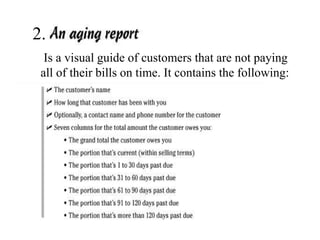

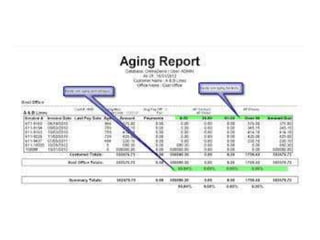

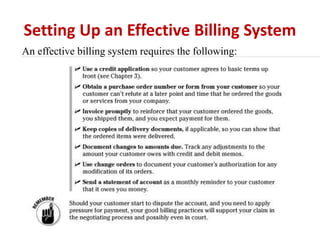

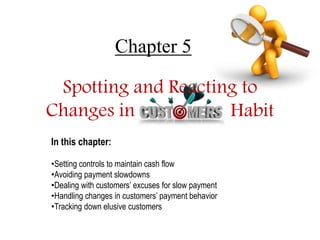

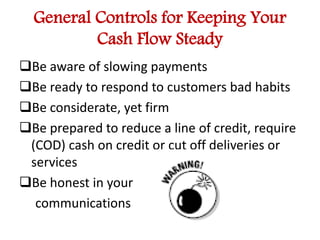

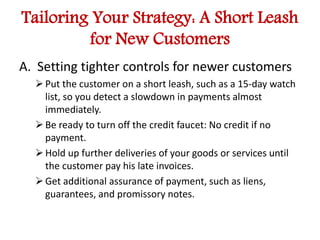

This document discusses establishing effective billing practices to avoid collection issues. It covers getting prompt payment, keeping billing organized, training employees on procedures, monitoring customer payment habits, and escalating responses for late and delinquent payments. When customers fall behind on payments, the document advises creating urgency, using frequent reminders, and establishing a thorough paper trail of all communication and documentation regarding amounts owed.