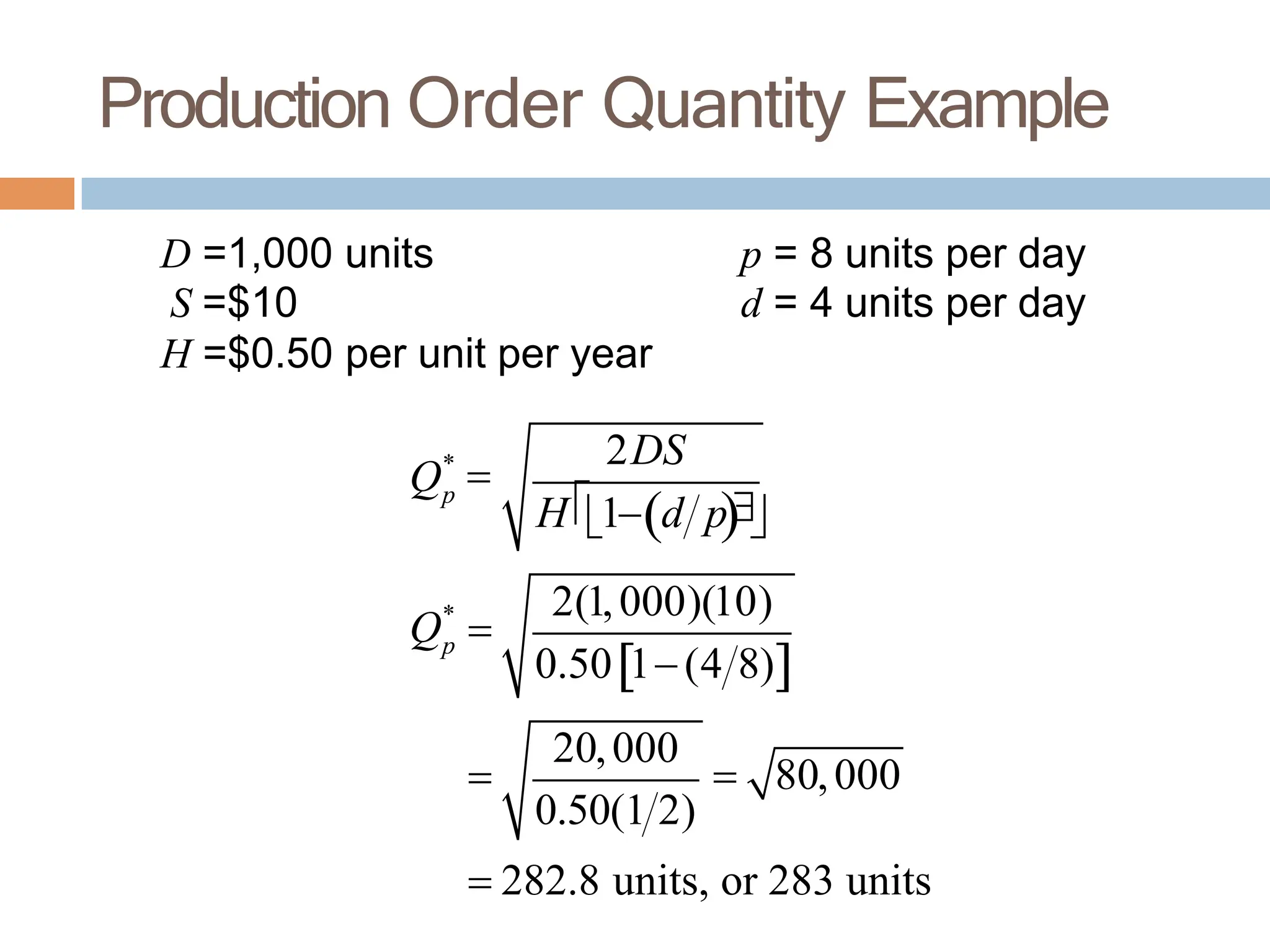

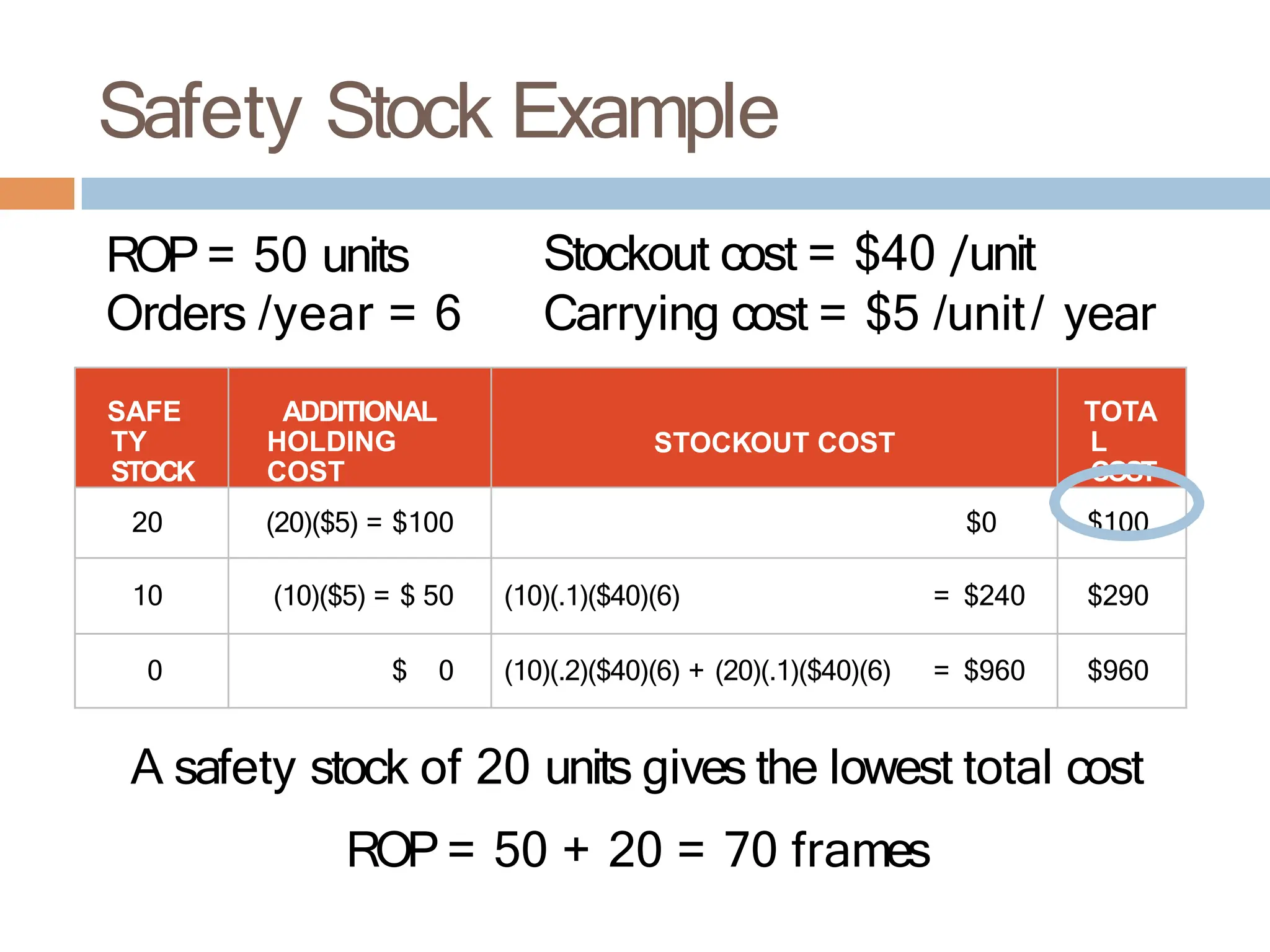

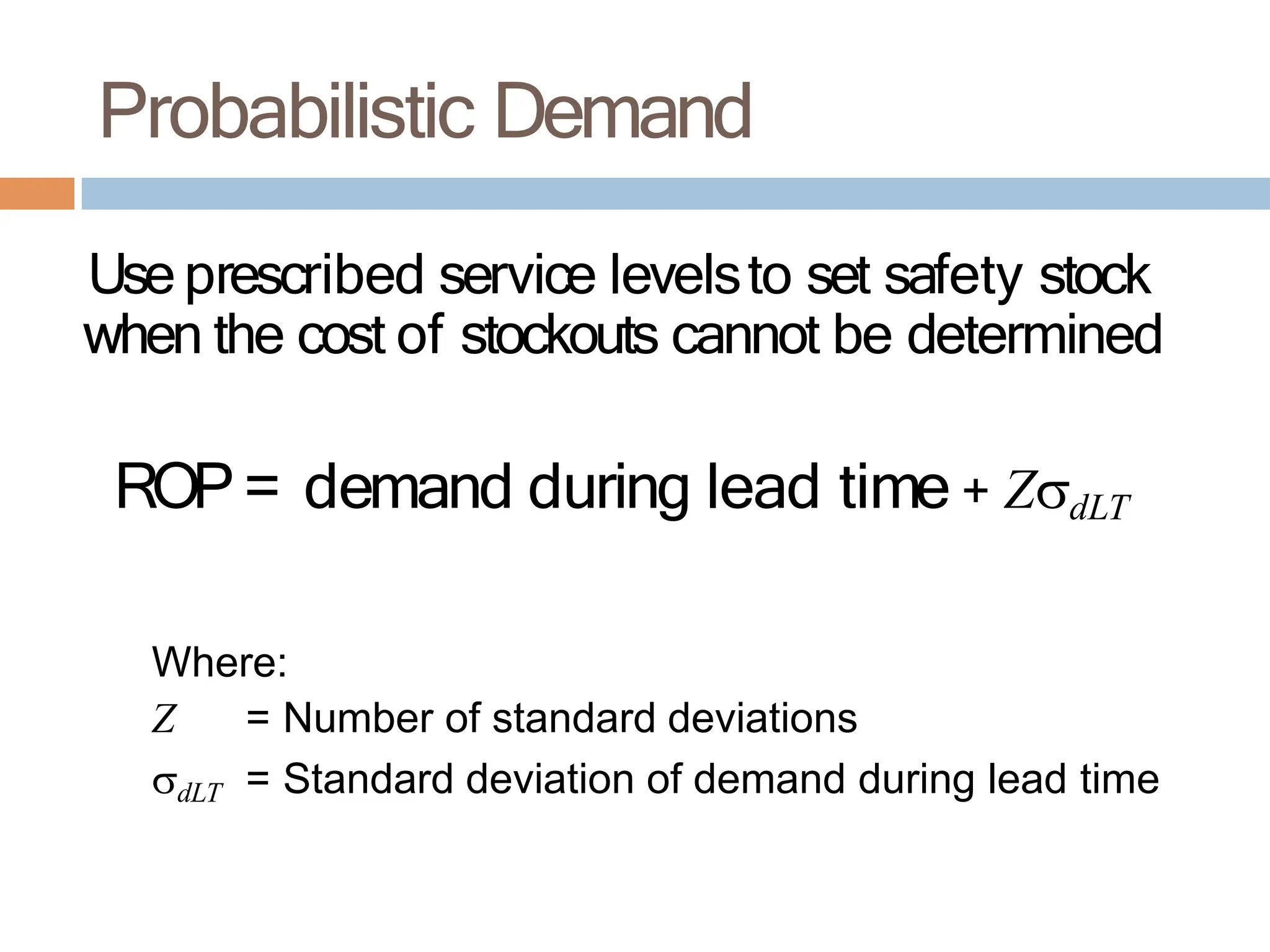

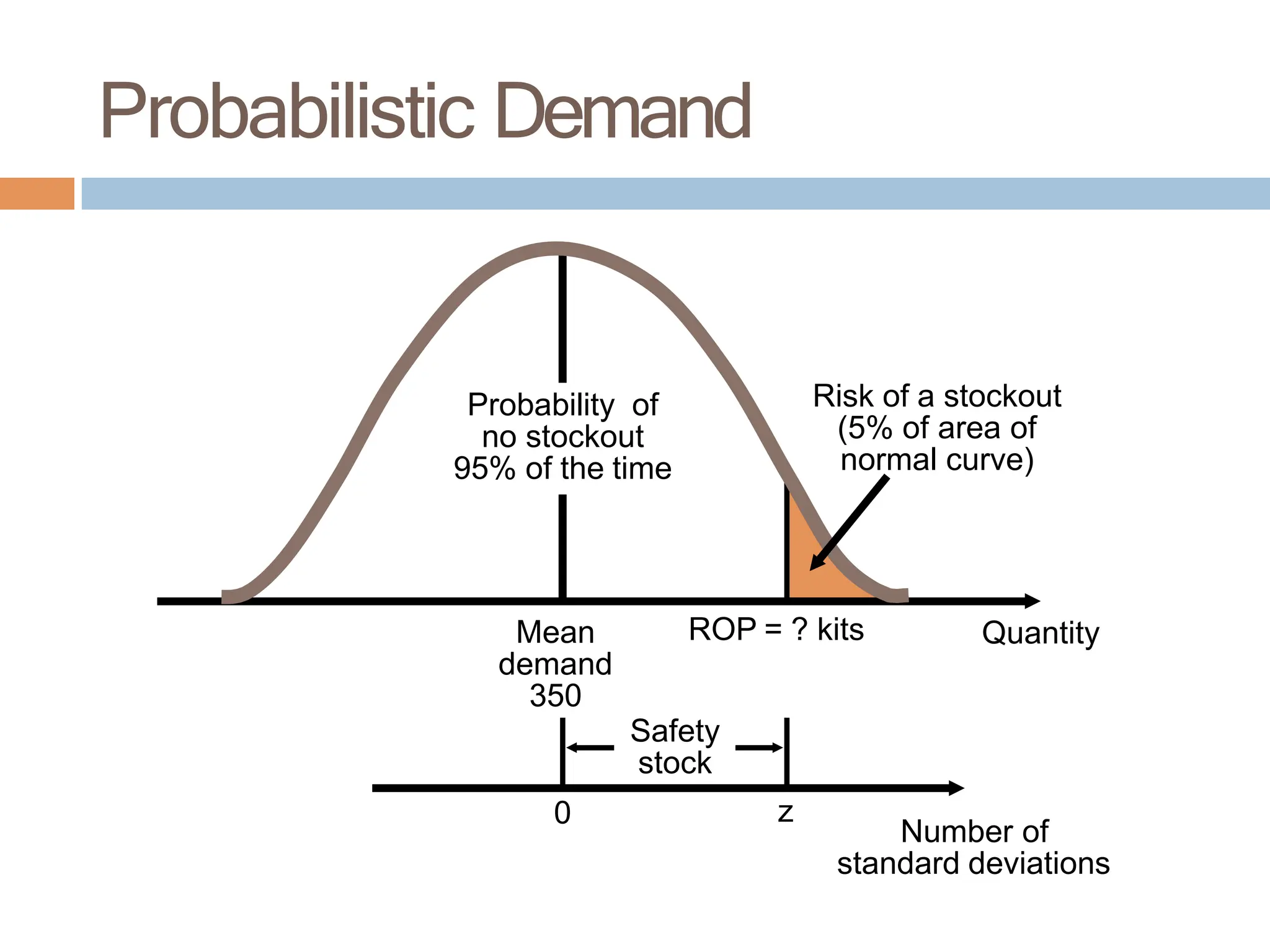

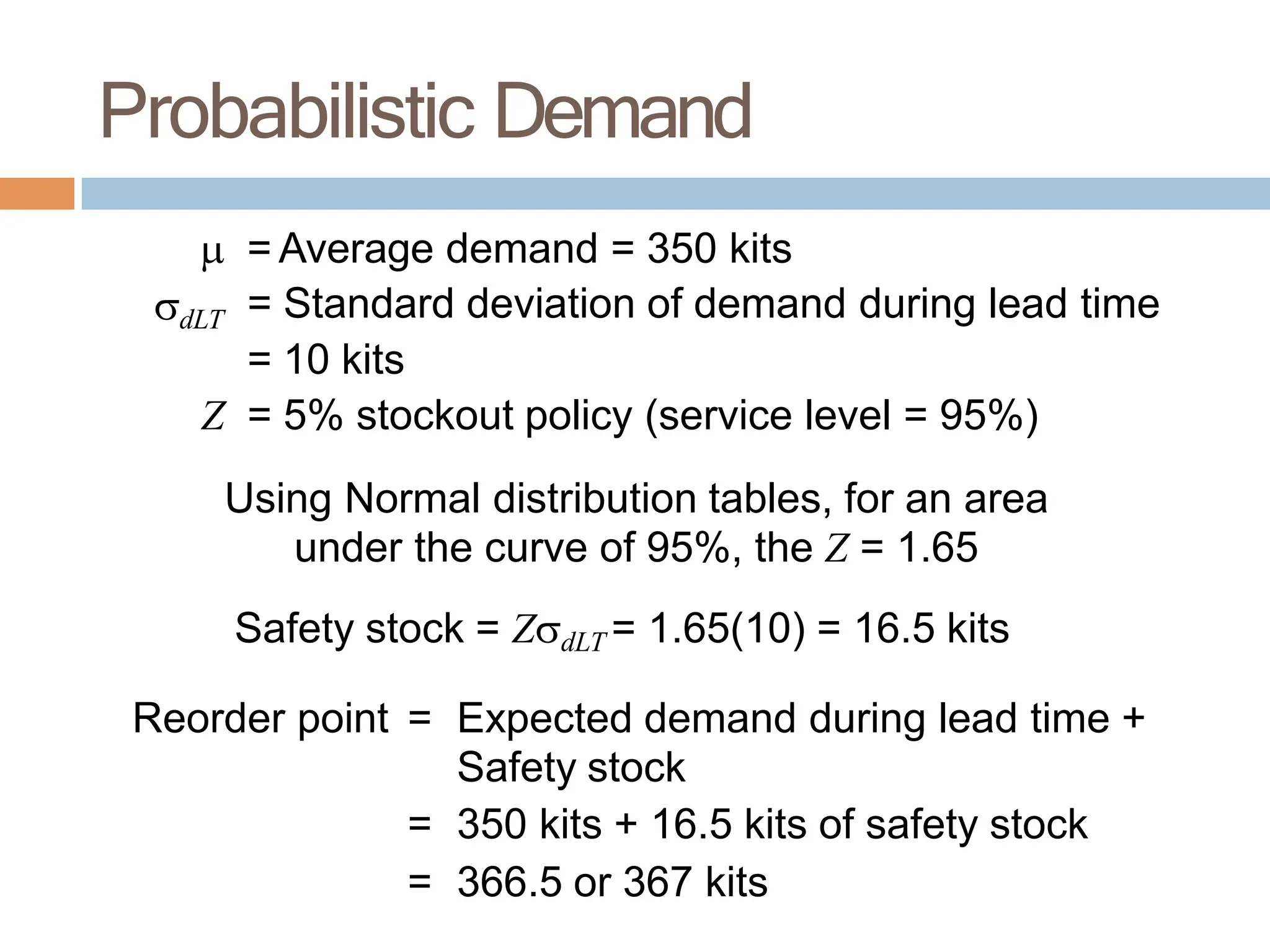

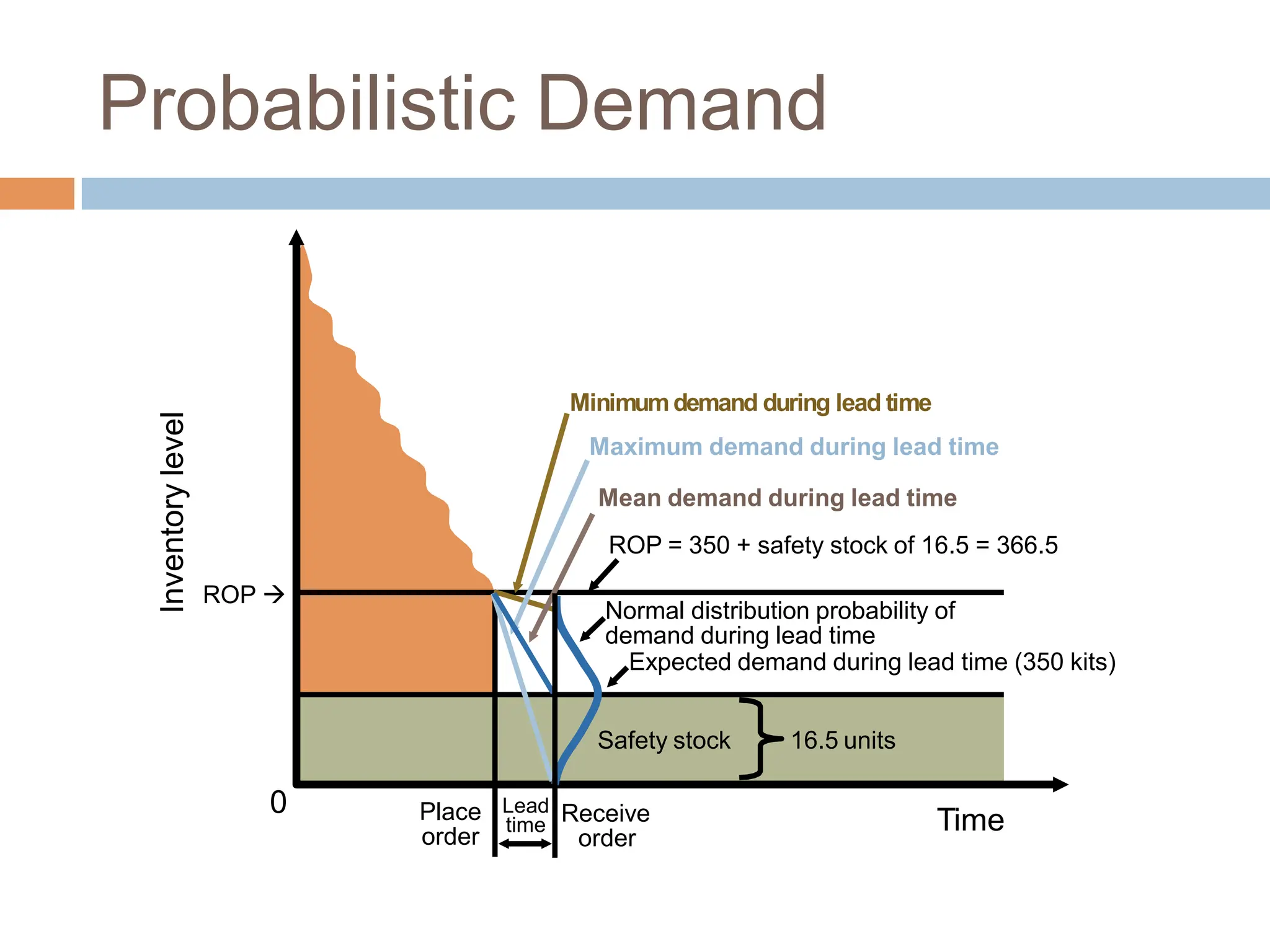

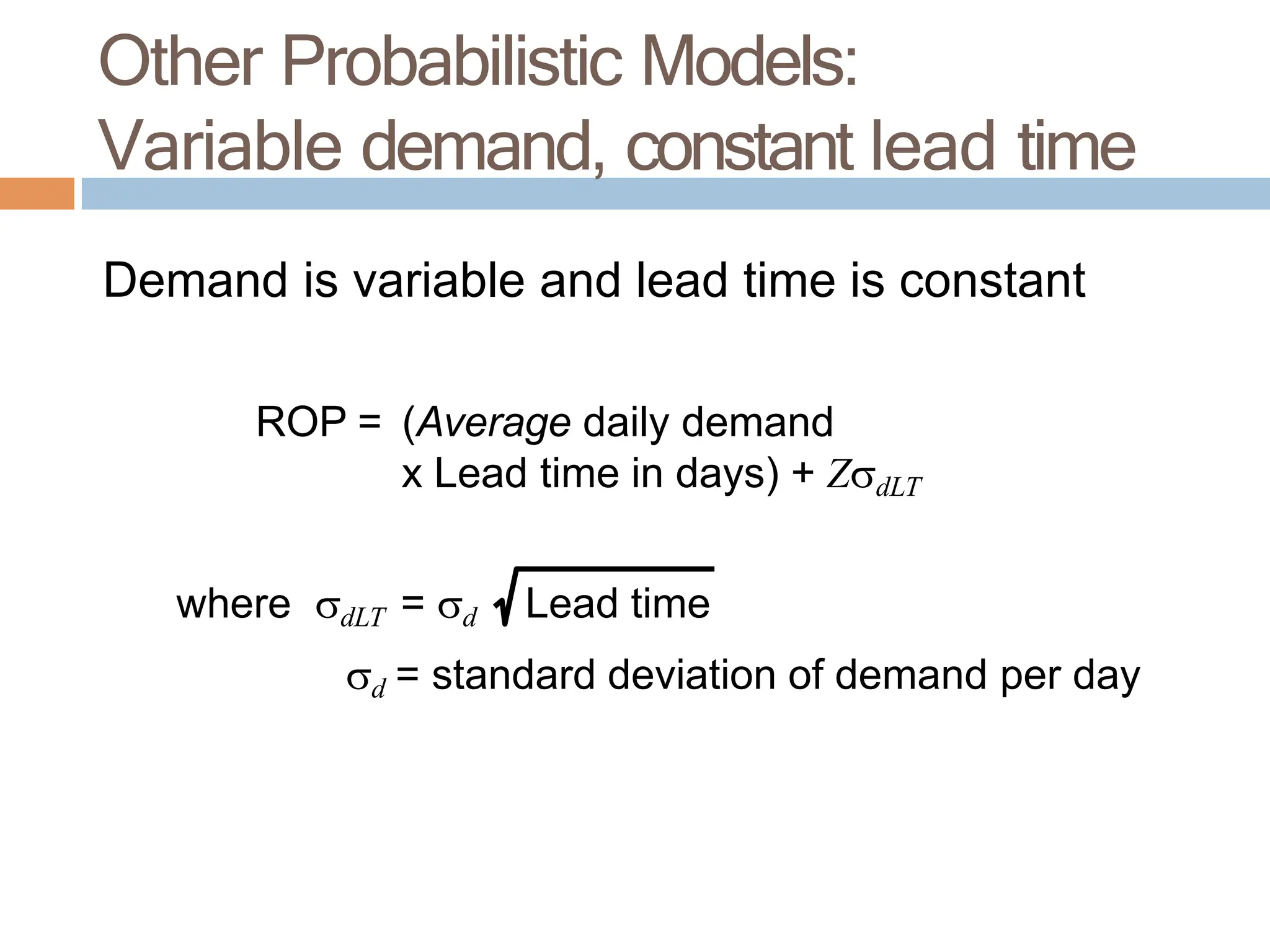

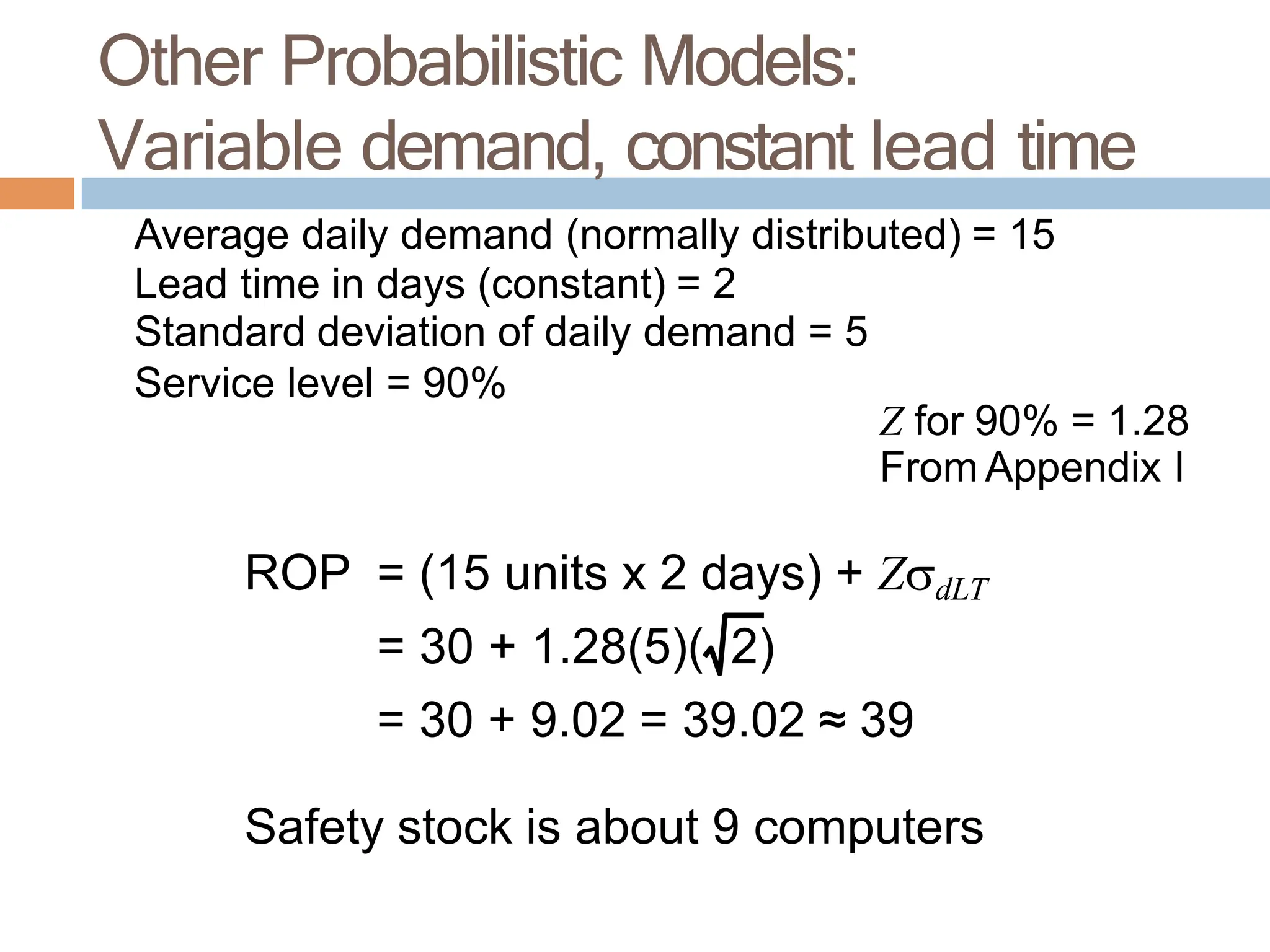

