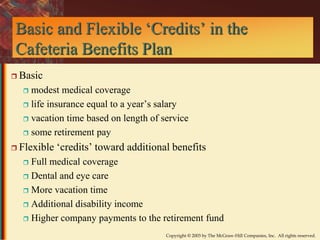

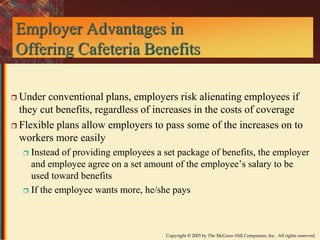

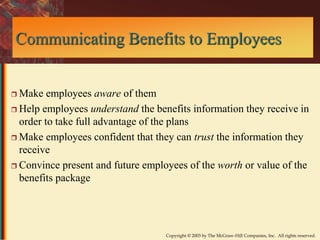

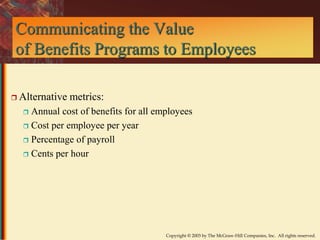

This document discusses employee benefit plans and strategies for their design and administration. It covers classifying benefits into security/health, time off, and services. Specific benefits are listed in each category. The document also discusses gaining control over healthcare costs, cafeteria/flexible benefit plans, communicating benefits to employees, and calculating the value of benefits programs.