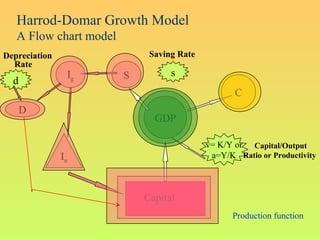

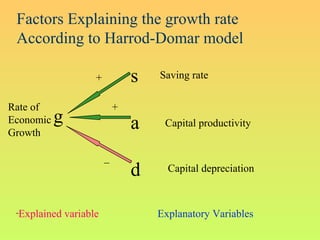

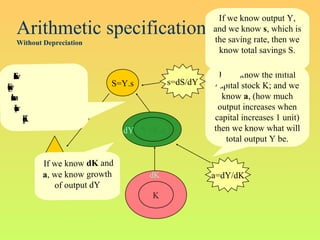

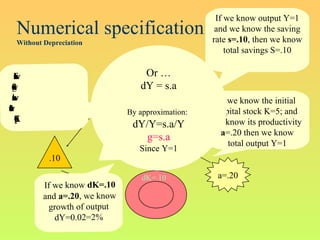

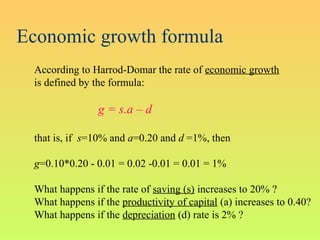

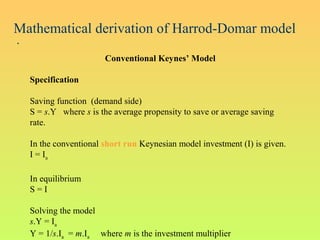

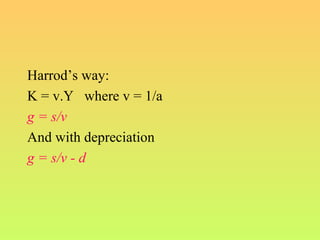

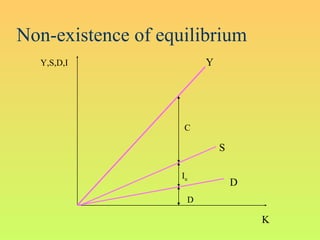

The Harrod-Domar growth model uses 3 key variables to determine the growth rate:

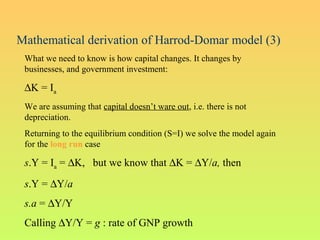

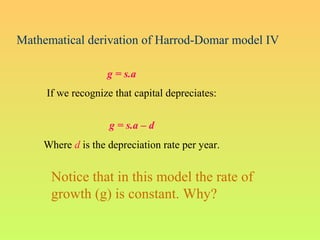

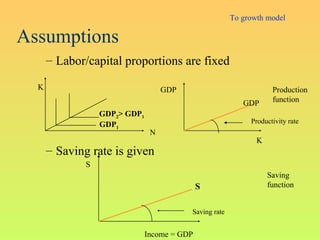

1. The saving rate, which determines how much can be invested.

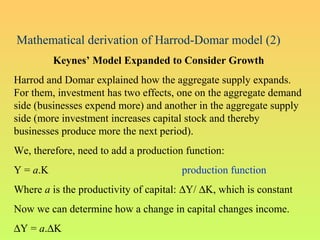

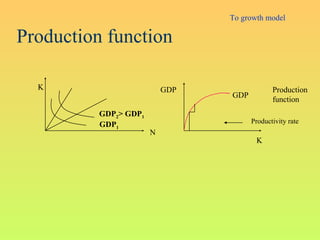

2. Capital productivity, or how much output increases with each unit of new capital.

3. The depreciation rate, which accounts for aging of the existing capital stock.

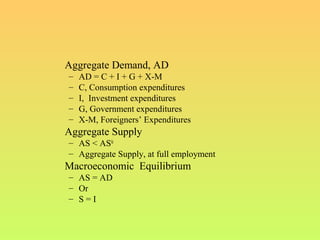

The model's formula is: Growth Rate = Saving Rate x Capital Productivity - Depreciation Rate. It provides a simple framework for analyzing how changes to these variables impact long-term economic growth.