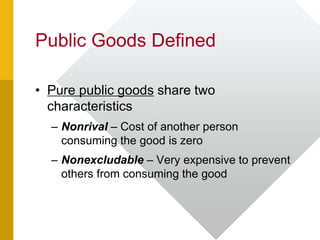

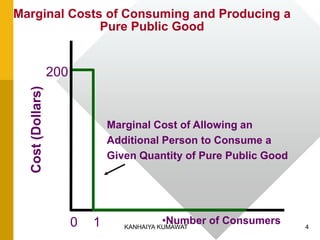

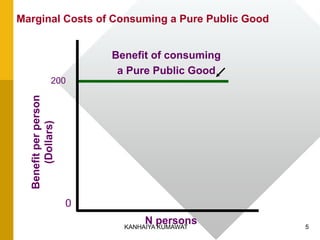

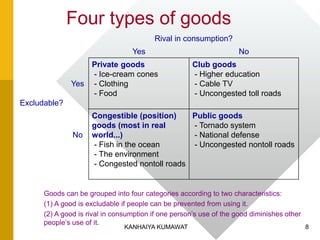

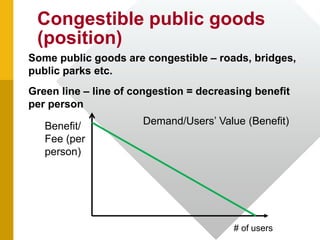

This document discusses public goods and their efficient provision. It defines public goods as nonrival and nonexcludable, meaning consumption by one person does not reduce availability to others and it is difficult to prevent others from consuming them. This leads to a free rider problem where people have an incentive to let others pay for public goods while still enjoying the benefits. While private markets fail to efficiently provide public goods due to this issue, government intervention through taxation can potentially solve the free rider problem and lead to more efficient outcomes. The document also discusses the debate around privatizing certain goods and services traditionally provided publicly.