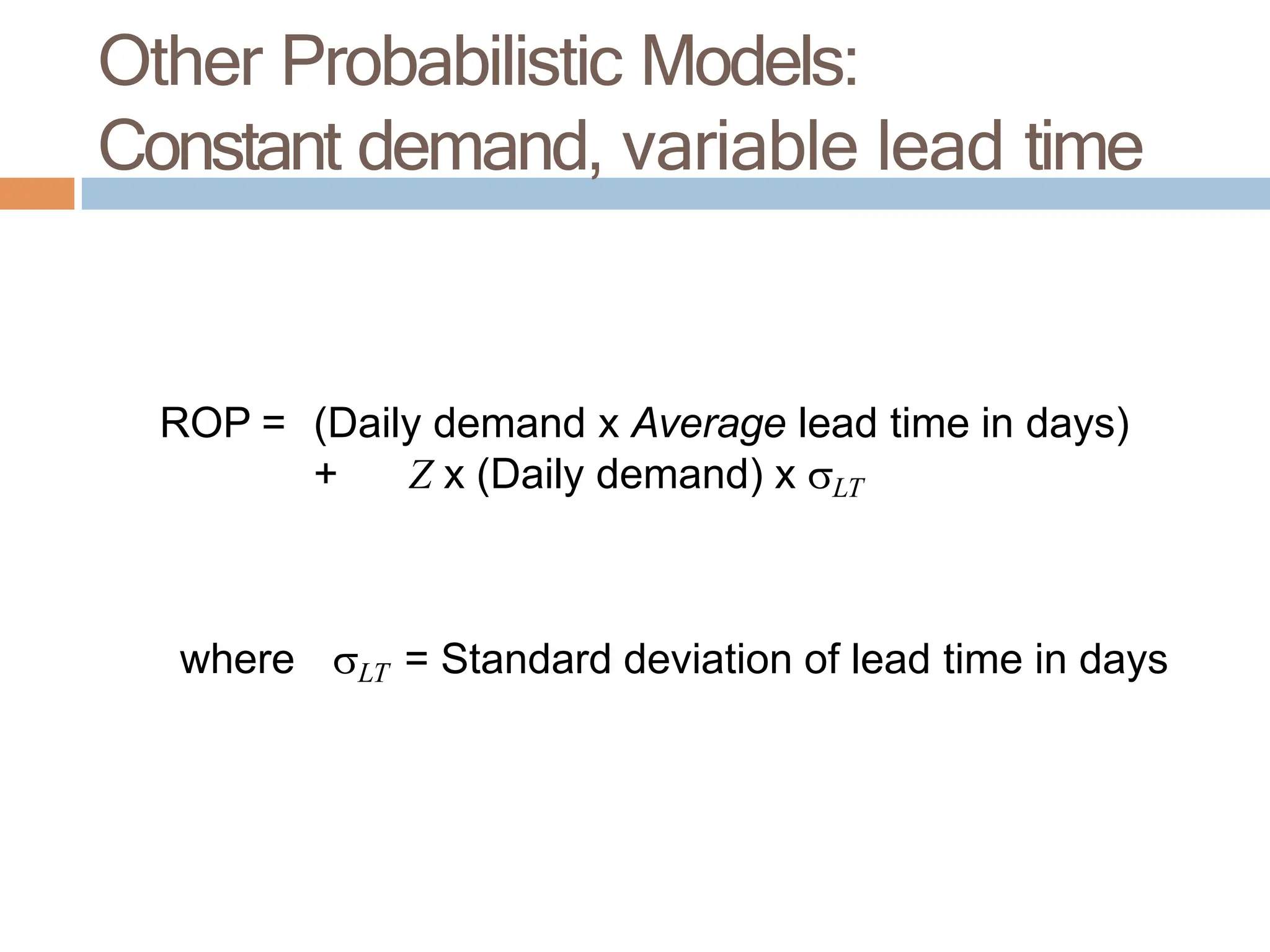

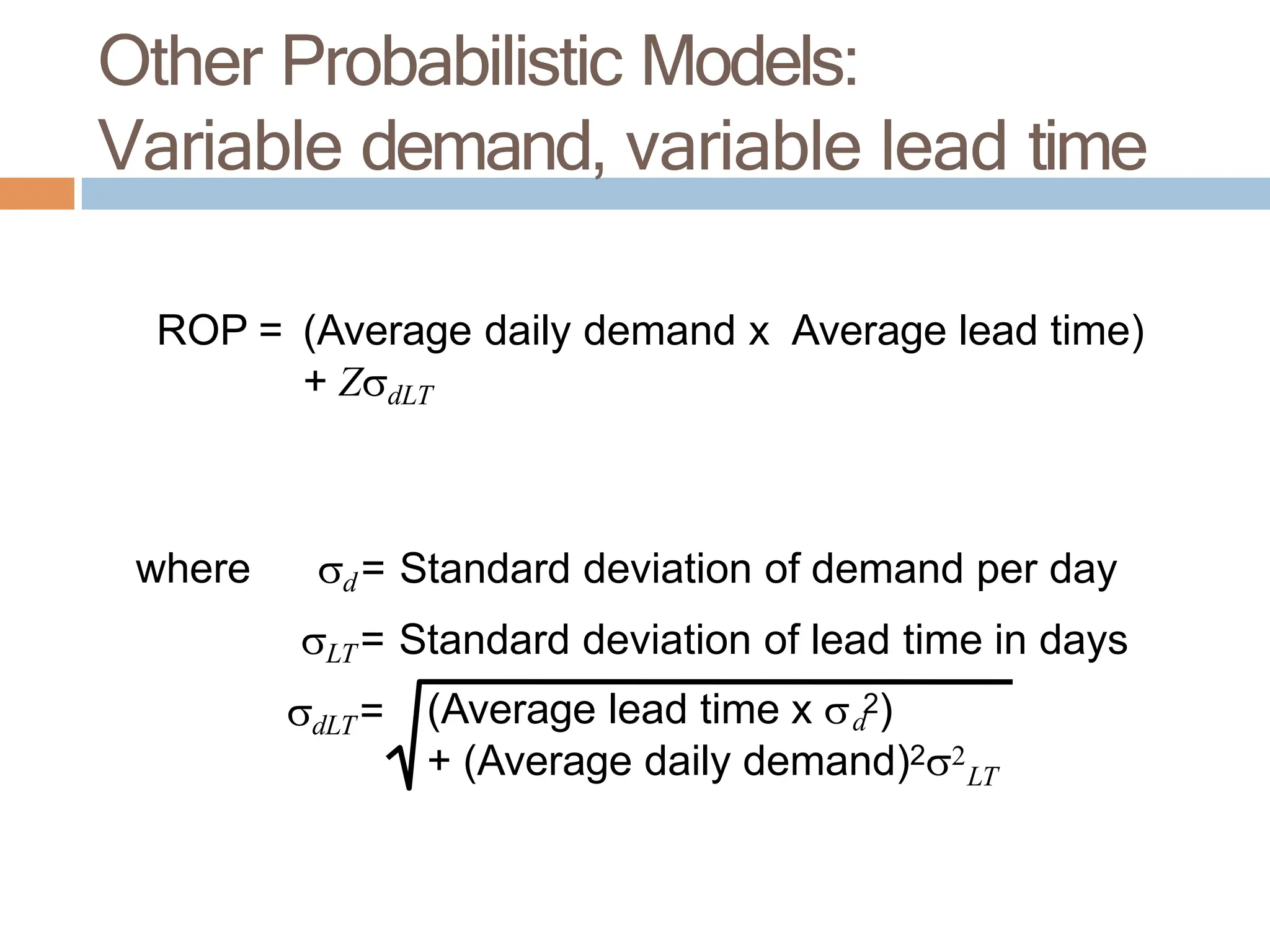

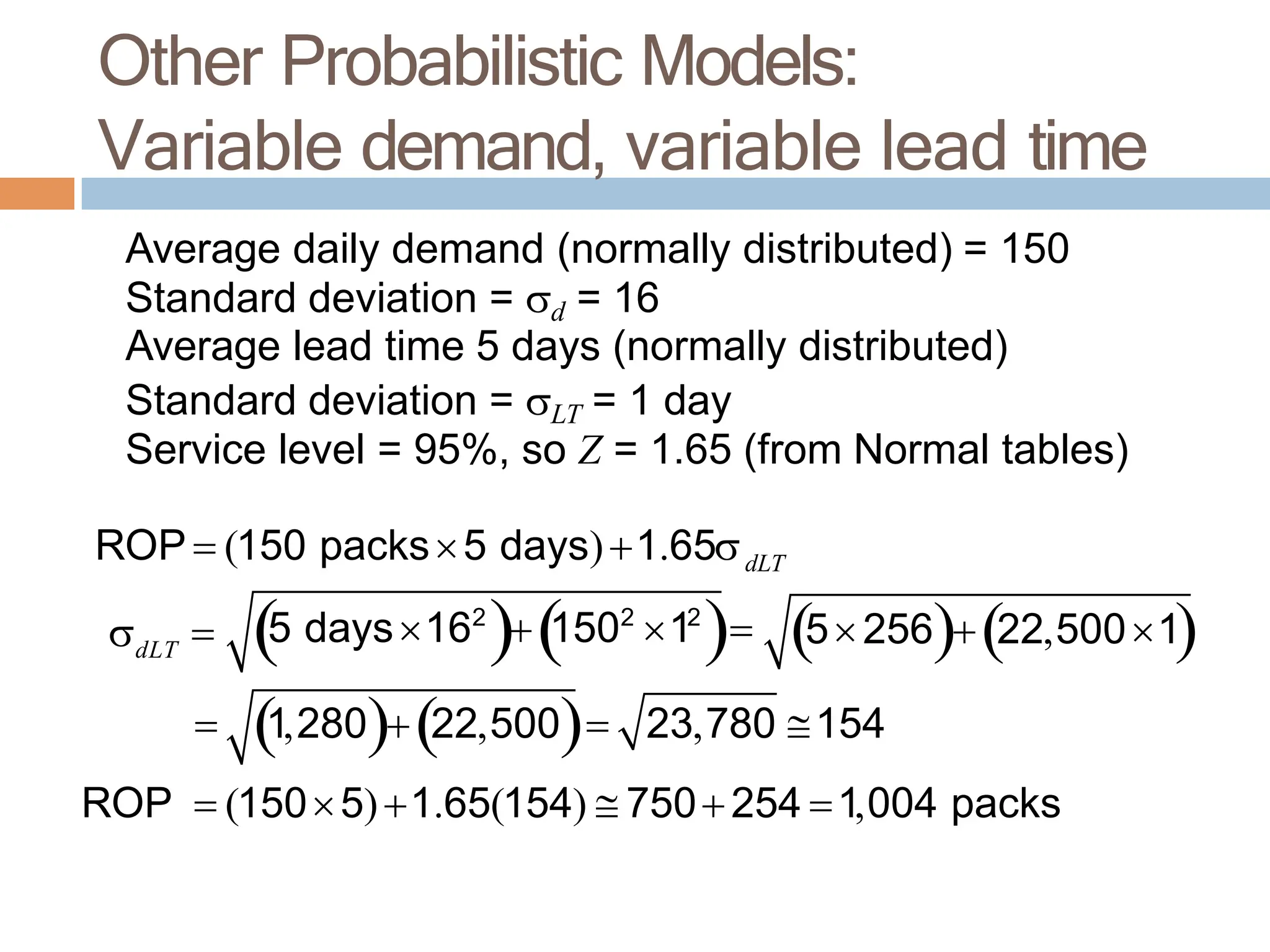

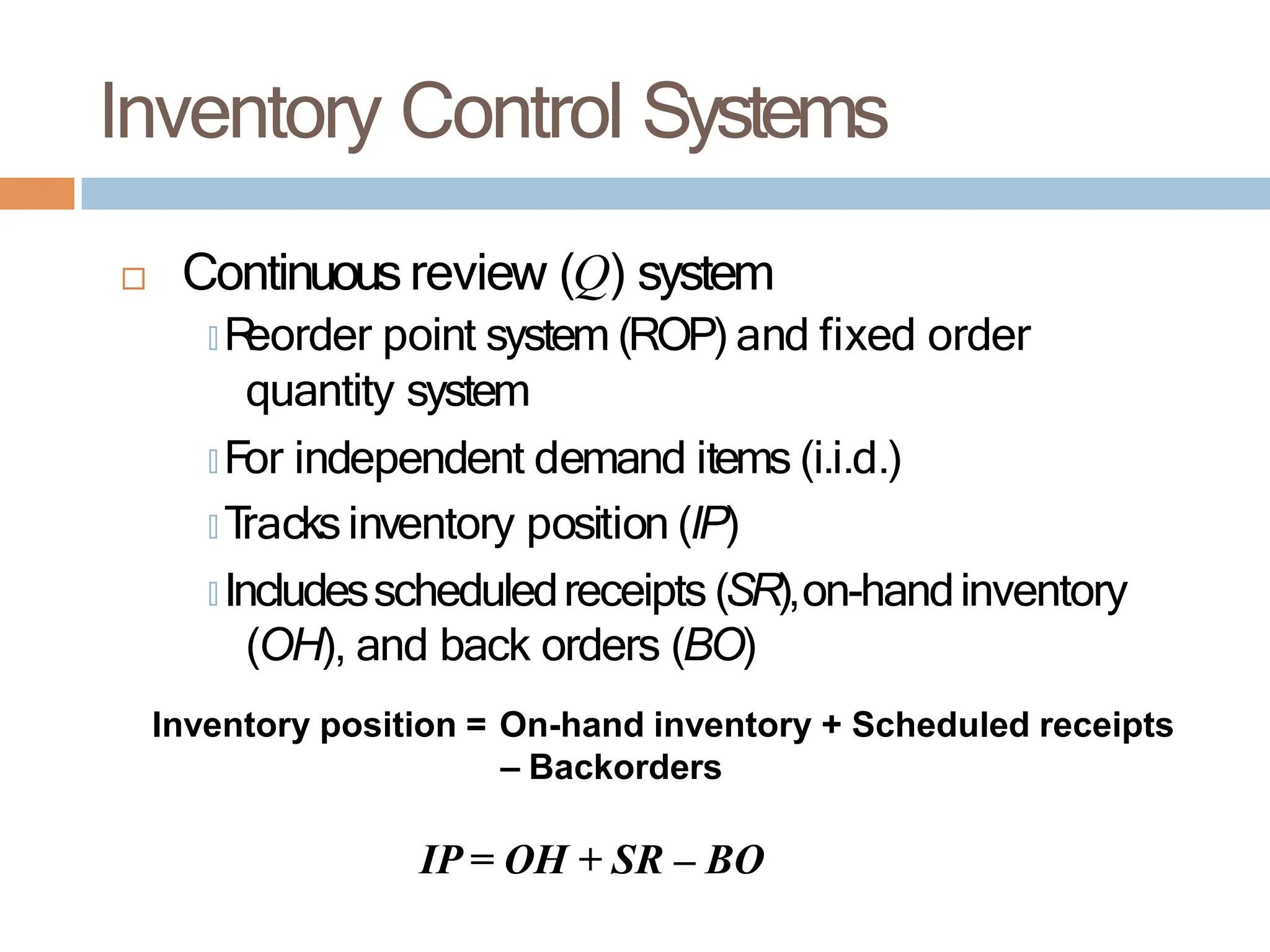

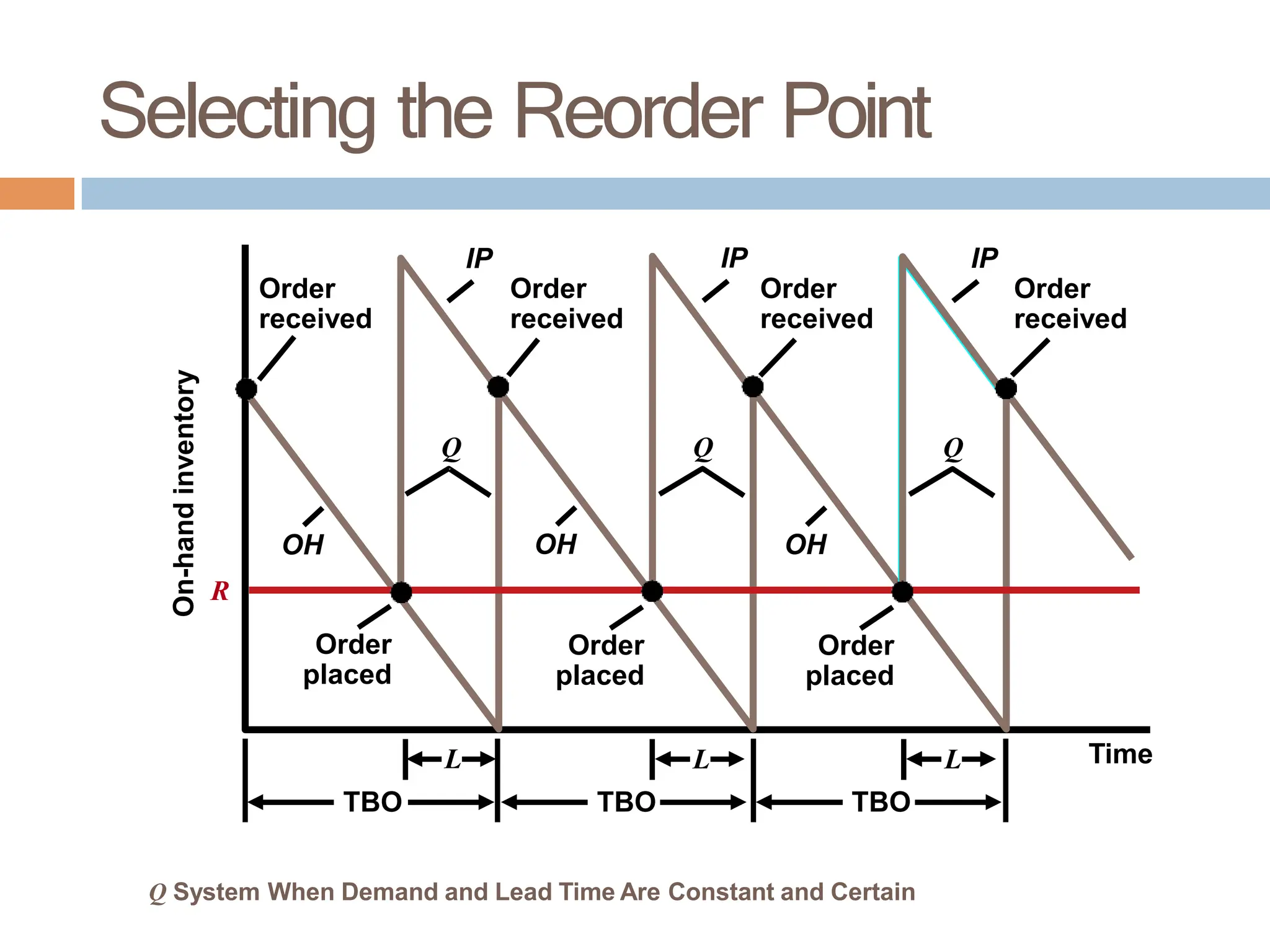

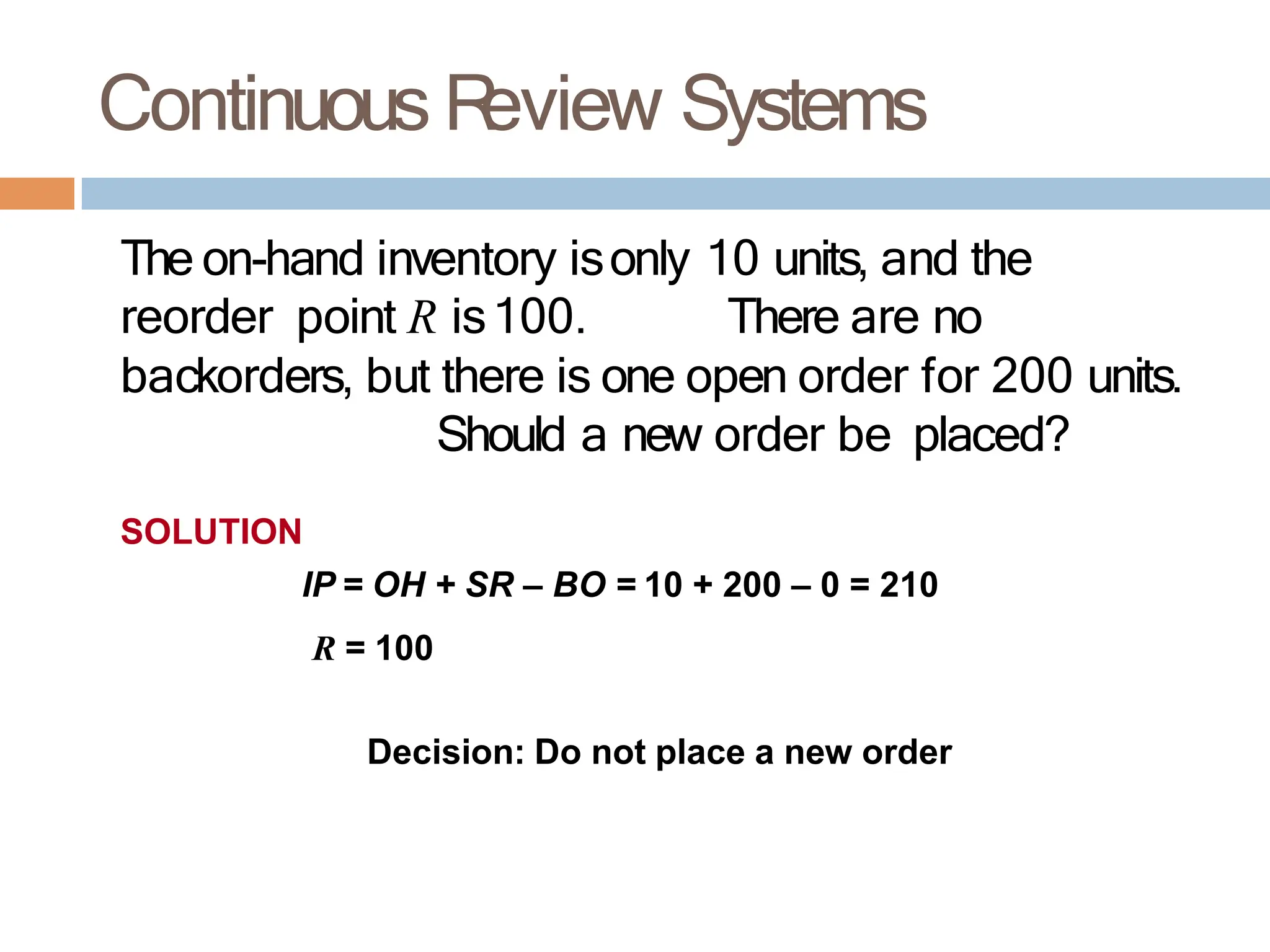

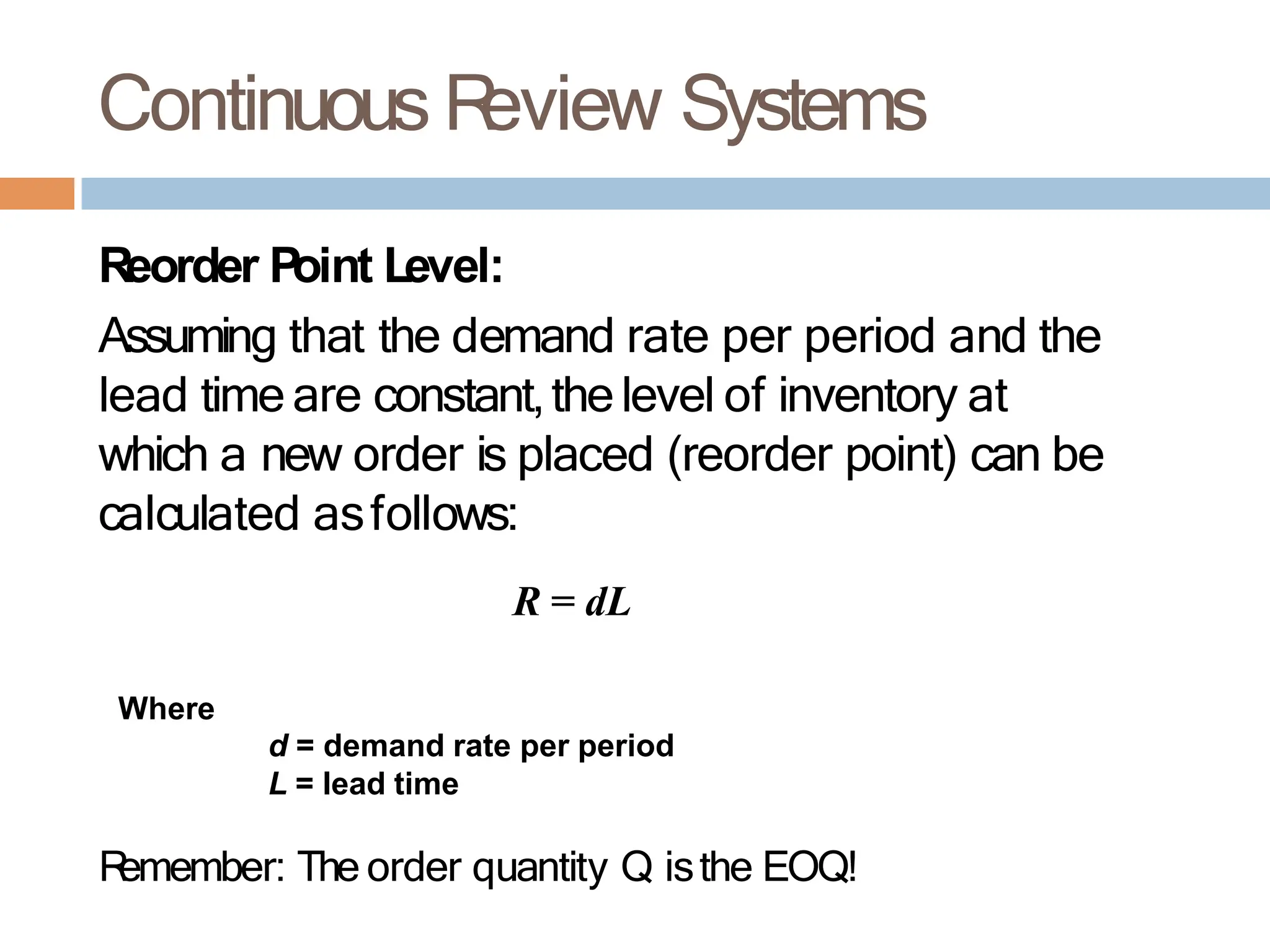

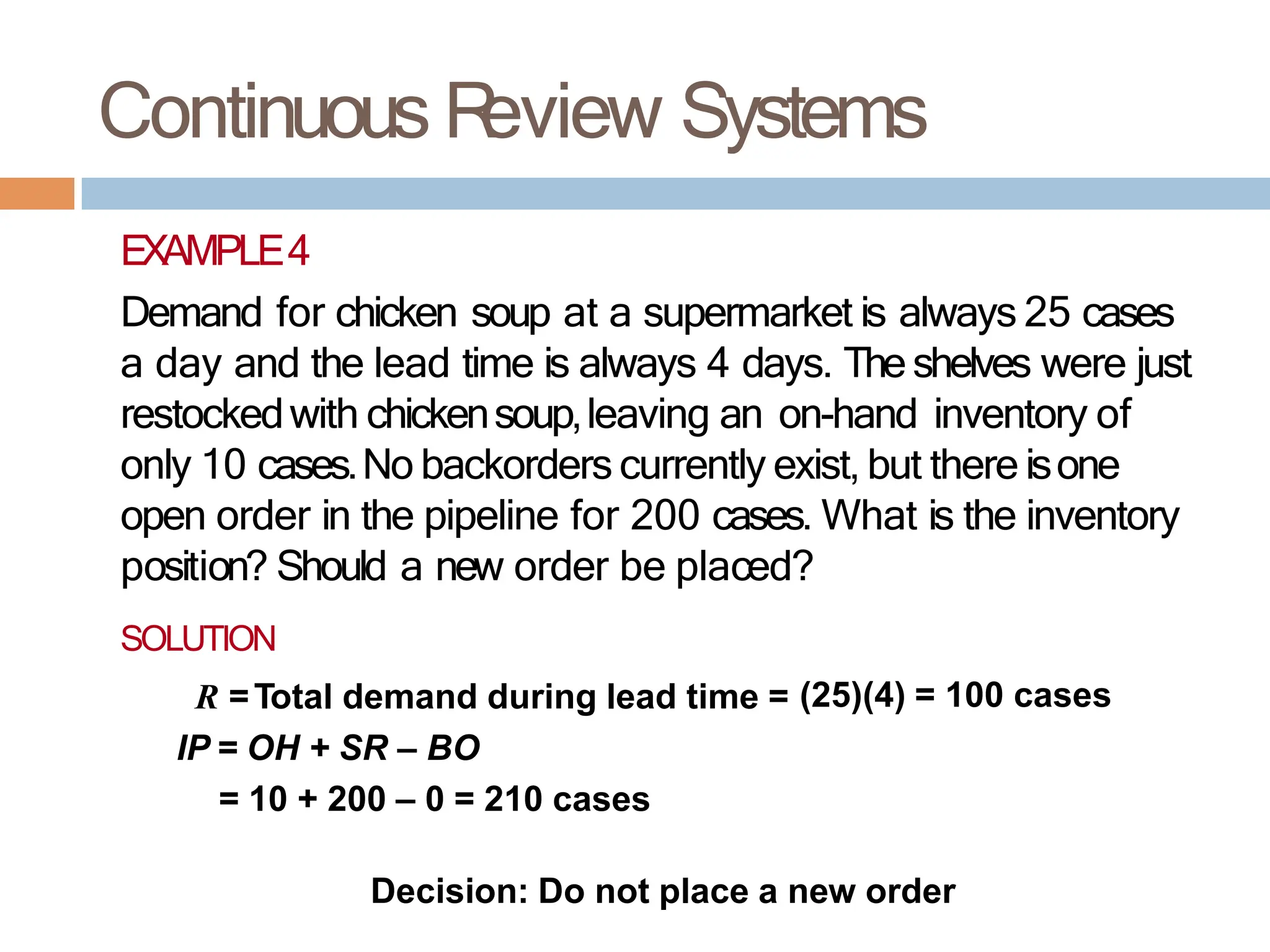

