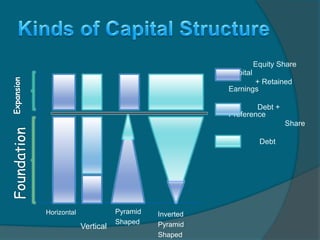

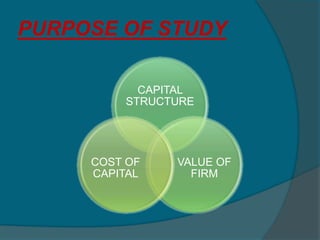

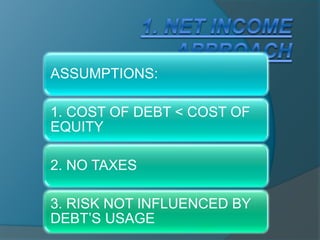

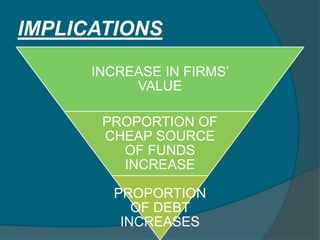

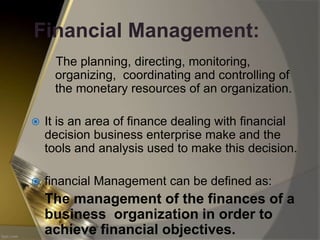

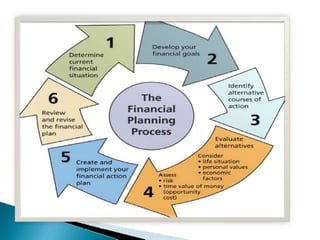

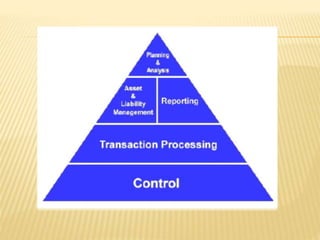

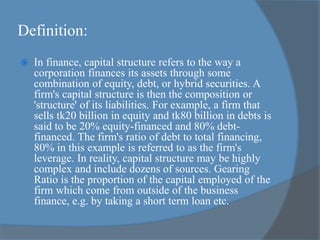

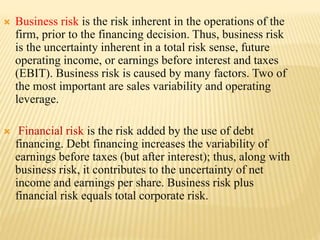

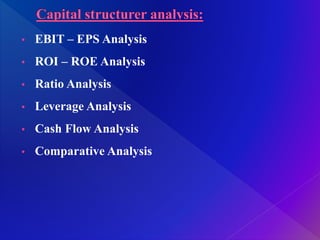

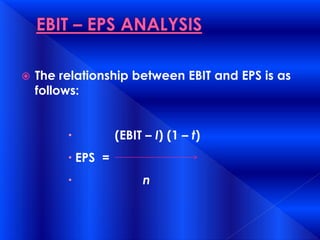

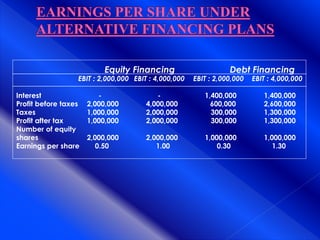

The document discusses financial management and capital structure. It defines financial management as planning, directing, monitoring, and controlling a company's monetary resources. It also discusses the key objectives of financial management which include creating wealth, generating cash flow, and providing sufficient returns. The document then covers various aspects of financial management including financial planning, organizing, controlling, and reporting. It also discusses the importance of financial management and fundamental financial management decisions related to investments, financing, and dividends. Finally, the document defines capital structure and discusses different types of capital including equity and debt capital. It also covers various approaches to analyzing capital structure.

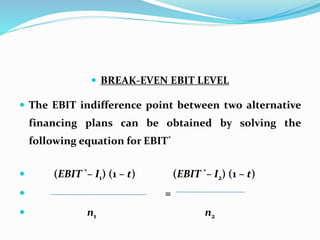

![ROI – ROE ANALYSIS

ROE = [ROI + (ROI – r) D/E] (1 – t)

where ROE = return on equity

ROI = return on investment

r = cost of debt

D/E = debt-equity ratio

t = tax rate](https://image.slidesharecdn.com/financialmanagement1-150104010236-conversion-gate01/85/Financial-management-1-24-320.jpg)