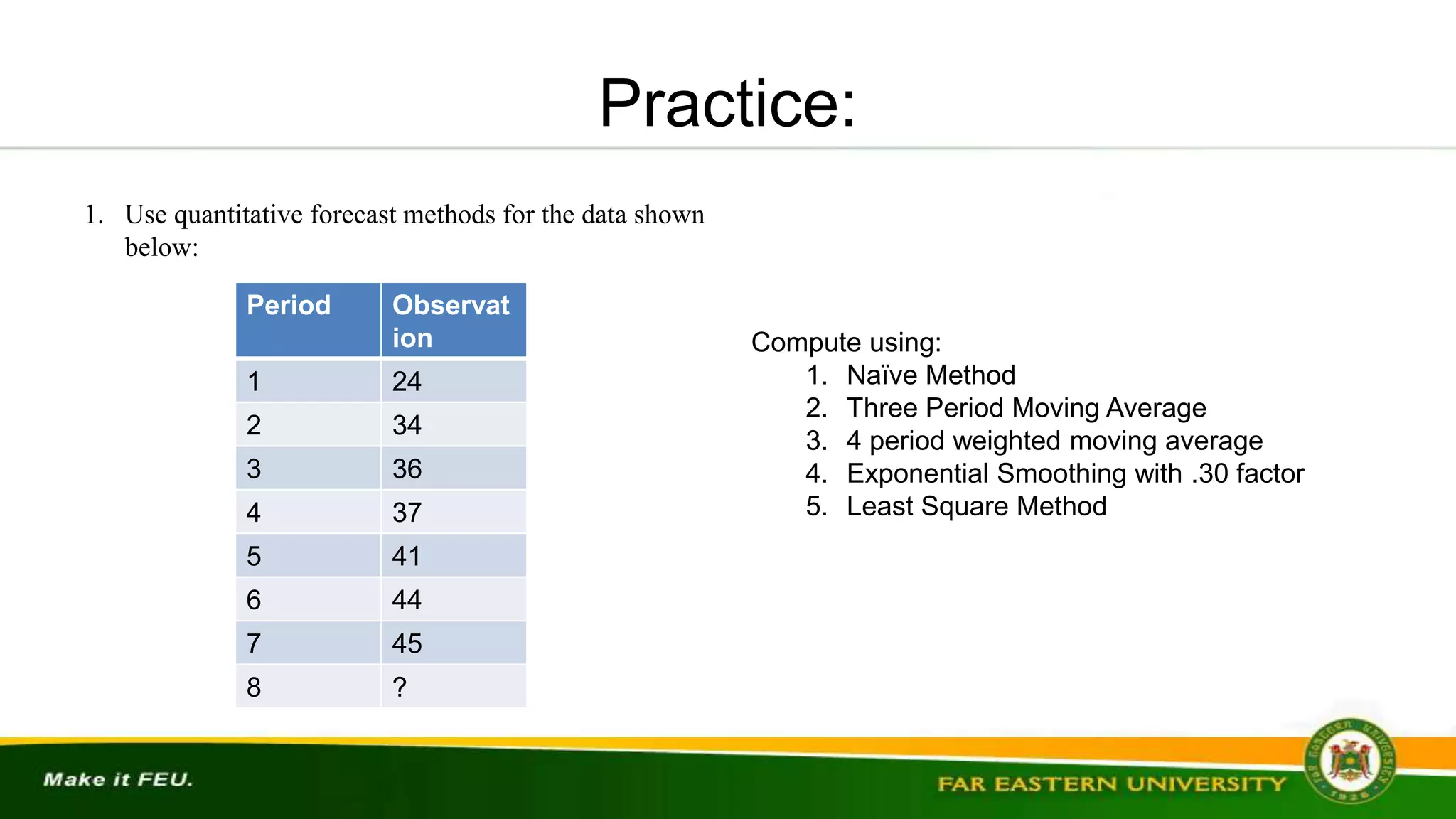

Here are 3 practice problems using quantitative forecasting methods:

1. Using simple exponential smoothing, forecast next period's sales given the following data with a smoothing constant of 0.3:

Period: Sales

1: 100

2: 110

3: 120

4: ?

