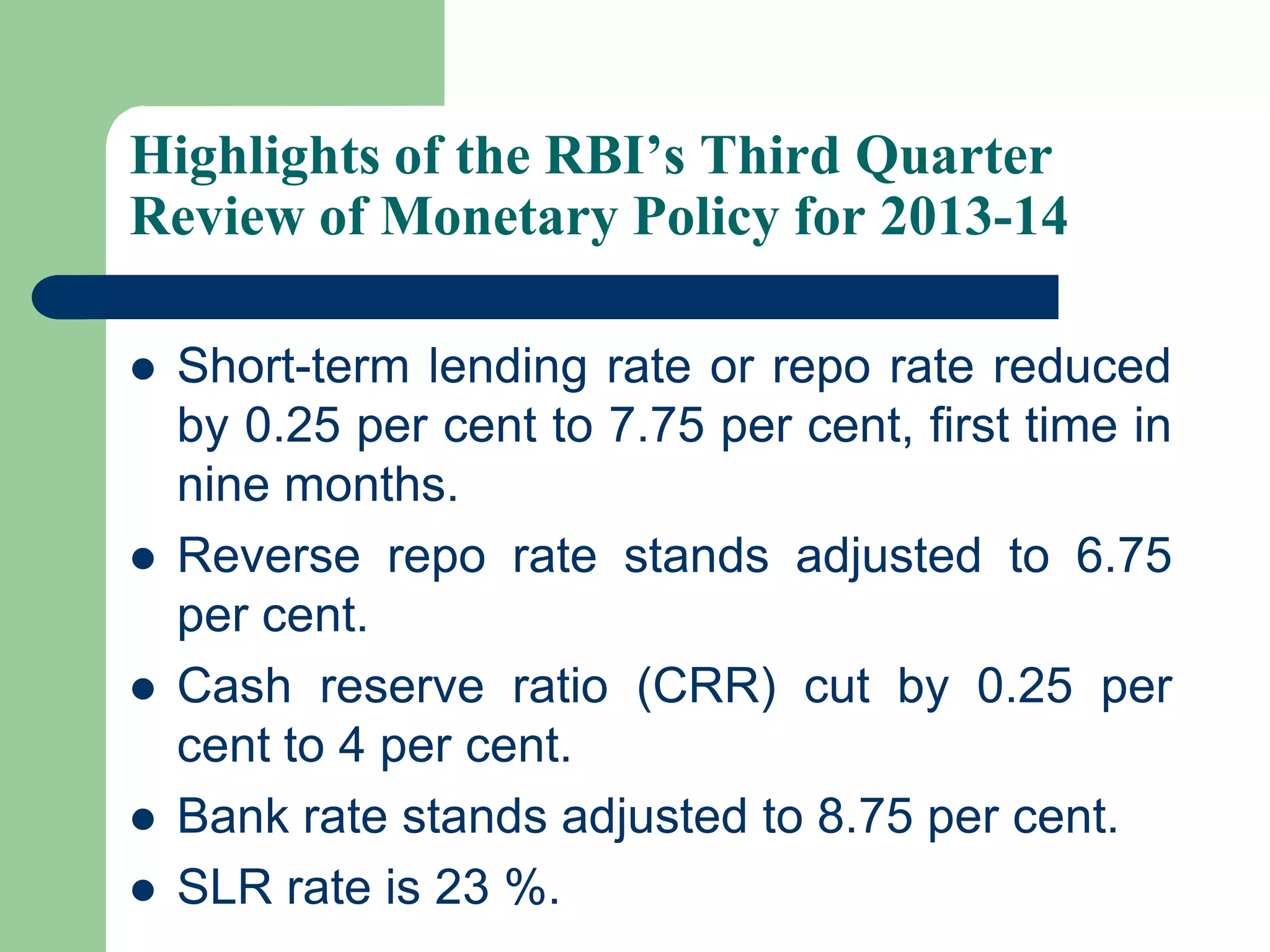

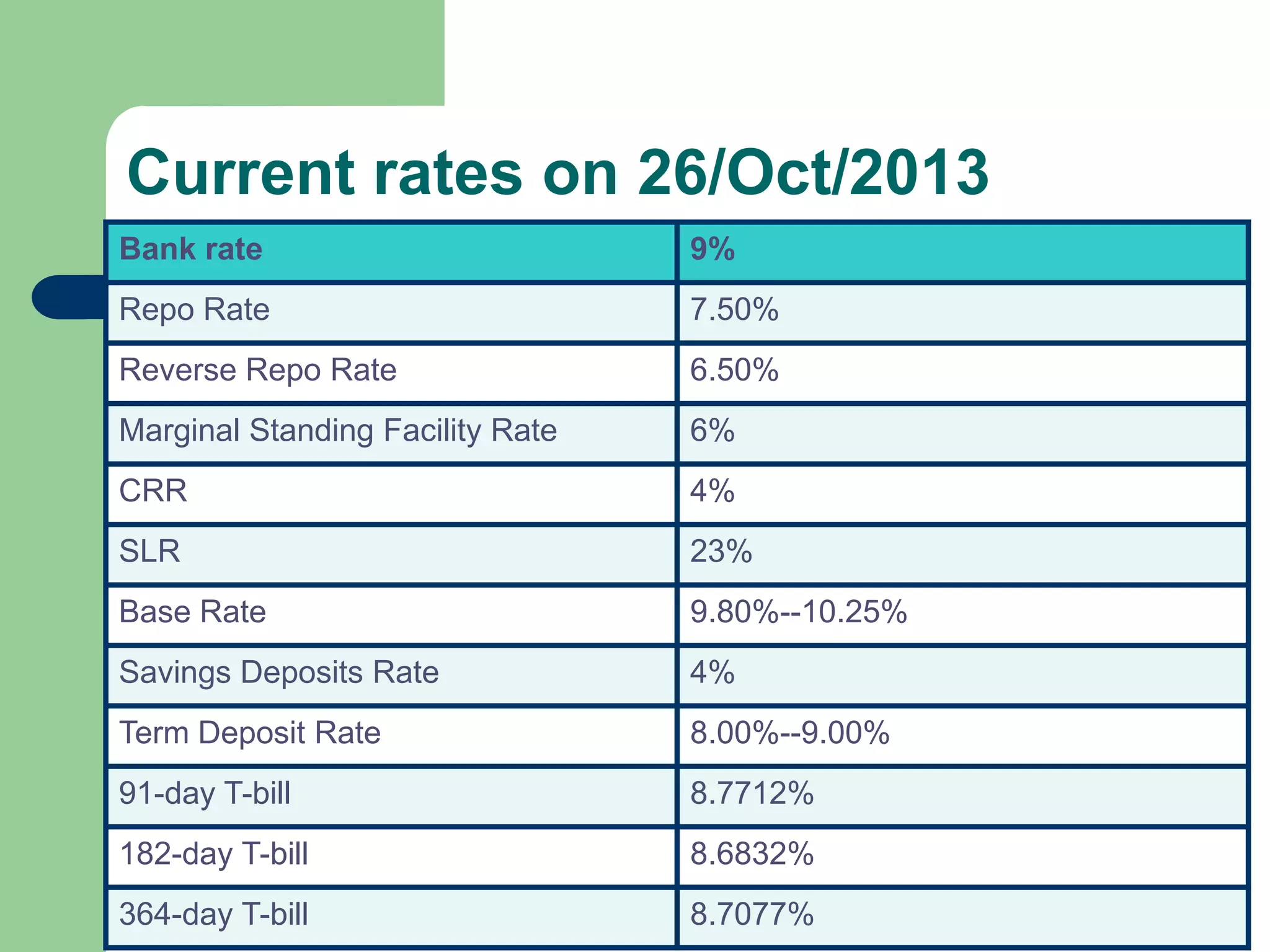

This document provides an overview of liquidity concepts, instruments, and theories of liquidity management for commercial banks. It defines liquidity as the ability to meet cash needs and discusses how banks estimate liquidity needs based on past loan and deposit fluctuations. The main types of liquidity risk are funding risk, asset liquidity risk, and interest rate risk. The document then outlines various instruments banks use to manage liquidity, including liquid assets like cash reserves and securities, as well as liquid liabilities like certificates of deposits and interbank borrowing. Finally, it discusses several theories of liquidity management that have developed over time, such as the commercial loan theory, shiftability theory, and anticipated income theory.