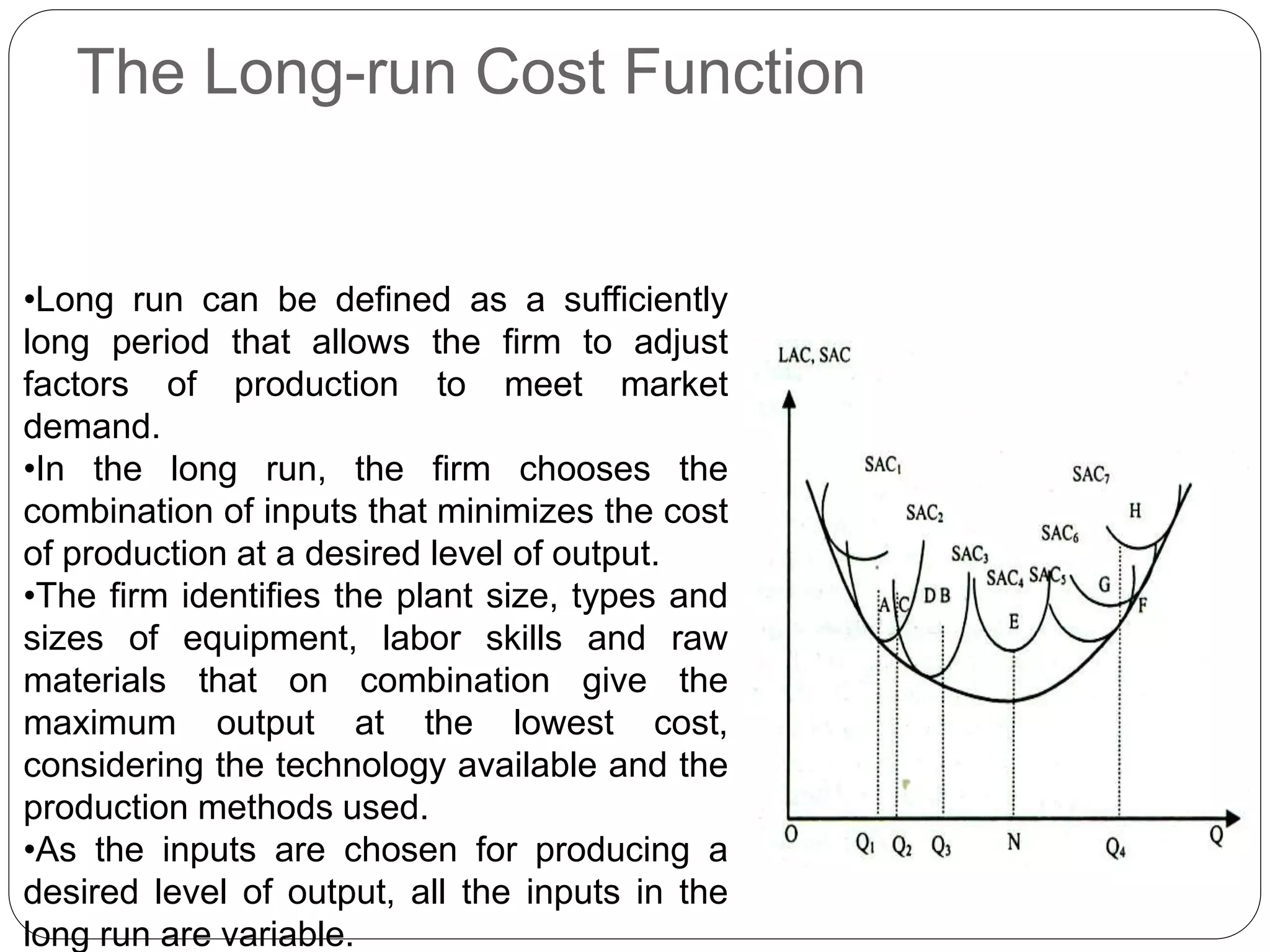

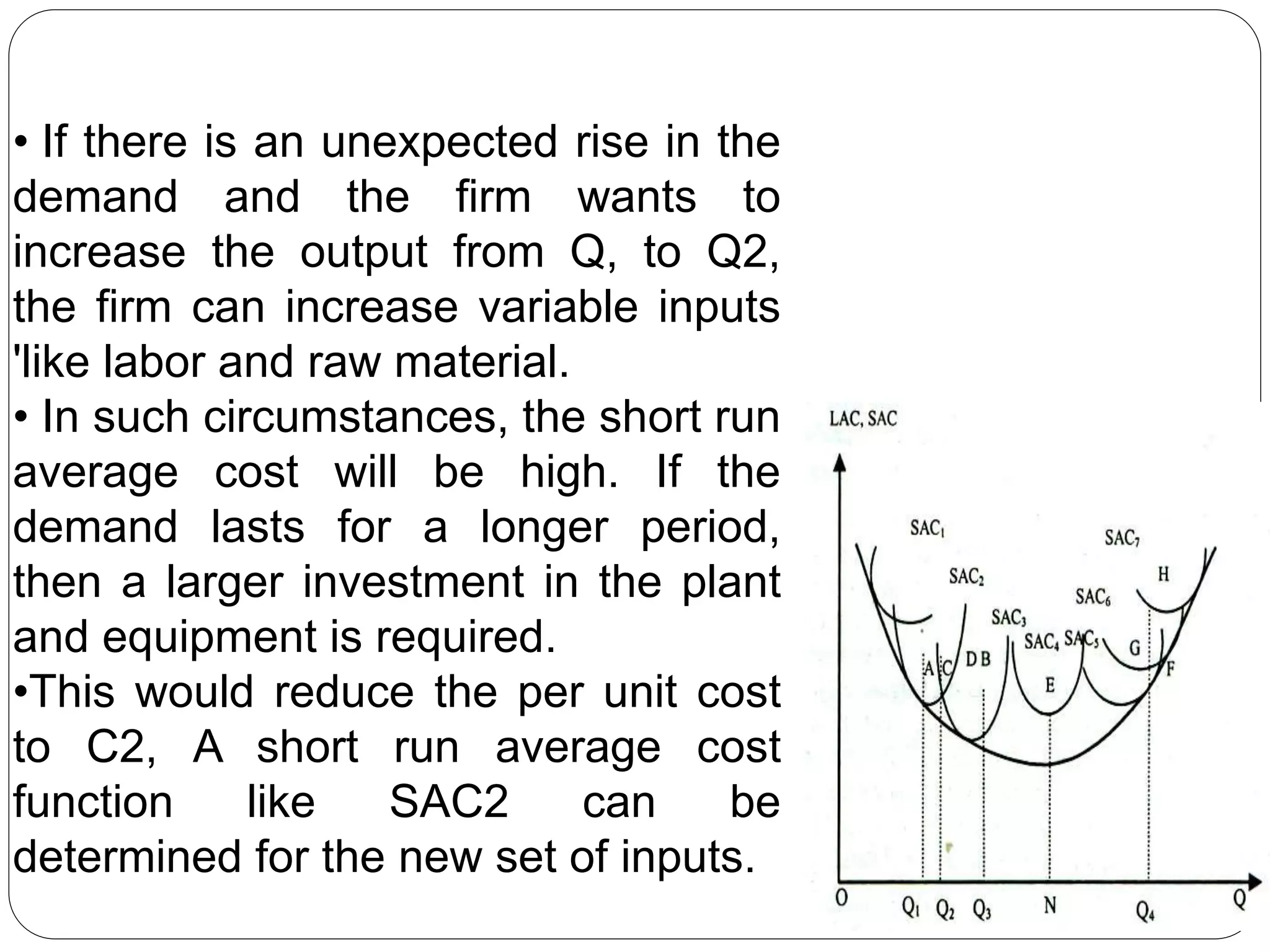

This document discusses cost concepts including the theory of costs, types of costs, and cost functions. It explains that a firm's total costs are made up of fixed costs and variable costs. Fixed costs do not change with output while variable costs do change with output. It also discusses the relationships between total cost, average cost, and marginal cost. Specifically, it explains that as output increases, average and marginal costs first decrease then increase, with marginal cost rising more quickly than average cost. The document also differentiates between short-run and long-run cost functions and how a firm's costs change in each time period.

