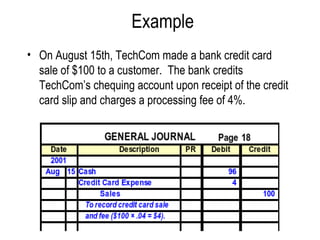

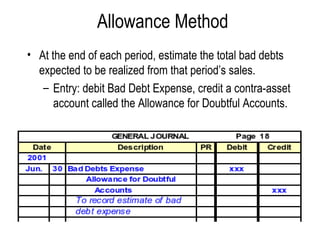

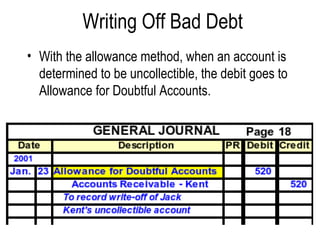

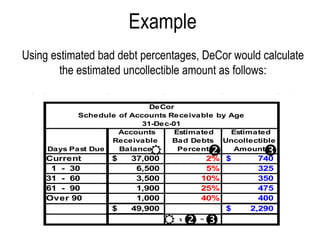

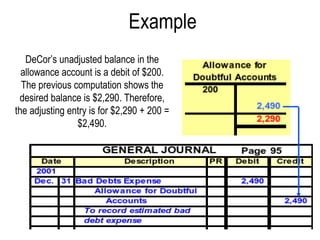

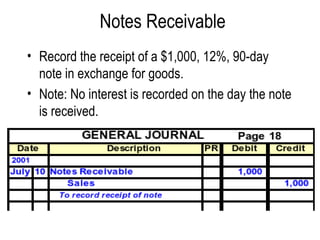

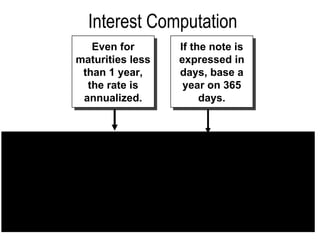

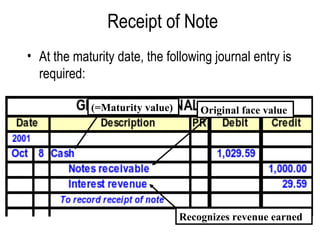

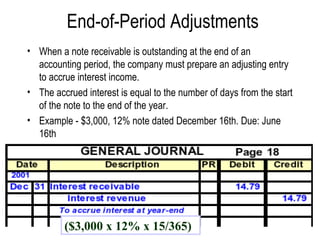

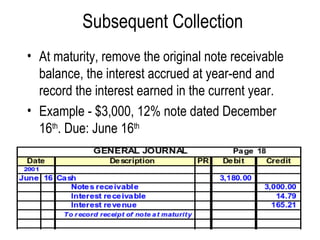

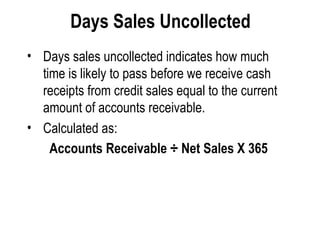

This document discusses various types of receivables including accounts receivable, credit card sales, bank credit card sales, valuing accounts receivable using the allowance and direct write-off methods, notes receivable including recording, adjusting, and collecting notes receivable, and calculating accounts receivable turnover and days sales uncollected.