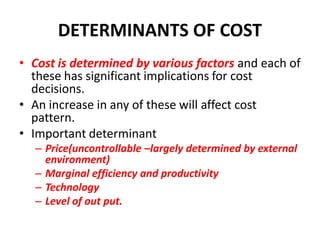

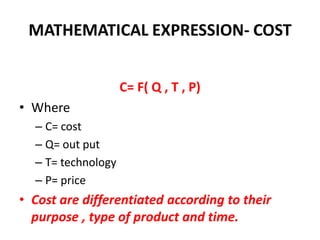

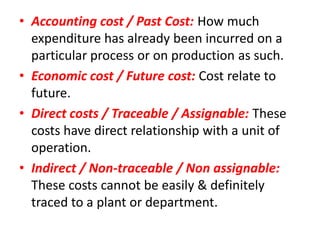

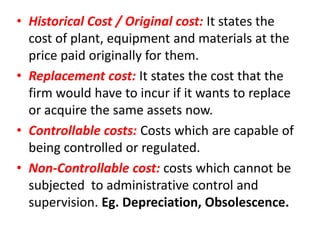

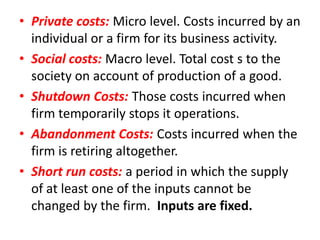

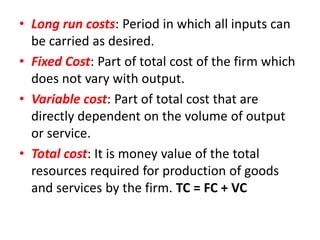

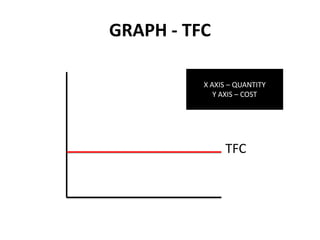

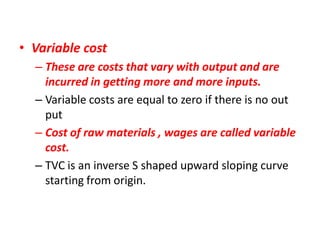

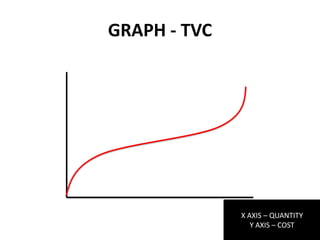

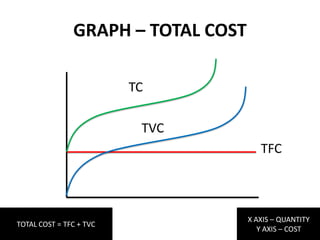

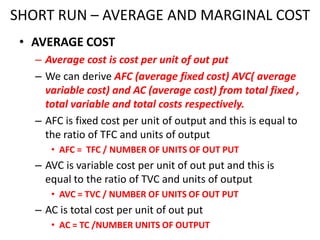

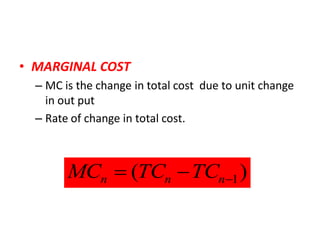

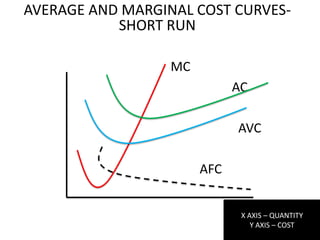

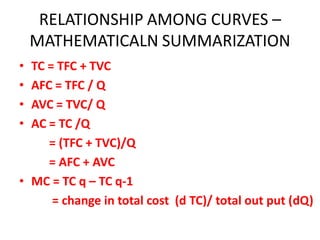

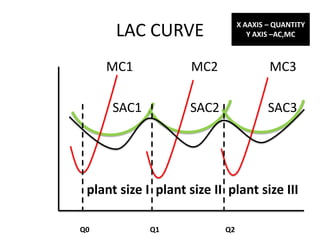

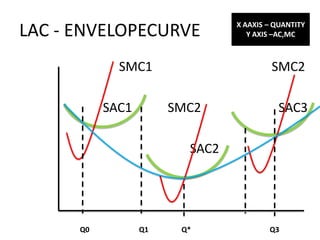

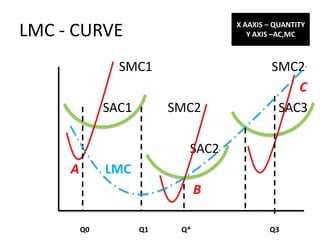

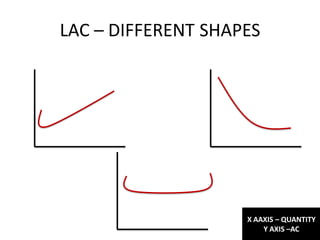

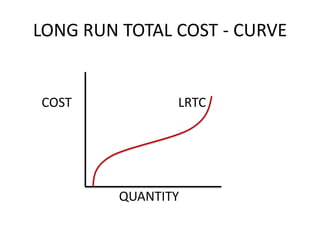

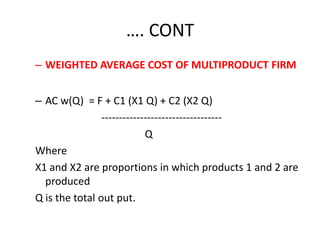

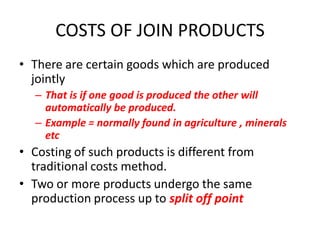

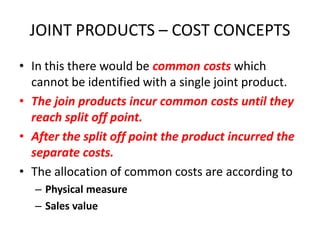

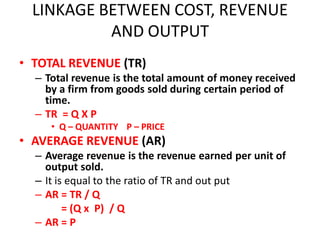

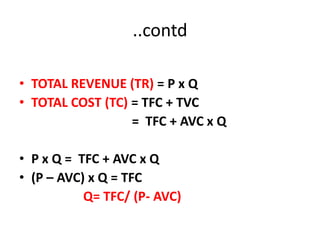

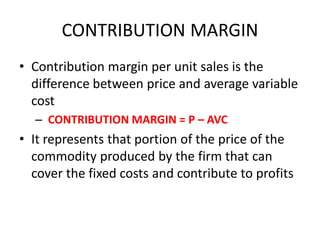

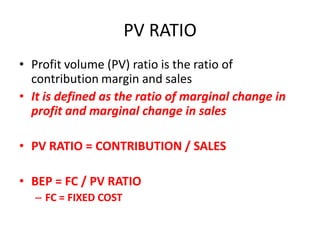

The document discusses various concepts related to cost. It defines cost as a sacrifice or foregone opportunity measured in monetary terms. It then discusses different types of costs such as fixed costs, variable costs, sunk costs, explicit costs, implicit costs, and others. It also discusses cost determination factors and different cost curves and functions in the short run and long run, including total cost, average cost, and marginal cost curves. Finally, it discusses costs for multi-product firms and joint products.