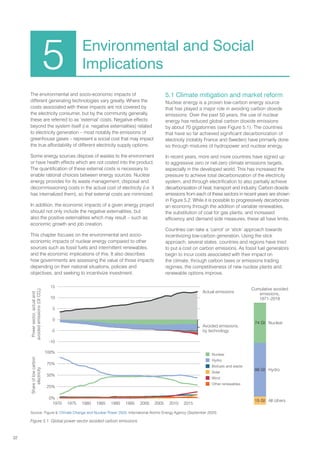

The 2024 edition of the report on nuclear power economics assesses the economic viability of nuclear energy, emphasizing its importance in achieving low-carbon electricity and supporting sustainable development goals. It discusses the competitive landscape shaped by increasing renewable energy costs and highlights the risks and financing challenges associated with new nuclear projects amidst changing market regulations. The report advocates for a balanced recognition of nuclear's contributions to energy security and environmental goals while addressing the complexities of project structuring and risk allocation.