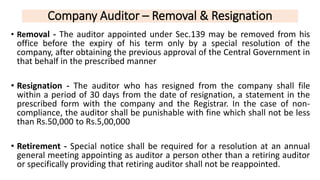

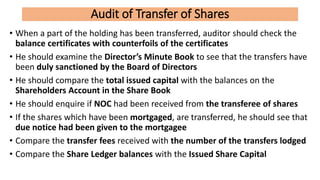

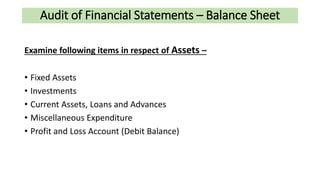

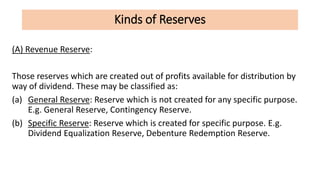

The document outlines the principles and practices of auditing with a focus on company auditors' roles, including their appointment, qualifications, rights, powers, duties, liabilities, and ethical responsibilities. It details the audit process for limited companies, audit reports' structure and types, and the examination of financial statements, share capital, and reserves. Additionally, it compares reserves and provisions, emphasizing the legal and professional obligations auditors must adhere to.