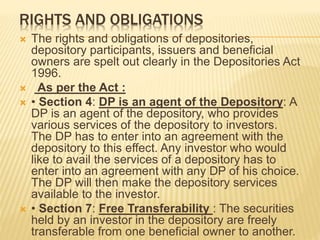

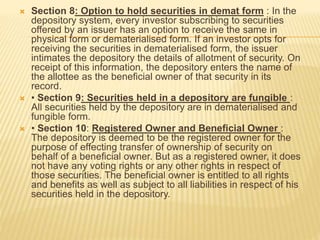

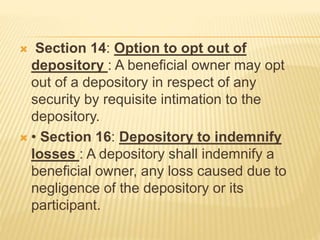

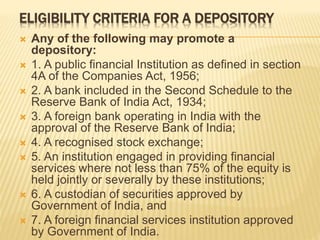

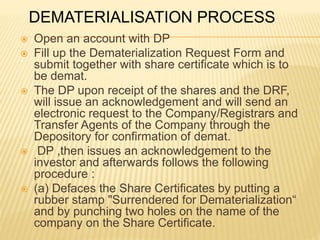

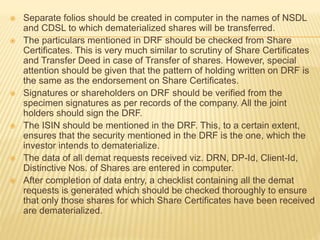

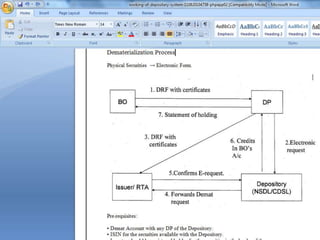

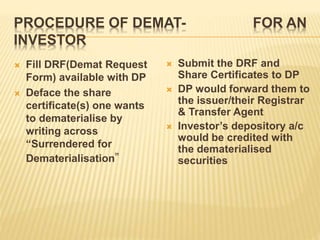

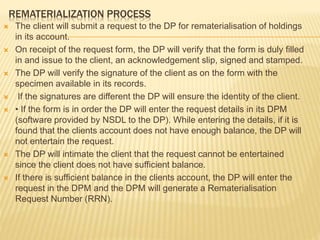

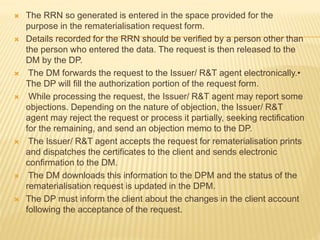

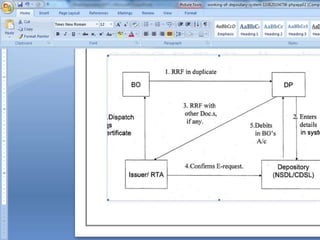

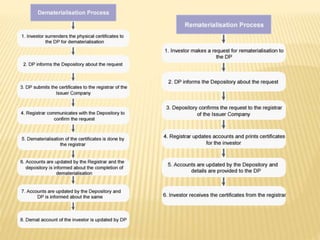

The document describes the depository system, which is an organization where investors' securities are held in electronic form, facilitating transactions without physical certificates. It outlines the history, legal framework, features, and benefits of the system, emphasizing reduced risks and streamlined processes associated with paperless trading. The document also details the roles of depositories and participants, as well as the process for dematerialization and rematerialization of securities in India.

![INVESTORS [BENEFICIAL OWNER]

Individual

Partnership Firm

HUF

Company

“Beneficial Owner” is a person in whose name a

demat account is opened with Depository for the

purpose of holding securities in the electronic

form](https://image.slidesharecdn.com/depositoryppt-170122063036/85/Depository-ppt-17-320.jpg)