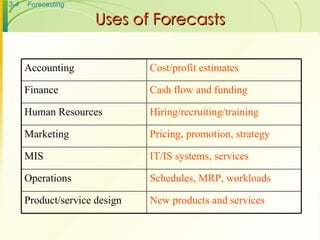

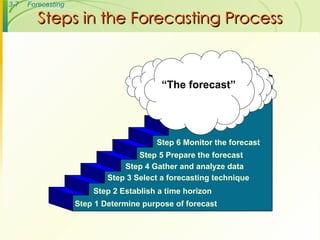

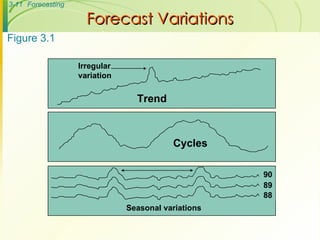

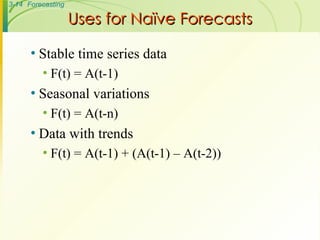

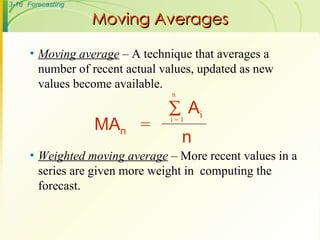

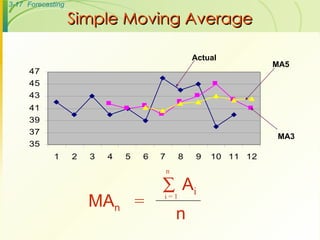

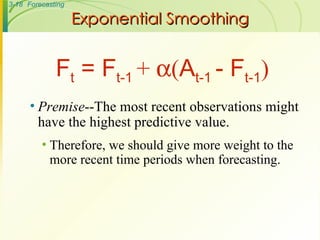

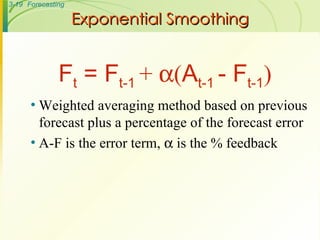

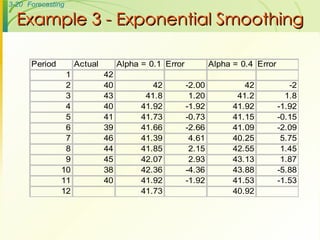

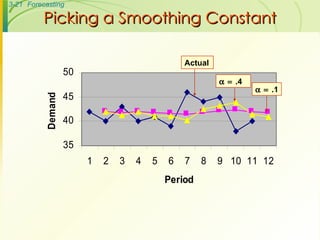

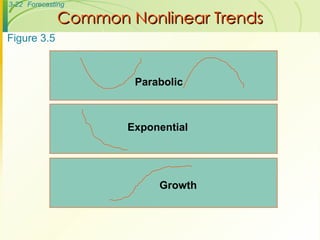

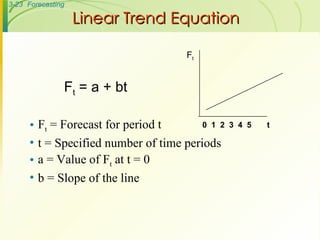

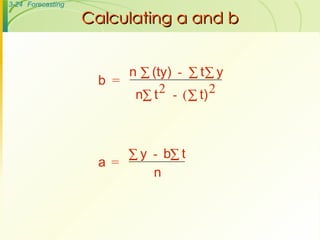

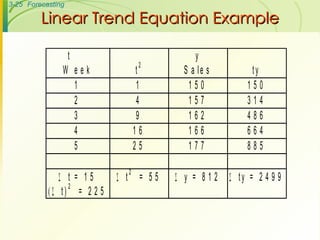

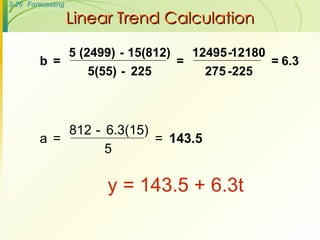

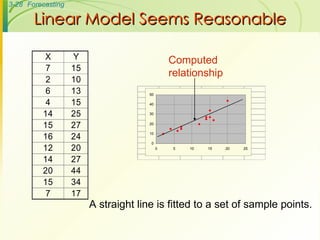

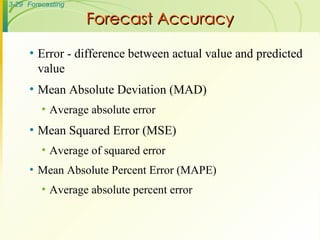

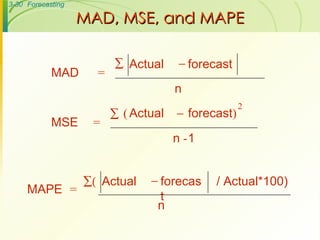

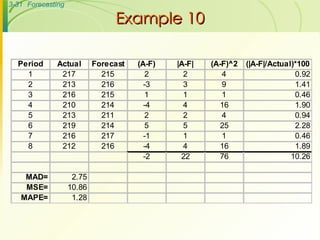

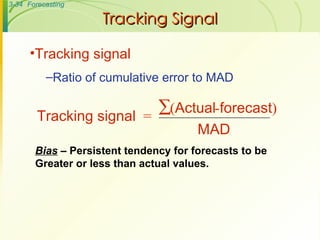

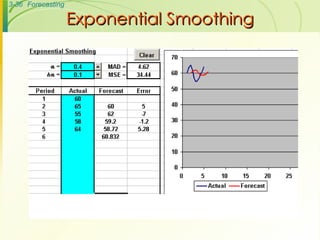

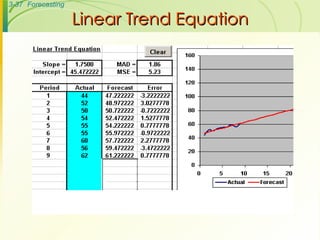

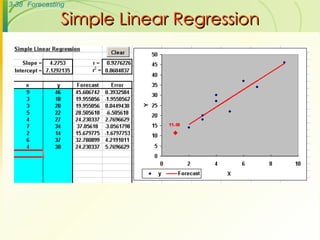

The document discusses various forecasting techniques including judgmental forecasts, time series forecasts, naive forecasts, moving averages, exponential smoothing, linear trends, and associative forecasts using simple linear regression. It describes the basic approaches and formulas for each technique and discusses factors to consider when choosing a forecasting method such as cost, accuracy, data availability, and forecast horizon.