Forecast: F1 = 100

F2 = 100 + 0.3(110 - 100) = 103

F3 = 103 + 0.3(120 - 103) = 108.9

F4 = 108.9 + 0.3(120 - 108.9) = 113.67

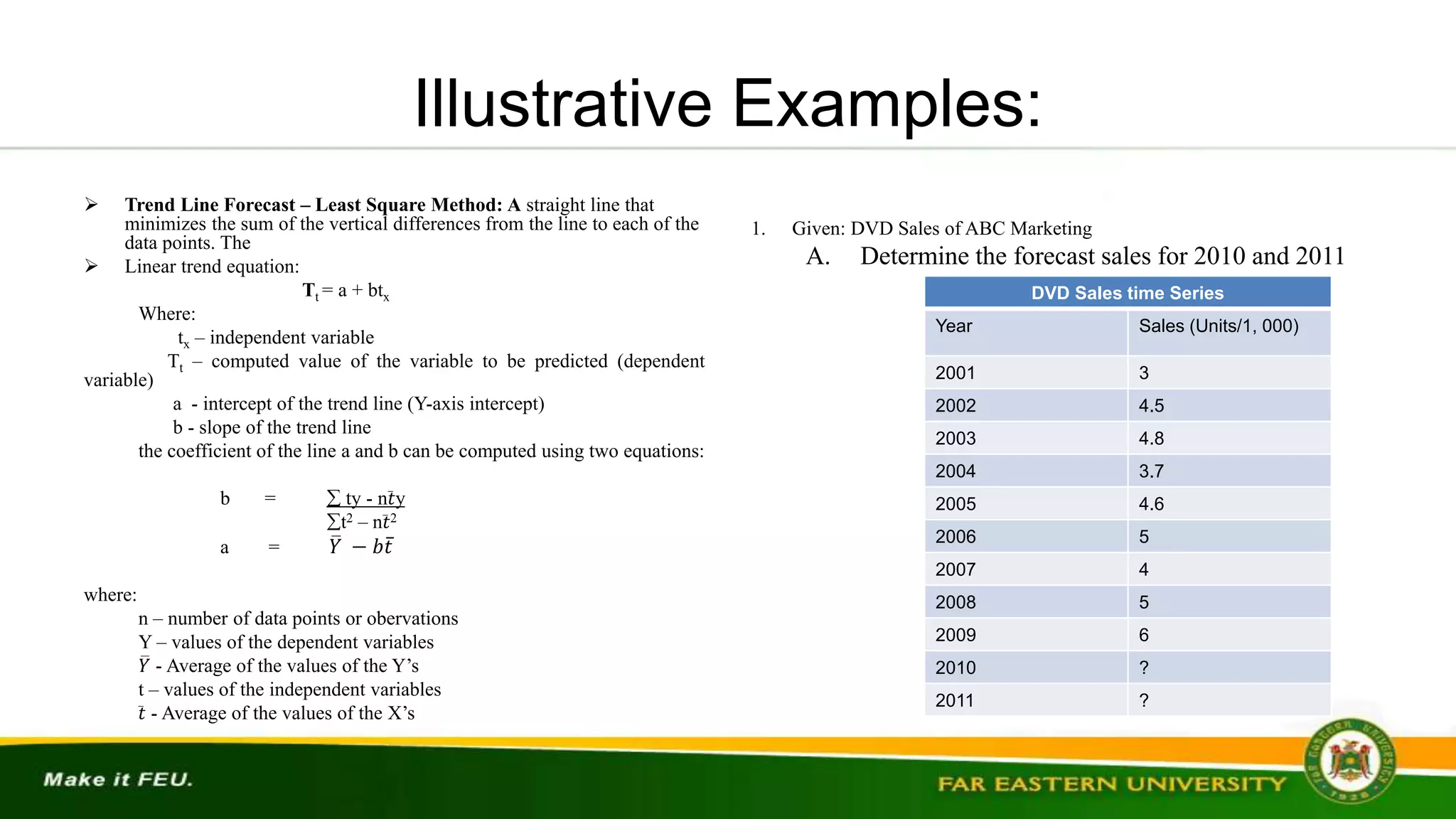

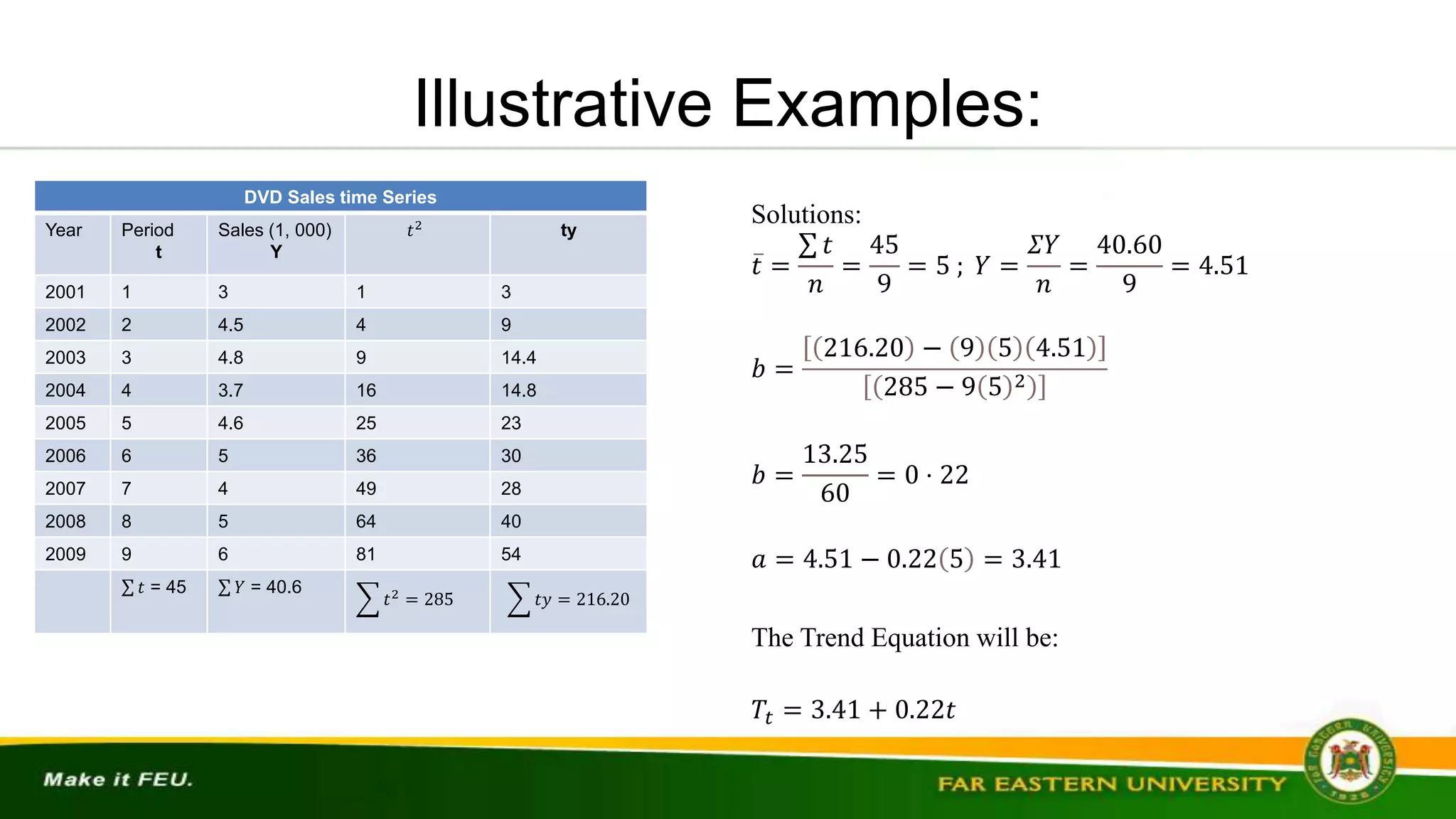

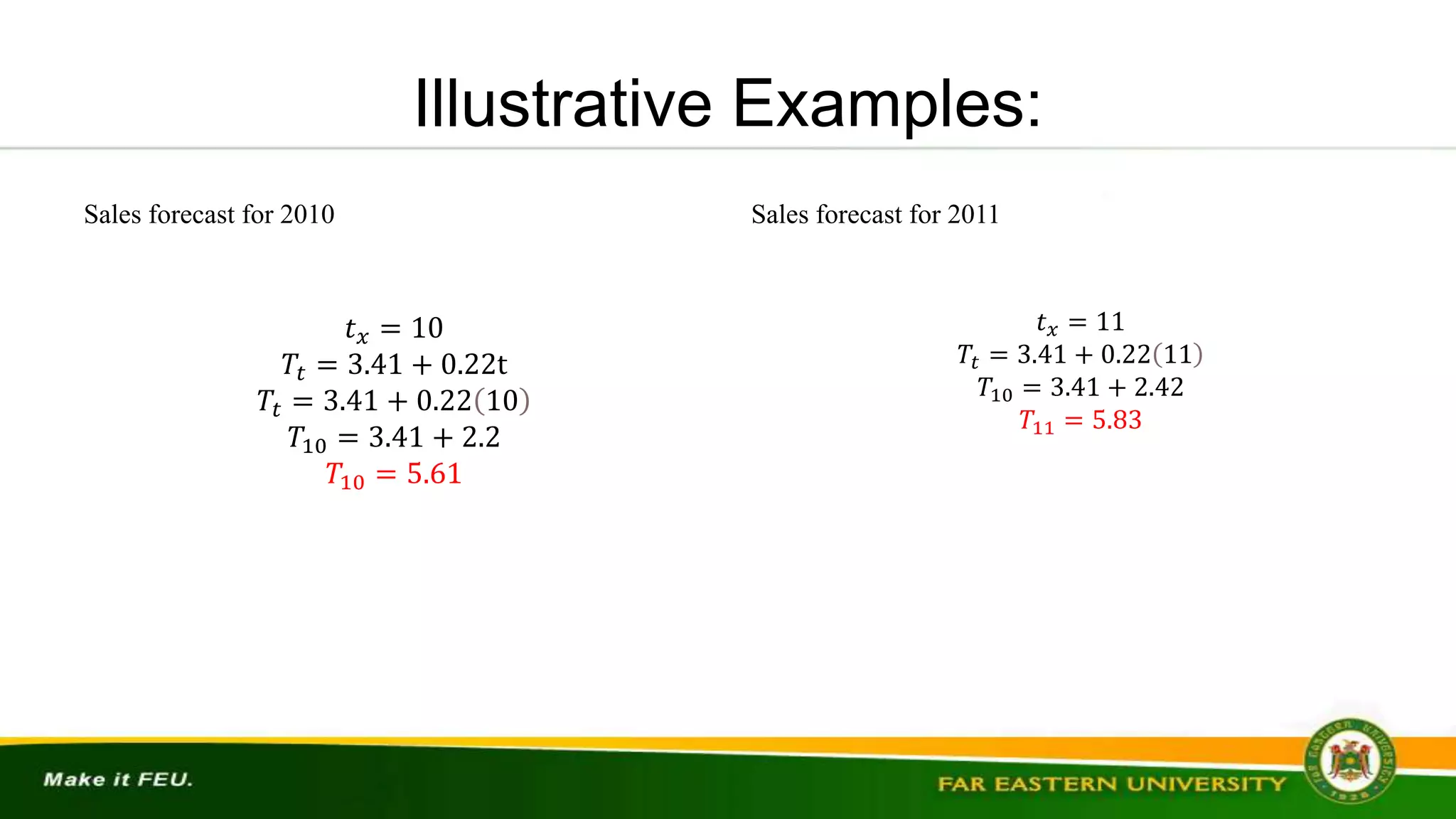

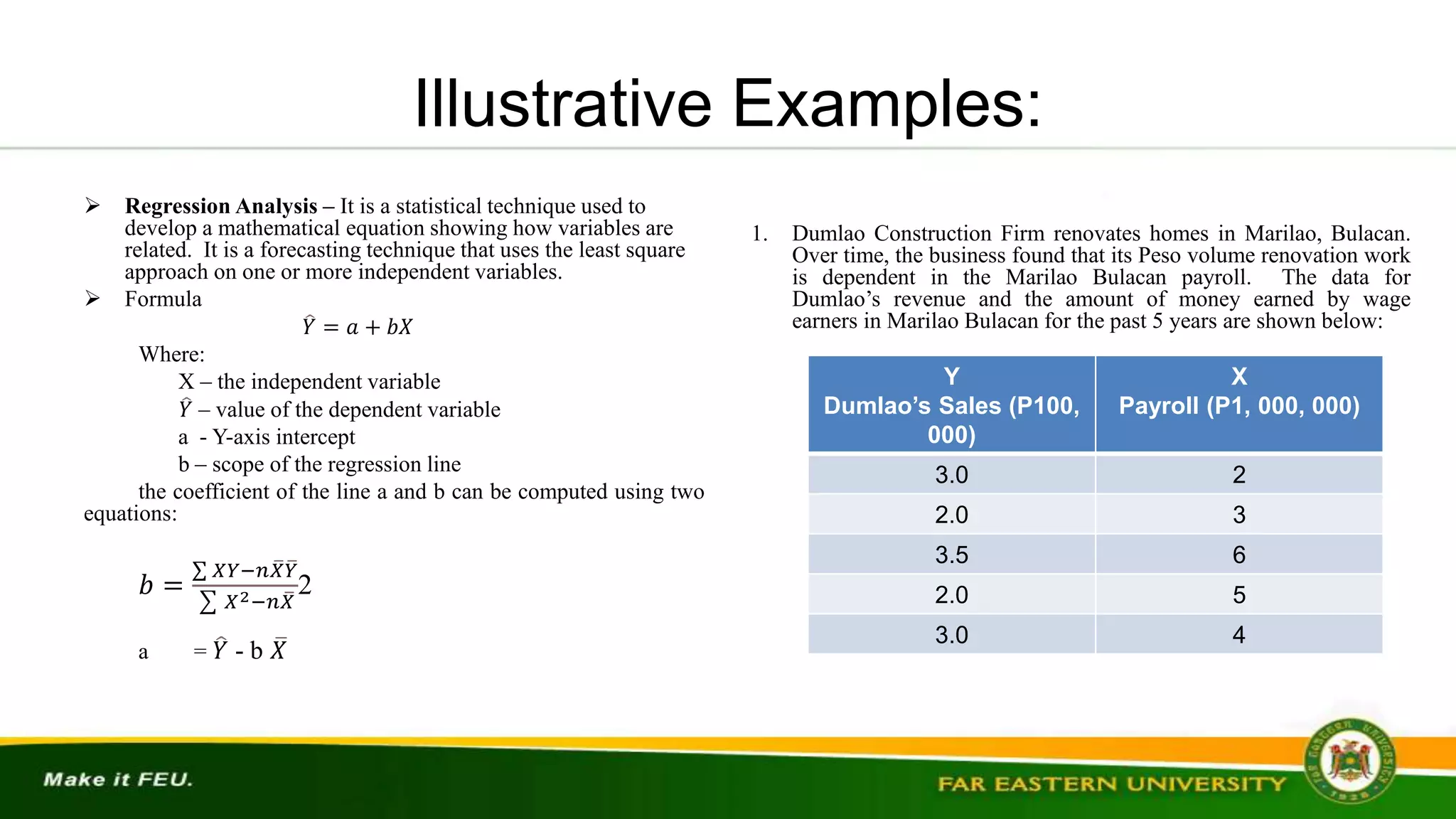

