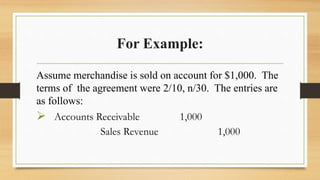

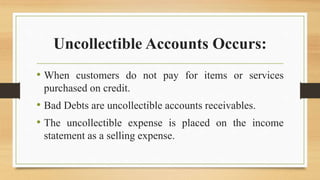

- An account receivable represents money owed to a company for goods or services sold on credit. When an account receivable becomes uncollectible, it is recorded as a bad debt expense.

- There is an upside to offering credit sales by encouraging purchases, but there is a downside in that some customers will delay payment or not pay at all, creating bad debts.

- Companies must investigate outstanding accounts receivable to identify bad debts, which are difficult to determine if a customer is merely late or unable to pay. Accounting standards provide two methods to account for doubtful accounts and bad debts.