![Concepts of Costs

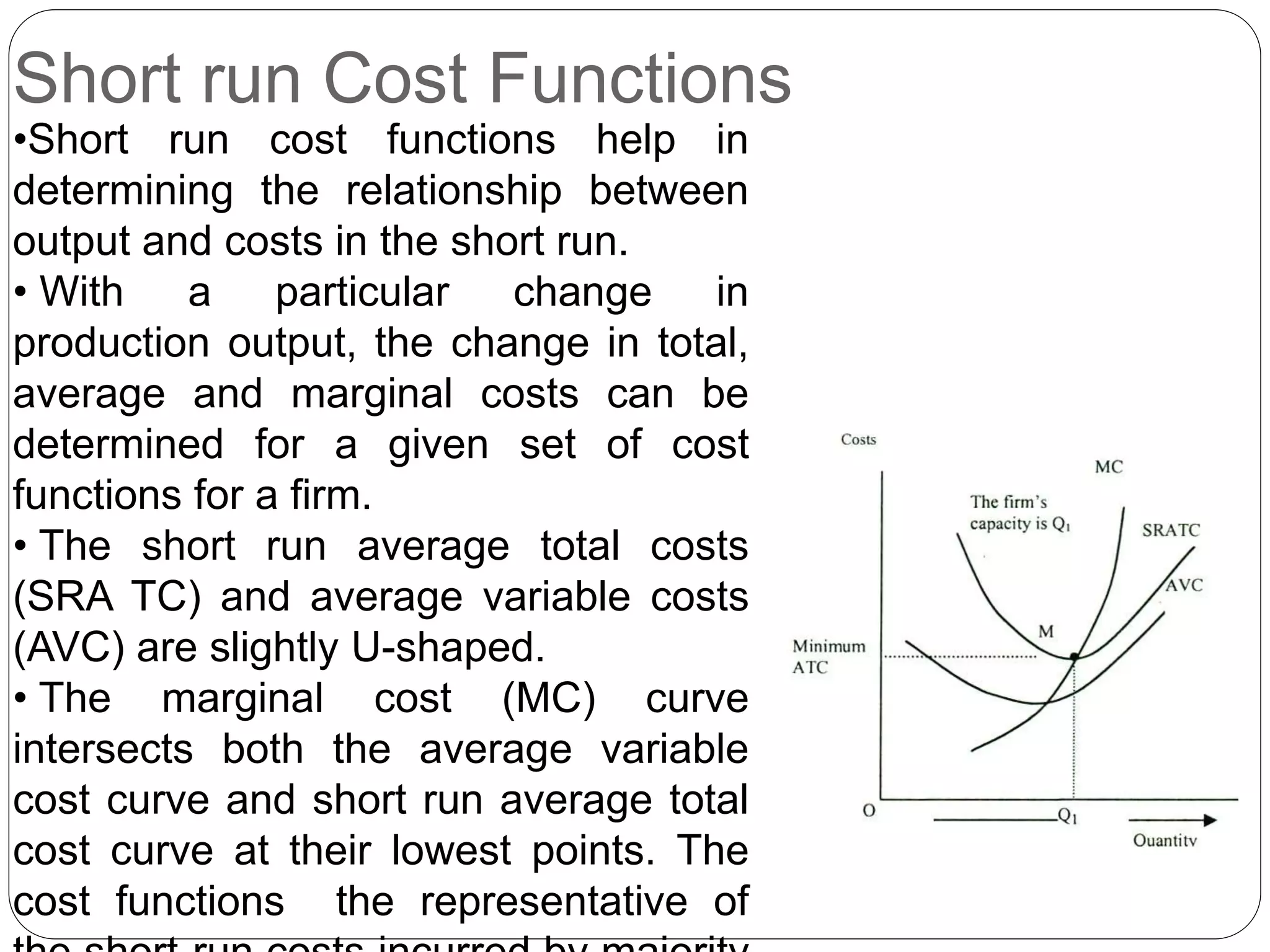

Fixed Cost FC : Fixed costs, are those which are

independent of output, that is, they do not change

with changes in output.

Even if the firm closes down for some time in the

short run remains in business, these costs have to

be borne by it.

Fixed costs are also known as overhead costs and

include charges such as contractual rent, insurance fee,

maintenance costs, property taxes, interest on the capital

invested, minimum administrative expenses such as

manager's salary, watchman's wages etc.

Variable cost [VC]: Variable costs, on the other hand,

are those costs which are incurred on the employment

variable factors of production whose amount can be

altered.

