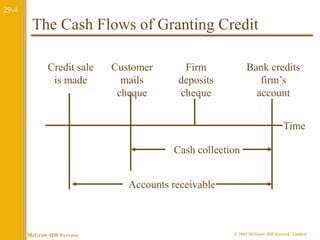

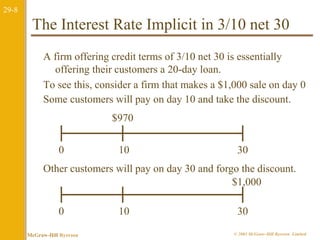

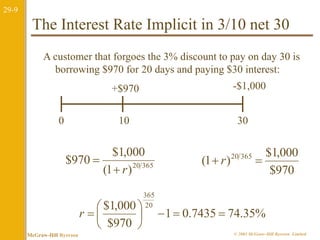

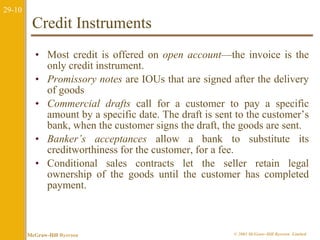

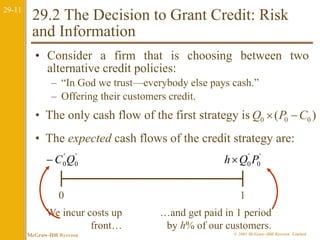

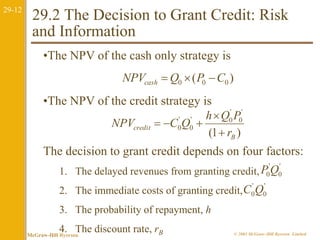

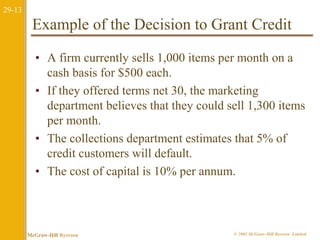

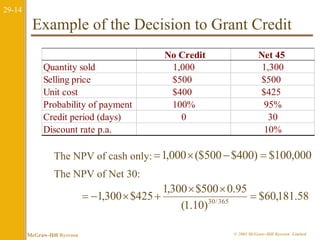

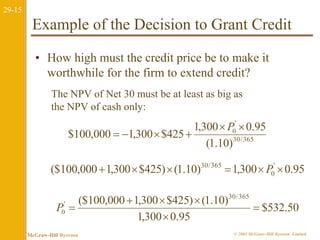

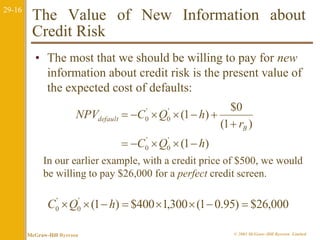

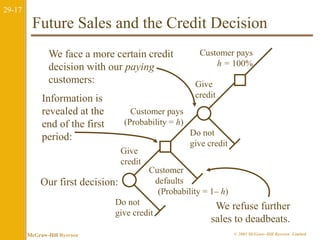

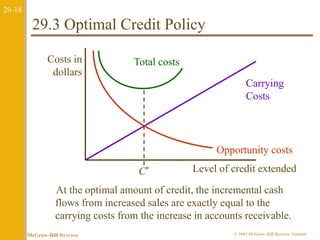

This document discusses credit management and policy. It outlines the key components of a firm's credit policy, including terms of sale, credit analysis, and collection policy. It examines the decision to grant credit by analyzing the risks, costs, expected revenues and probability of repayment. The optimal credit policy balances the incremental cash flows from increased sales with the carrying costs of accounts receivable. Effective credit analysis incorporates financial statements, credit reports, payment history and credit scoring models.