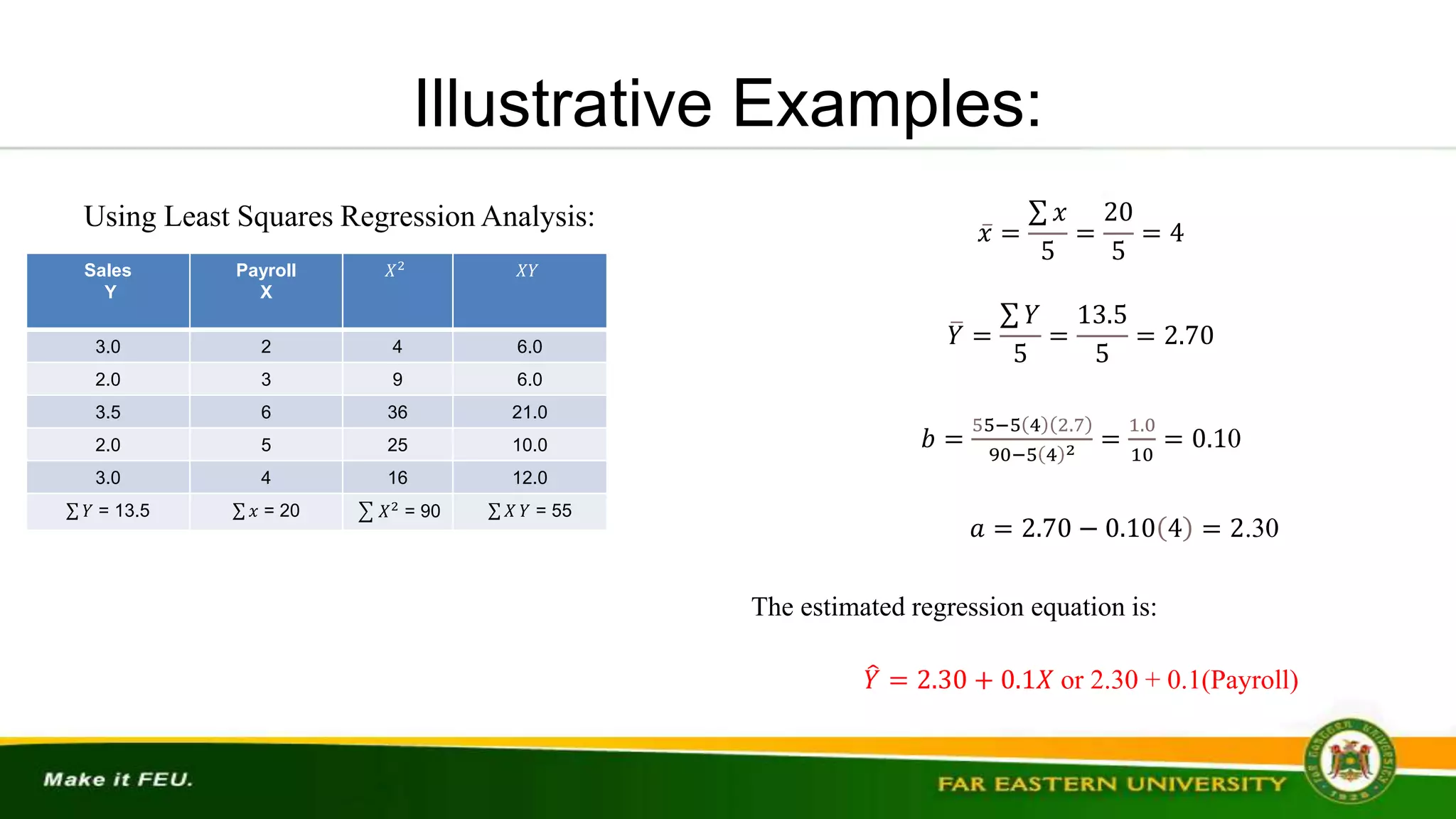

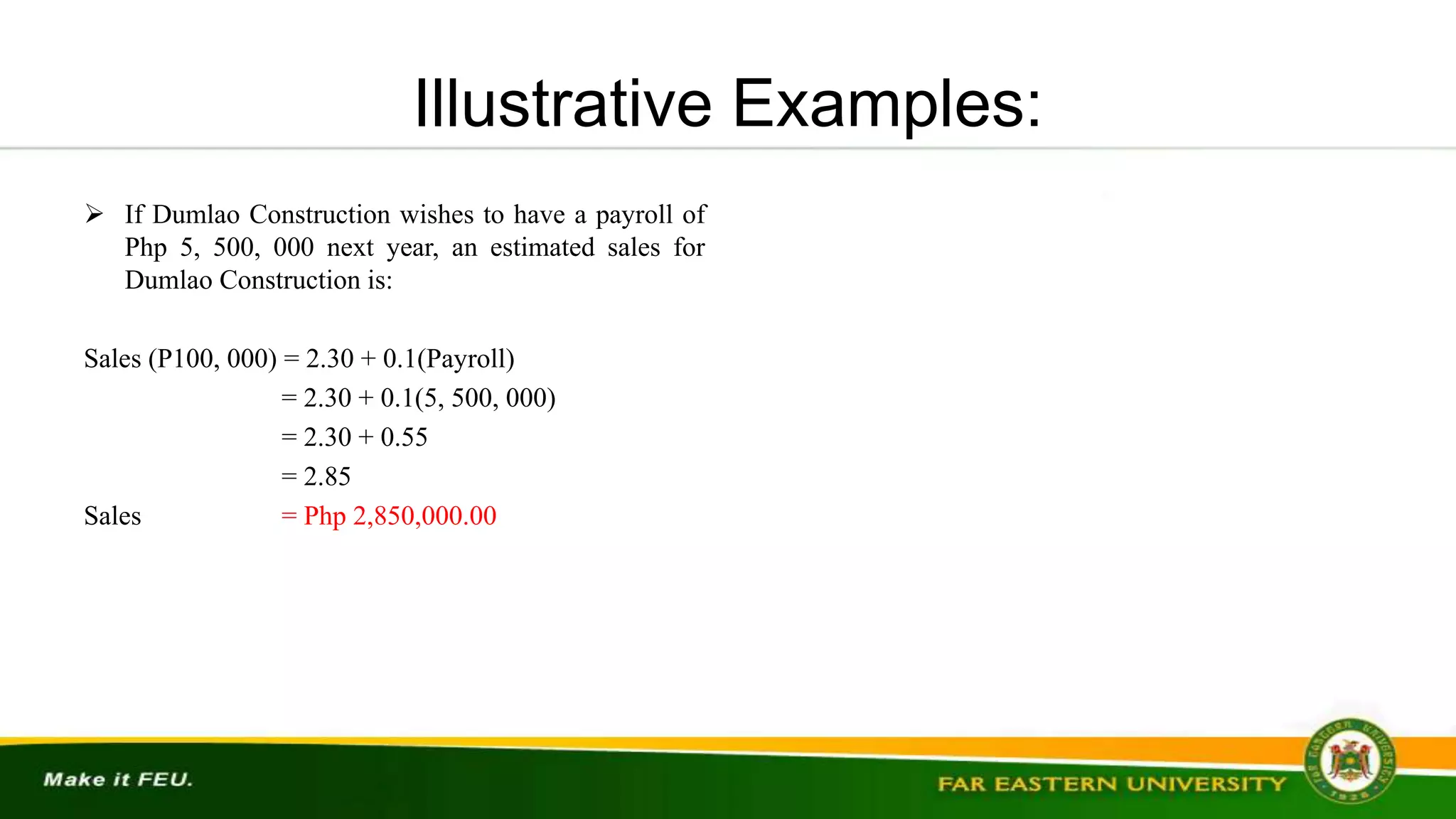

2. Using linear regression, forecast next year's