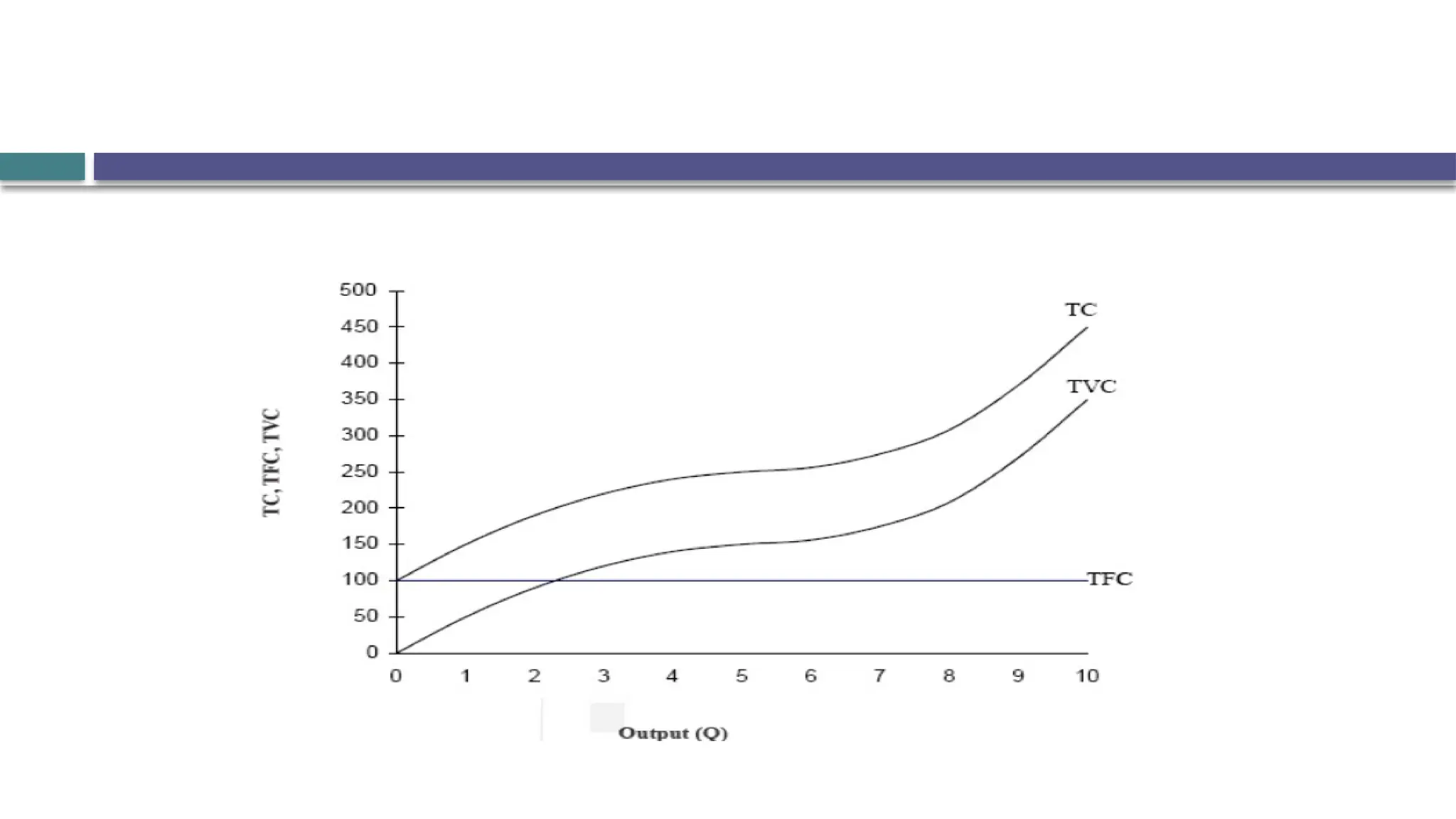

The document discusses cost analysis in managerial economics, emphasizing the relationship between production and expenses while categorizing cost concepts into accounting and analytical types. Key elements include fixed and variable costs, total and marginal costs, and differences between short-run and long-run costs, along with incremental and sunk costs. Various methods to estimate cost functions, such as historical data analysis and statistical techniques, are also outlined.