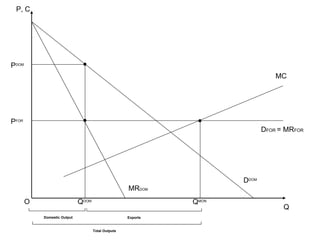

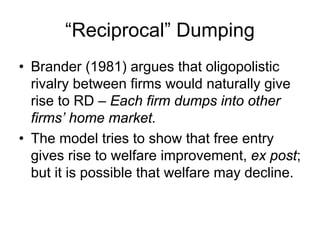

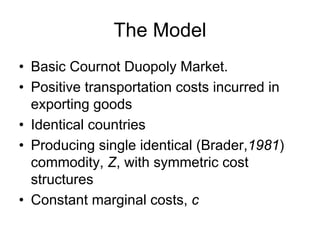

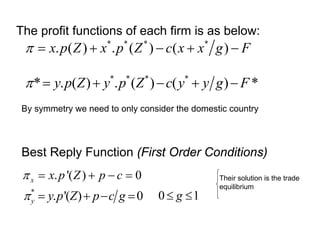

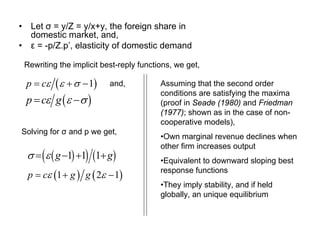

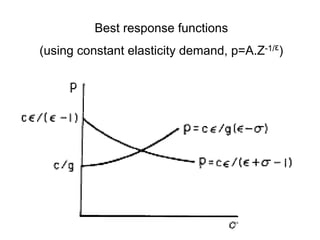

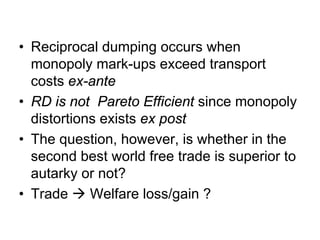

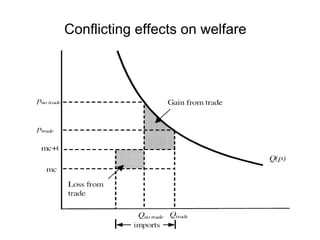

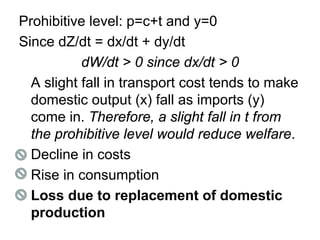

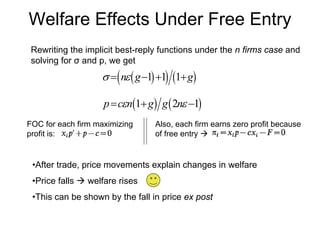

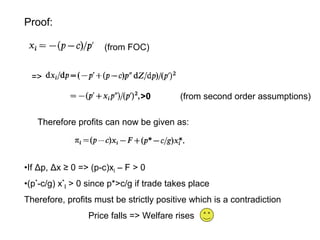

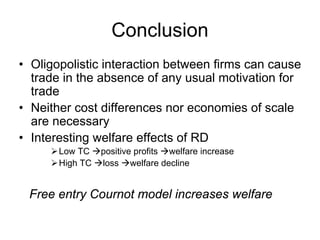

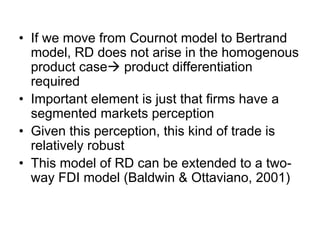

The document discusses the reciprocal dumping model of international trade, highlighting how firms may engage in dumping by charging lower prices abroad due to different demand elasticity. It presents a basic Cournot duopoly framework to analyze welfare implications and concludes that while reciprocal dumping can lead to welfare gains, it may also not be Pareto efficient. The findings suggest that oligopolistic competition allows trade without typical motivations such as cost differences or economies of scale, and emphasize the importance of market segmentation in this context.