profits based on advertising expenditures given:

Year: Prof

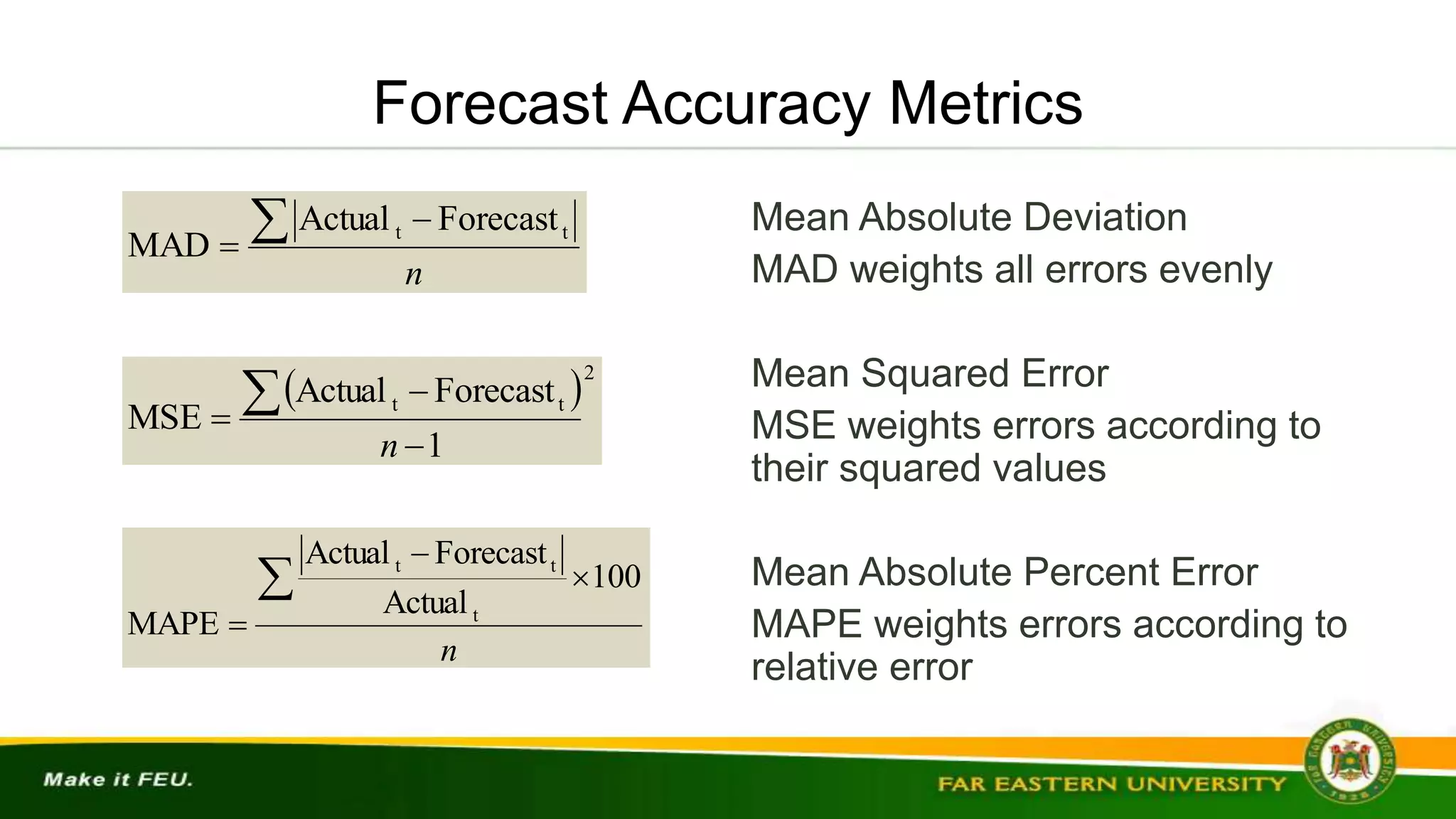

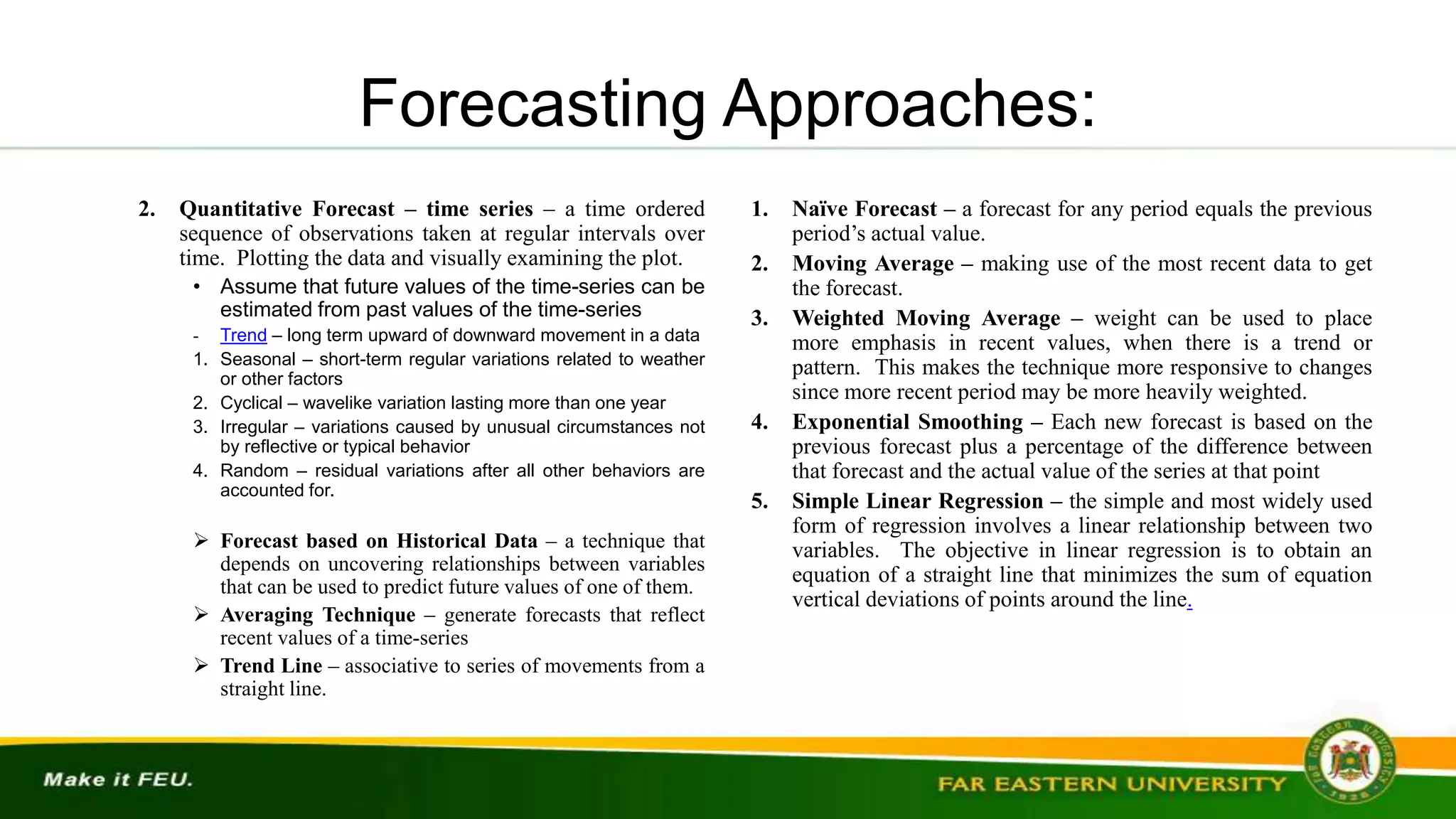

