This document discusses carbon emissions trading in the EU and alternatives like a carbon tax. It covers:

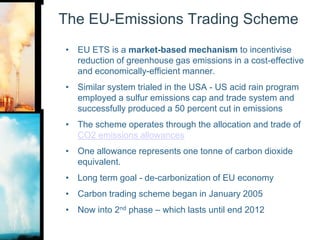

1) The EU Emissions Trading Scheme which creates a market for carbon allowances in an effort to reduce emissions cost-effectively. However, the scheme has faced criticisms like over-allocation of quotas and price volatility.

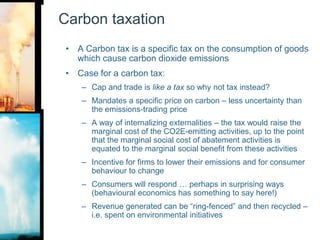

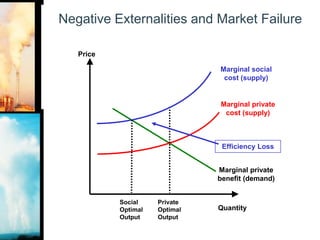

2) A potential alternative of a carbon tax which would directly price carbon and provide incentives for emission reductions, but faces challenges in agreement and measuring emissions accurately.

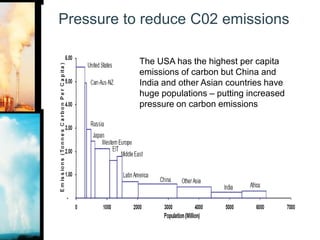

3) Key considerations in evaluating different policy approaches include their effectiveness in changing behavior, encouraging innovation, reducing emissions at lowest cost, and achieving global participation. Putting an accurate price on carbon is necessary but not sufficient.