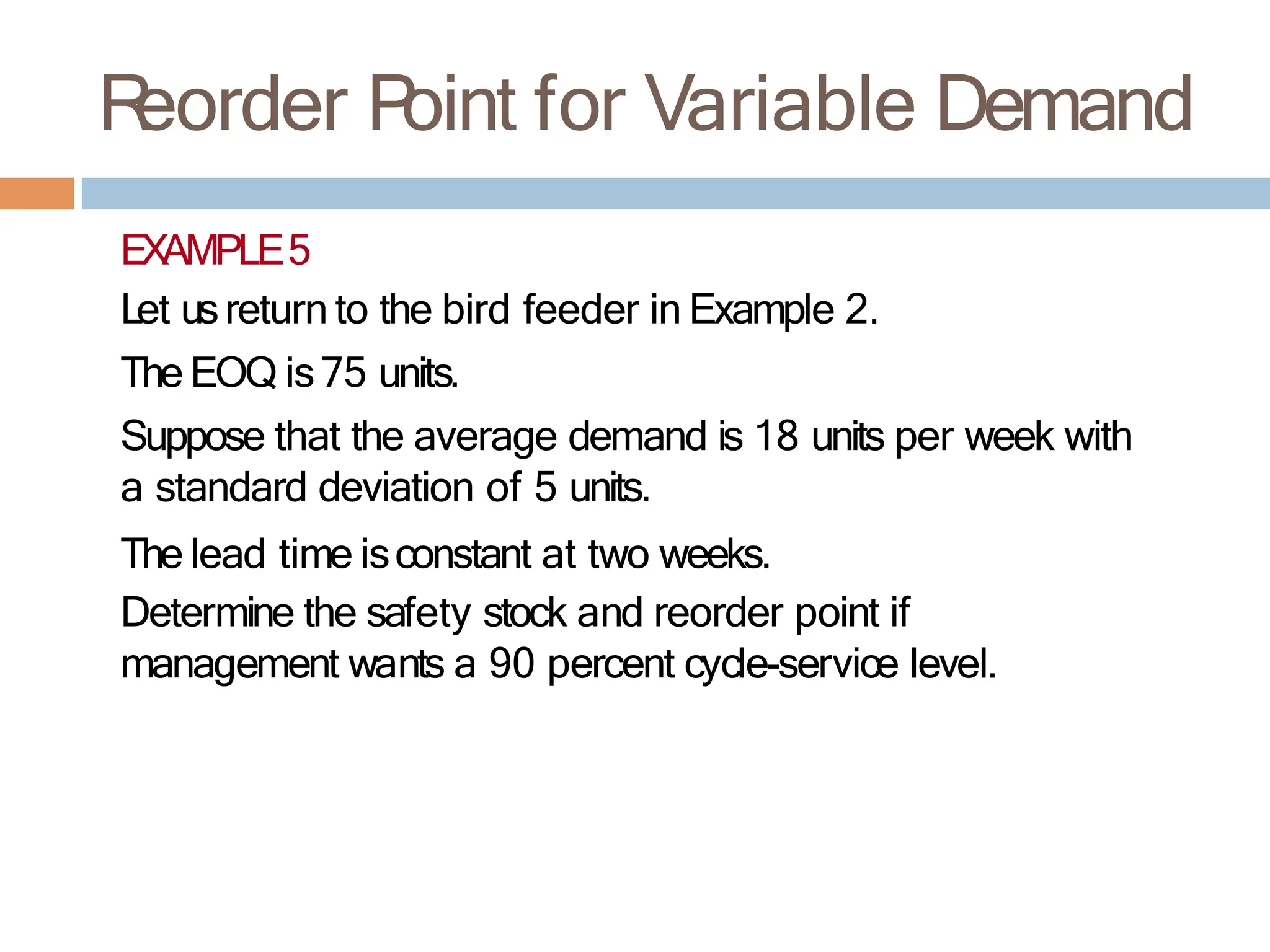

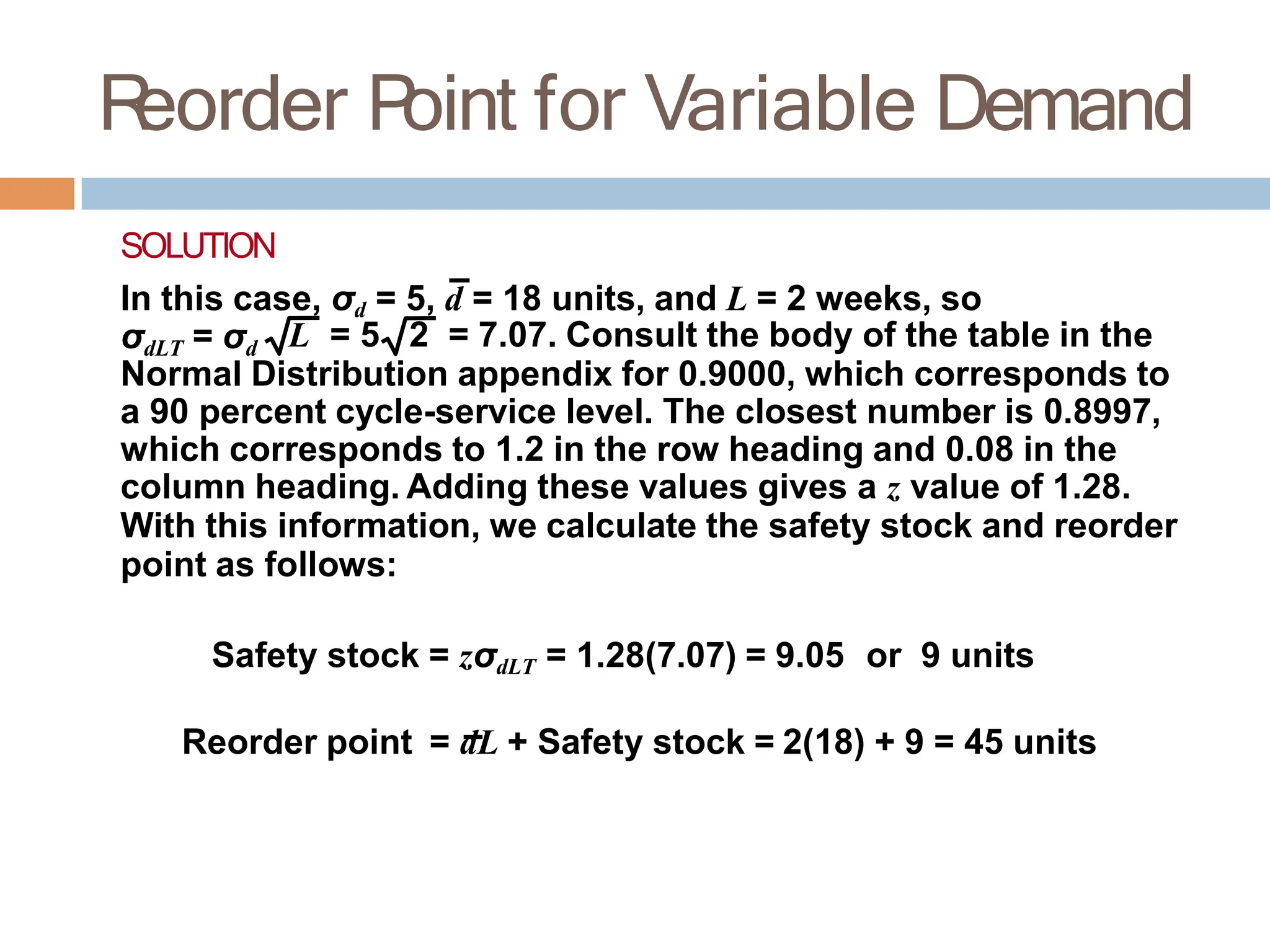

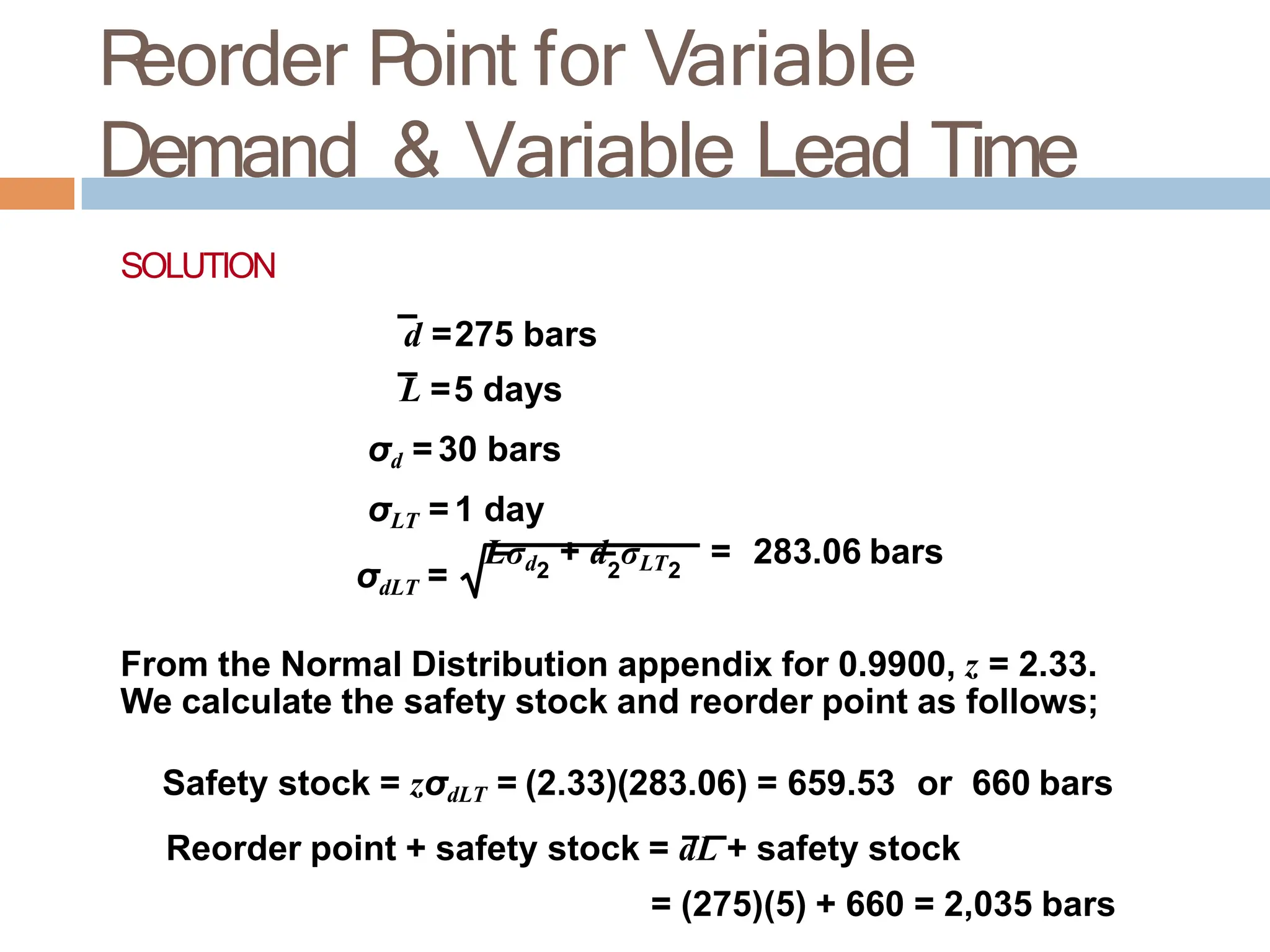

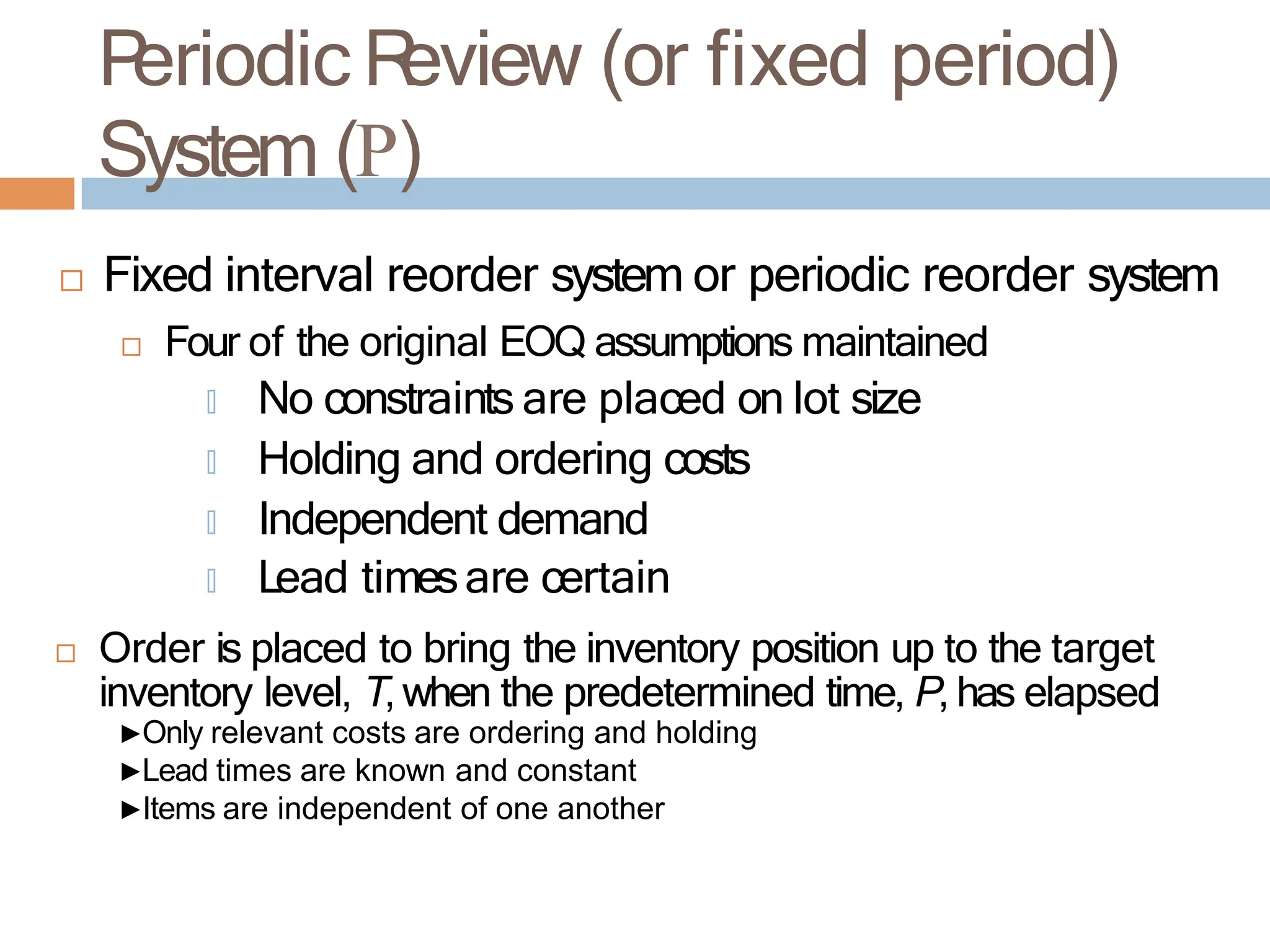

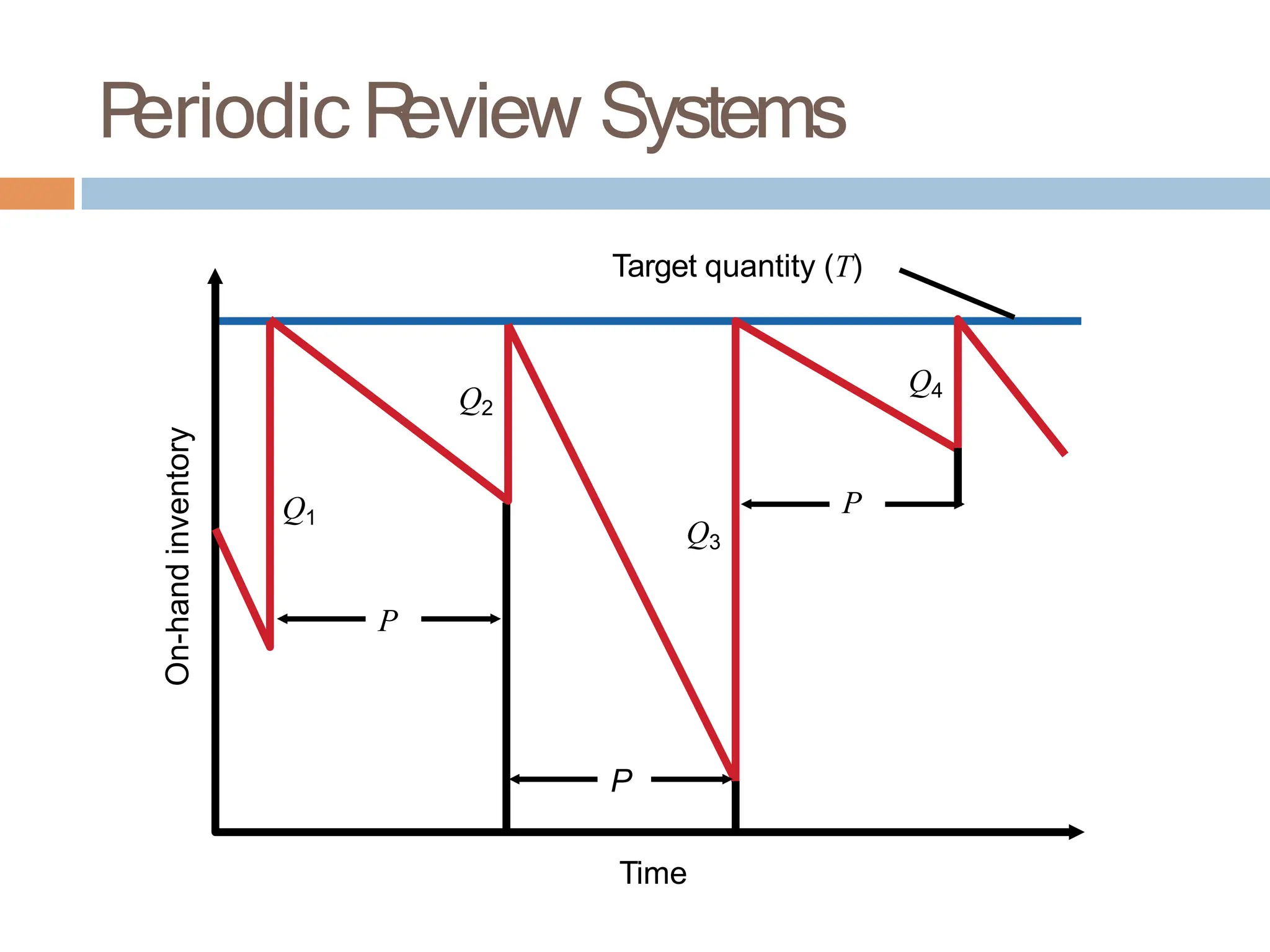

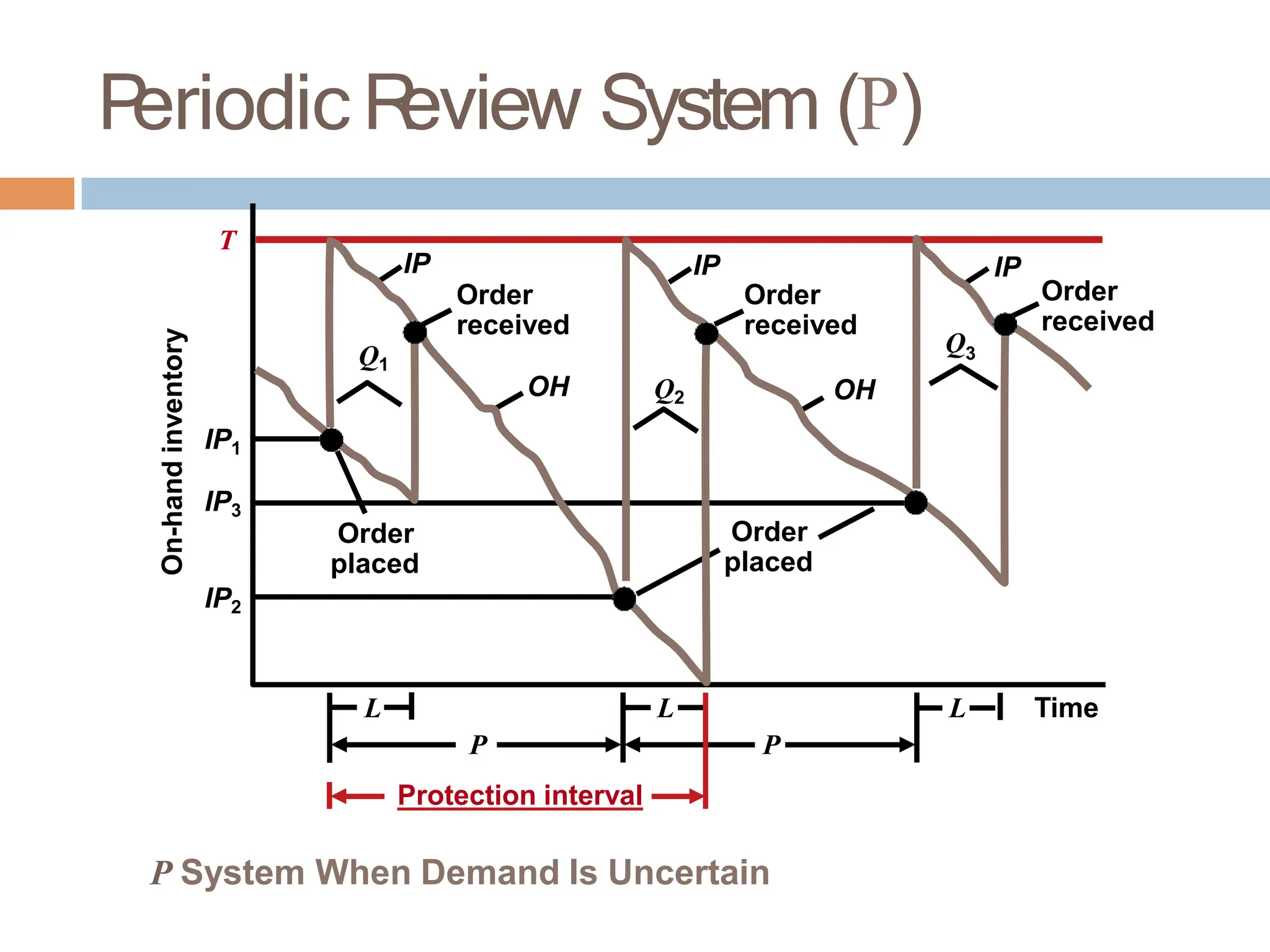

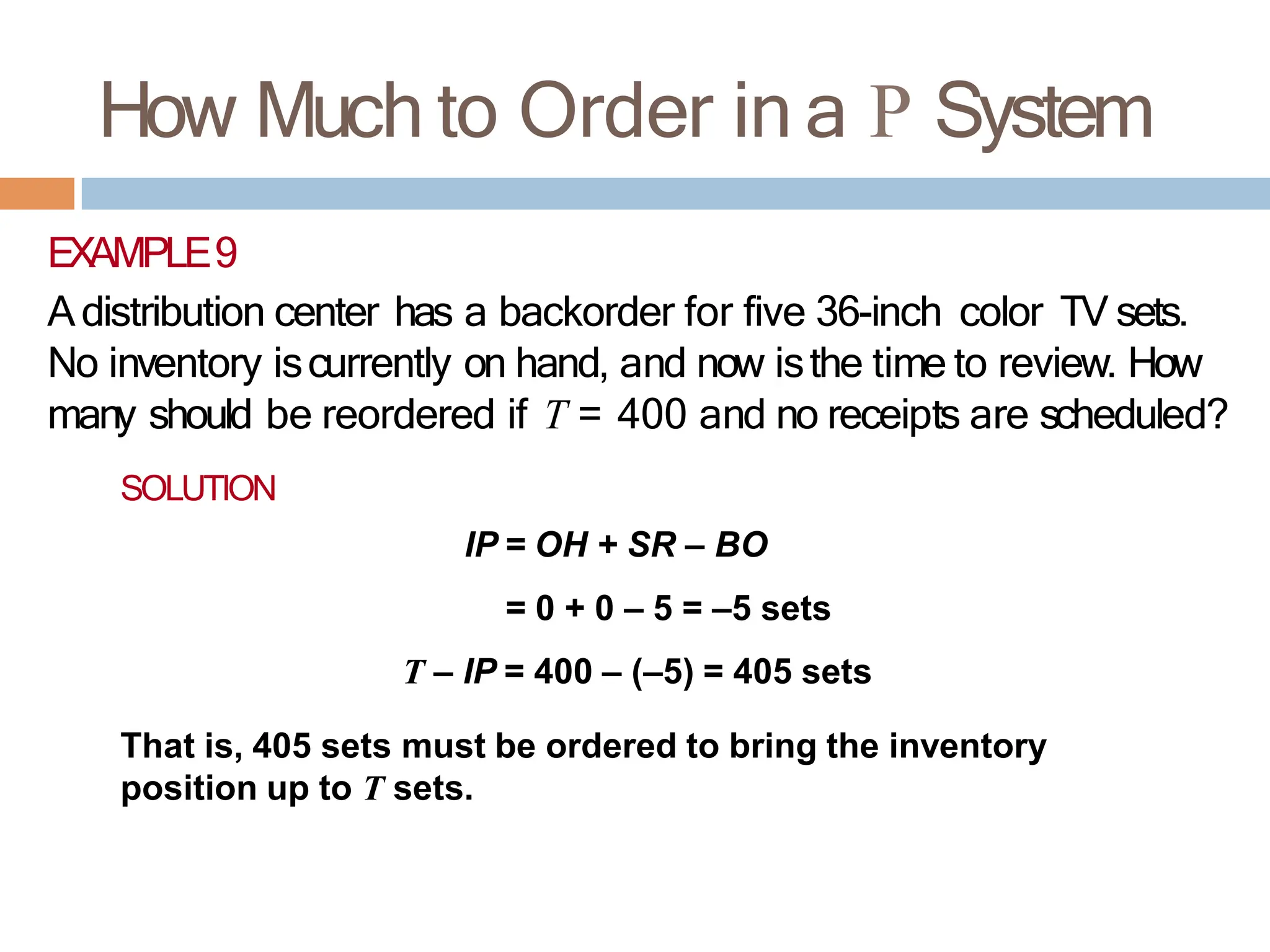

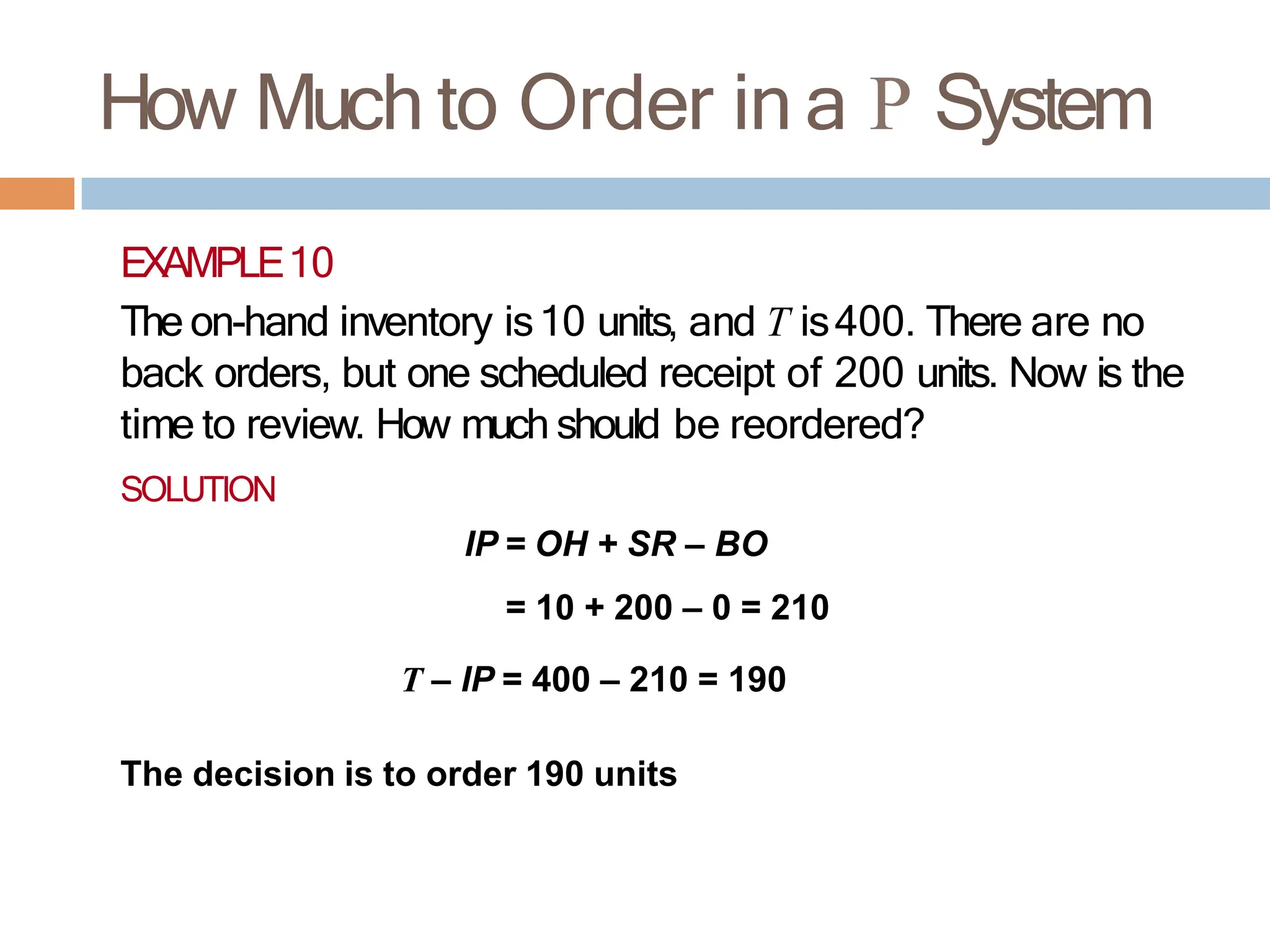

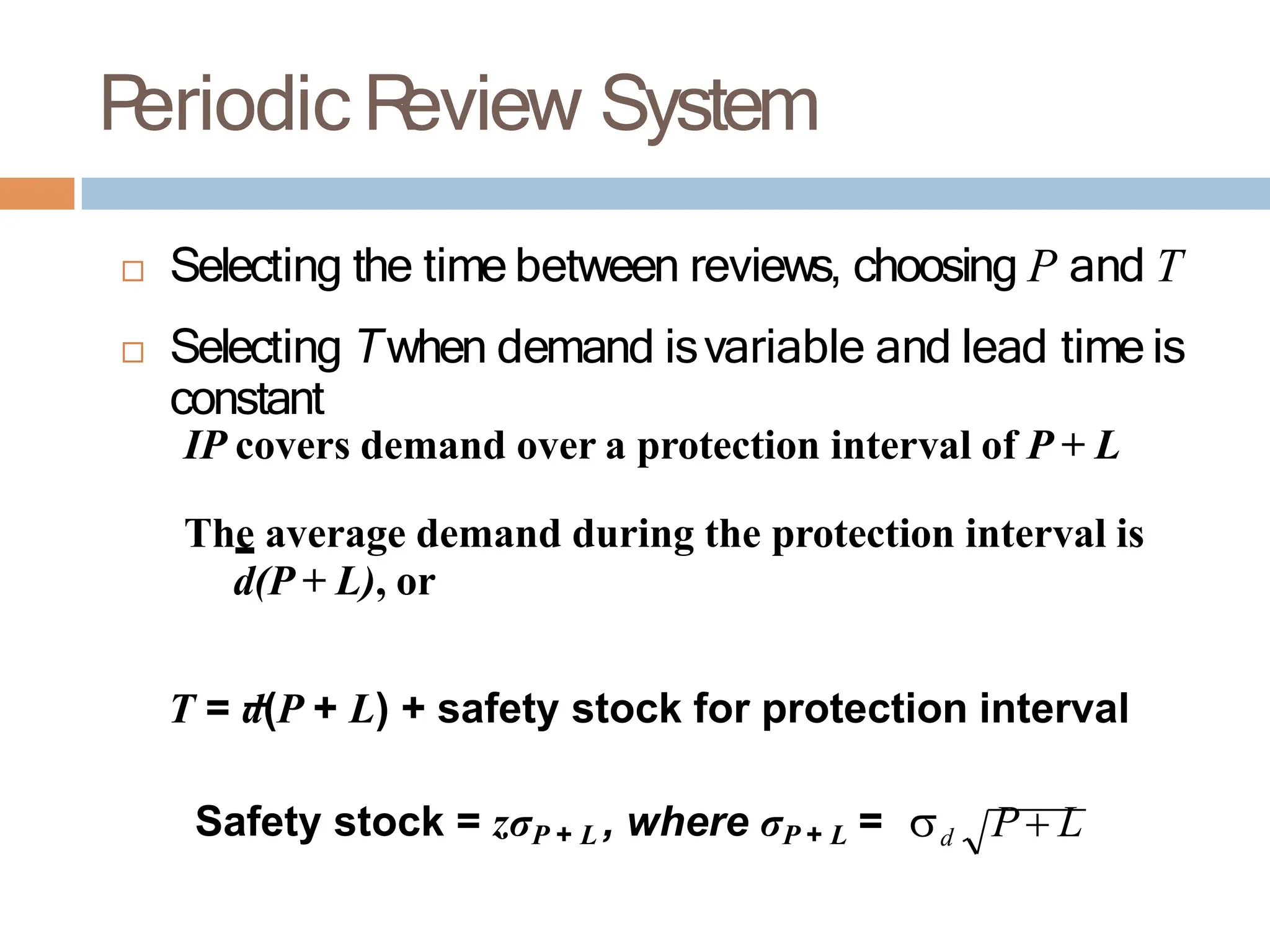

