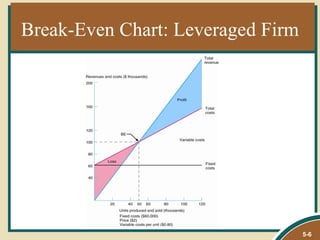

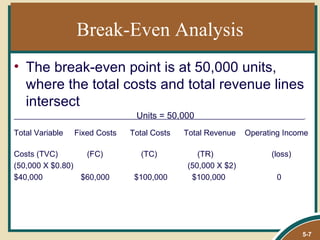

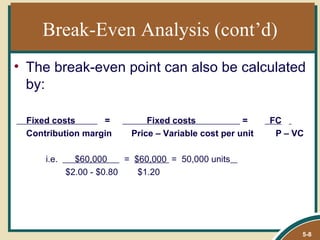

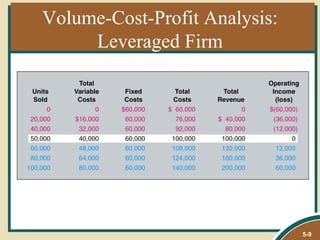

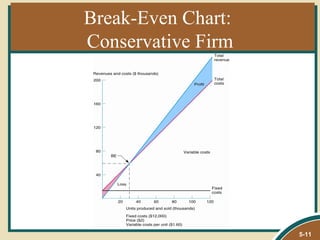

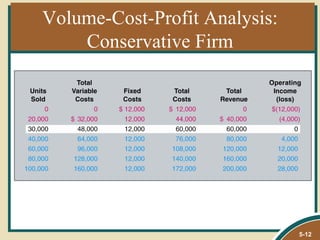

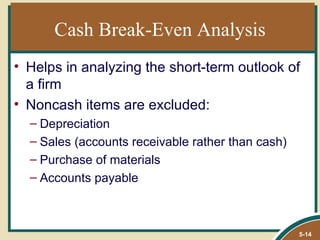

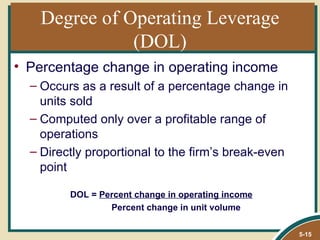

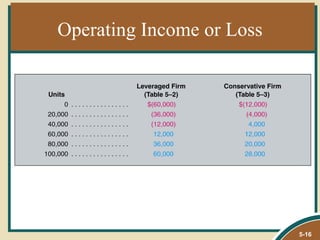

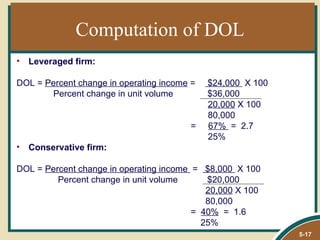

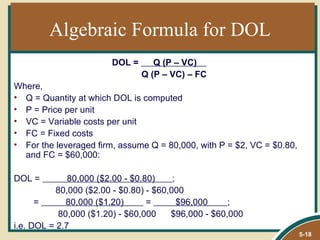

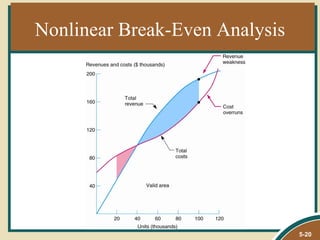

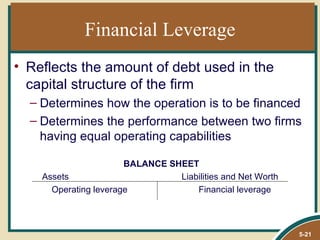

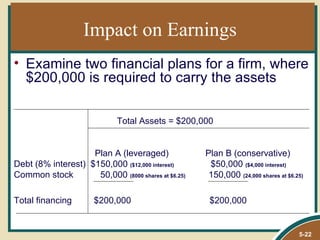

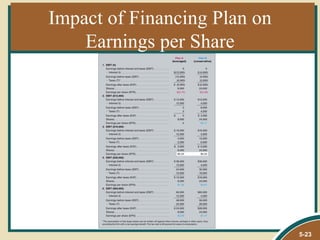

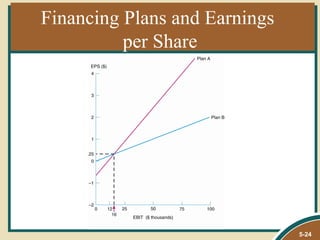

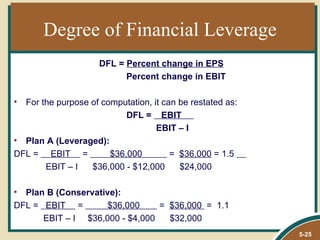

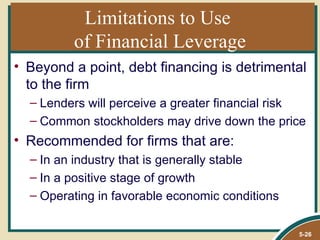

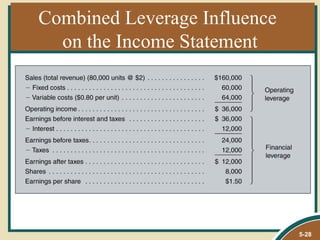

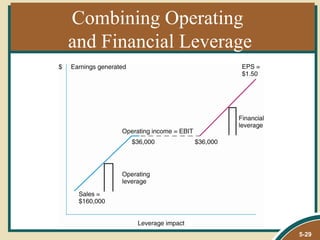

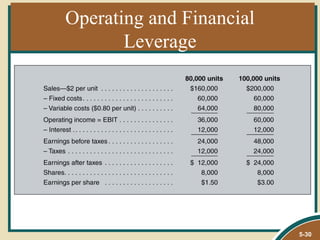

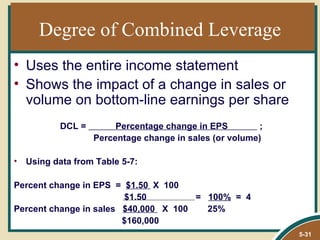

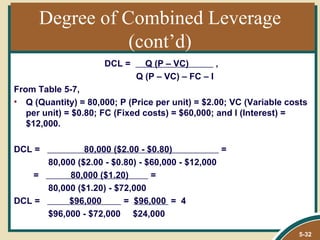

The document covers the concepts of operating and financial leverage, detailing how businesses can use these strategies to maximize profits while managing risks. It includes discussions on break-even analysis, the implications of fixed and variable costs, and the calculations related to degrees of operating and financial leverage. Additionally, it addresses the potential downsides of excessive leverage and when it is advisable for firms to adopt conservative approaches.