These costs include payments such as wages of labour

employed, prices of the raw materials, fuel and power

used, the expenses incurred on transporting.](https://image.slidesharecdn.com/costconcepts-150108043754-conversion-gate02/75/Cost-concepts-3-2048.jpg)

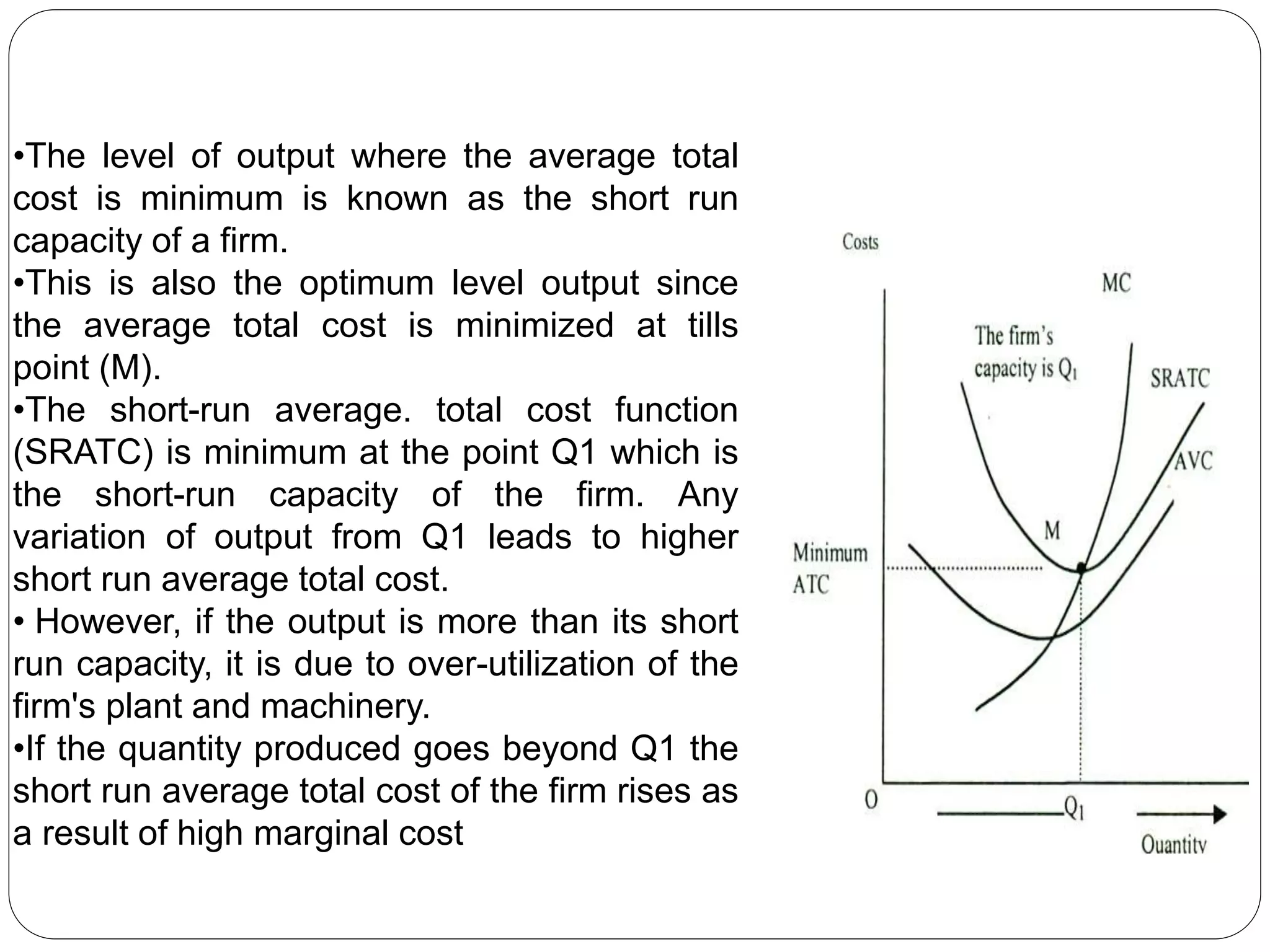

![Concept of total cost , Average Cost and marginal

cost

Total cost is the sum of its total variable costs and total

fixed costs. Thus:

TC = TFC + TVC

where TC stands for total cost, TFC for total fixed cost

and TVC for total variable cost.

Average fixed cost is the total fixed cost divided by the

number of units of output produced.

Average Variable Cost (AVC): Average variable cost is

the total variable cost divided by the number of units of

output produced. Therefore,

Average total cost (ATC) is the sum of the average

variable cost [AVC] and average fixed cost [AFC]

Marginal cost {MC] can be found for further units of

output

where ΔTC represents a change in total cost and ΔQ

represents a unit change in output or total product.](https://image.slidesharecdn.com/costconcepts-150108043754-conversion-gate02/75/Cost-concepts-4-2048.jpg)