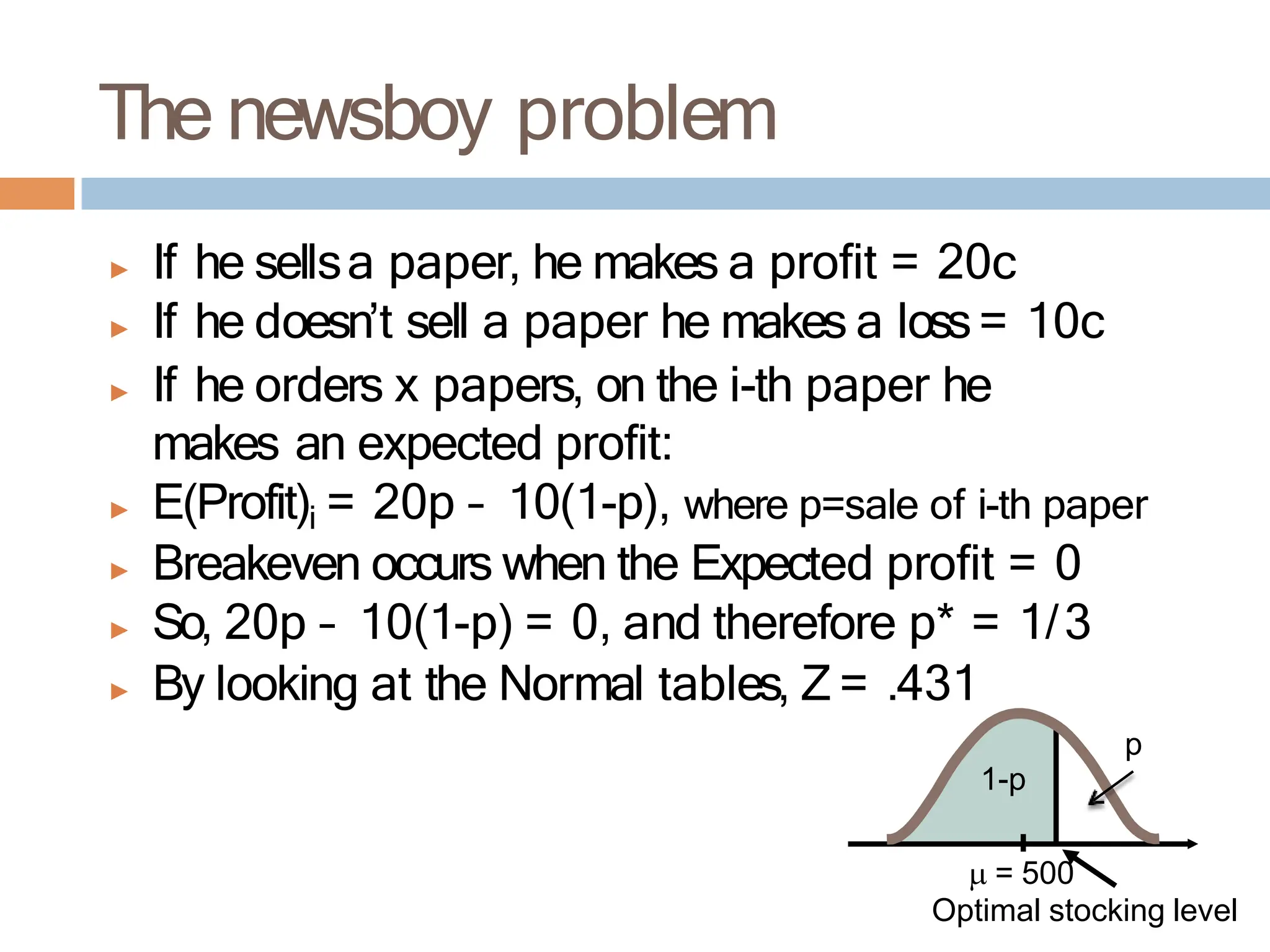

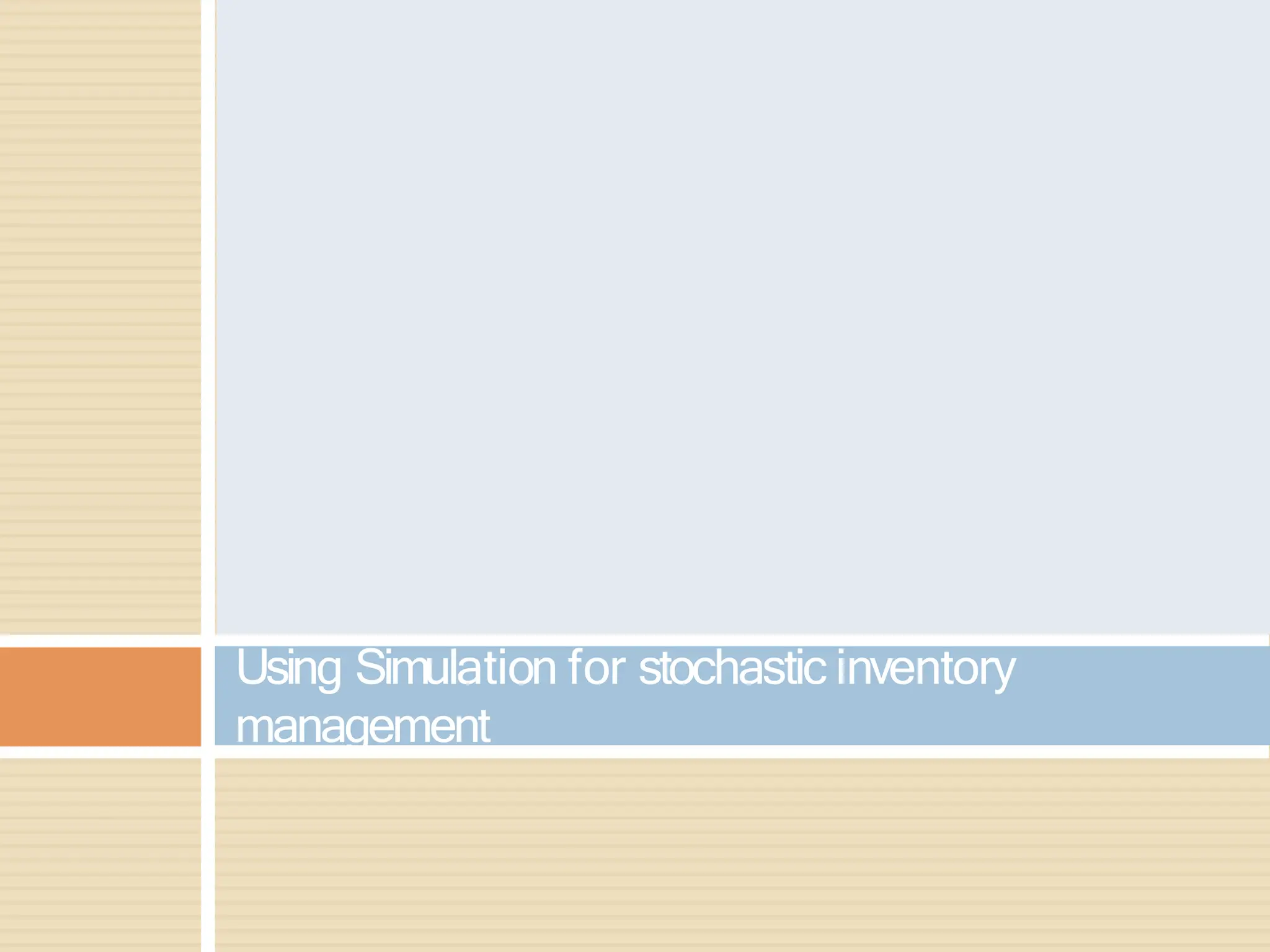

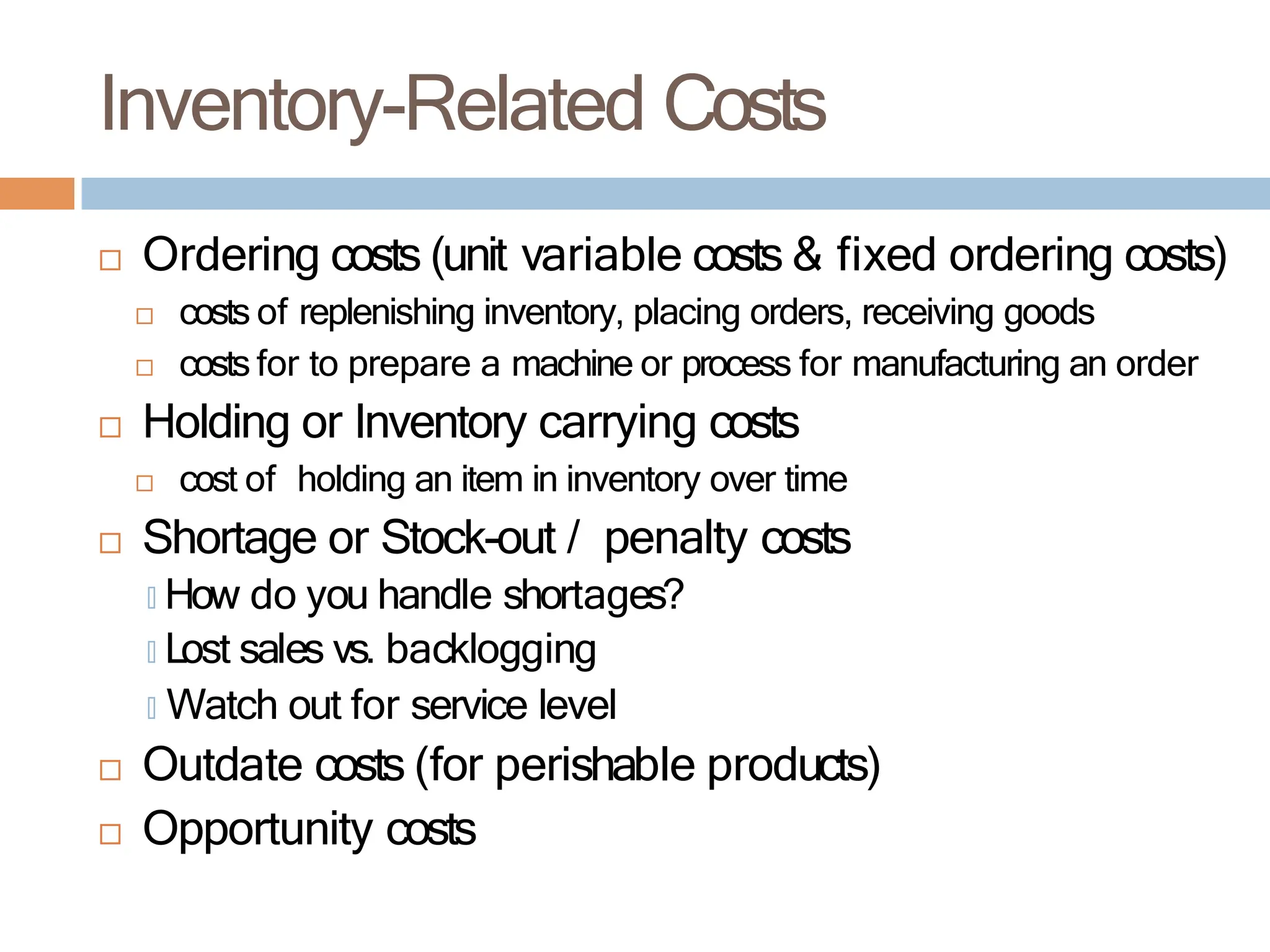

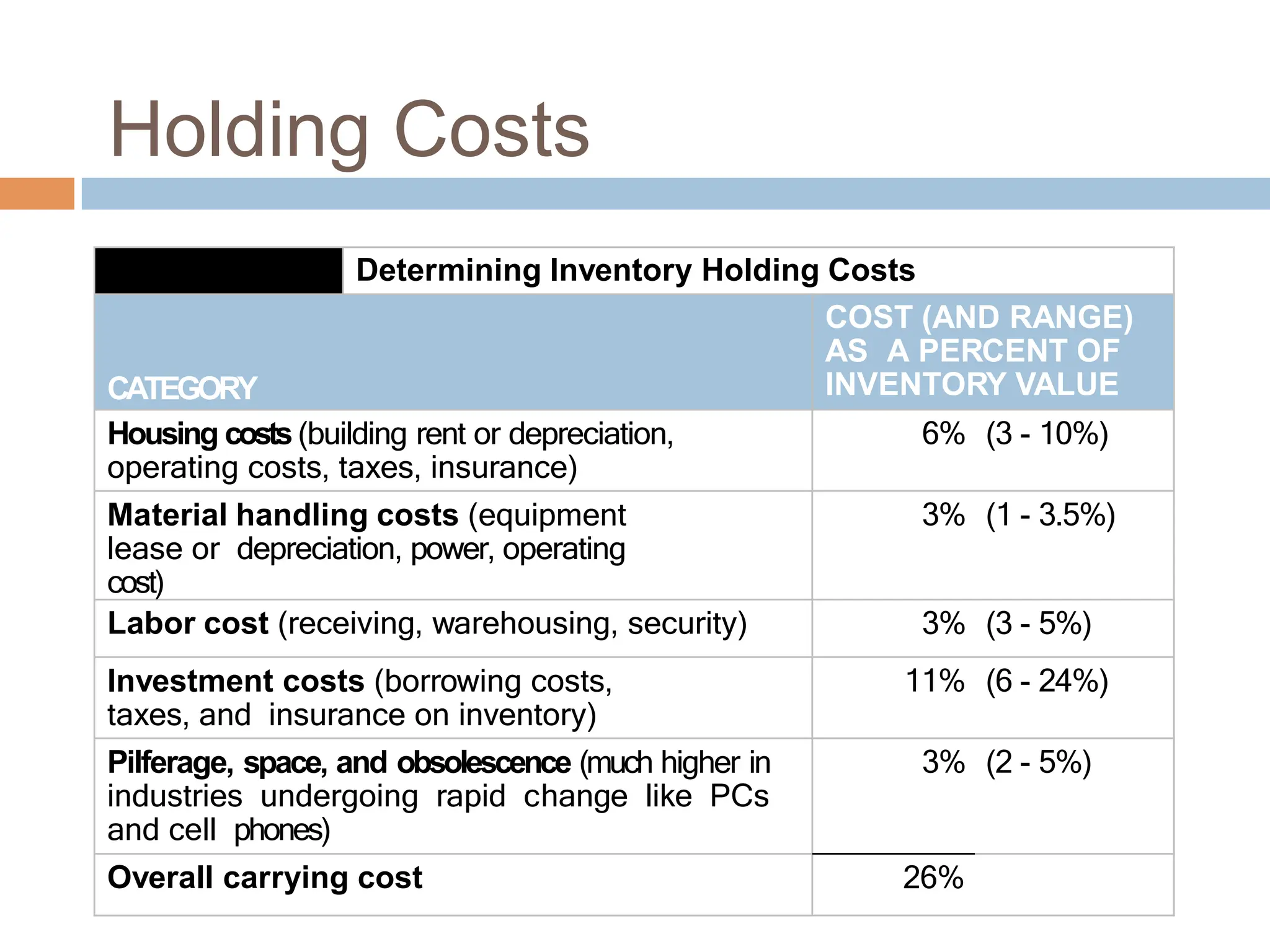

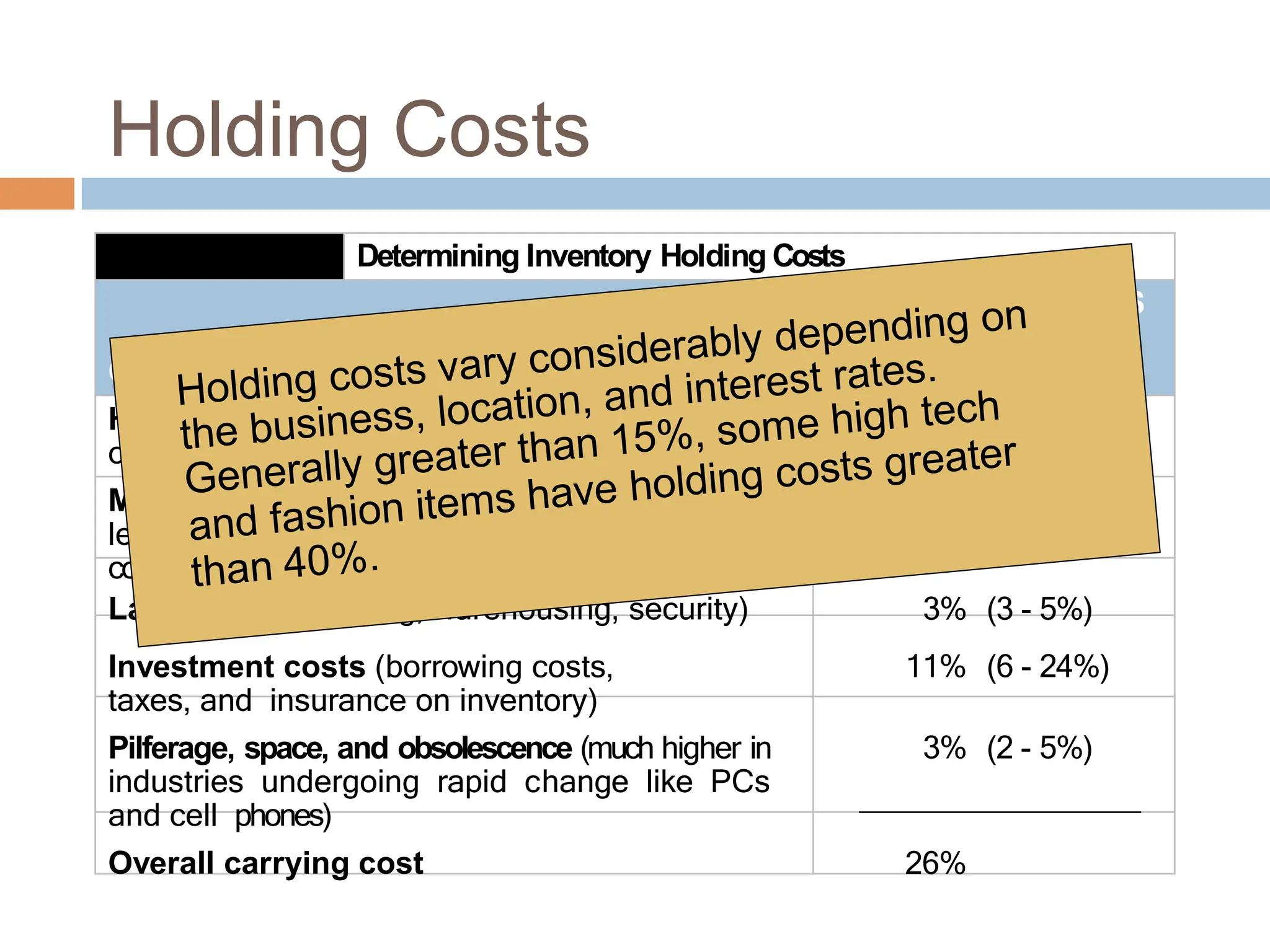

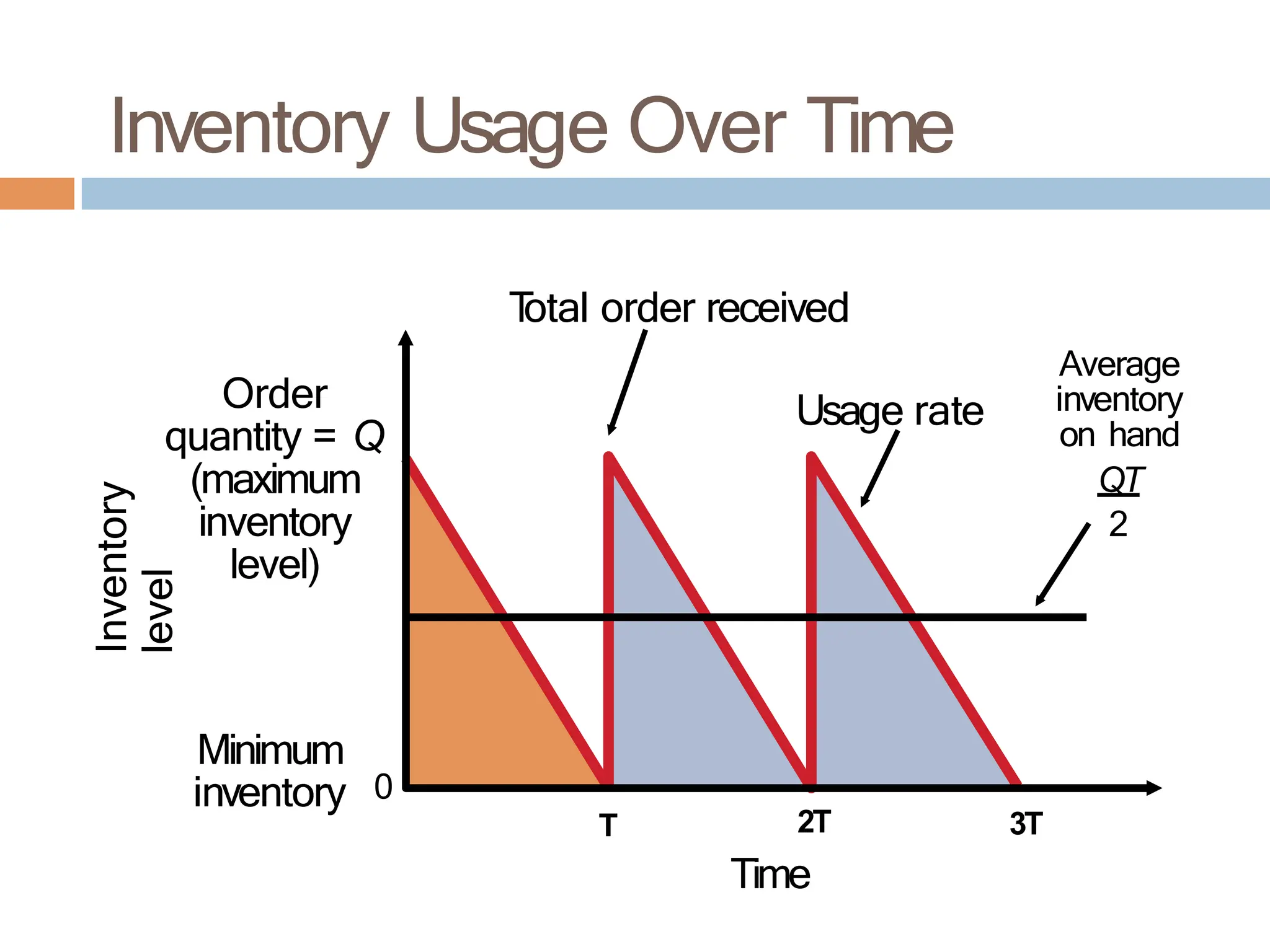

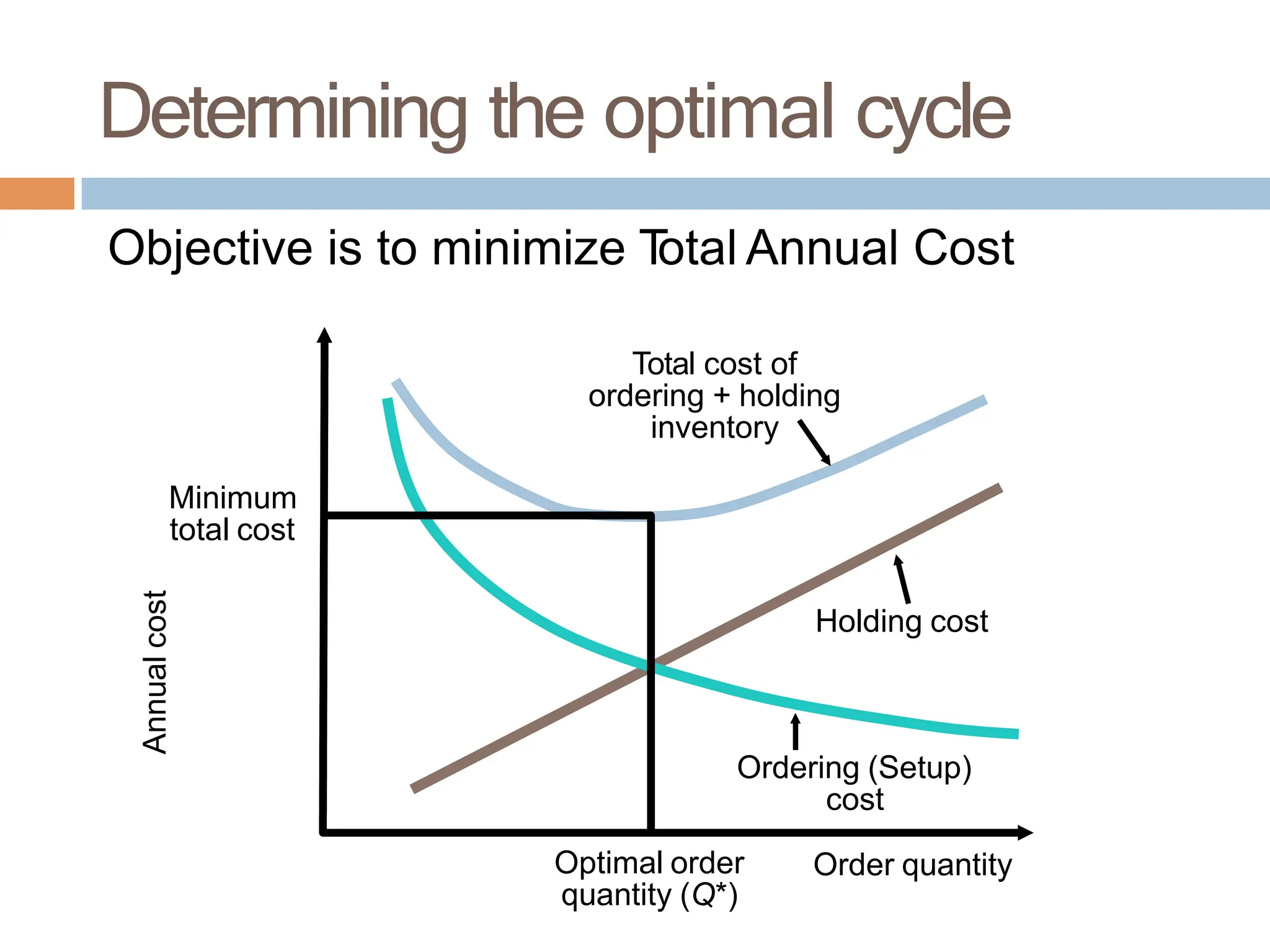

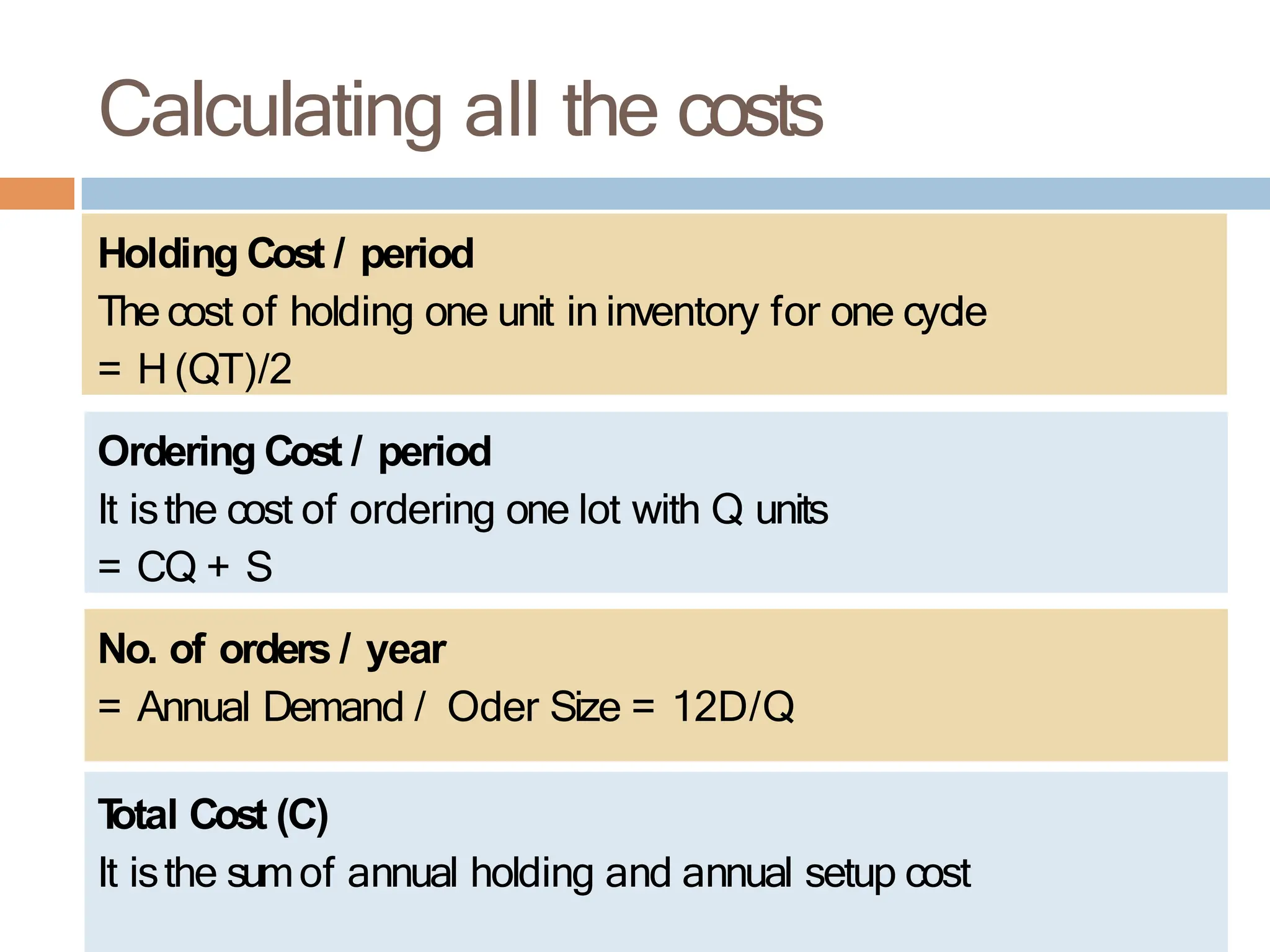

