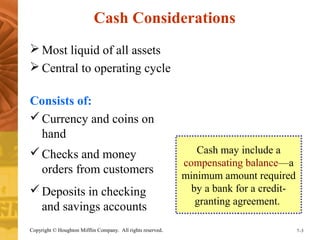

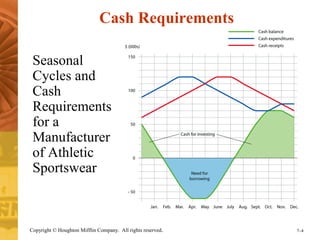

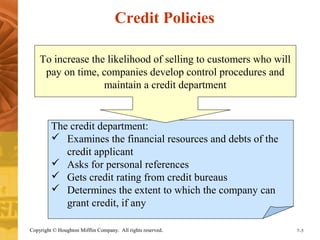

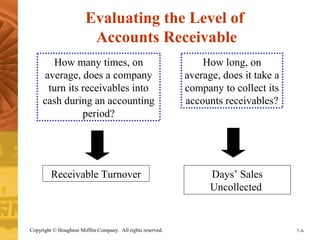

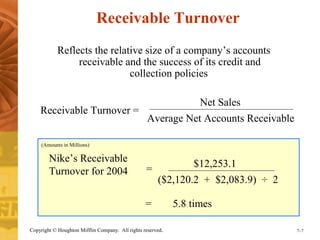

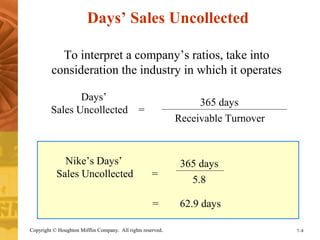

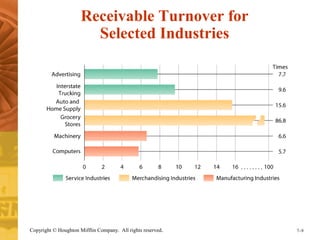

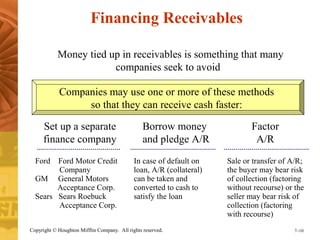

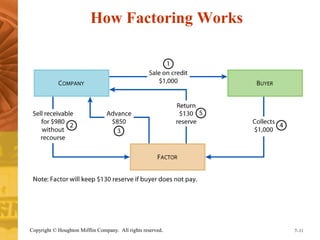

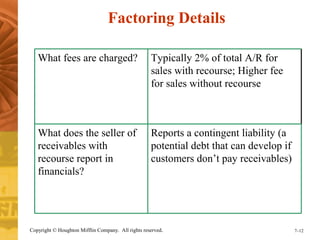

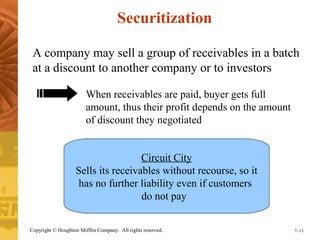

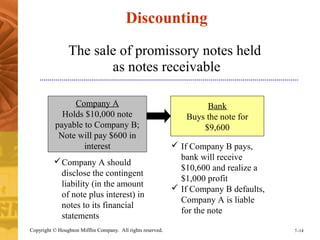

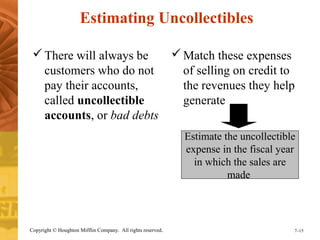

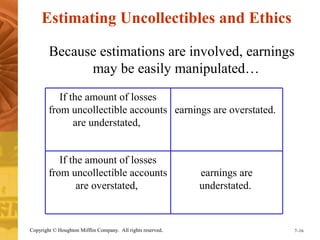

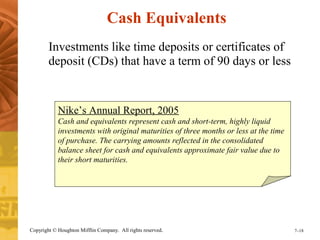

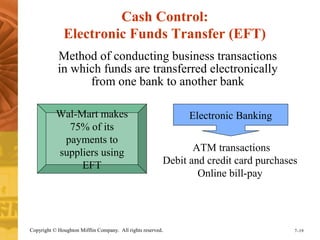

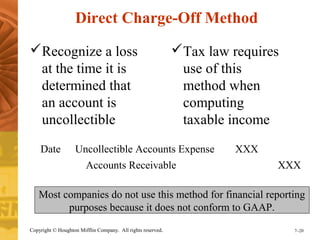

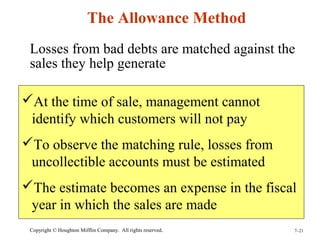

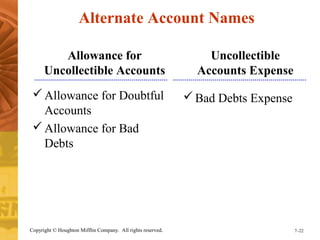

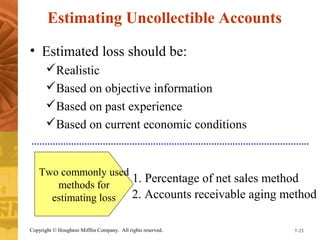

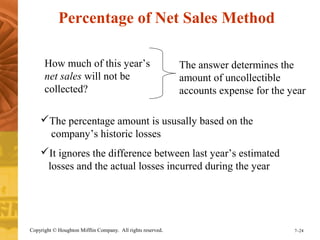

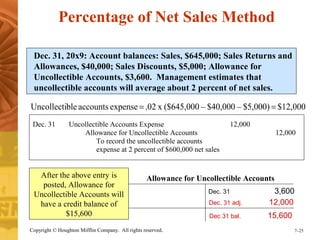

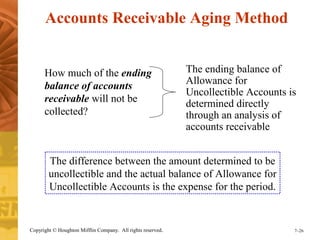

