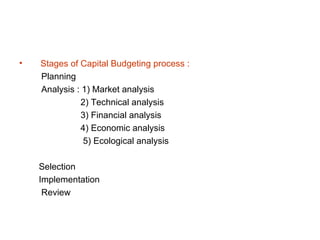

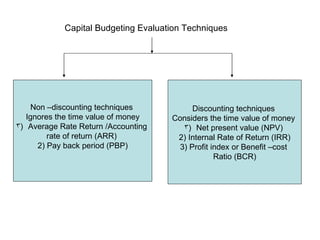

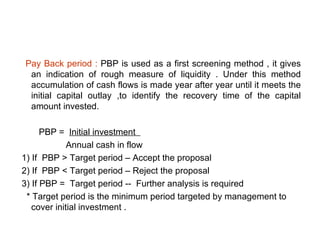

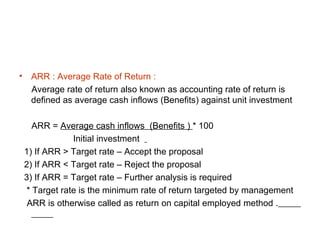

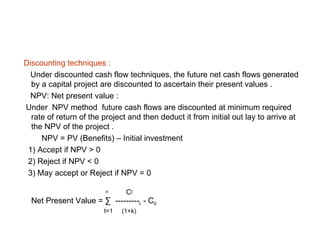

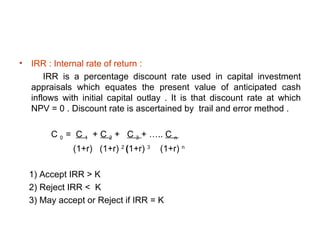

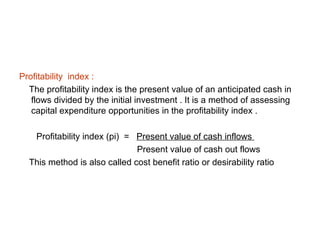

The document discusses capital budgeting, which refers to the process of evaluating long-term investment projects. It describes the various techniques used to evaluate capital budgeting proposals, including non-discounting methods like payback period and accounting rate of return, as well as discounted cash flow methods like net present value, internal rate of return, and profitability index. The stages of the capital budgeting process and sources of financing for capital budgeting decisions are also outlined.