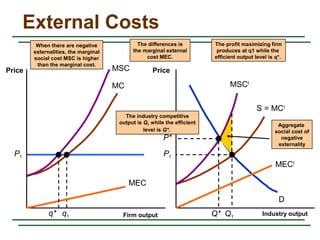

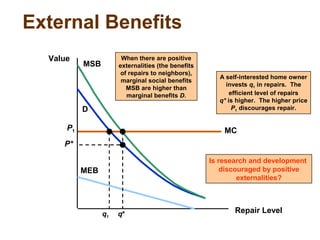

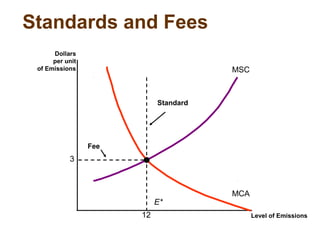

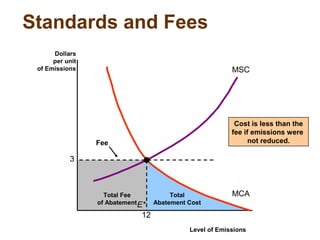

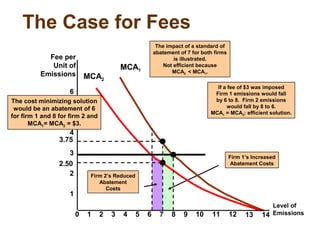

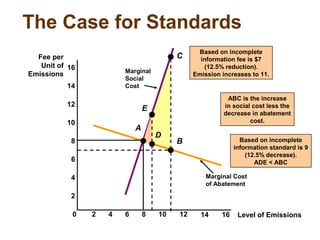

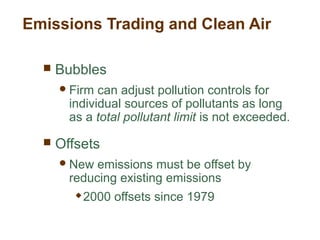

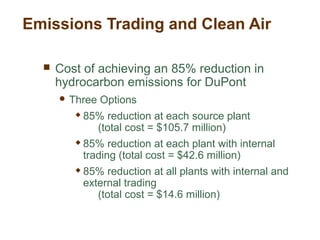

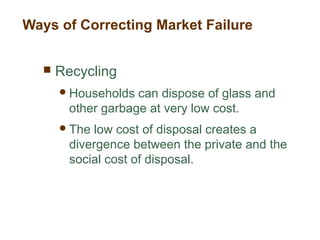

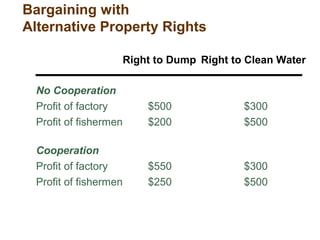

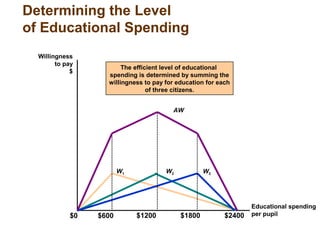

This document discusses externalities, public goods, and market failures. It begins by defining externalities as costs or benefits imposed on third parties from economic transactions. When negative externalities are present, the competitive market outcome is inefficient. The document presents different ways to correct this, such as emissions fees, standards, and tradable permits. It also discusses public goods, which are nonrival and nonexclusive, leading to underprovision in the private market due to free-riding incentives. Common resources are also prone to overuse without controls due to high social costs not faced by individual actors.