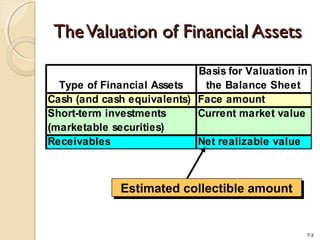

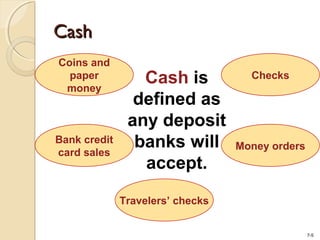

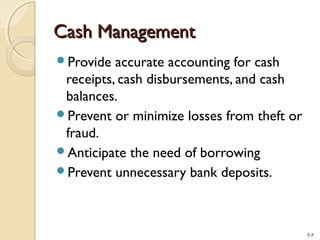

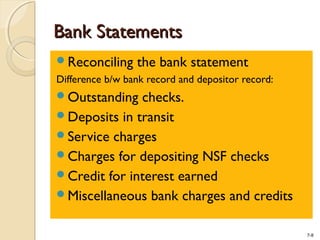

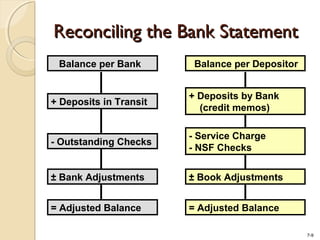

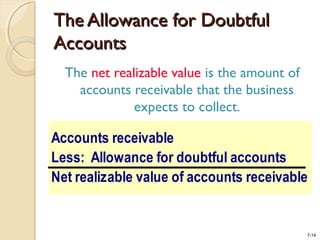

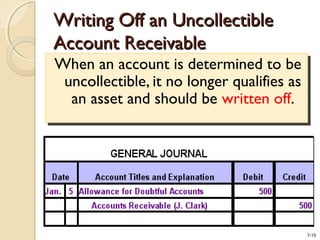

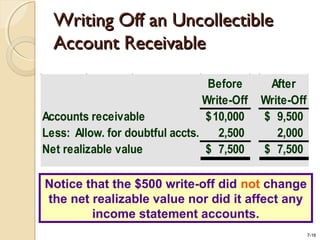

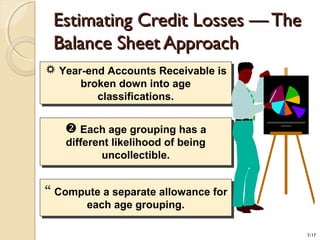

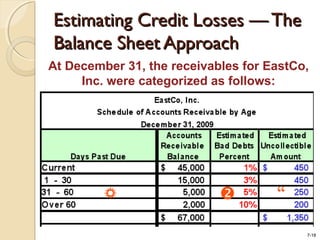

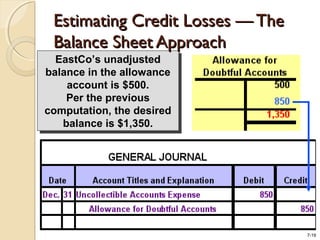

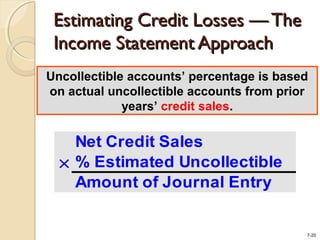

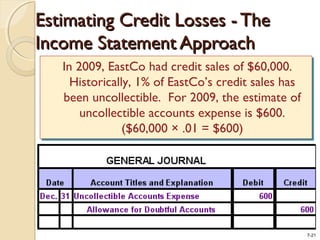

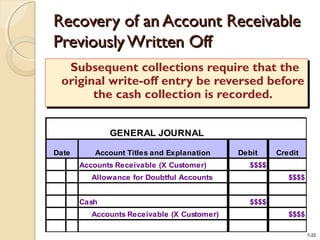

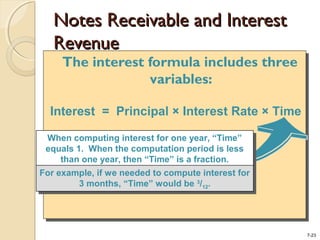

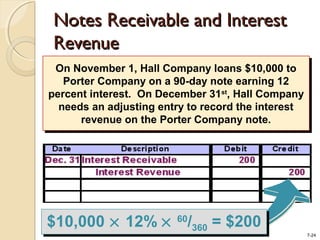

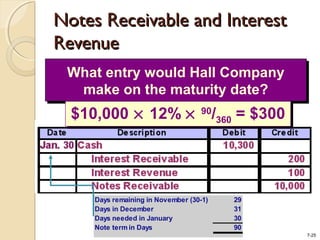

This document discusses various topics relating to financial assets, including cash, marketable securities, receivables, and notes receivable. It provides information on how these assets are valued for financial statements, cash management techniques, accounting for uncollectible accounts receivable, and calculating interest revenue for notes receivable. Worked examples are provided to illustrate estimating credit losses and recording interest earned on a short-term note receivable.