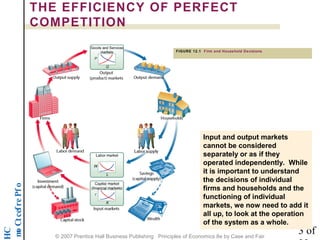

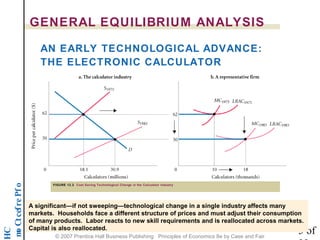

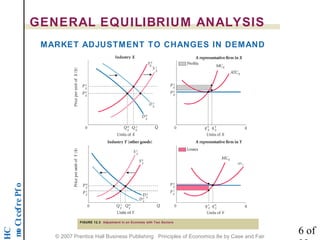

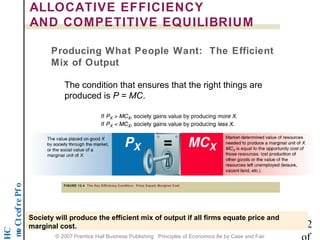

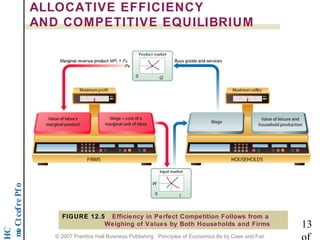

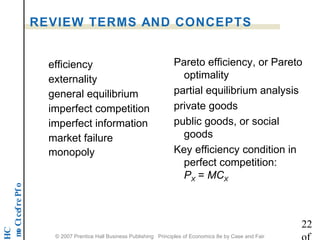

The document discusses the concept of general equilibrium and the efficiency of perfect competition. It provides definitions for key terms related to general equilibrium analysis and competitive markets such as partial equilibrium, general equilibrium, efficiency, and allocative efficiency. It examines how perfectly competitive markets can allocate resources efficiently and produce outcomes that are Pareto optimal. However, it notes that real-world markets often differ from the assumptions of perfect competition, which can result in market failures from things like imperfect competition, externalities, public goods, and imperfect information.