![Illustrative Examples:

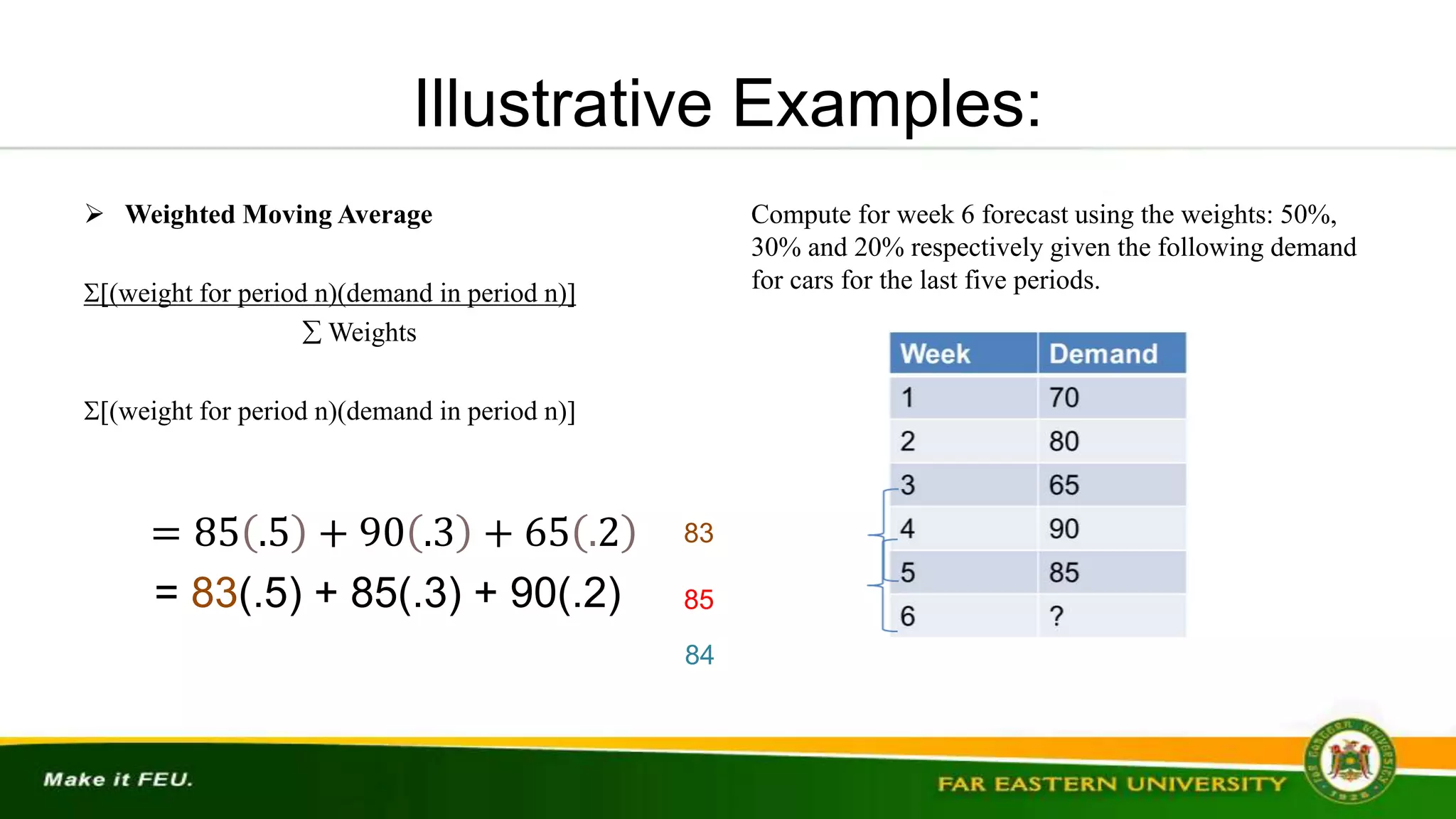

Exponential Smoothing

New forecast = Last Period’s Forecast + (Last

Period’s Actual Demand – Last Period’s Forecast)

Where: represents the value of a weighing factor – smoothing

factor – value is 0 and 1.