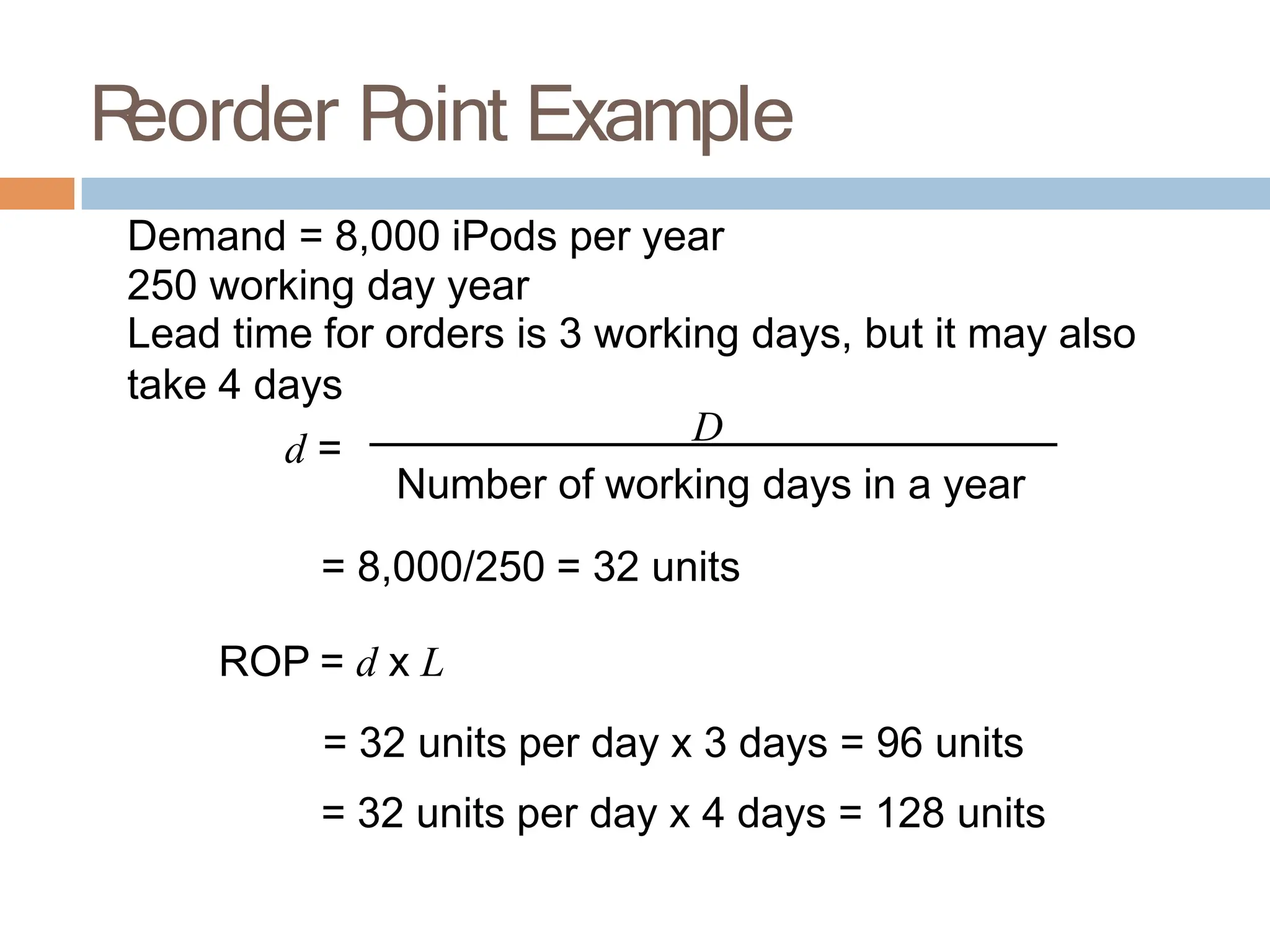

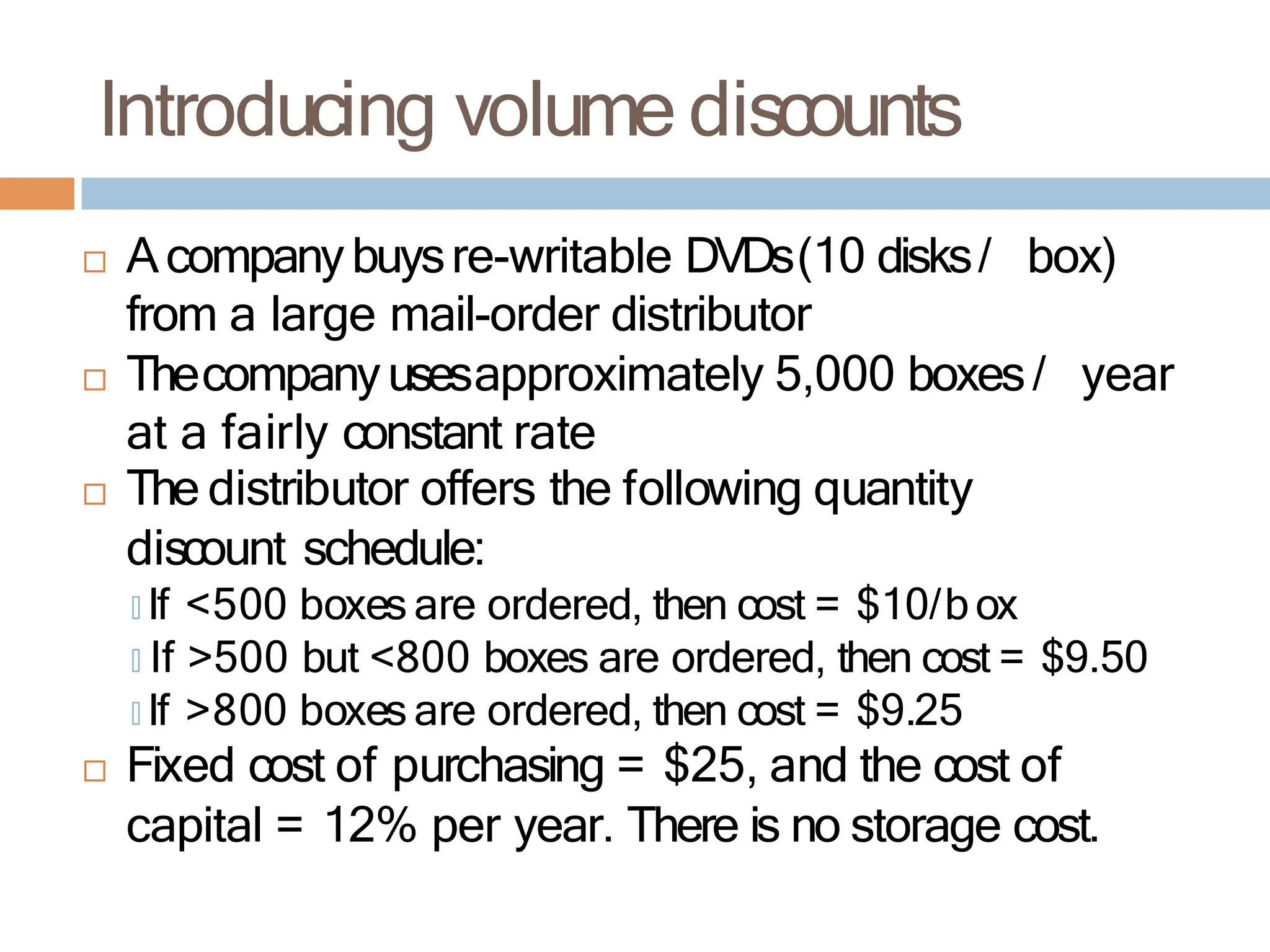

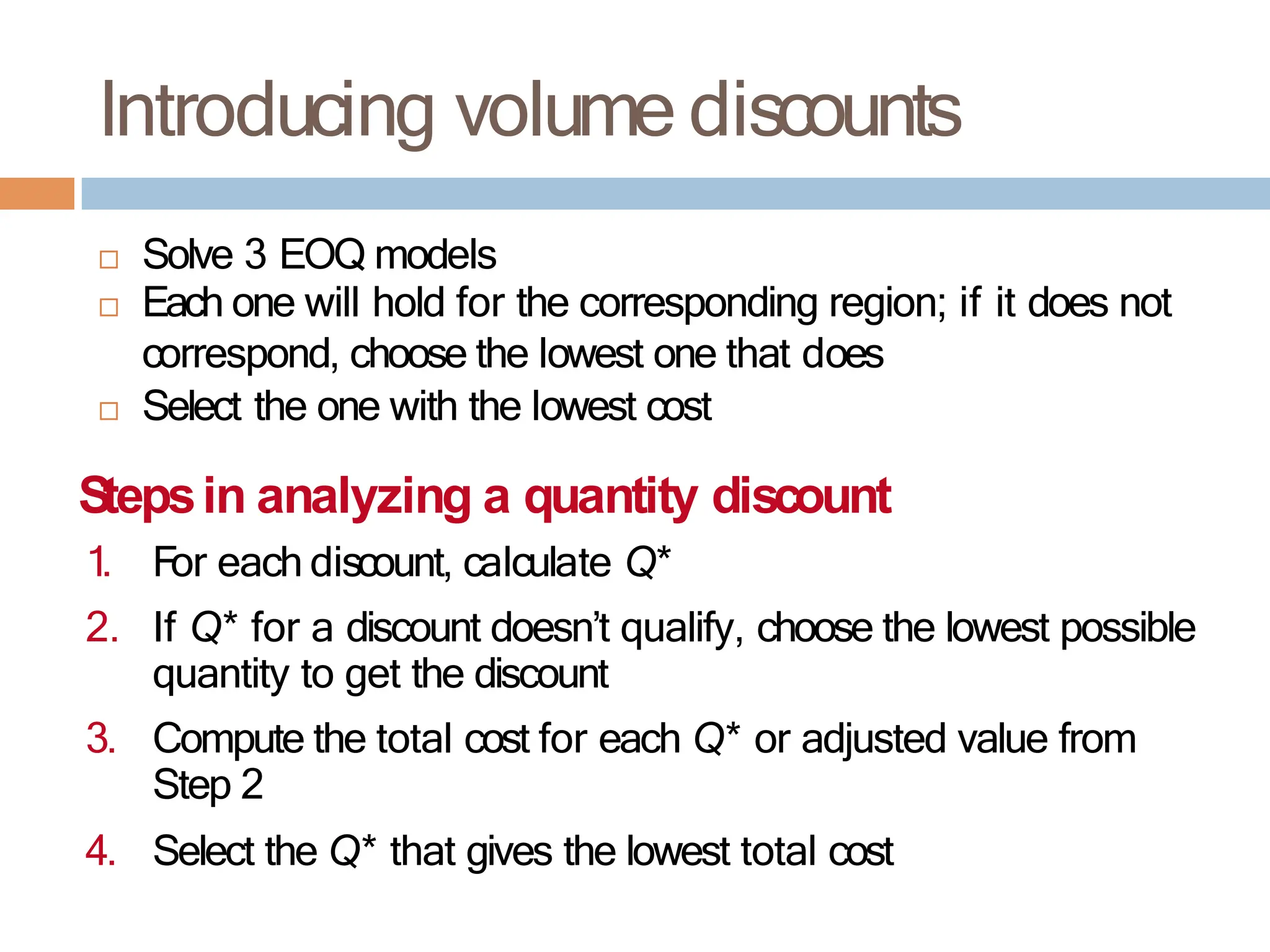

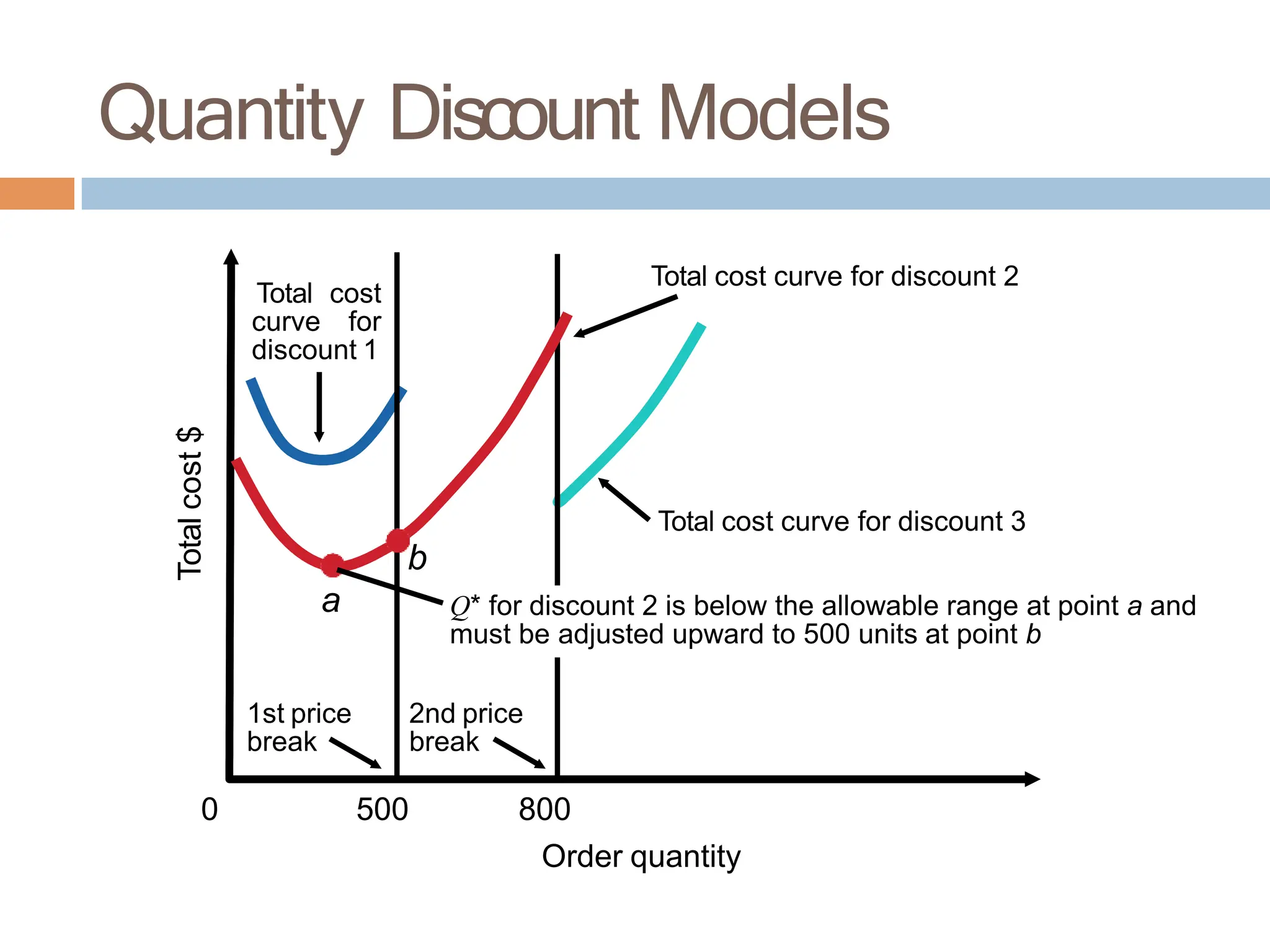

The document discusses inventory management, focusing on its importance, associated costs, and various inventory models including ABC analysis and Economic Order Quantity (EOQ). It highlights the significance of balancing inventory investments with customer service levels and examines factors impacting the decision to hold inventory. Additionally, it provides detailed methodologies for calculating optimal order quantities and total annual costs, enhancing the understanding of effective inventory control systems.

