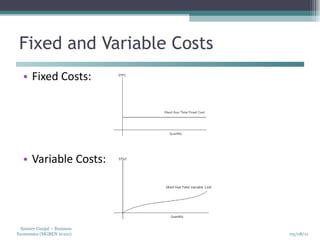

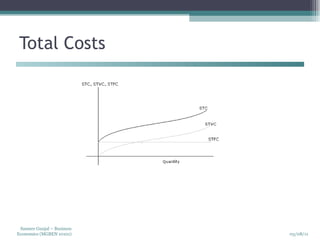

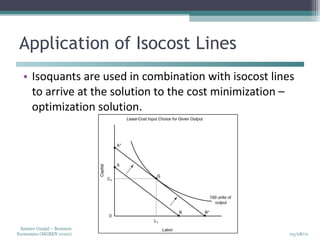

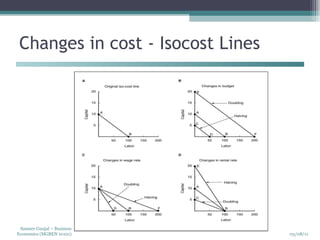

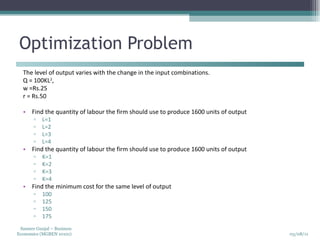

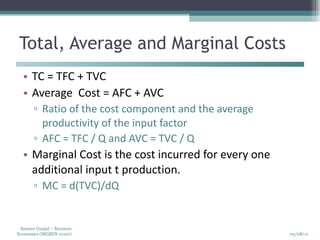

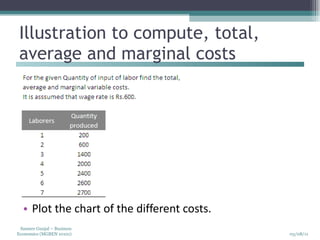

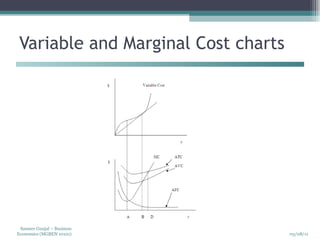

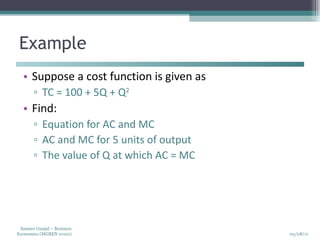

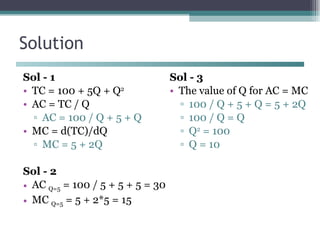

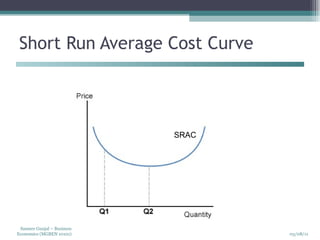

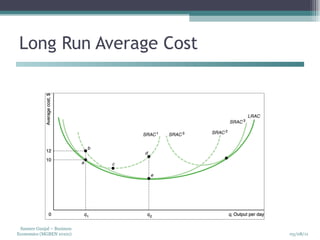

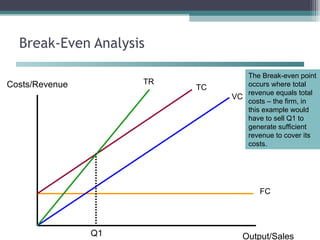

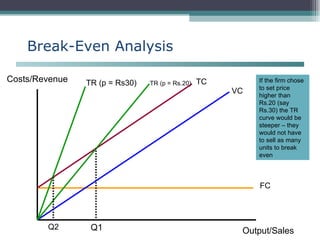

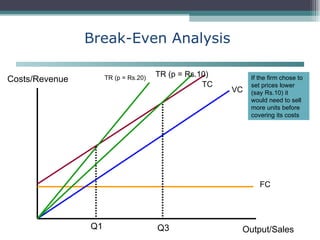

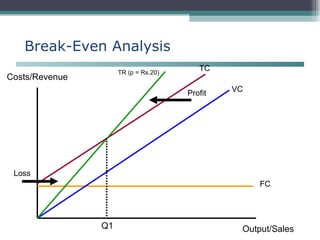

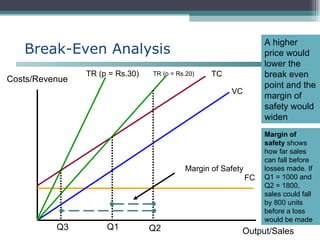

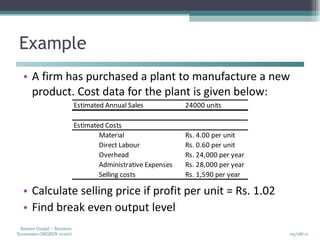

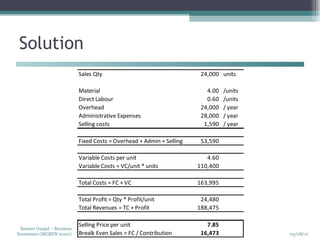

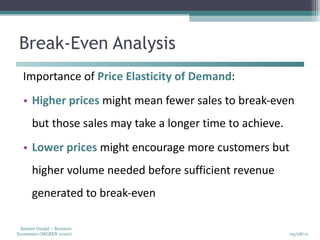

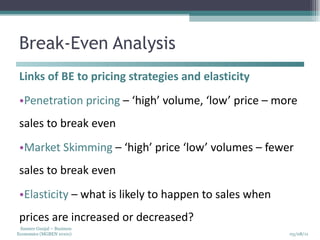

The document discusses various cost concepts in business economics including cost functions, opportunity costs, types of costs, fixed and variable costs, total costs, average costs, marginal costs, break-even analysis, contribution margin, and profit-volume ratio. It provides definitions and formulas for these concepts and illustrates their calculation and application in decision making.