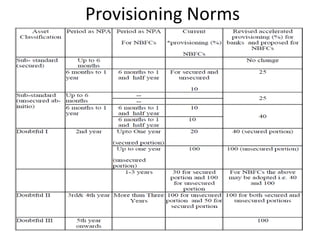

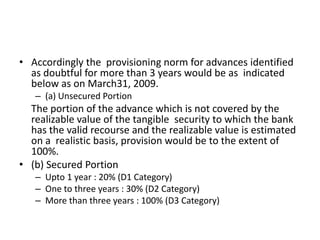

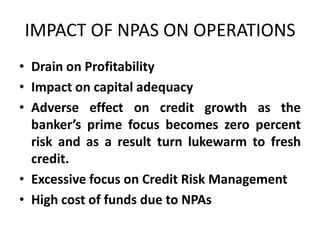

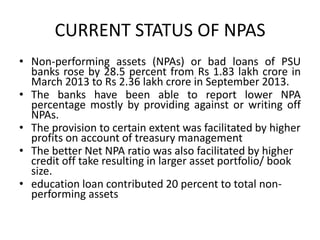

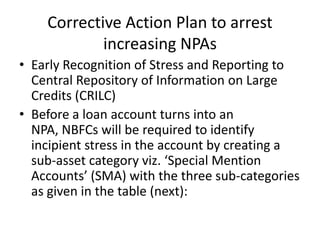

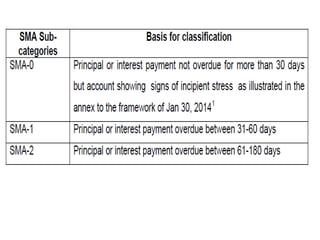

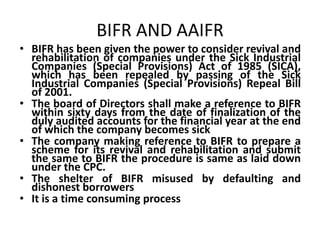

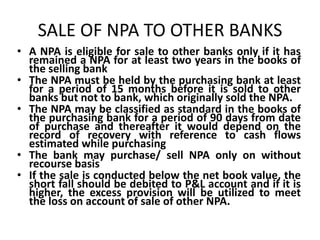

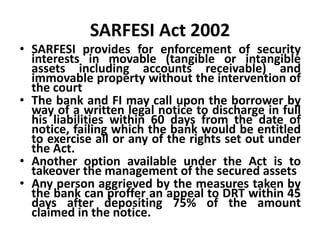

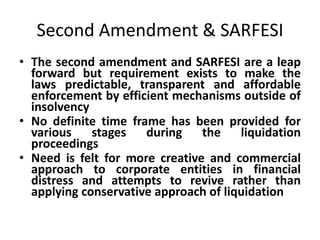

This document discusses management of non-performing assets (NPAs) in banks. It defines NPAs and categories them as substandard, doubtful or loss assets depending on the time period for which they have remained non-performing. It outlines provisioning norms for different asset categories. Factors contributing to rising NPAs and their impact on bank operations are examined. Current status of NPAs in public sector banks is reviewed along with various corrective measures taken by RBI like formation of joint lenders' forum and corrective action plans. Other measures discussed include compromise settlement schemes, Lok Adalats, BIFR, sale of NPAs to other banks and the SARFAESI Act.