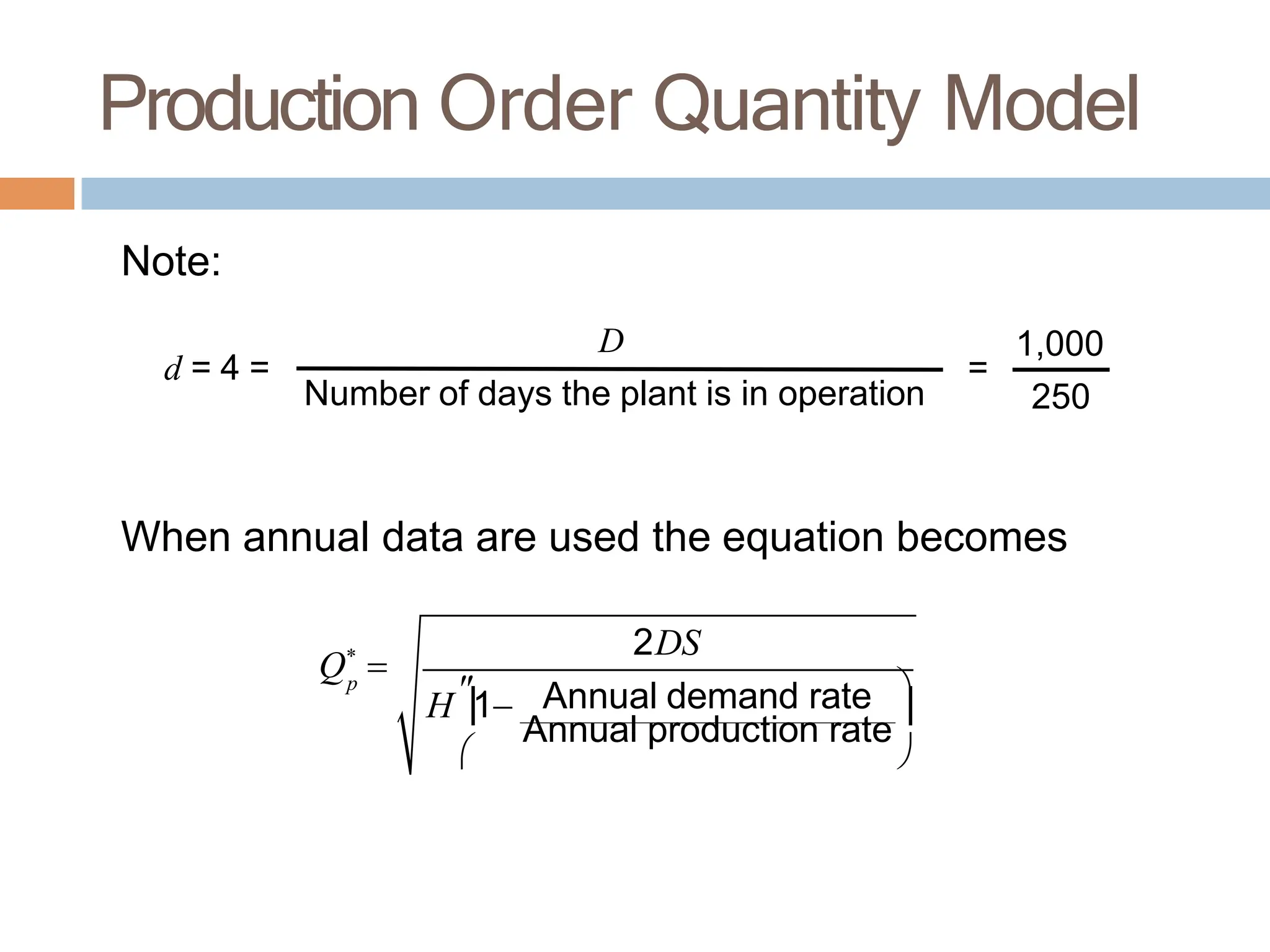

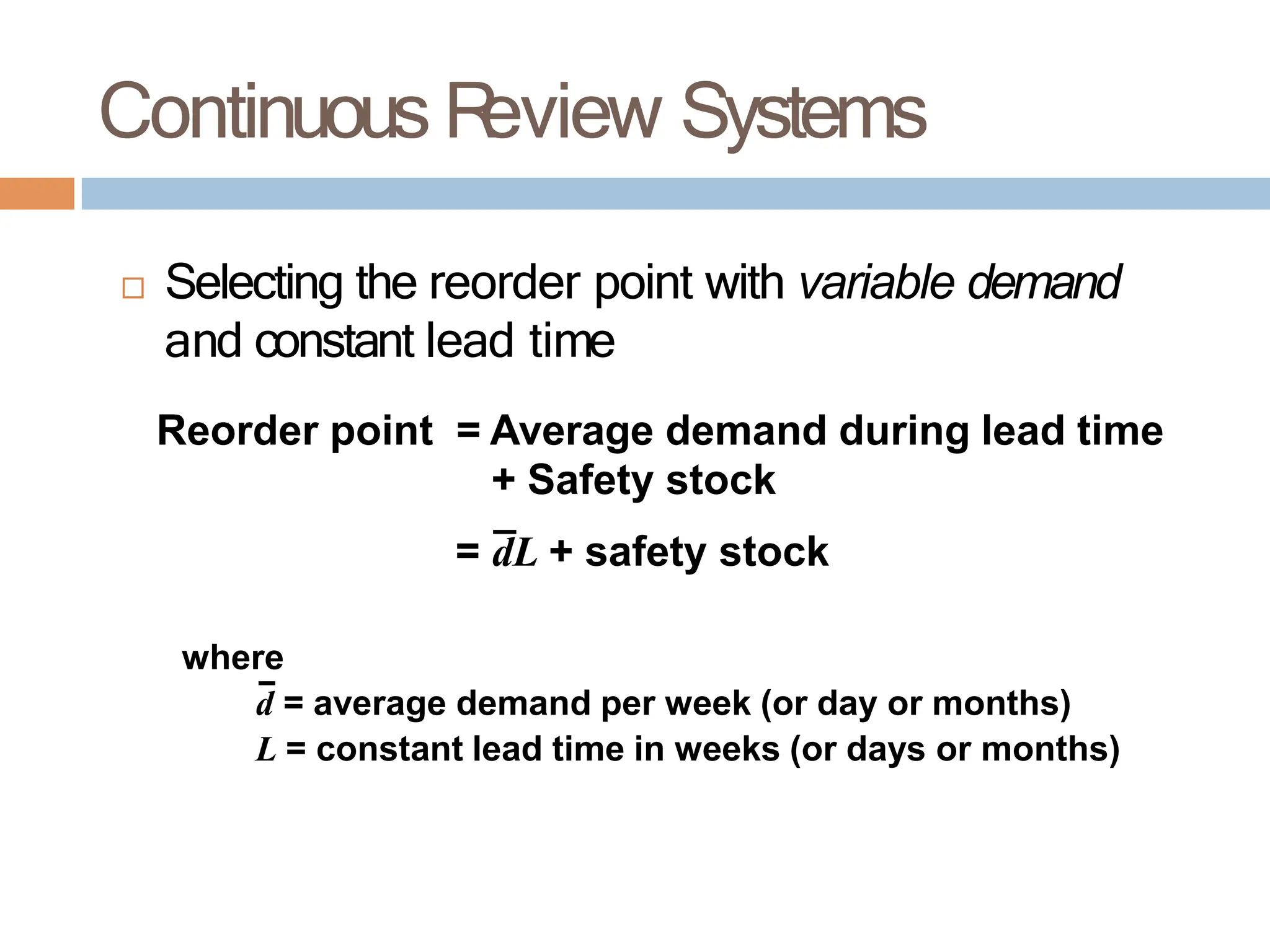

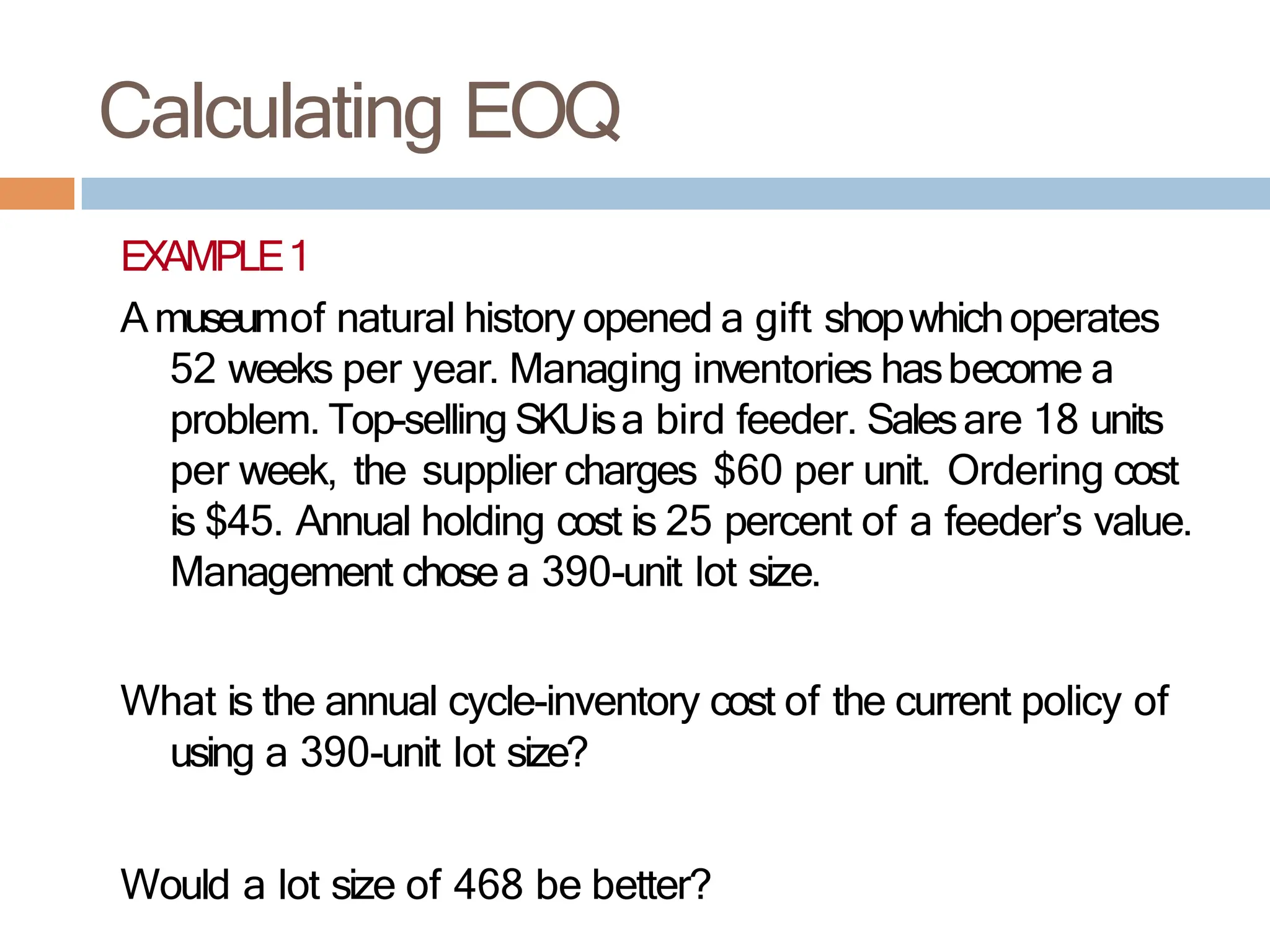

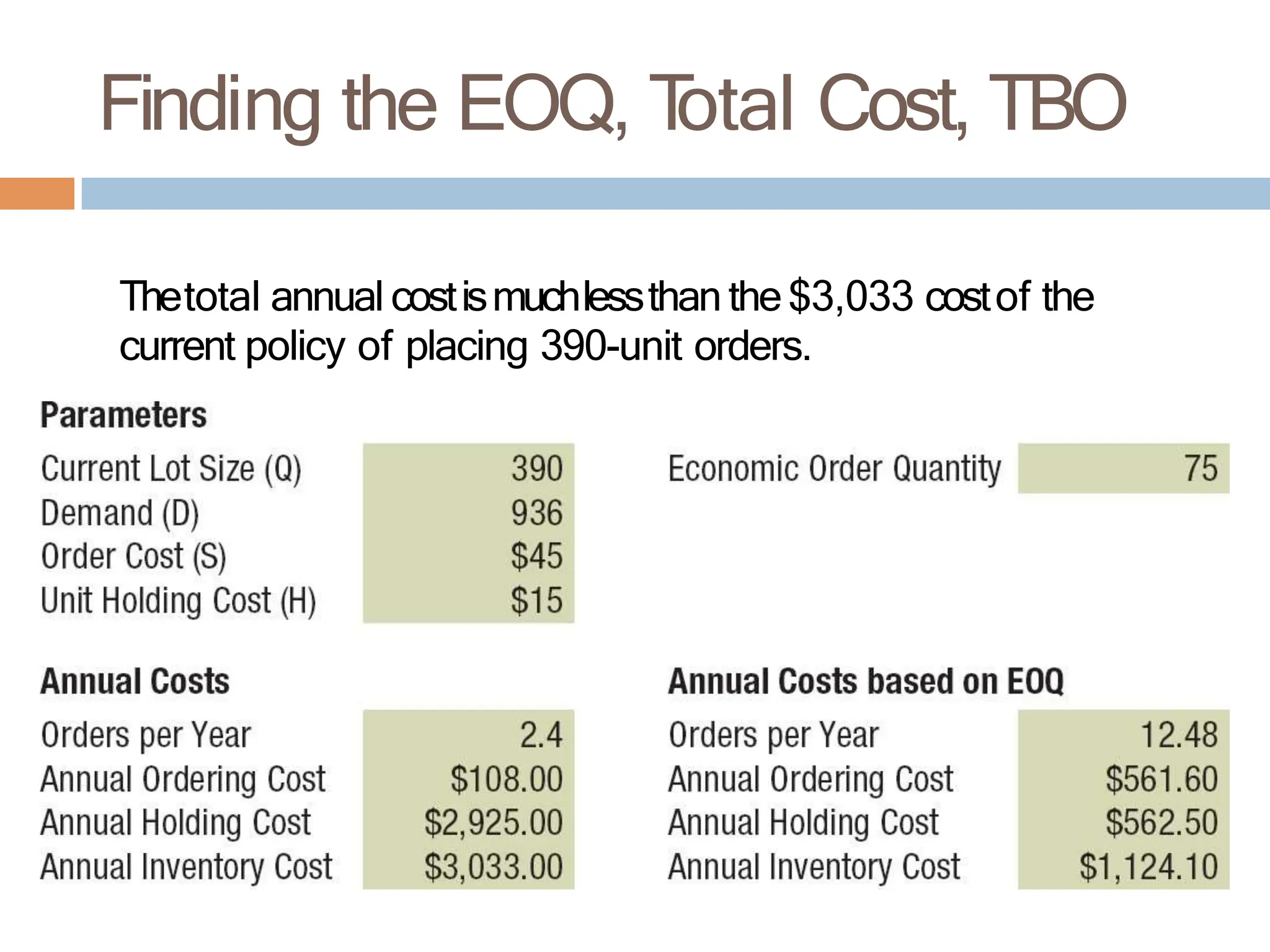

![Calculating the EOQ

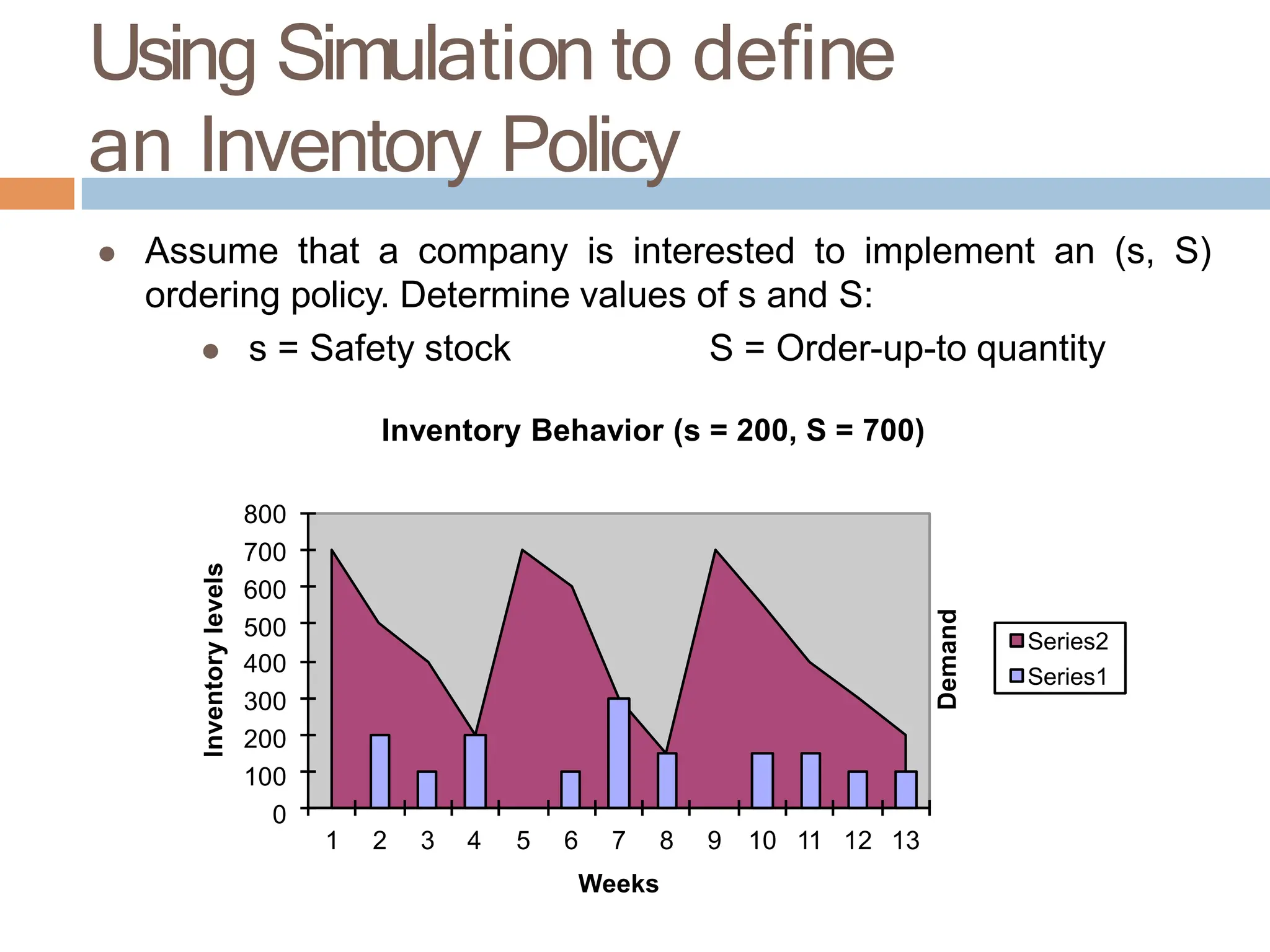

T

C = N[(S + CQ) + H(QT/2)]=

= (12DS/Q) + (12D/Q)CQ + (12D/Q)(HQ2/2D)=

=12DS/Q + 12DC + 6HQ

Tofind the optimal Quantity Q: Set derivative w.r.t Q = 0

Therefore,

-(12DS/Q2)+6H = 0 The optimal - order- quantity

Q* = 2SD/H = 50 tons

T = 0,5 month](https://image.slidesharecdn.com/sca12-inventorymanagement-240727194905-8c2962d4/75/Inventory-management-course-Material-for-All-32-2048.jpg)

