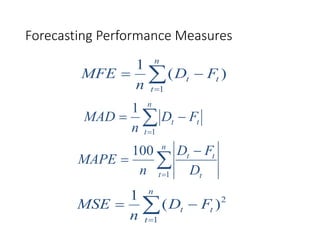

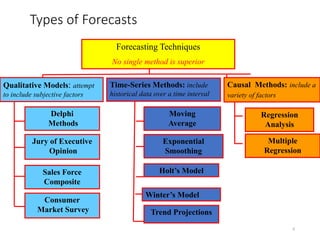

Demand forecasting plays a key role in supply chain planning and decision making. Accurate forecasts are needed for production scheduling, inventory management, marketing activities, financial planning, and workforce management. However, forecasts are never perfectly accurate and error should be measured. Different forecasting techniques exist, including qualitative methods that use expert opinions and quantitative methods like time series analysis and regression. The bullwhip effect occurs when demand variability increases at each step up the supply chain, exacerbating distortions in information flow and potentially disrupting operations.

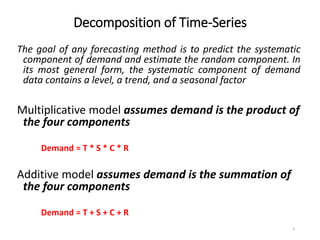

![Weighted Three-Month Moving Average

14

Month Actual

Sales

Three-Month Weighted

Moving Average

10

12

13

16

19

23

January

February

March

April

May

June

July 26

[3*13+2*12+1*10]/6 = 12 1/6

[3*16+2*13+1*12]/6 =14 1/3

[3*19+2*16+1*13]/6 = 17

[3*23+2*19+1*16]/6 = 20 1/2](https://image.slidesharecdn.com/forecasting-230111104857-a1305649/85/forecasting-14-320.jpg)