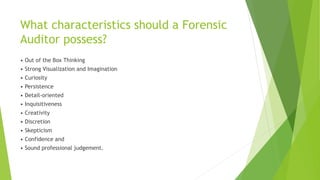

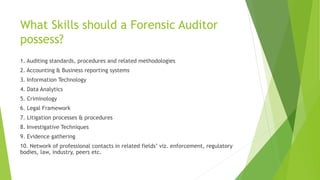

Forensic auditors investigate financial fraud and other legal issues by applying accounting skills and knowledge. They are often hired by law enforcement, banks, insurance companies, and businesses to detect fraud, prevent fraud, provide expert testimony in court, and review internal controls. Forensic auditors must have strong analytical abilities, be detail-oriented, inquisitive, and able to gather and analyze financial evidence. Their work involves activities like tracing missing funds, reviewing documents for legal cases, and assisting with prosecuting financial crimes.