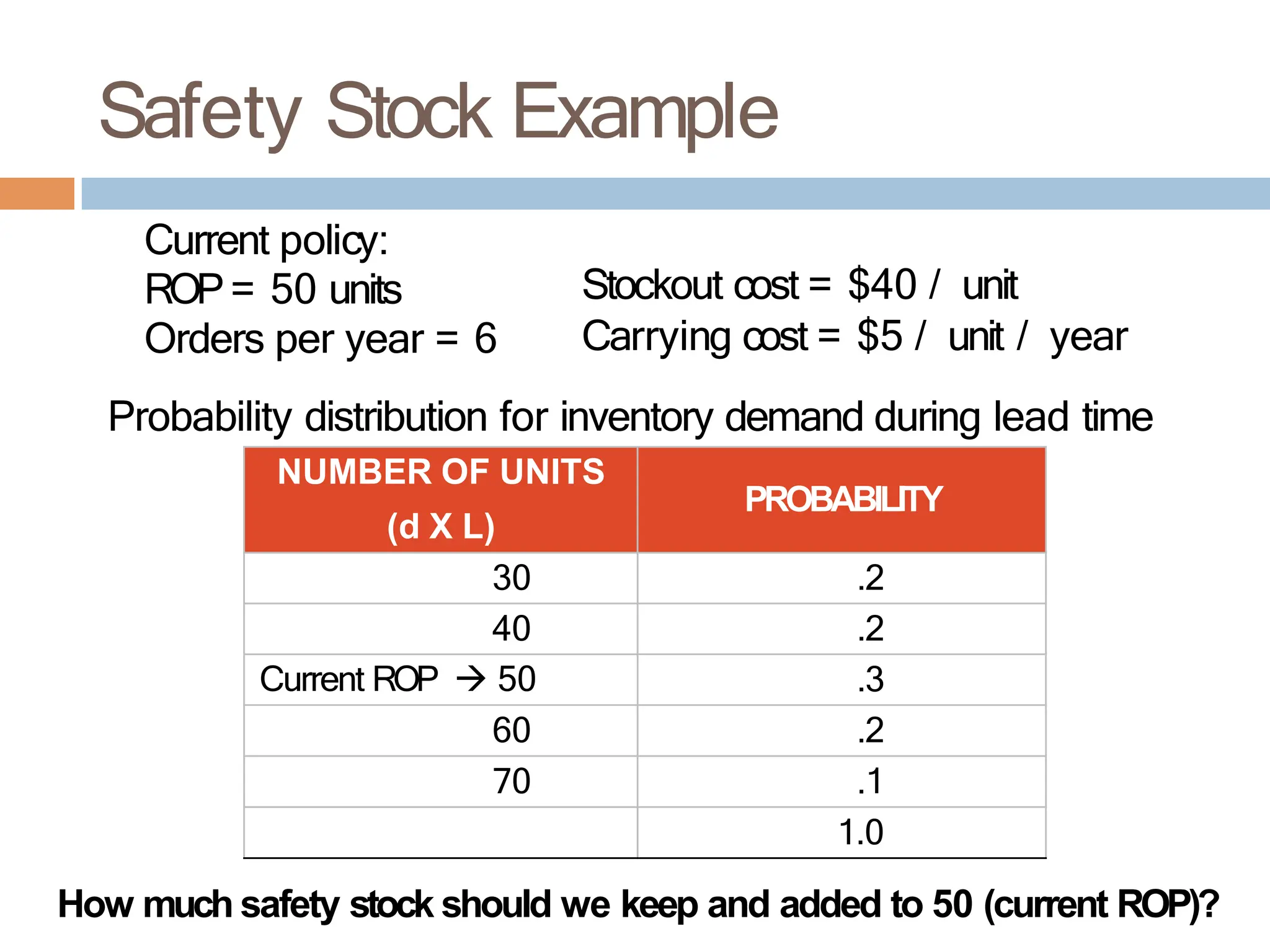

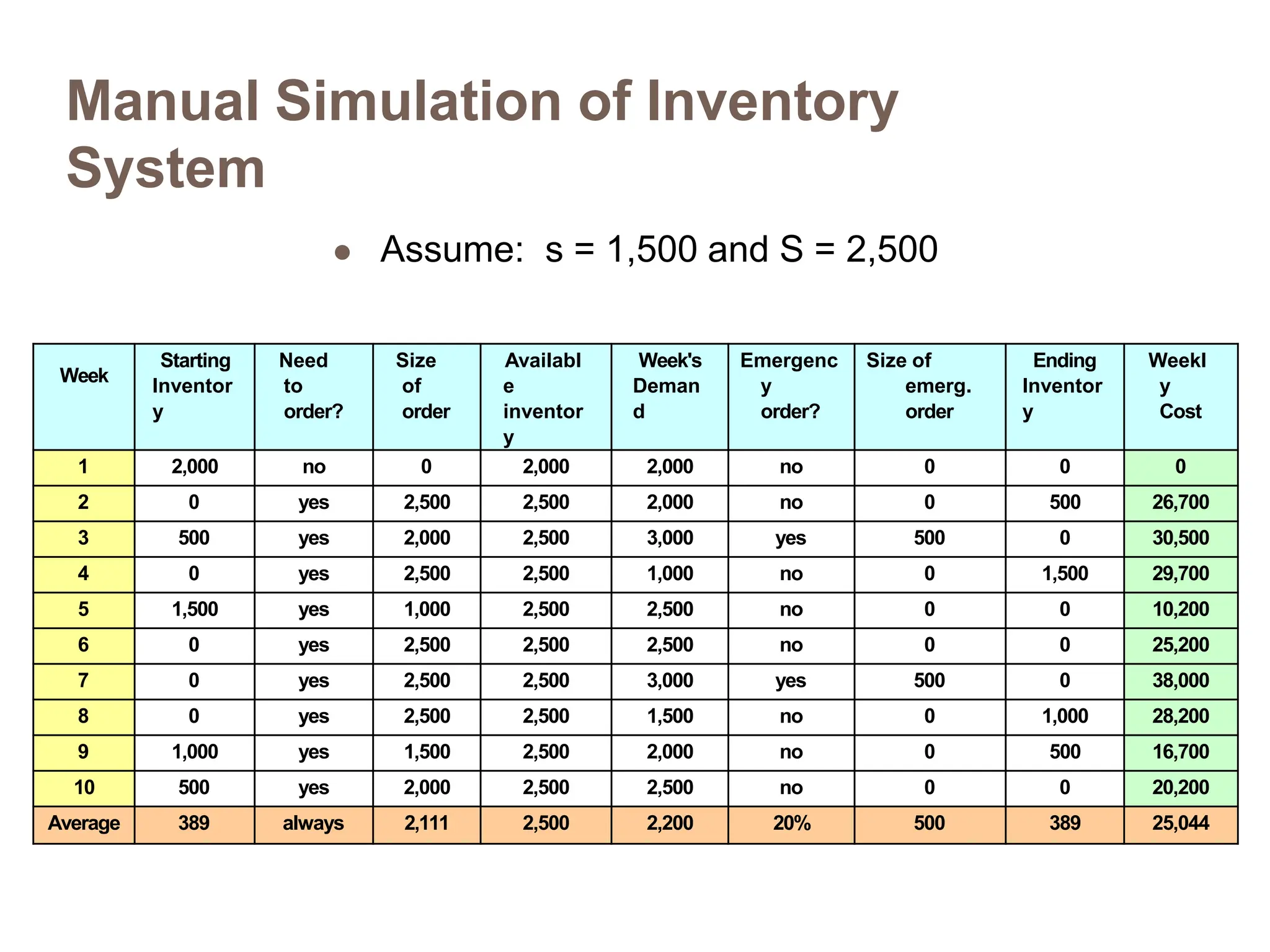

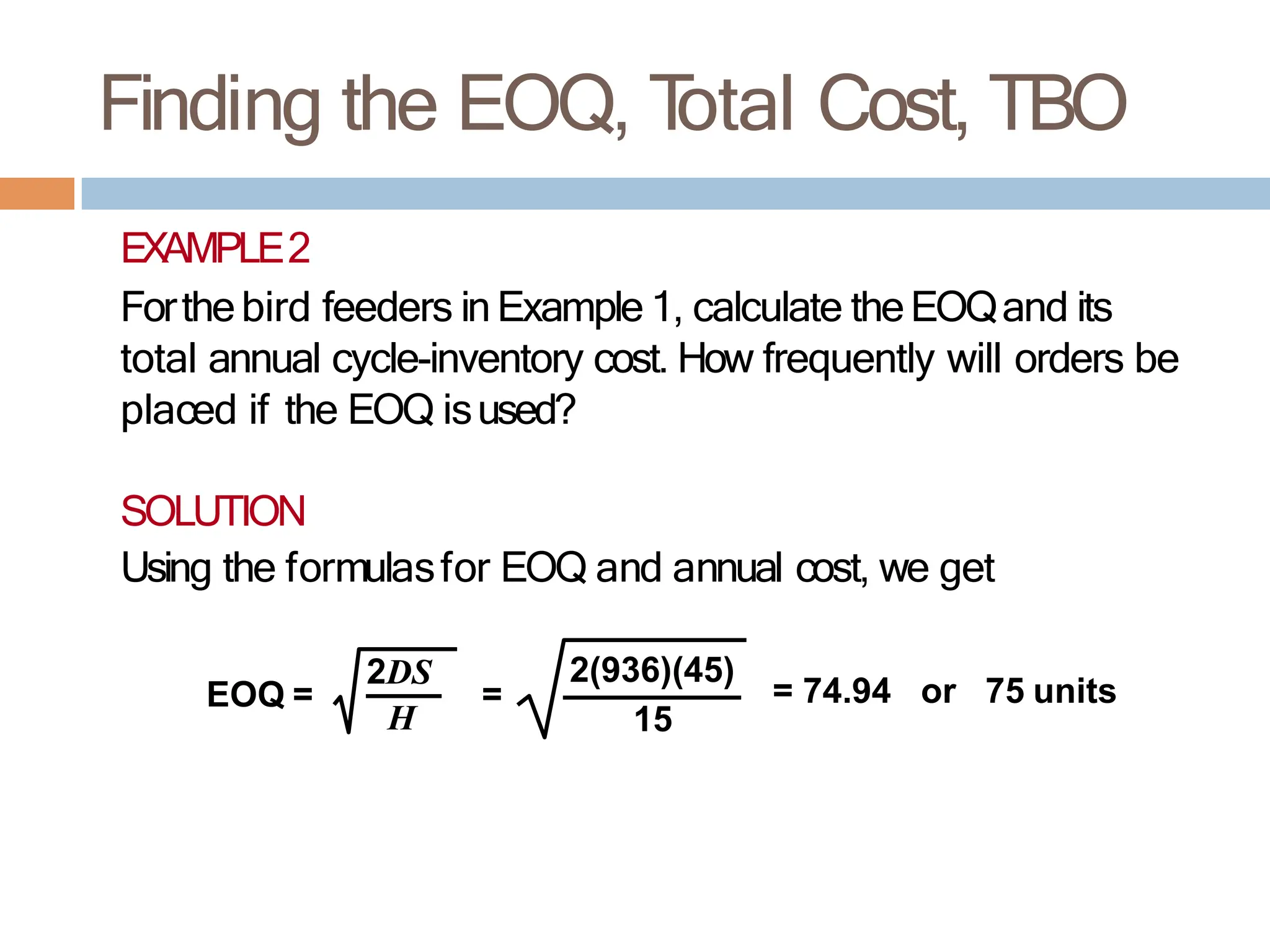

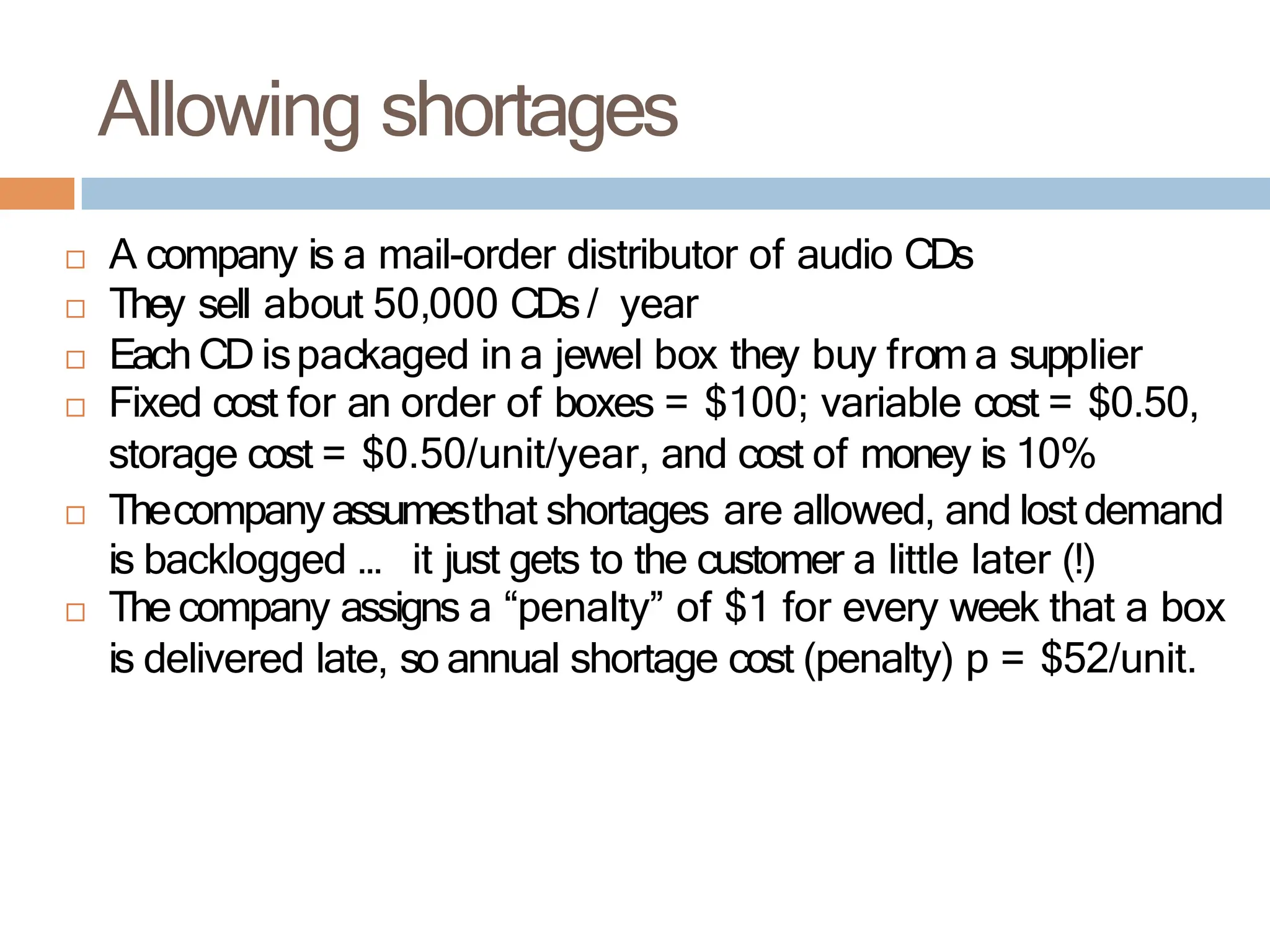

![ Total Annual Cost = Ordering + Shortage + Holding costs

Ordering cost = N [(S+CQ) + (pb(b/D)/2) + H(Q-b)((Q-b)/D)/2]

Since N = D/Q, we have

T

otal Annual Cost = DS/Q + CD + (pb2/2Q) +H(Q-b)2/2D

T

o minimize, take derivative = 0, and solve

hQ2 – HbQ – (DS+pb2) = 0

Allowing shortages](https://image.slidesharecdn.com/sca12-inventorymanagement-240727194905-8c2962d4/75/Inventory-management-course-Material-for-All-56-2048.jpg)