Ft = Ft – 1 + [At – 1 – Ft - 1]

Where:

Ft – the new forecast or forecast for period

Ft-1 – the previous forecast or forecast for period t-1

- smoothing constant

At-1 – actual demand or sales for period t-1

The smoothing constant, , represents percentage of the

forecast error. Each new forecast is equal to the

previous forecast plus a percentage of the previous

1. In January, a demand for 200 units of Toyota car model

“Vios” for February was predicted by a car dealer. Actual

February demand was 250 cars. Forecast the March

demand using a smoothing constant of = 0.30.

New Forecast: 200 + 0.30(250-200) = 215 cars

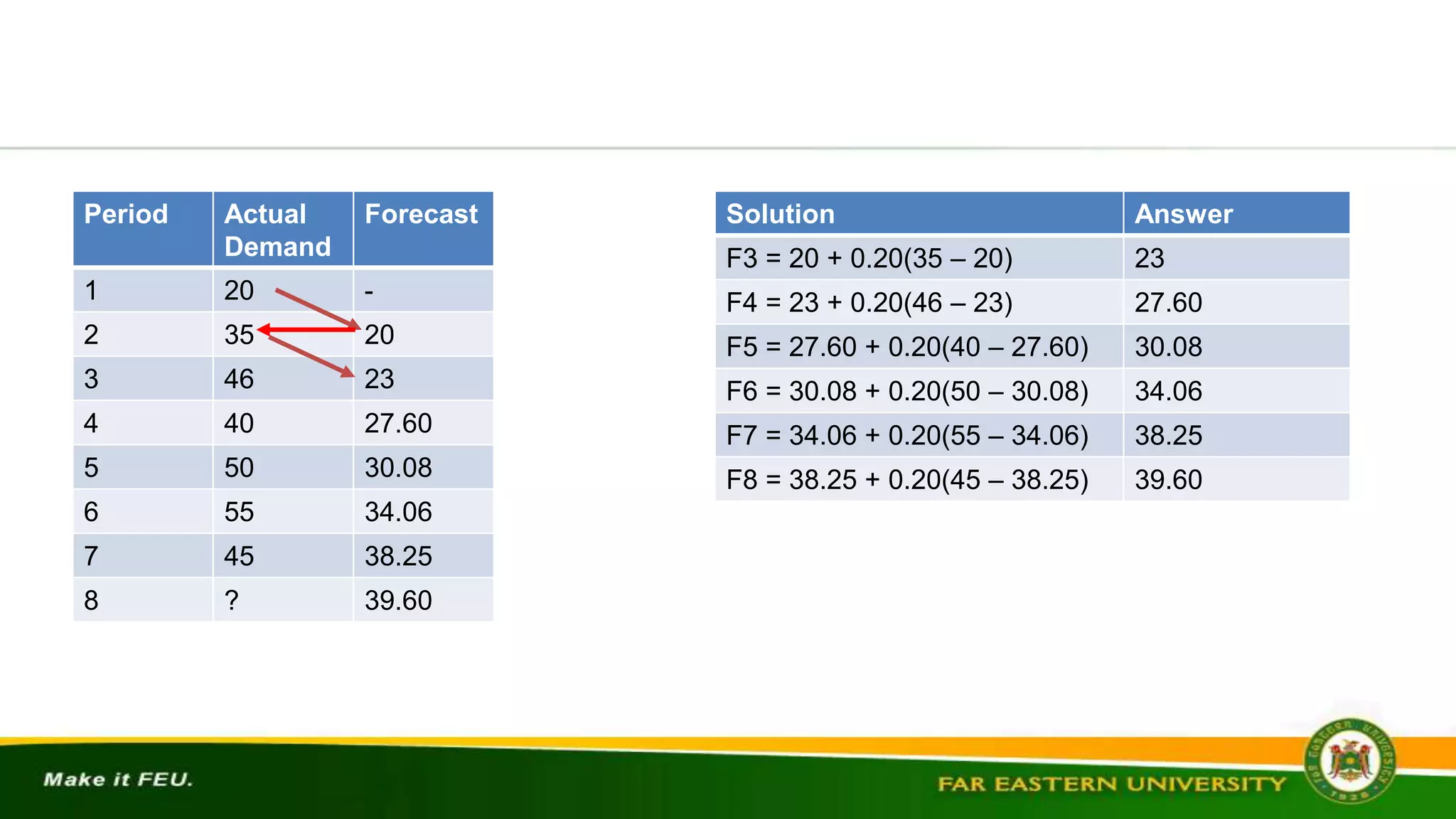

2. Use exponential smoothing model to develop a series of

forecast for the following data and compute.

a. Use a smoothing factor of 0.20

PERIOD ACTUAL DEMAND

1 20

2 35

3 46

4 40

5 50

6 55

7 45

8 ?](https://image.slidesharecdn.com/chapter-3heizers1-221111133404-c39f98be/75/Chapter-3_Heizer_S1-pptx-12-2048.jpg)