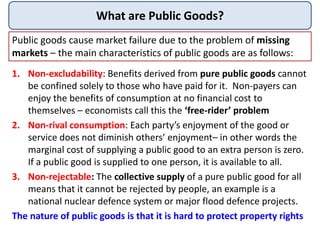

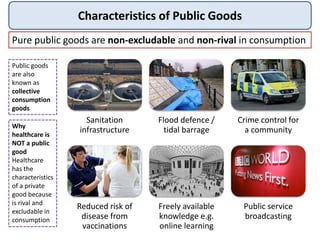

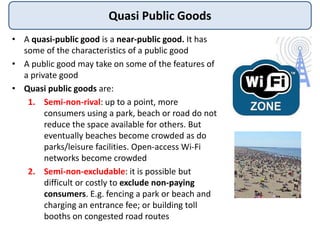

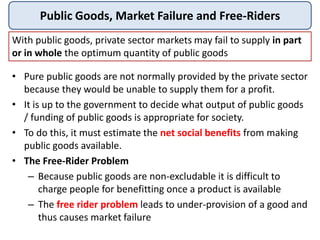

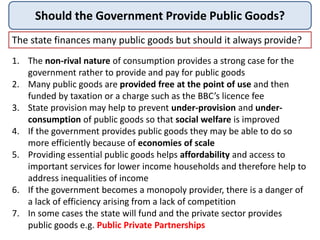

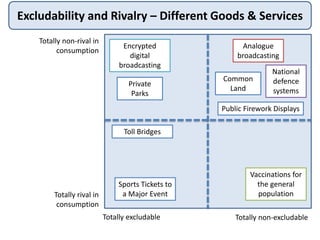

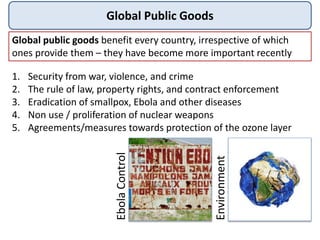

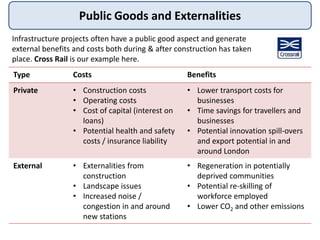

Public goods are characterized by non-excludability, meaning it is impossible to prevent people who have not paid from consuming them, and non-rivalry, meaning that one person's consumption does not reduce availability to others. Examples include national defense, street lighting, flood defenses. Public goods cause market failure as it is difficult to charge people for their provision or exclude non-payers. While governments often provide public goods, technological advances are blurring the distinction between public and private goods in some cases.