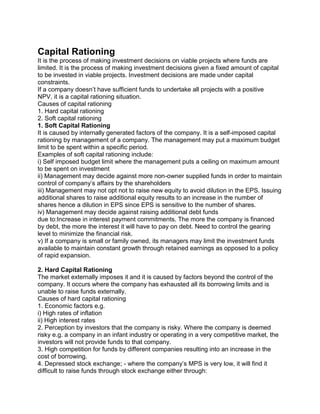

Capital rationing refers to situations where a company has a limited amount of capital to invest in projects, even if those projects have a positive net present value. There are two types of capital rationing: soft rationing, which is self-imposed by management, and hard rationing, which is imposed by external market factors limiting the company's ability to raise funds. Companies facing capital rationing must use techniques like ranking projects based on profitability index to allocate scarce funds to the most desirable projects.