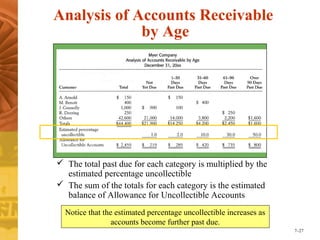

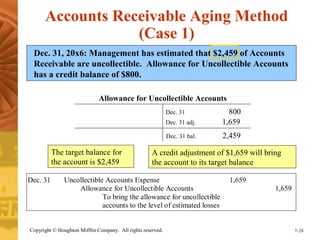

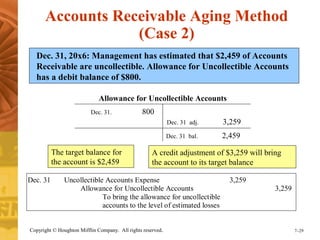

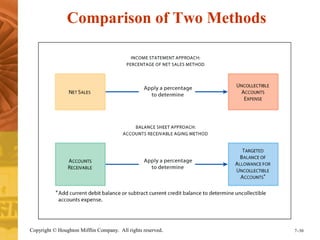

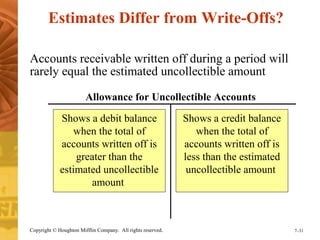

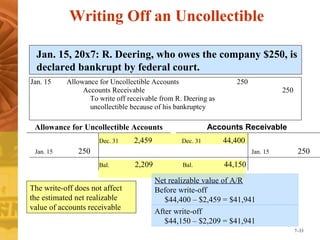

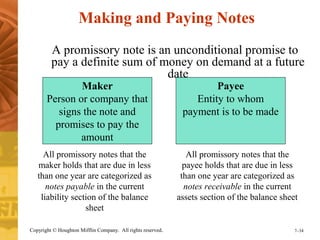

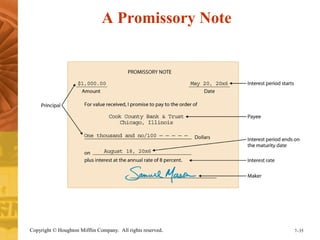

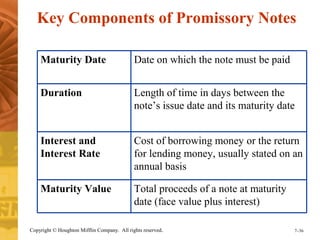

This document discusses key concepts related to managing cash and receivables. It covers cash needs and considerations, credit policies, evaluating accounts receivable levels, and methods for financing receivables. It also addresses estimating uncollectible accounts, writing off accounts, and making and paying promissory notes. Specific topics include cash requirements, receivable turnover, days' sales uncollected, allowance method for estimating bad debts, percentage of net sales method, accounts receivable aging method, and discounting and factoring receivables.